The Arizona Simple Agreement for Future Equity (SAFE) is a legal document utilized by early-stage startups in Arizona to raise capital without determining an explicit valuation. It grants investors the right to obtain equity in the company in the future, generally triggered by a specific event such as a subsequent financing round or an acquisition. This agreement provides a simple and streamlined process for both startups and investors to negotiate and execute investment deals. The Arizona SAFE agreement is structured similarly to the standard SAFE agreement developed by Y Combinator, with a few specific provisions tailored to comply with Arizona state laws and regulations. It allows startups to attract financing from angel investors, venture capitalists, or other accredited investors, without the need to fix a valuation at the time of investment, which is often challenging during the early stages of a company. The Arizona SAFE agreement includes various key elements that are crucial for both parties involved. It outlines the terms and conditions under which the investment will convert into equity, the trigger events, and the conversion valuation cap. The conversion valuation cap is the maximum valuation at which the investment may convert into equity. This cap ensures that investors are guaranteed a certain percentage of the company, protecting their potential returns. As for the different types of Arizona Simple Agreement for Future Equity, there may be variations based on specific requirements or preferences of individual startups or investors. Some possible variations could include the use of a post-money SAFE, which sets the conversion valuation cap after the investment is made, or a capped SAFE, which limits the potential dilution by setting a higher conversion valuation cap. Furthermore, startups may use an Arizona SAFE with discount terms, offering investors a discount on the future valuation when converting their investment into equity. This discount provides an additional incentive for early investors, compensating them for the higher risk they take compared to later-stage investors. In conclusion, the Arizona Simple Agreement for Future Equity (SAFE) is a popular financing instrument that enables startups in Arizona to raise capital without determining an immediate company valuation. It allows startups to attract investors through straightforward and investor-friendly terms, facilitating early-stage fundraising.

Arizona Simple Agreement for Future Equity

Description

How to fill out Arizona Simple Agreement For Future Equity?

US Legal Forms - one of the biggest libraries of authorized kinds in the USA - offers a wide array of authorized papers themes it is possible to acquire or produce. Utilizing the web site, you can find a huge number of kinds for business and individual functions, categorized by groups, suggests, or search phrases.You will discover the newest variations of kinds just like the Arizona Simple Agreement for Future Equity within minutes.

If you currently have a subscription, log in and acquire Arizona Simple Agreement for Future Equity in the US Legal Forms collection. The Down load key will show up on every single develop you look at. You have accessibility to all formerly downloaded kinds from the My Forms tab of your account.

If you wish to use US Legal Forms the very first time, here are straightforward instructions to help you started off:

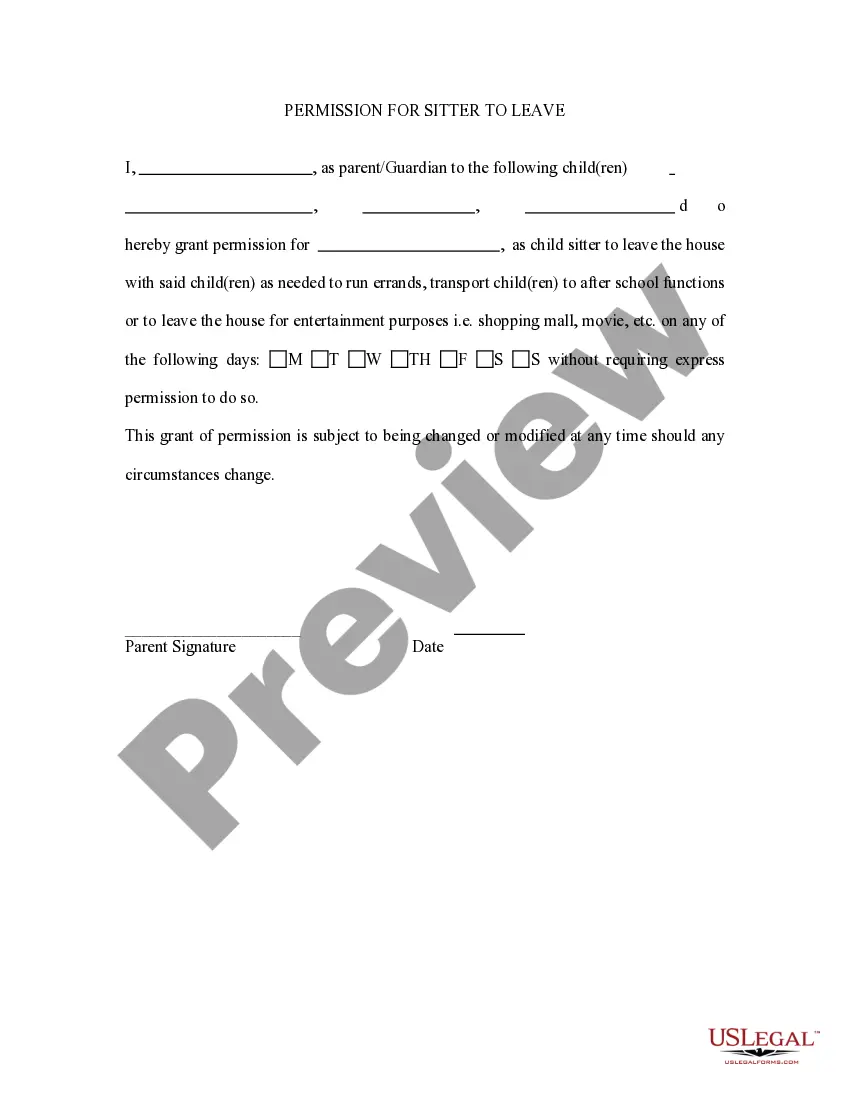

- Ensure you have picked out the best develop for your personal area/region. Click on the Review key to check the form`s content. See the develop outline to ensure that you have chosen the proper develop.

- In the event the develop doesn`t suit your demands, use the Look for industry at the top of the screen to get the one that does.

- Should you be satisfied with the form, affirm your selection by clicking the Buy now key. Then, opt for the costs program you favor and give your credentials to register for an account.

- Process the purchase. Make use of your Visa or Mastercard or PayPal account to perform the purchase.

- Select the structure and acquire the form on the device.

- Make changes. Complete, edit and produce and indication the downloaded Arizona Simple Agreement for Future Equity.

Every single template you added to your account lacks an expiration day which is yours for a long time. So, in order to acquire or produce an additional copy, just go to the My Forms segment and click on on the develop you will need.

Get access to the Arizona Simple Agreement for Future Equity with US Legal Forms, the most substantial collection of authorized papers themes. Use a huge number of expert and express-certain themes that meet your organization or individual demands and demands.

Form popularity

FAQ

Due to the fact that SAFE notes are converted to equity only when the startup is able to raise funds for its next round, it carries a small amount of risk for investors. There is a chance that an investor's investment may never be converted into equity.

Cons: SAFE investors assume most, if not all, of the risk, in that there is no guarantee of any equity ownership in the company. ... A SAFE holder is not entitled to any company assets in the event of a liquidation.

Calculation ing to the Discount Rate The total shares are calculated ing to the SAFE money invested divided by the share price in the next round, multiplied by the discount rate. If we take our example above, if during the next financing round, the company raises money ing to a share price of $10.

A SAFE is an agreement to provide you a future equity stake based on the amount you invested if?and only if?a triggering event occurs, such as an additional round of financing or the sale of the company.

Like all early-stage investments, SAFEs can be especially risky because when you provide the funding, you don't end up owning anything. In the event of a liquidation or wind-down, you may get nothing if the SAFE hasn't already converted.

Overall, giving up equity in a startup can be an effective way for founders to raise capital and attract talented employees. However, these benefits must be weighed against potential cons such as dilution of ownership and control, increased time commitment, higher expenses, and decreased long-term value.

A Simple Agreement for Future Equity (SAFE) is a contractual agreement between a startup company and its investors. It exchanges the investor's investment for the right to preferred shares in the startup company when the company raises a future round of funding.

A Simple Agreement for Future Equity (we'll call it a SAFE from here on out) is an agreement that an early-stage startup makes with an investor?typically when raising money during a seed round. Because the startup doesn't yet have a formal valuation, it doesn't have shares to issue to the investor.