Arizona Trust Indenture and Agreement between John Naveen and Co., Inc. and Chase Manhattan Bank is a legally binding document that outlines the terms and conditions for the Naveen Tax Free Unit Trust, Series 1140. This trust indenture serves as a framework for the relationship and collaboration between John Naveen and Co., Inc. as the issuer and the Chase Manhattan Bank as the trustee. The Arizona Trust Indenture and Agreement provide a comprehensive understanding of the rights, obligations, and responsibilities of both parties involved in the administration of the Naveen Tax Free Unit Trust, Series 1140. It covers various aspects, including investment guidelines, distribution policies, reporting requirements, and the protection of investors' interests. This particular trust indenture ensures that John Naveen and Co., Inc. and Chase Manhattan Bank operate within the boundaries established by regulatory bodies and adhere to the agreed-upon guidelines to maximize the benefits for unit trust investors. The key terms and conditions within this Arizona Trust Indenture and Agreement may include but are not limited to: 1. Trust Purpose and Objectives: Clearly defining the purpose and objectives of the Naveen Tax Free Unit Trust, Series 1140, such as providing tax-free income to investors while preserving capital. 2. Authorized Investments: Outlining the types of securities or assets in which the trust can invest, ensuring compliance with regulatory requirements. 3. Voting Rights: Specifying whether and the extent to which unit holders are entitled to exercise voting rights in the trust's affairs. 4. Distribution Policies: Detailing the timing and manner of income distributions to unit holders, including any tax implications. 5. Termination or Modification: Establishing the circumstances and procedures for terminating or modifying the trust agreement, ensuring the protection of investors' interests. 6. Reporting and Disclosure Obligations: Enumerating the reporting requirements, including financial statements and disclosures, to be presented to unit holders and regulatory authorities. 7. Trustee's Duties and Liabilities: Outlining the responsibilities and liabilities of the trustee, including the duty to act in the best interests of the unit holders. 8. Default and Remedies: Specifying the consequences of default by either party and the available remedies in such situations. It is important to note that these are general terms that might be present in various types of trust indentures and agreements. As the specification of "Series 1140" indicates, there might be several other Arizona Trust Indenture and Agreements between John Naveen and Co., Inc. and Chase Manhattan Bank for different series of Naveen Tax Free Unit Trusts, each tailored to the specific needs and objectives of the respective series.

Arizona Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140

Description

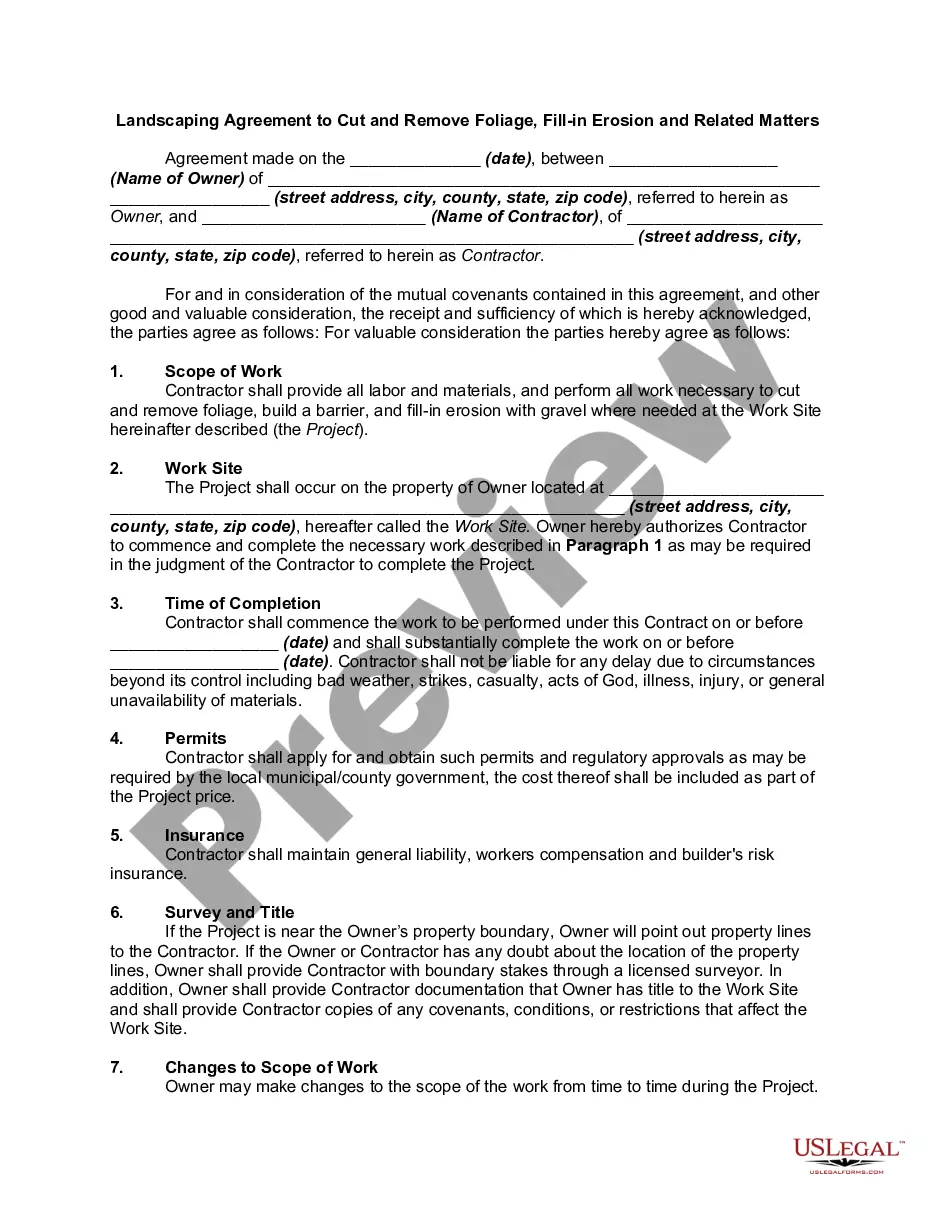

How to fill out Arizona Trust Indenture And Agreement Between John Nuveen And Co., Inc. And Chase Manhattan Bank Regarding Terms And Conditions For Nuveen Tax Free Unit Trust, Series 1140?

Finding the right legitimate record template could be a have a problem. Needless to say, there are a variety of themes available on the net, but how can you discover the legitimate type you need? Use the US Legal Forms website. The support delivers a huge number of themes, such as the Arizona Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140, that you can use for company and private needs. All the types are inspected by pros and meet federal and state requirements.

Should you be presently signed up, log in to your account and click on the Download switch to get the Arizona Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140. Make use of account to appear throughout the legitimate types you possess acquired formerly. Proceed to the My Forms tab of your own account and acquire an additional version in the record you need.

Should you be a fresh customer of US Legal Forms, allow me to share straightforward recommendations that you should adhere to:

- First, make sure you have chosen the right type for your metropolis/region. You may check out the shape using the Review switch and study the shape information to make certain it will be the right one for you.

- If the type fails to meet your expectations, take advantage of the Seach area to obtain the proper type.

- Once you are positive that the shape is acceptable, go through the Purchase now switch to get the type.

- Choose the rates strategy you desire and enter in the essential information and facts. Create your account and buy an order utilizing your PayPal account or charge card.

- Opt for the data file format and download the legitimate record template to your device.

- Complete, modify and print out and signal the acquired Arizona Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140.

US Legal Forms will be the most significant catalogue of legitimate types for which you will find various record themes. Use the company to download professionally-created documents that adhere to state requirements.