"Note Form and Variations" is a American Lawyer Media form. This form is for your note payments with different variations.

Arizona Note Form and Variations

Description

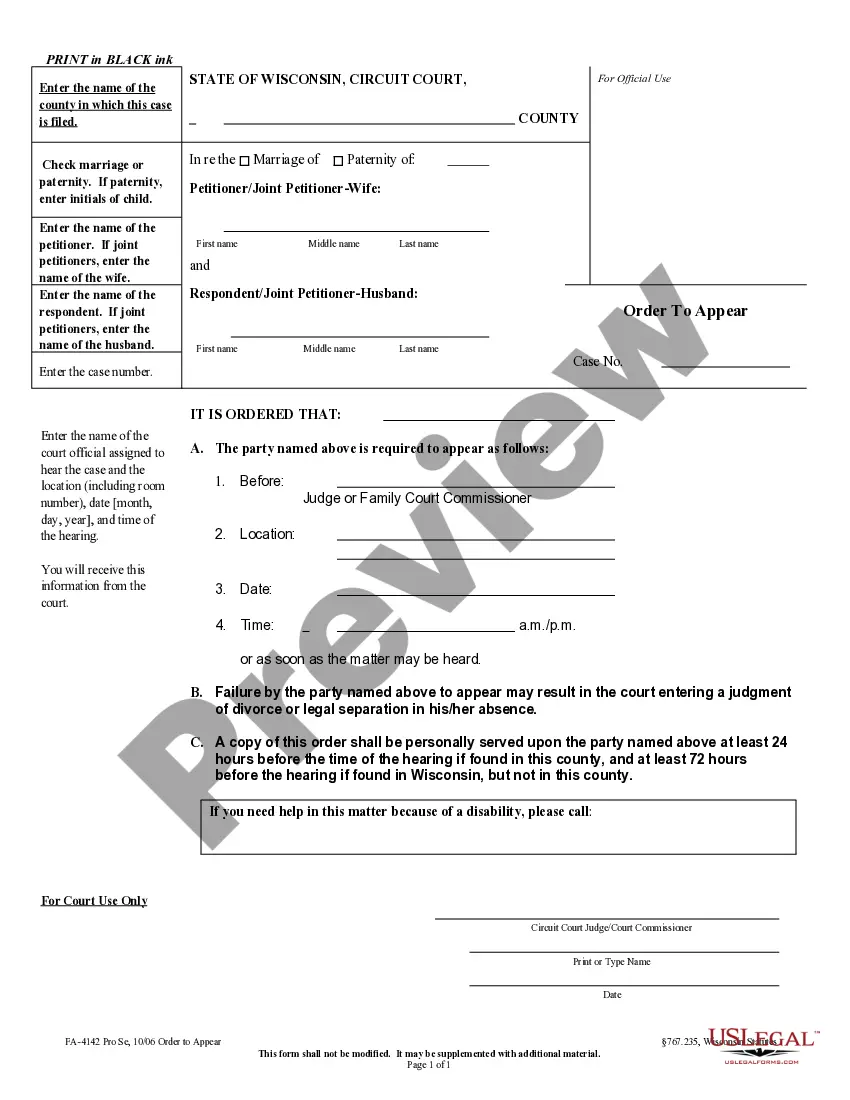

How to fill out Note Form And Variations?

US Legal Forms - one of the biggest libraries of authorized forms in America - delivers a wide array of authorized file templates you can download or produce. Using the internet site, you may get thousands of forms for company and specific reasons, categorized by groups, states, or key phrases.You will discover the most up-to-date models of forms much like the Arizona Note Form and Variations in seconds.

If you already have a registration, log in and download Arizona Note Form and Variations from the US Legal Forms collection. The Down load key will show up on each type you see. You have accessibility to all in the past downloaded forms inside the My Forms tab of your respective bank account.

If you want to use US Legal Forms the very first time, listed here are easy directions to get you began:

- Ensure you have picked out the proper type for your metropolis/county. Click the Preview key to analyze the form`s articles. Browse the type explanation to ensure that you have chosen the proper type.

- When the type doesn`t satisfy your needs, utilize the Look for industry towards the top of the screen to get the the one that does.

- In case you are content with the form, verify your selection by visiting the Get now key. Then, opt for the prices plan you like and supply your qualifications to register to have an bank account.

- Method the financial transaction. Make use of credit card or PayPal bank account to finish the financial transaction.

- Pick the structure and download the form on your own device.

- Make changes. Load, change and produce and indication the downloaded Arizona Note Form and Variations.

Each and every template you included in your account lacks an expiration particular date which is the one you have eternally. So, if you want to download or produce yet another copy, just visit the My Forms portion and click on around the type you want.

Obtain access to the Arizona Note Form and Variations with US Legal Forms, by far the most comprehensive collection of authorized file templates. Use thousands of professional and status-specific templates that meet your company or specific demands and needs.

Form popularity

FAQ

Employers should withhold half (7.65%) of the 15.3% owed in FICA (Social Security and Medicare) taxes from an employee's gross pay. FICA taxes come in addition to regular federal income taxes, which change depending on your income level. There are seven tax brackets in 2022 and 2023: 12%.

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

The new flat tax of 2.5% will affect the 2023 tax year ? which is filed by April 2024.

¶11-520, Apportionment The double-weighted sales factor formula is a fraction consisting of the sum of the property factor, the payroll factor, and two times the sales factor, divided by four. Arizona - Apportionment - Income Taxes, Corporate - Explanations cch.com ? document ? state ? appo... cch.com ? document ? state ? appo...

The 2023 tax year?meaning the return you'll file in 2024?will have the same seven federal income tax brackets as the last few seasons: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your filing status and taxable income, including wages, will determine the bracket you're in.

To change the amount of Arizona income tax withheld, an employee must complete Arizona Form A-4 and submit to his or her employer to choose a different withholding percentage option. Employees may request to have an additional amount withheld by their employer. Arizona Withholding Tax - Arizona Department of Revenue azdor.gov ? business ? withholding-tax azdor.gov ? business ? withholding-tax

2.0% Yes, the employer should then select 2.0% as the default rate. This means by March 2023 the paychecks would have the default rate chosen for them. Withholding FAQs - Arizona Department of Revenue azdor.gov ? business ? withholding-tax ? withhol... azdor.gov ? business ? withholding-tax ? withhol...

Enter your annual gross taxable wages, the number of paychecks you receive each year, your annual withholding goal, the amount already withheld for this year, the number of paychecks remaining in this year, and select the largest percentage on line 10 that is less than line 9. Withholding Calculations | Arizona Department of Revenue azdor.gov ? withholding-tax-individual ? withhol... azdor.gov ? withholding-tax-individual ? withhol...