Arizona Storage Services Contract - Self-Employed

Description

How to fill out Arizona Storage Services Contract - Self-Employed?

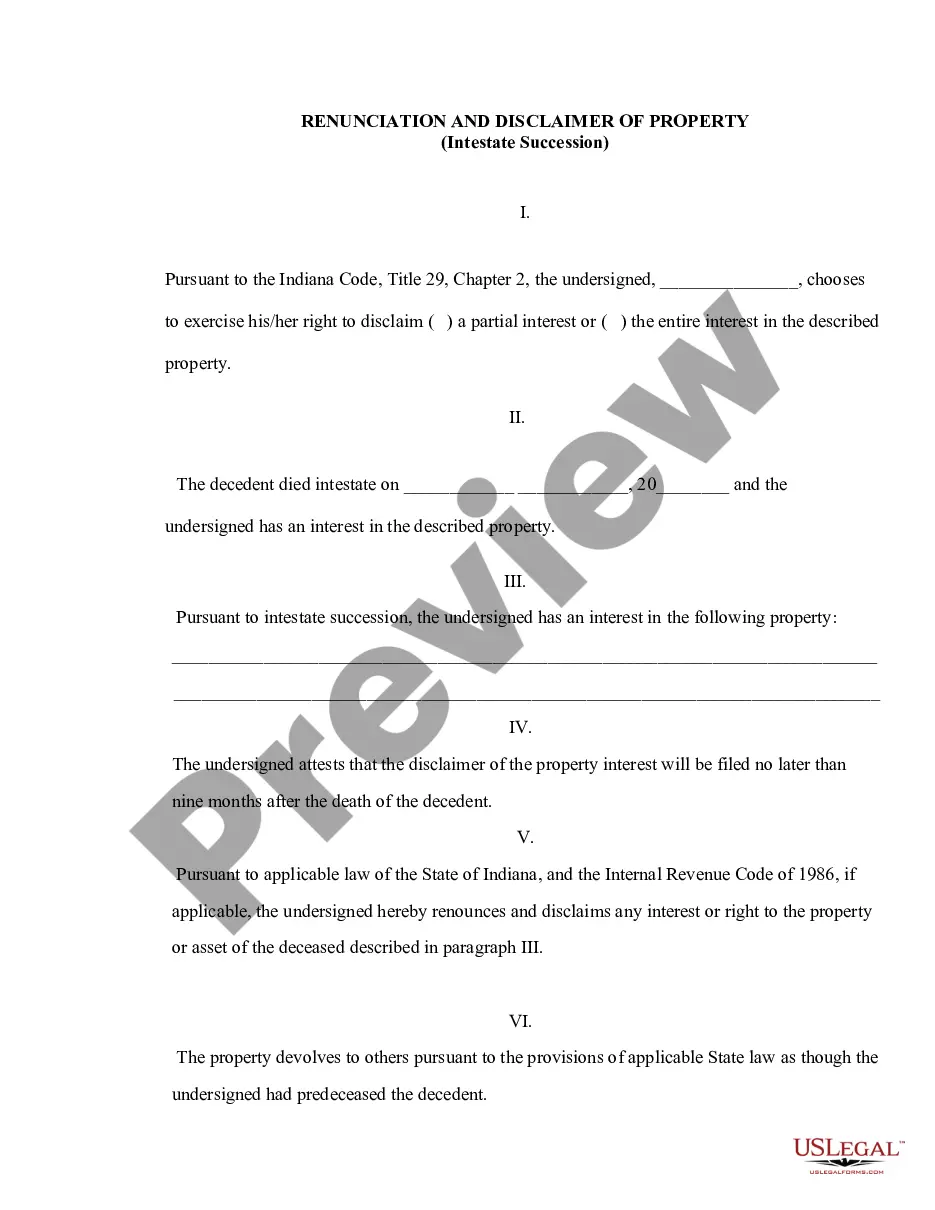

Are you presently within a placement where you need files for sometimes company or personal functions nearly every day? There are a variety of lawful document layouts available online, but locating types you can rely isn`t effortless. US Legal Forms gives thousands of type layouts, much like the Arizona Storage Services Contract - Self-Employed, that are published to fulfill federal and state requirements.

Should you be presently informed about US Legal Forms site and also have a merchant account, basically log in. Following that, it is possible to acquire the Arizona Storage Services Contract - Self-Employed web template.

If you do not offer an account and want to begin using US Legal Forms, follow these steps:

- Get the type you will need and make sure it is to the right metropolis/county.

- Take advantage of the Preview key to review the form.

- See the explanation to ensure that you have chosen the correct type.

- When the type isn`t what you`re searching for, use the Search area to obtain the type that fits your needs and requirements.

- If you get the right type, click on Get now.

- Pick the pricing plan you need, complete the desired details to make your bank account, and pay money for your order using your PayPal or Visa or Mastercard.

- Pick a practical document file format and acquire your backup.

Find each of the document layouts you might have bought in the My Forms menus. You can aquire a further backup of Arizona Storage Services Contract - Self-Employed any time, if necessary. Just go through the required type to acquire or printing the document web template.

Use US Legal Forms, the most comprehensive variety of lawful types, to save efforts and steer clear of errors. The services gives skillfully created lawful document layouts that can be used for a variety of functions. Make a merchant account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

The new law allows Arizona employing units and independent contractors to establish their shared intent for the status of their relationship from its inception by permitting employing units to require their independent contractors to execute declarations affirming that their relationship with the business is as an

Self-employed people are those who own their own businesses and work for themselves. According to the IRS, you are self-employed if you act as a sole proprietor or independent contractor, or if you own an unincorporated business.

A contract that is used for appointing a genuinely self-employed individual such as a consultant (or a profession or business run by that individual) to carry out services for another party where the relationship between the parties is not that of employer and employee or worker.

§ 42-5155(A) imposes Arizona use tax on the storage, use or consumption in this state of tangible personal property purchased from a retailer or utility business, as a percentage of the sales price. A.R.S.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

An independent contractor is defined as an individual who contracts to work for others without having the legal status of an employee. By engaging independent contractors, employers can avoid many of the costs associated with hiring employees.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Arizona allows employers to request that individuals classified as independent contractors sign a Declaration of Independent Business Status (DIBS). The execution of a DIBS is not mandatory in order to establish the existence of an independent contractor relationship between a business and an independent contractor.

More info

Our site and services are provided on an “as is” and “as available” basis. In the event of a catastrophe or emergency, your data may not be available until after all the affected materials are recovered. By using this site, you acknowledge this risk. This site is intended for users with at least minimal proficiency in basic computer literacy, but it may not be suitable for users who are physically or financially disabled (including but not limited to those who are pregnant, sick, emotionally disturbed, or who use a screen reader), are under the age of eighteen (18) or otherwise lack the ability to provide consent to our use or access of information. By using this site, you hereby release all the parties associated with this site from any and all liability to you including, but not limited to, damages for loss of data, business interruption, or business disruption beyond the control of our site or the party from whose site our site is made available.