Arizona Interest Verification is a crucial process that ensures the accuracy and legitimacy of interests declared by individuals in the state of Arizona. This verification system aims to prevent any fraudulent claims and protect the rights of residents. By conducting this verification, Arizona can maintain the integrity of its various interest-related programs and initiatives. One type of Arizona Interest Verification involves verifying the interests declared by individuals when applying for government-issued identification cards, such as driver's licenses or state identification cards. The Arizona Department of Transportation (ADOPT) oversees the process of verifying the interests declared by applicants to ensure that the provided information is accurate and matches the individual's records. Another type of Arizona Interest Verification focuses on the interests declared by individuals when applying for various state benefits and assistance programs. These may include programs related to healthcare, financial aid, unemployment benefits, or housing assistance. The responsible agencies, such as the Arizona Department of Economic Security (DES), conduct thorough verifications to determine eligibility and prevent any misuse or fraudulent claims. In addition, Arizona Interest Verification is also relevant when individuals declare their interests in specific fields or sectors. For instance, professionals seeking licensure in various occupations need to provide evidence of their qualifications, skills, and interests to obtain a license from the appropriate regulatory bodies. These may include licenses for healthcare professionals, teachers, contractors, or real estate agents. The respective licensing boards in Arizona, such as the Arizona State Board of Nursing or the Arizona Department of Real Estate, conduct interest verification to ensure that applicants meet the necessary criteria. Furthermore, Arizona Interest Verification plays a crucial role in verifying the interests declared by individuals who are involved in public elections. Candidates running for political office are required to disclose their interests, financial information, and potential conflicts of interest. The Arizona Secretary of State's Office oversees the verification process to ensure transparency, accountability, and the integrity of the democratic system. In conclusion, Arizona Interest Verification is a comprehensive process that verifies the interests declared by individuals in various contexts, such as identification applications, benefit programs, occupational licensing, and political elections. By conducting thorough verifications, Arizona aims to maintain integrity, prevent fraud, and protect the rights of its residents.

Arizona Interest Verification

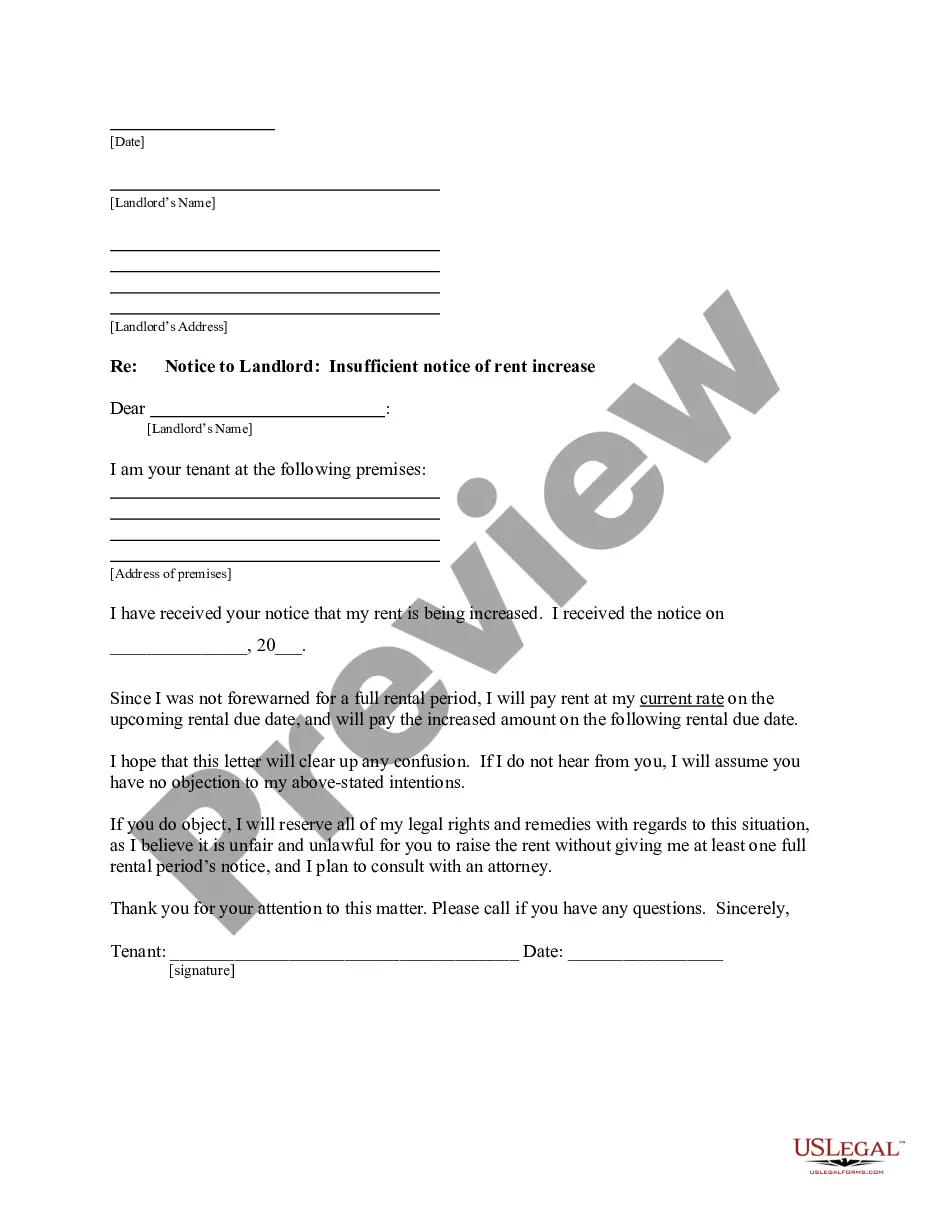

Description

How to fill out Arizona Interest Verification?

If you have to comprehensive, down load, or printing authorized file templates, use US Legal Forms, the biggest assortment of authorized varieties, which can be found on-line. Take advantage of the site`s easy and convenient lookup to obtain the papers you require. A variety of templates for business and personal uses are sorted by categories and states, or keywords and phrases. Use US Legal Forms to obtain the Arizona Interest Verification within a couple of clicks.

If you are previously a US Legal Forms consumer, log in in your account and then click the Acquire key to find the Arizona Interest Verification. Also you can accessibility varieties you previously delivered electronically within the My Forms tab of your account.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form to the correct area/land.

- Step 2. Use the Review method to check out the form`s content. Don`t forget about to read the description.

- Step 3. If you are not happy using the kind, use the Lookup industry near the top of the display to locate other models of your authorized kind web template.

- Step 4. Upon having located the form you require, select the Get now key. Choose the pricing strategy you favor and put your credentials to register to have an account.

- Step 5. Method the financial transaction. You may use your Мisa or Ьastercard or PayPal account to complete the financial transaction.

- Step 6. Find the format of your authorized kind and down load it in your gadget.

- Step 7. Full, revise and printing or signal the Arizona Interest Verification.

Every authorized file web template you get is the one you have eternally. You may have acces to each and every kind you delivered electronically with your acccount. Select the My Forms section and decide on a kind to printing or down load once again.

Be competitive and down load, and printing the Arizona Interest Verification with US Legal Forms. There are millions of skilled and express-particular varieties you may use for your business or personal requirements.

Form popularity

FAQ

? Mail to Arizona Department of Revenue, PO Box 29085, Phoenix, AZ 85038-9085. To ensure proper application of this payment, this form must be completed in its entirety.

Form 120EXT or a valid federal extension provides an extension of time to file, but does not provide an extension of time to pay. The entire amount of tax, penalties, and interest is due by the original due date of the return.

Tips to speed up the refund process: Do not staple any items to the return. Do not staple any documents, schedules or payment to your return. Ensure all the necessary lines and forms are filled out properly.

If your amended federal return was filed as a paper return, or if electronic filing is unavailable, mail Arizona Form 120S to: Arizona Department of Revenue PO Box 29079 Phoenix, AZ 85038-9079 ? If the S Corporation was required to make its tax payments for the 2022 taxable year by electronic funds transfer (EFT), it ...

You should include the 2nd federal return copy with your state return to mail in. Most states require you to mail in a copy of your Federal Return with your state return.

Instead, many states require you to submit a copy of your entire federal tax return, including any schedules you attach such as a Schedule C for self-employment earnings or Schedule A for your itemized deductions. In certain circumstances, you may have to attach an additional state schedule to your state tax return.

Form is used by individual taxpayers mailing a voluntary or mandatory estimated payment; a partnership or S corporation mailing a voluntary estimated payment on behalf of its nonresident individual partners/shareholders participating in the filing of a composite return. 140ES.

The late filing penalty is 4.5% (. 045) of the amount of tax required to be shown on the return. The penalty period is each month or fraction of a month between the due date of the return and the date the taxpayer filed the return. The maximum penalty is 25% of the tax found to be remaining due.

A limited liability company (LLC) that is classified as a partnership for federal income tax purposes must file Arizona Form 165. A single-member LLC that is disregarded as an entity for federal income tax purposes is treated as a branch or division of its owner, and is included in the tax return of its owner.

You may be required to include additional files with your return. If you are, you'll be prompted to attach those files during the e-filing process. Check the Federal and State sections of the TaxAct program to make sure you've added any necessary attachments.