Arizona Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions

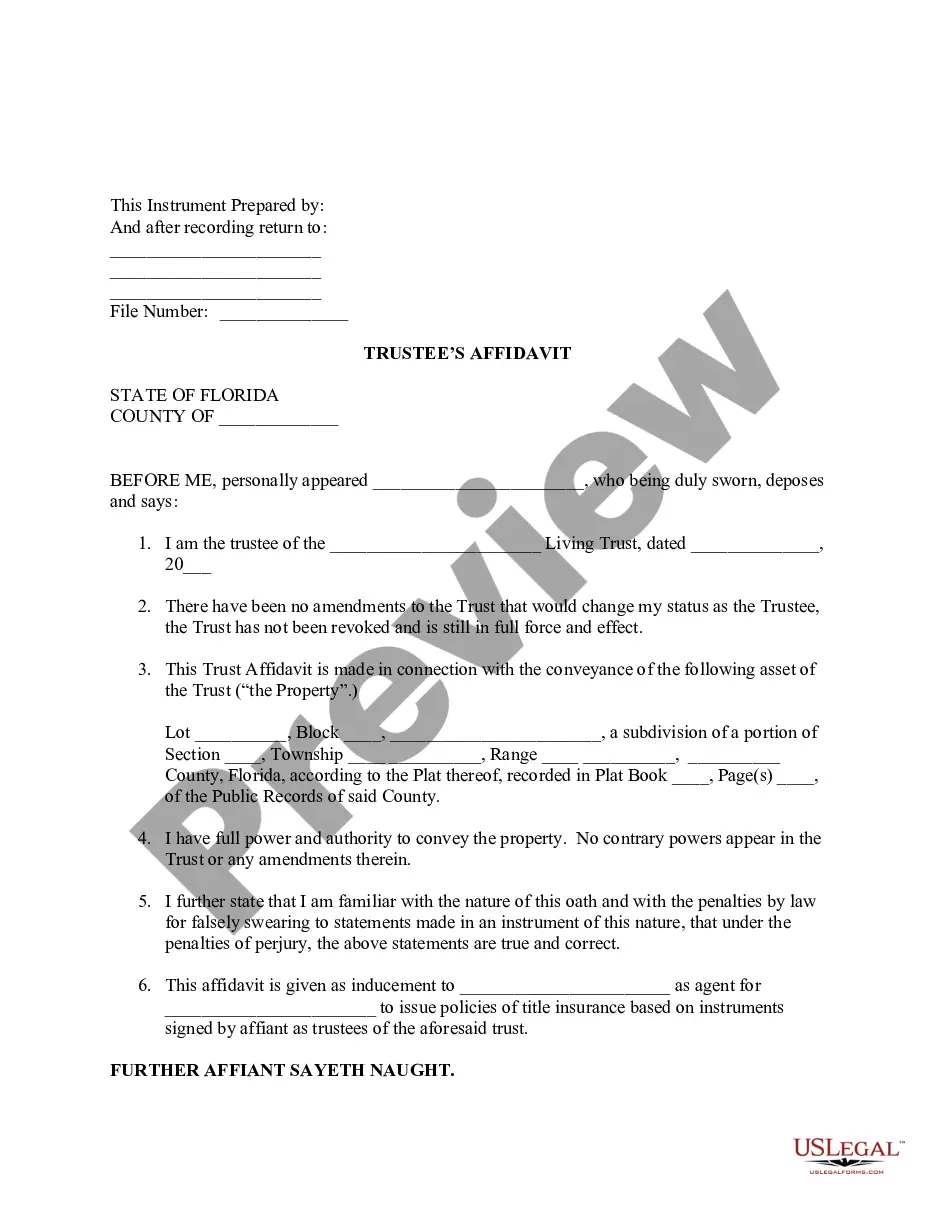

Description

How to fill out Second Amended And Restated Credit Agreement Among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks And Financial Institutions?

Choosing the right authorized record web template could be a struggle. Of course, there are a lot of layouts available online, but how do you get the authorized develop you need? Take advantage of the US Legal Forms web site. The services offers a large number of layouts, such as the Arizona Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions, that can be used for business and personal needs. Every one of the kinds are examined by pros and meet federal and state demands.

If you are previously listed, log in for your bank account and then click the Obtain key to get the Arizona Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions. Make use of your bank account to search from the authorized kinds you have acquired in the past. Check out the My Forms tab of the bank account and obtain an additional copy of the record you need.

If you are a brand new consumer of US Legal Forms, listed here are simple directions for you to stick to:

- Initially, be sure you have selected the proper develop for your metropolis/area. It is possible to check out the form utilizing the Preview key and read the form outline to make sure this is basically the best for you.

- If the develop will not meet your expectations, utilize the Seach industry to get the appropriate develop.

- Once you are certain the form is suitable, click the Acquire now key to get the develop.

- Opt for the rates program you desire and enter the essential information. Design your bank account and buy the transaction utilizing your PayPal bank account or Visa or Mastercard.

- Pick the data file structure and obtain the authorized record web template for your gadget.

- Complete, modify and print out and indicator the acquired Arizona Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions.

US Legal Forms will be the most significant collection of authorized kinds that you can see different record layouts. Take advantage of the service to obtain appropriately-made files that stick to express demands.