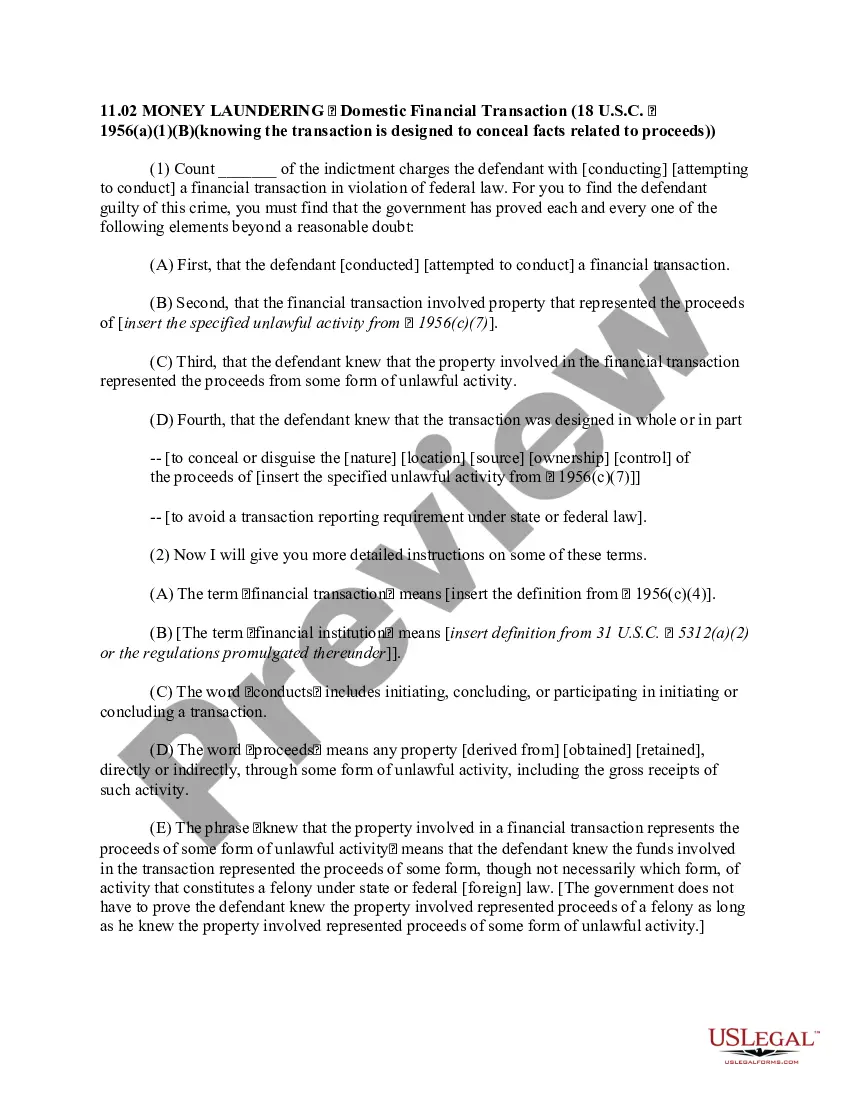

An Arizona Affidavit That All the Estate Assets Have Been Distributed to Devises by Executor or Estate Representative with Statement Concerning Debts and Taxes is a legal document used to confirm that all assets of an estate have been distributed to the devised beneficiaries by the executor or estate representative. This affidavit is crucial in settling the estate and ensuring that all remaining assets are properly accounted for. In Arizona, there are two main types of affidavits related to distributing estate assets to devises by the executor or estate representative: 1. Arizona Affidavit That All the Estate Assets Have Been Distributed to Devises by Executor: This type of affidavit indicates that the executor, appointed by the court, has successfully fulfilled their duties by distributing all estate assets to the intended beneficiaries, known as devises. It serves as proof that the executor has performed their responsibilities diligently and in accordance with the law. 2. Arizona Affidavit That All the Estate Assets Have Been Distributed to Devises by Estate Representative with Statement Concerning Debts and Taxes: This affidavit is similar to the first type but includes an additional statement concerning the debts and taxes of the estate. The estate representative, who may not necessarily be an appointed executor, is responsible for overseeing the distribution process and ensuring that any outstanding debts and taxes owed by the estate are paid before the assets are allocated to the devises. Keywords: Arizona affidavit, estate assets, distributed, devises, executor, estate representative, statement, debts, taxes, legal document, settling the estate, beneficiaries, appointed, proof, responsibilities, law.

Arizona Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes

Description

How to fill out Arizona Affidavit That All The Estate Assets Have Been Distributed To Devisees By Executor Or Estate Representative With Statement Concerning Debts And Taxes?

Choosing the best legitimate file template might be a battle. Obviously, there are a variety of web templates available on the net, but how do you get the legitimate type you will need? Take advantage of the US Legal Forms internet site. The service delivers a large number of web templates, like the Arizona Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes, which can be used for enterprise and private demands. Every one of the forms are inspected by experts and meet up with state and federal specifications.

When you are previously authorized, log in for your profile and click the Down load option to obtain the Arizona Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes. Make use of profile to look from the legitimate forms you possess ordered in the past. Check out the My Forms tab of your own profile and get an additional copy of the file you will need.

When you are a new user of US Legal Forms, listed here are basic instructions that you can follow:

- Very first, ensure you have selected the right type for your area/county. It is possible to check out the shape making use of the Preview option and look at the shape outline to guarantee this is basically the right one for you.

- When the type fails to meet up with your needs, take advantage of the Seach area to obtain the right type.

- When you are certain the shape would work, click on the Acquire now option to obtain the type.

- Select the prices plan you want and type in the needed information and facts. Build your profile and buy the order with your PayPal profile or bank card.

- Pick the submit file format and down load the legitimate file template for your product.

- Comprehensive, modify and print out and indication the acquired Arizona Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes.

US Legal Forms may be the greatest catalogue of legitimate forms that you will find a variety of file web templates. Take advantage of the service to down load skillfully-created documents that follow express specifications.