The Arizona Credit Agreement regarding the extension of credit is a legal and binding document outlining the terms and conditions between a creditor and a debtor. This agreement serves as a written contract that establishes the rights and responsibilities of both parties involved in the transaction. One type of Arizona Credit Agreement regarding the extension of credit is the Revolving Credit Agreement. Under this agreement, the creditor provides the debtor with a predetermined credit limit that can be utilized repeatedly over time. The debtor has the flexibility to borrow up to the established credit limit and repay the borrowed amount in installments. The interest rate is typically variable, meaning it can fluctuate based on market conditions or other factors agreed upon in the contract. Another type is the Installment Credit Agreement. This agreement involves the extension of a specified amount of credit to the debtor, which is repaid over a set period in regular installments. The terms of repayment, including the interest rate and the frequency of payments, are predetermined and stated in the agreement. Unlike revolving credit, installment credit typically involves a fixed interest rate, providing the debtor with a predictable repayment schedule. The Arizona Credit Agreement regarding the extension of credit covers various important aspects, including: 1. Parties: Identifies the legal names and addresses of both the creditor and debtor involved in the agreement. 2. Loan Amount: Specifies the maximum credit amount available or the specific loan amount extended to the debtor. 3. Interest Rates: Outlines the interest rate charged on the credit amount, whether fixed or variable, as well as any penalties or fees if payments are not made on time. 4. Repayment Terms: Describes how the credit or loan is to be repaid, including the length of the repayment period and the frequency of payments (e.g., monthly, bi-weekly). 5. Collateral: States whether collateral is required to secure the credit, such as real estate, vehicles, or other valuable assets that the creditor can claim in case of default. 6. Late Payment and Default: Specifies the consequences of late payments or default, such as increased interest rates, penalties, or even legal action. 7. Termination or Renewal: Outlines the conditions under which the agreement can be terminated or renewed, including any notice periods required. 8. Governing Law: Indicates that the agreement is governed by the laws of the state of Arizona, ensuring compliance with local regulations. It's crucial for both the creditor and debtor to carefully review and understand the terms included in the Arizona Credit Agreement regarding the extension of credit before signing. Seeking legal advice is recommended to ensure compliance with applicable laws and to protect the rights and interests of both parties involved.

Arizona Credit Agreement regarding extension of credit

Description

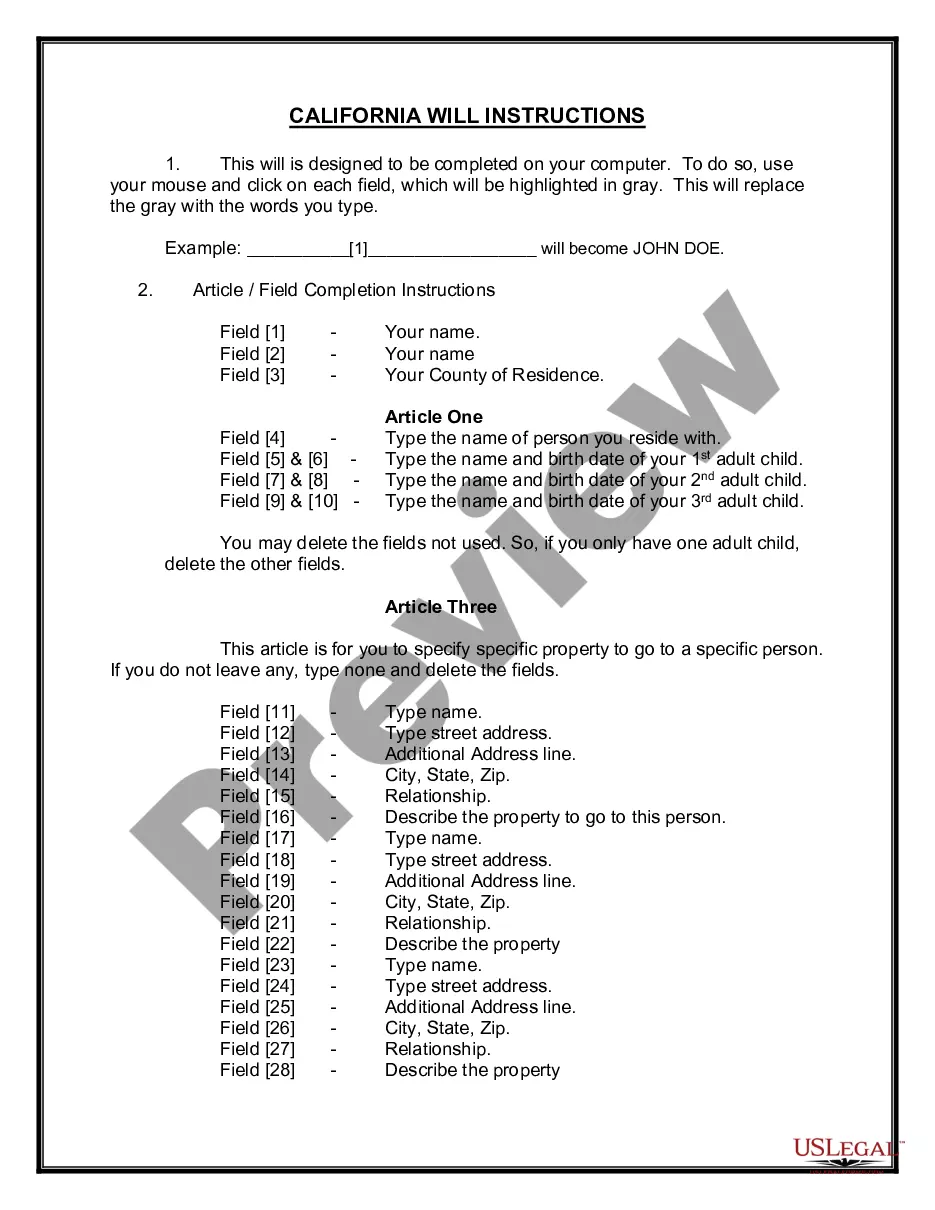

How to fill out Arizona Credit Agreement Regarding Extension Of Credit?

Discovering the right legal papers web template can be quite a battle. Obviously, there are plenty of web templates available on the Internet, but how will you find the legal kind you want? Make use of the US Legal Forms site. The support gives a huge number of web templates, like the Arizona Credit Agreement regarding extension of credit, which can be used for organization and private requires. All the forms are checked out by pros and meet up with state and federal needs.

Should you be presently authorized, log in in your bank account and click the Obtain button to find the Arizona Credit Agreement regarding extension of credit. Make use of your bank account to check with the legal forms you have acquired earlier. Go to the My Forms tab of your bank account and acquire an additional backup in the papers you want.

Should you be a new customer of US Legal Forms, here are easy directions that you should stick to:

- First, make sure you have selected the appropriate kind for your area/county. It is possible to look over the form while using Review button and browse the form explanation to ensure it is the right one for you.

- If the kind is not going to meet up with your requirements, utilize the Seach industry to find the correct kind.

- Once you are positive that the form would work, click the Get now button to find the kind.

- Select the costs prepare you would like and enter in the required details. Build your bank account and buy your order making use of your PayPal bank account or charge card.

- Select the data file format and acquire the legal papers web template in your gadget.

- Complete, revise and print and indicator the attained Arizona Credit Agreement regarding extension of credit.

US Legal Forms may be the largest local library of legal forms that you will find various papers web templates. Make use of the service to acquire expertly-manufactured papers that stick to status needs.

Form popularity

FAQ

A Z file is a Unix compressed file. Open one with 7-Zip or the uncompress command. Convert to ZIP or another format by extracting its contents first.

For proper application of payment and to avoid delays, corporations must submit payments together with the completed Arizona Form 120EXT. The department will also accept a valid federal extension for the same period of time covered by the federal extension.

To file an extension on a return, individuals use Arizona Form 204 to apply for an automatic extension to file. The completed extension form must be filed by April 18, 2023.

Arizona Tax Extension Tip: If you have a valid Federal tax extension (IRS Form 4868), you will automatically receive a corresponding Arizona tax extension for the same period of time. In this case, Form 204 does not need to be filed unless you're making an Arizona extension payment.

Automatic with an Approved Federal Extension: Arizona grants an automatic 6-month extension with your IRS-approved federal extension. IMPORTANT: Your extension is only an extension to file your return. IT IS NOT AN EXTENSION TO PAY any taxes that you may owe the state.

Form 120EXT or a valid federal extension provides an extension of time to file, but does not provide an extension of time to pay. The entire amount of tax, penalties, and interest is due by the original due date of the return.

Lenders must provide a full disclosure of all of the loan's terms in the credit agreement. That can include the annual interest rate (APR), how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.

What are the tax rates in 2022 and 2023? For tax year 2022, there are two individual income tax rates, 2.55% and 2.98%. The new flat tax of 2.5% will affect the 2023 tax year ? which is filed by April 2024.