Arizona Geologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Arizona Geologist Agreement - Self-Employed Independent Contractor?

Discovering the right lawful file design could be a battle. Obviously, there are a variety of layouts available on the Internet, but how would you get the lawful type you need? Make use of the US Legal Forms web site. The assistance offers 1000s of layouts, for example the Arizona Geologist Agreement - Self-Employed Independent Contractor, that you can use for business and private requirements. All of the varieties are examined by experts and satisfy federal and state needs.

When you are presently signed up, log in for your bank account and then click the Obtain key to find the Arizona Geologist Agreement - Self-Employed Independent Contractor. Utilize your bank account to search from the lawful varieties you may have bought previously. Go to the My Forms tab of your bank account and get yet another duplicate of your file you need.

When you are a whole new end user of US Legal Forms, listed here are simple guidelines that you should adhere to:

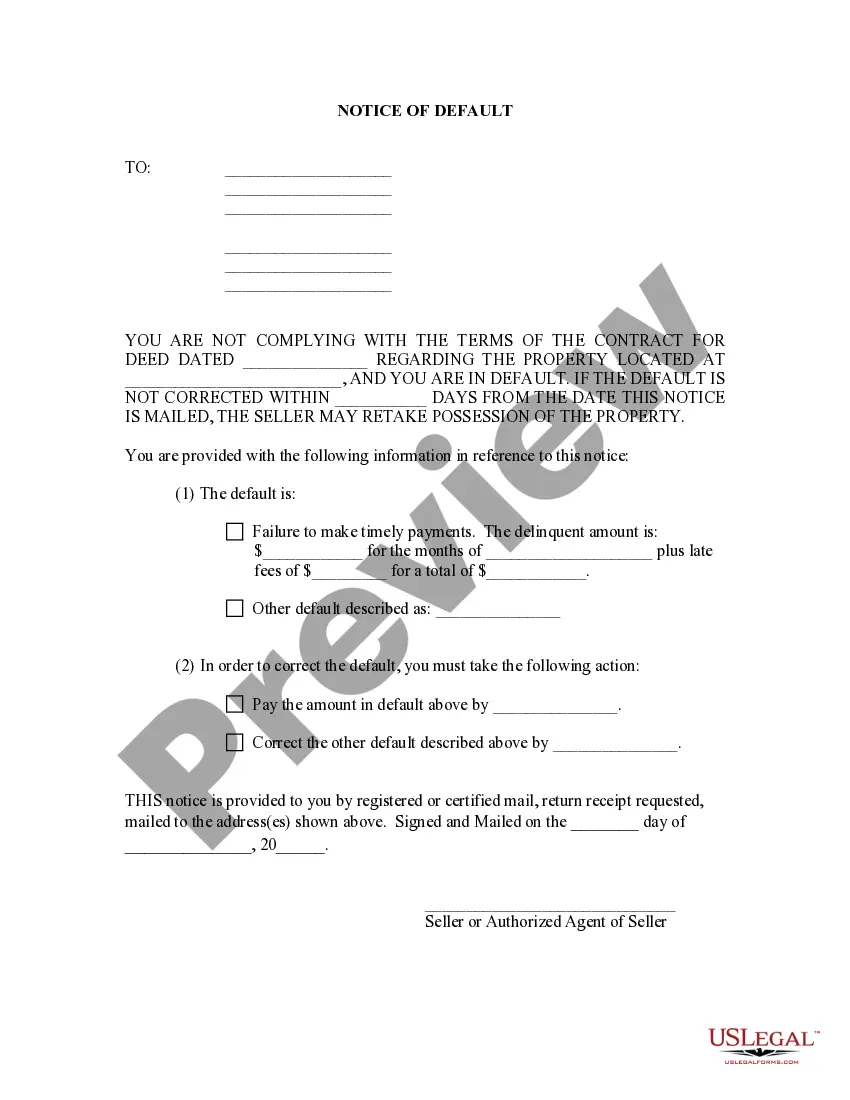

- Initial, make sure you have selected the appropriate type for the metropolis/area. You are able to look over the form utilizing the Review key and study the form information to ensure it will be the best for you.

- In the event the type fails to satisfy your expectations, use the Seach field to discover the correct type.

- Once you are certain that the form is acceptable, select the Get now key to find the type.

- Select the rates program you desire and type in the required information and facts. Make your bank account and pay for the transaction using your PayPal bank account or charge card.

- Pick the document format and obtain the lawful file design for your gadget.

- Full, edit and print out and indication the received Arizona Geologist Agreement - Self-Employed Independent Contractor.

US Legal Forms may be the greatest collection of lawful varieties in which you can see various file layouts. Make use of the service to obtain expertly-manufactured papers that adhere to state needs.

Form popularity

FAQ

Arizona allows employers to request that individuals classified as independent contractors sign a Declaration of Independent Business Status (DIBS). The execution of a DIBS is not mandatory in order to establish the existence of an independent contractor relationship between a business and an independent contractor.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

An independent contractor is defined as an individual who contracts to work for others without having the legal status of an employee. By engaging independent contractors, employers can avoid many of the costs associated with hiring employees.

1099 employees don't have to paid overtime. Since they aren't on payroll, you can keep payroll and other taxes, including the unemployment tax, under control. They can't collect workers' compensation so you get a break on premiums as well.

Arizona allows employers to request that individuals classified as independent contractors sign a Declaration of Independent Business Status (DIBS). The execution of a DIBS is not mandatory in order to establish the existence of an independent contractor relationship between a business and an independent contractor.

Under normal circumstances (at least here in Arizona), businesses do not pay State or Federal unemployment taxes on compensation paid to independent contractors. As a result, independent contractors have not been eligible to apply for or receive unemployment benefits.

The new law allows Arizona employing units and independent contractors to establish their shared intent for the status of their relationship from its inception by permitting employing units to require their independent contractors to execute declarations affirming that their relationship with the business is as an