Title: Exploring the Arizona Sample Stock Purchase Agreement between Grey stone Funding Corporation and Schick Technologies, Inc. Introduction: The Arizona Sample Stock Purchase Agreement serves as a key legal document that outlines the terms and conditions for the acquisition of stocks between two entities, Grey stone Funding Corporation and Schick Technologies, Inc. This comprehensive agreement ensures both parties understand their rights, obligations, and the overall transaction process. Let's delve into the various types and components of this agreement. 1. Arizona Sample Stock Purchase Agreement Overview: The Arizona Sample Stock Purchase Agreement provides a general framework for stock acquisitions, including key sections such as interpretation, definitions, and governing laws. It acts as a foundation on which the specific terms will be built. 2. Terms and conditions: This section outlines the precise terms agreed upon by the parties involved in the stock purchase. It includes details regarding the number of shares being sold, the purchase price per share, and the payment method. 3. Representations and warranties: Here, both Grey stone Funding Corporation and Schick Technologies, Inc. present assertions and assurances about the accuracy and completeness of information provided. This includes financial statements, legal compliance, and any relevant material facts important for the transaction. 4. Conditions precedent: This section enumerates certain conditions that must be met or fulfilled before the transaction can be completed. It may include obtaining necessary approvals, consents, or securing financing arrangements. 5. Closing and post-closing obligations: The closing provisions specify the date, time, and location where the stock purchase will be finalized. It also outlines the responsibilities of each party during the transition period, such as filing necessary documents and transferring ownership. 6. Indemnification and liabilities: This part addresses how indemnification will be handled in case one party breaches representations or warranties provided in the agreement. It also outlines the limitations, exceptions, and timeframes for filing claims. 7. Confidentiality and non-competition: To protect sensitive information shared during the stock purchase, this section establishes provisions for maintaining confidentiality. It may also address any non-competition agreements between the parties. 8. Termination and remedies: In the event that either party fails to fulfill their obligations, this section defines the circumstances under which the agreement may be terminated and the remedies available to the non-defaulting party. Types of Arizona Sample Stock Purchase Agreements: While the Arizona Sample Stock Purchase Agreement between Grey stone Funding Corporation and Schick Technologies, Inc. may have different iterations based on specific variables, some variations may include: — Stock Purchase Agreement with Cash Payment: This agreement involves the acquisition of stocks through cash transactions, where Grey stone Funding Corporation pays a predetermined amount per share in cash to Schick Technologies, Inc. — Stock Purchase Agreement with Earn-Out Provisions: In this variation, the agreement may include terms that allow additional payments to Schick Technologies, Inc. in case certain financial or operational milestones are achieved post-transaction. — Stock Purchase Agreement with Stock Consideration: This agreement may involve the issuance of stocks of Grey stone Funding Corporation in exchange for the stocks held by Schick Technologies, Inc., acting as payment for the acquisition. Conclusion: The Arizona Sample Stock Purchase Agreement between Grey stone Funding Corporation and Schick Technologies, Inc. provides a comprehensive framework for finalizing a stock acquisition. This legally binding document, built on mutual understanding and consent, safeguards both parties' interests. By adhering to its terms and conditions, both entities can ensure a smooth and secure transaction process.

Arizona Sample Stock Purchase Agreement between Greystone Funding Corporation and Schick Technologies, Inc.

Description

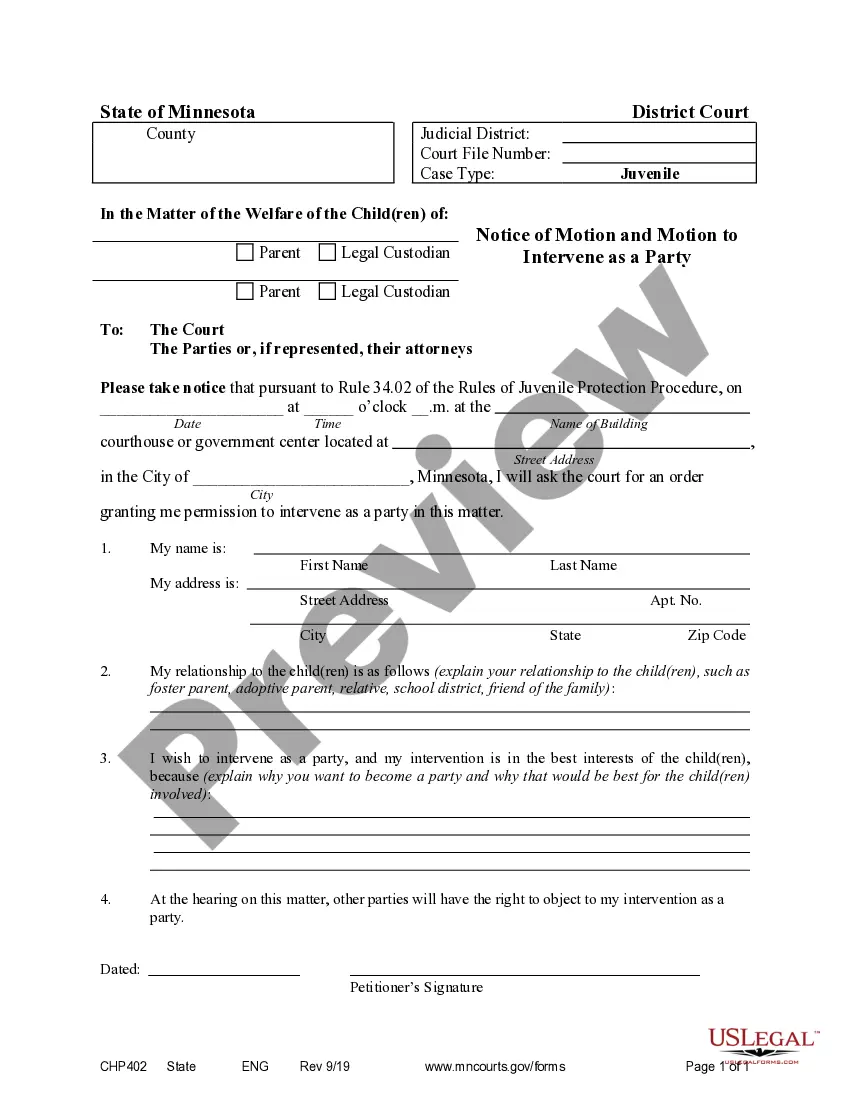

How to fill out Arizona Sample Stock Purchase Agreement Between Greystone Funding Corporation And Schick Technologies, Inc.?

US Legal Forms - one of the most significant libraries of lawful varieties in America - provides a wide array of lawful record themes you may down load or print out. Making use of the web site, you can get thousands of varieties for company and specific reasons, categorized by groups, suggests, or keywords and phrases.You can find the most up-to-date variations of varieties just like the Arizona Sample Stock Purchase Agreement between Greystone Funding Corporation and Schick Technologies, Inc. in seconds.

If you already have a subscription, log in and down load Arizona Sample Stock Purchase Agreement between Greystone Funding Corporation and Schick Technologies, Inc. in the US Legal Forms collection. The Download button will appear on every type you see. You get access to all earlier downloaded varieties inside the My Forms tab of your own accounts.

In order to use US Legal Forms the first time, listed here are easy recommendations to obtain started out:

- Make sure you have selected the best type for your personal town/state. Go through the Review button to examine the form`s content. See the type outline to ensure that you have chosen the proper type.

- If the type doesn`t fit your specifications, use the Look for area at the top of the display screen to find the one which does.

- In case you are pleased with the form, affirm your choice by clicking the Purchase now button. Then, opt for the costs prepare you favor and supply your credentials to register for an accounts.

- Method the financial transaction. Make use of Visa or Mastercard or PayPal accounts to perform the financial transaction.

- Choose the file format and down load the form on your own gadget.

- Make modifications. Complete, edit and print out and indicator the downloaded Arizona Sample Stock Purchase Agreement between Greystone Funding Corporation and Schick Technologies, Inc..

Every single design you put into your bank account does not have an expiration date and is also the one you have forever. So, in order to down load or print out yet another duplicate, just go to the My Forms segment and click about the type you need.

Gain access to the Arizona Sample Stock Purchase Agreement between Greystone Funding Corporation and Schick Technologies, Inc. with US Legal Forms, by far the most extensive collection of lawful record themes. Use thousands of skilled and status-specific themes that meet up with your small business or specific needs and specifications.