Arizona Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner

Description

How to fill out Ratification Of Pooled Unit Designation By Overriding Royalty Or Royalty Interest Owner?

Choosing the best legal papers design can be a battle. Naturally, there are a lot of web templates accessible on the Internet, but how do you get the legal type you will need? Utilize the US Legal Forms website. The services offers a large number of web templates, like the Arizona Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner, which you can use for business and private needs. All the forms are checked by experts and meet state and federal demands.

If you are currently listed, log in for your bank account and click on the Obtain button to find the Arizona Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner. Make use of your bank account to appear with the legal forms you may have bought formerly. Proceed to the My Forms tab of your bank account and get one more version of the papers you will need.

If you are a whole new end user of US Legal Forms, listed here are basic guidelines so that you can follow:

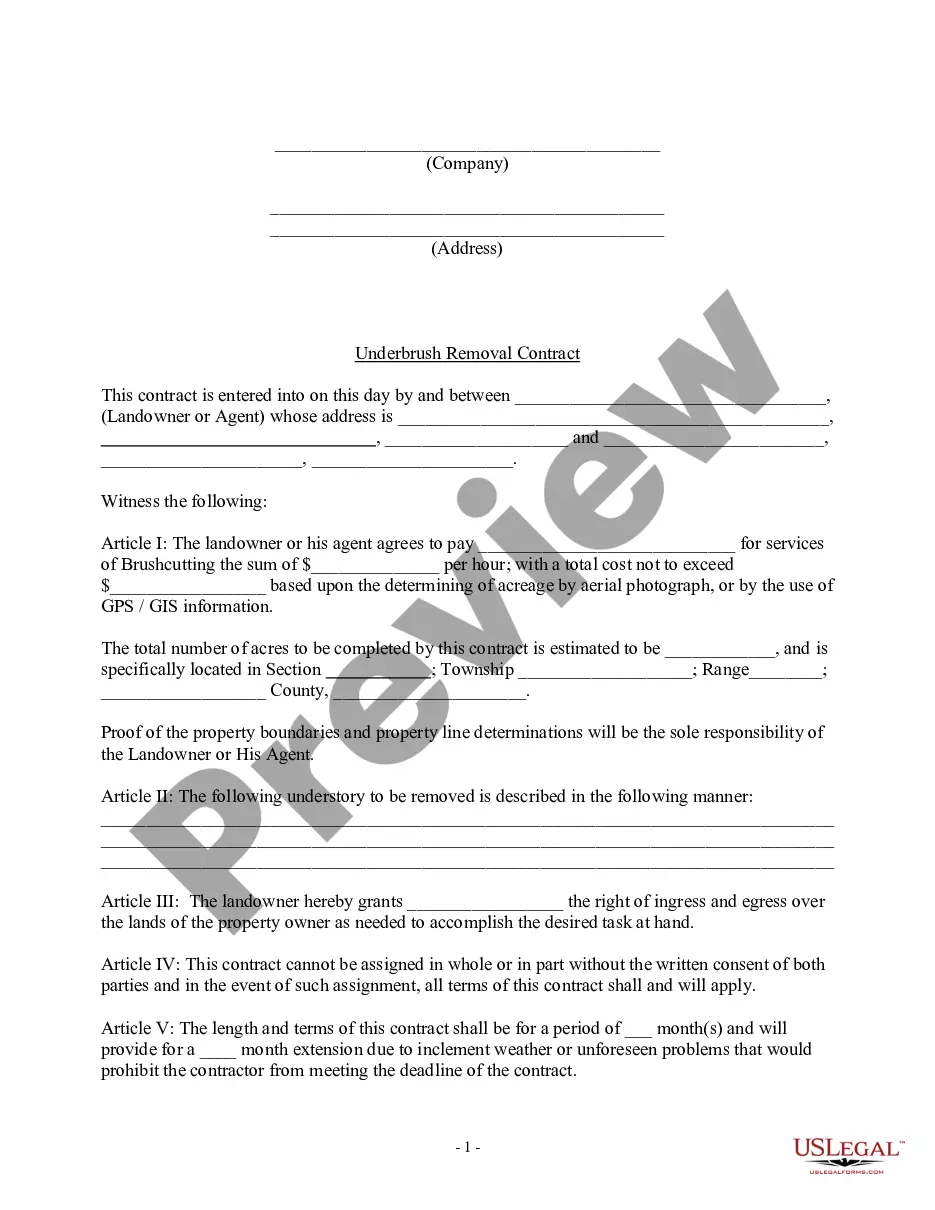

- First, make certain you have chosen the appropriate type for your personal area/county. You are able to check out the form making use of the Preview button and study the form outline to make sure it is the best for you.

- When the type fails to meet your preferences, take advantage of the Seach discipline to get the proper type.

- Once you are sure that the form would work, click on the Get now button to find the type.

- Opt for the prices strategy you desire and type in the required information and facts. Design your bank account and pay for your order with your PayPal bank account or charge card.

- Choose the submit formatting and obtain the legal papers design for your gadget.

- Full, change and produce and indication the attained Arizona Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner.

US Legal Forms is the biggest collection of legal forms where you can find a variety of papers web templates. Utilize the company to obtain professionally-made documents that follow status demands.

Form popularity

FAQ

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An Overriding Royalty Interest IORRI), commonly referred to as an override, is a fractional, undivided interest granting the right to receive proceeds from the sale of oil and gas. It is not an interest in the minerals themselves, but rather in the proceeds of the sale of oil and gas.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.