Arizona Form - Large Quantity Sales Distribution Agreement

Description

How to fill out Form - Large Quantity Sales Distribution Agreement?

Are you inside a position where you require files for sometimes enterprise or personal uses nearly every day time? There are a lot of legitimate document themes available on the Internet, but discovering types you can rely on is not effortless. US Legal Forms gives 1000s of develop themes, just like the Arizona Form - Large Quantity Sales Distribution Agreement, that are published to satisfy federal and state requirements.

If you are presently knowledgeable about US Legal Forms internet site and possess a merchant account, just log in. Following that, you can down load the Arizona Form - Large Quantity Sales Distribution Agreement format.

Should you not have an bank account and want to begin to use US Legal Forms, follow these steps:

- Find the develop you want and make sure it is for the correct city/state.

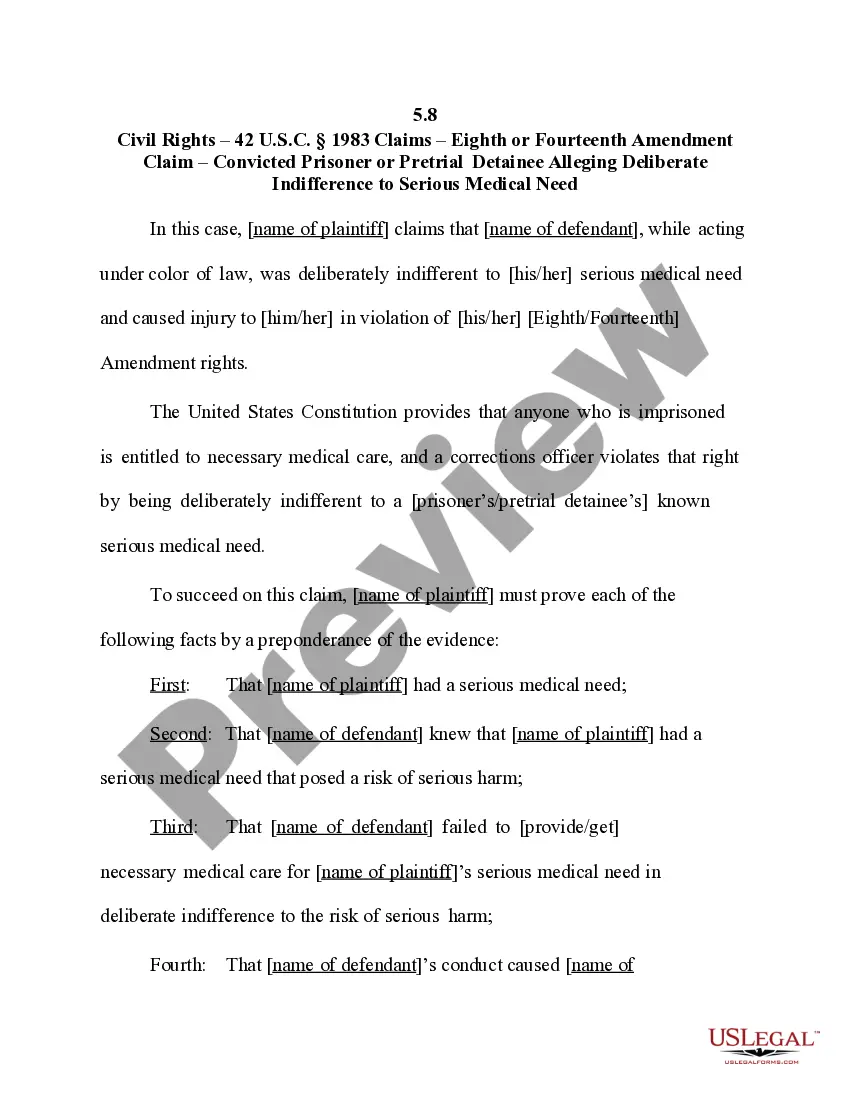

- Make use of the Preview key to review the shape.

- Read the description to ensure that you have selected the correct develop.

- In the event the develop is not what you are trying to find, take advantage of the Lookup discipline to find the develop that meets your needs and requirements.

- If you discover the correct develop, click Purchase now.

- Choose the prices plan you need, fill out the required information to make your bank account, and purchase your order making use of your PayPal or bank card.

- Pick a handy file format and down load your duplicate.

Discover every one of the document themes you may have purchased in the My Forms menu. You can obtain a more duplicate of Arizona Form - Large Quantity Sales Distribution Agreement at any time, if possible. Just select the necessary develop to down load or print out the document format.

Use US Legal Forms, probably the most extensive selection of legitimate kinds, to save some time and steer clear of errors. The services gives professionally manufactured legitimate document themes that can be used for a selection of uses. Generate a merchant account on US Legal Forms and commence making your life easier.

Form popularity

FAQ

ALL EMPLOYEES - ARIZONA STATE WITHHOLDING HAS BEEN UPDATED TO THE DEFAULT RATE 2.0% Any existing additional dollar amounts an employee had chosen to be withheld will not be changed.

Changes to the 2023 tax rate structure mean changes to state withholdings from your paychecks. The new default withholding rate for AZ is 2 percent, so now is the time to review if this amount is appropriate for you. If you want to change this percentage, you can do so at any time during the year.

If your amended federal return was filed as a paper return, or if electronic filing is unavailable, mail Arizona Form 120S to: Arizona Department of Revenue PO Box 29079 Phoenix, AZ 85038-9079 ? If the S Corporation was required to make its tax payments for the 2022 taxable year by electronic funds transfer (EFT), it ...

The employer should select 2.0% on behalf of the employee. The new default Arizona withholding rate is 2.0%.

Tax deductions lower the amount of taxable income. Standard deductions for single filers are increasing from $12,950 in 2022 to $13,850 in 2023. Married couples filing jointly will go from $25,900 in 2022 to $27,700 in 2023, and married filing separately will go from $12,950 to $13,850.

Employers should withhold half (7.65%) of the 15.3% owed in FICA (Social Security and Medicare) taxes from an employee's gross pay. FICA taxes come in addition to regular federal income taxes, which change depending on your income level. There are seven tax brackets in 2022 and 2023: 12%.

A limited liability company (LLC) that is classified as a partnership for federal income tax purposes must file Arizona Form 165. A single-member LLC that is disregarded as an entity for federal income tax purposes is treated as a branch or division of its owner, and is included in the tax return of its owner.

The 2023 tax year?meaning the return you'll file in 2024?will have the same seven federal income tax brackets as the last few seasons: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your filing status and taxable income, including wages, will determine the bracket you're in.