The Arizona Plan of Merger and Reorganization is a legal agreement negotiated and entered into by Digital Insight Corp., Black Transitory Corp., and front, Inc. In this detailed description, we will explore the various aspects of this plan, including its purpose, key terms, and potential types or variations. The Arizona Plan of Merger and Reorganization aims to facilitate the consolidation of Digital Insight Corp., Black Transitory Corp., and front, Inc. into a single entity. This merger and reorganization provide an opportunity for these companies to leverage their respective strengths and resources to achieve synergistic growth and enhanced operational efficiency. The plan encompasses a multitude of agreements, terms, and obligations that dictate how the merger and reorganization will take place. These may include the exchange of company shares, the appointment of new board members, the valuation of assets and liabilities, and the integration of business operations. Additionally, the plan may outline the treatment of outstanding contracts, intellectual property, employee benefits, and any potential tax implications. Different types or variations of the Arizona Plan of Merger and Reorganization can arise depending on the specific objectives and circumstances of the involved companies. These variations may include: 1. Horizontal Merger: This type of merger occurs when two or more companies operating in the same industry and similar markets merge to create a larger, more competitive entity. Digital Insight Corp., Black Transitory Corp., and front, Inc., may pursue a horizontal merger if their respective services or products are complementary or if merging would grant them a competitive advantage. 2. Vertical Merger: In a vertical merger, two or more companies operating at different stages of the supply chain merge to streamline operations and gain more control over the production process. If Digital Insight Corp., Black Transitory Corp., and front, Inc. have mutually beneficial relationships within the supply chain, a vertical merger might be considered. 3. Conglomerate Merger: A conglomerate merger involves companies from unrelated industries merging to diversify their business portfolios and reduce risk. If Digital Insight Corp., Black Transitory Corp., and front, Inc. operate in distinct industries but find strategic advantages in merging, a conglomerate merger could be an option. The Arizona Plan of Merger and Reorganization is a complex legal document that requires careful consideration and execution. It involves multiple stages, such as due diligence, shareholder approvals, regulatory compliance, and post-merger integration planning. Professional advice from legal, financial, and tax experts is crucial to ensure a smooth execution and successful implementation of the plan. In conclusion, the Arizona Plan of Merger and Reorganization presents an opportunity for Digital Insight Corp., Black Transitory Corp., and front, Inc. to combine their strengths and resources for enhanced growth and operational efficiency. By exploring different types or variations of the plan, the companies can tailor their merger strategy to align with their specific objectives and market dynamics.

Arizona Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc.

Description

How to fill out Plan Of Merger And Reorganization By And Among Digital Insight Corp., Black Transitory Corp. And NFront, Inc.?

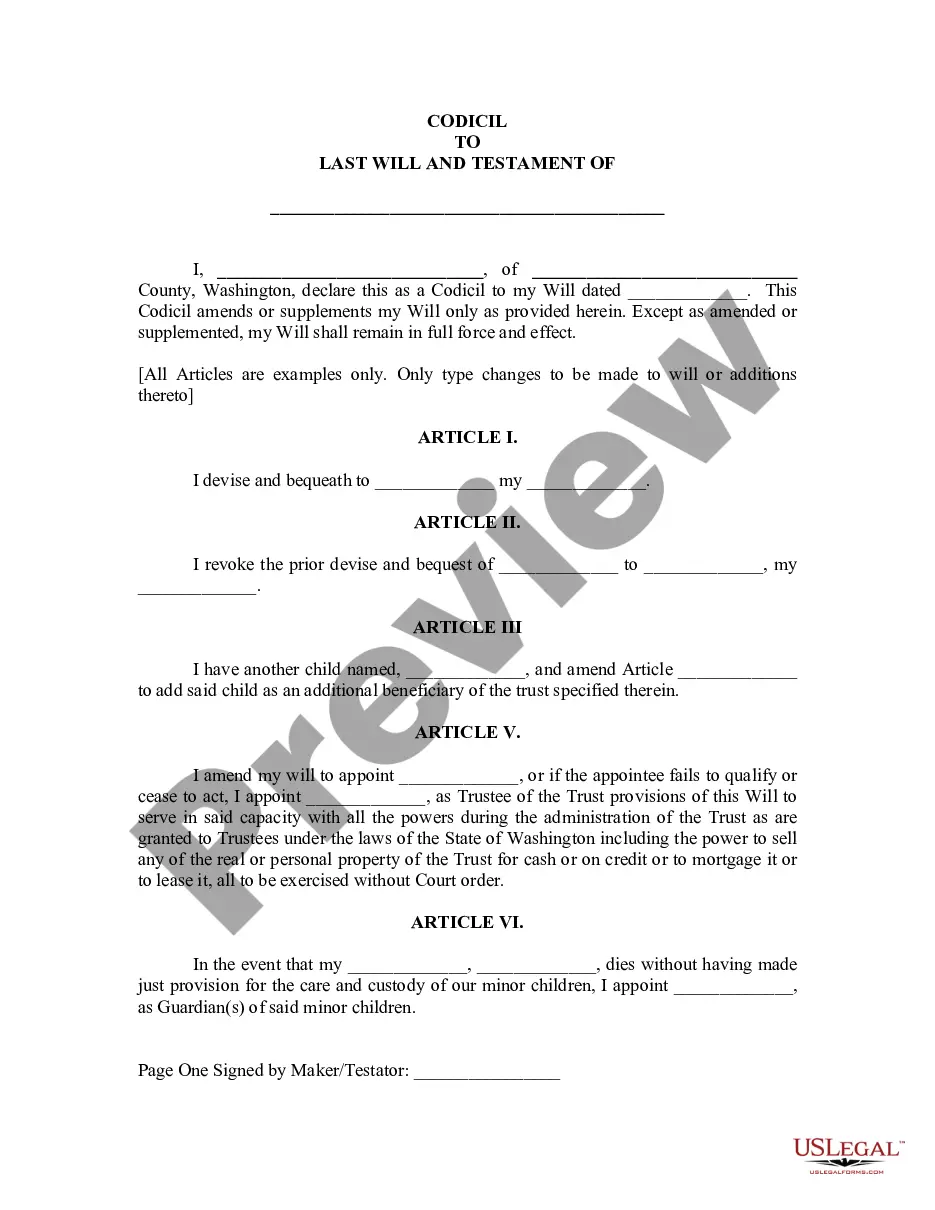

You can invest several hours online searching for the authorized papers web template that meets the federal and state requirements you need. US Legal Forms provides a large number of authorized types which are analyzed by specialists. You can easily down load or produce the Arizona Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc. from your service.

If you already have a US Legal Forms profile, you are able to log in and click on the Obtain button. Next, you are able to full, revise, produce, or sign the Arizona Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc.. Each and every authorized papers web template you purchase is your own for a long time. To acquire another backup associated with a acquired kind, visit the My Forms tab and click on the related button.

If you are using the US Legal Forms site for the first time, keep to the simple recommendations under:

- Initial, be sure that you have chosen the correct papers web template for that state/area that you pick. Read the kind description to ensure you have picked out the correct kind. If accessible, take advantage of the Preview button to search through the papers web template at the same time.

- If you wish to discover another variation in the kind, take advantage of the Research industry to discover the web template that suits you and requirements.

- Upon having found the web template you would like, simply click Get now to carry on.

- Pick the pricing prepare you would like, type your qualifications, and sign up for your account on US Legal Forms.

- Total the financial transaction. You can utilize your credit card or PayPal profile to fund the authorized kind.

- Pick the structure in the papers and down load it in your gadget.

- Make changes in your papers if necessary. You can full, revise and sign and produce Arizona Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc..

Obtain and produce a large number of papers web templates making use of the US Legal Forms site, that offers the most important variety of authorized types. Use specialist and condition-distinct web templates to take on your organization or specific needs.