Arizona Liens: A Comprehensive Overview of Different Types of Liens Found in Seller's Files In the real estate world, liens play a crucial role when it comes to property ownership and transactions. When buying a property, it is essential to conduct thorough due diligence and examine the seller's files to identify any existing liens that could potentially disrupt the purchase or affect the title. In Arizona, there are various types of liens that may be found in a seller's files, including: 1. Tax Liens: These liens arise when property owners fail to pay their property taxes. The local government places a lien on the property, making it a priority debt that needs to be settled before any other claims can be addressed. Tax liens can be either federal or state, and ensuring they are resolved is vital for a smooth transaction. 2. Judgment Liens: Judgment liens occur when a creditor obtains a court judgment against a debtor for unpaid debts. These liens are recorded in the county where the debtor resides or owns property. By identifying judgment liens in seller's files, potential buyers can assess the risk associated with the property's transfer and determine the necessary steps to clear the lien. 3. Mechanic's Liens: Also known as construction liens, these are filed by contractors, subcontractors, or suppliers who have not been paid for work or materials provided to improve the property. Mechanic's liens need to be settled before the property can be sold, as failure to do so may result in the new owner assuming responsibility for the debt. Ensuring these liens are addressed is crucial for buyers to avoid unforeseen financial obligations. Moreover, the seller's files may also contain information regarding mortgages/deeds of trust, UCC statements, bankruptcies, and lawsuits. Mortgages/Deeds of Trust: These documents evidence loans secured by the property. Mortgages are the traditional form of a loan where the borrower grants the lender an interest in the property. Deeds of trust function similarly but involve a third-party trustee that holds the legal title until the loan is repaid. UCC Statements: UCC, or Uniform Commercial Code, statements pertain to personal property used as collateral for a loan. These statements are typically filed to notify potential buyers and creditors that a creditor has a security interest in certain assets. Identifying UCC statements provides insight into existing loans or encumbrances on personal property associated with the property being sold. Bankruptcies: Records of bankruptcies found in the seller's file indicate a financial condition where the seller cannot settle their debts and seek legal protection. Bankruptcy proceedings can significantly impact property transactions, potentially leading to delays or the seller's inability to transfer the property free and clear. Lawsuits: The seller's file may reveal ongoing or past lawsuits involving the property, such as disputes with previous owners, tenants, or neighboring properties. Identifying lawsuits helps buyers understand potential legal encumbrances and ascertain if any unresolved conflicts may impact their ownership or future plans for the property. In conclusion, when examining a seller's files in Arizona, being thorough in identifying various types of liens, mortgages/deeds of trust, UCC statements, bankruptcies, and lawsuits is paramount. This due diligence ensures that buyers are fully aware of any potential financial burdens or legal entanglements associated with the property, allowing them to make informed decisions and mitigate risks.

Arizona Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files

Description

How to fill out Arizona Liens, Mortgages/Deeds Of Trust, UCC Statements, Bankruptcies, And Lawsuits Identified In Seller's Files?

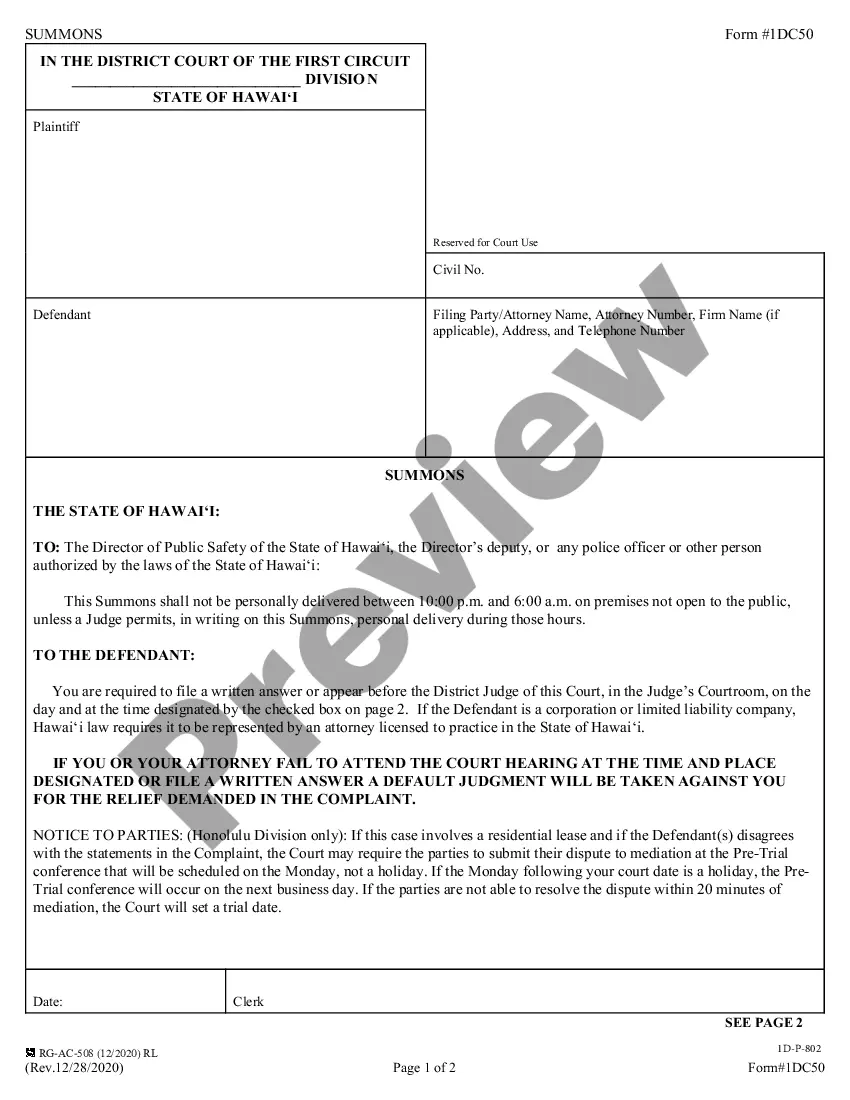

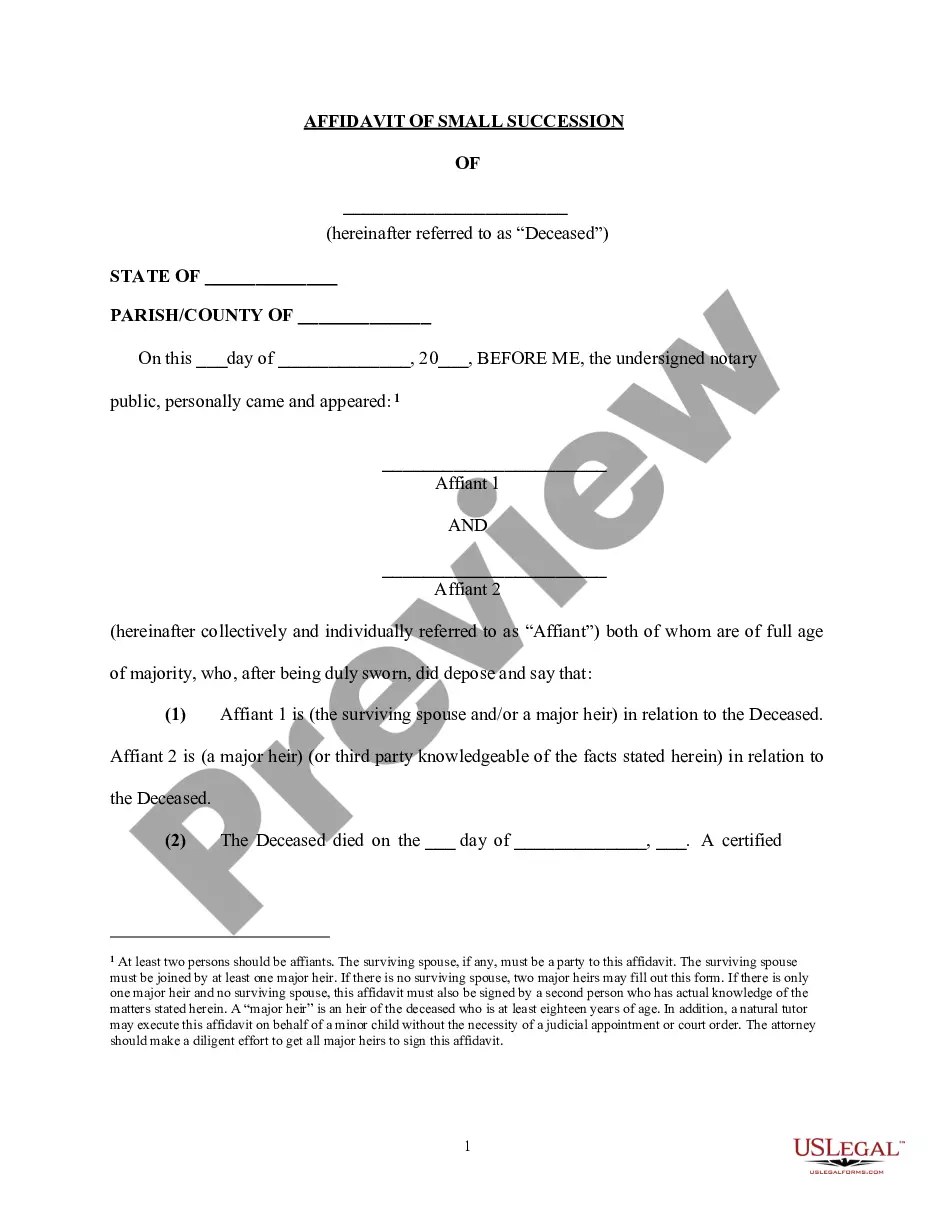

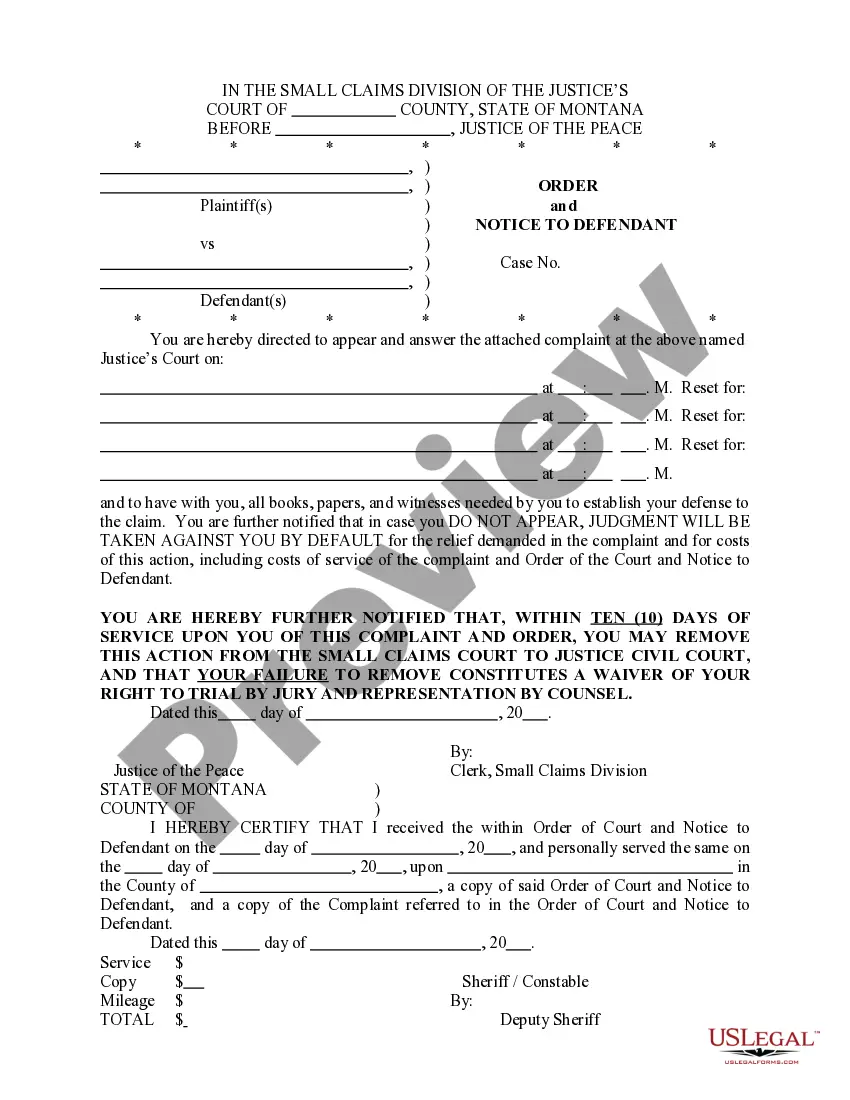

You may devote hrs on the Internet searching for the lawful document design that meets the state and federal demands you will need. US Legal Forms provides thousands of lawful kinds which are reviewed by professionals. You can easily obtain or printing the Arizona Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files from my support.

If you already have a US Legal Forms profile, you may log in and click on the Down load button. After that, you may full, change, printing, or sign the Arizona Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files. Every lawful document design you acquire is the one you have forever. To have another copy of the acquired kind, go to the My Forms tab and click on the related button.

If you work with the US Legal Forms site the first time, stick to the easy recommendations under:

- Very first, make certain you have chosen the correct document design for that state/metropolis of your choosing. Read the kind outline to ensure you have chosen the correct kind. If available, utilize the Review button to search through the document design as well.

- If you would like get another edition in the kind, utilize the Lookup area to obtain the design that fits your needs and demands.

- When you have located the design you desire, simply click Acquire now to carry on.

- Pick the rates strategy you desire, type your accreditations, and register for your account on US Legal Forms.

- Comprehensive the transaction. You should use your bank card or PayPal profile to purchase the lawful kind.

- Pick the formatting in the document and obtain it to the gadget.

- Make alterations to the document if possible. You may full, change and sign and printing Arizona Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files.

Down load and printing thousands of document templates while using US Legal Forms web site, which provides the largest assortment of lawful kinds. Use specialist and state-certain templates to take on your small business or individual needs.

Form popularity

FAQ

My Property Has a Lien ? Now What? Pay Off the Lien ? Once you determine that the lien is valid, the simplest method for removing it is to pay it off. ... Request a Release-of-Lien Form ? After paying off the balance of your debt in full, the creditor will file a release-of-lien form.

Lienholders hold the title until the lien is satisfied. The vehicle owner must hold a valid registration. All title transactions, including new, transfer, duplicate and corrected, that indicate a lien are processed in the usual manner.

After the lien is set, the debtor cannot refinance their property without paying off the owed debt first. 5 Steps To Put A Lien On A House. ... Check For Statute Of Limitations. ... File A Claim In Court. ... Serve Court Papers. ... Attend Court Hearing. ... Record Lien. ... Dar Liens Offers Lien Processing and Filing in Arizona.

An electronic lien and title (ELT) is an electronic method by which MVD and authorized lienholders exchange essential vehicle, lien and title information. Lienholders are required to perfect or release liens electronically using the current ELT process through an approved ELT service provider.

What is a Lien? The term lien refers to a legal claim or legal right which is made against the assets that are held as collaterals for satisfying a debt. A lien can be established by a creditor or a legal judgement. The purpose of the lien is to guarantee an underlying obligation such as the repayment of the loan.

If you have a title loan in Arizona, you need to inform potential buyers that you're currently paying off the loan, and you'll soon be released from the lien. You need to pay the title loan in full before transferring the vehicle title to the new car owner.

When filing a lien with the Division, a person shall submit a Title and Registration Application (available online at .azdot.gov/mvd/FormsandPub/mvd.asp), the most recently issued certificate of title, the fee or fees to be paid as provided by law, and any other documentation required pursuant to A.R.S. Title 28.