The Arizona Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease is a legal provision that outlines the rules and regulations for the distribution of nonparticipating royalty payments in oil and gas leases in Arizona. This stipulation ensures fair distribution of royalties to nonparticipating landowners who may not have signed the lease but are entitled to a share of the profits. Under this stipulation, segregated tracts covered by a single oil and gas lease are identified and their corresponding nonparticipating royalty beneficiaries are determined. The term "segregated tracts" refers to separate portions of land within the same lease, each with its own specific ownership and nonparticipating royalty interests. There are different types of Arizona Stipulations Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease, including: 1. Segregated Tract Identification: This type of stipulation focuses on defining and identifying the separate tracts of land within the overall oil and gas lease. It specifies the boundaries and ownership details of each tract to avoid any disputes or confusion. 2. Nonparticipating Royalty Determination: This stipulation outlines the process for determining the nonparticipating royalty interests in each segregated tract. It may include factors such as the size of the tract, the percentage of nonparticipating royalty interest, and any existing agreements or contracts. 3. Royalty Payment Distribution: This type of stipulation establishes the mechanism for distributing the nonparticipating royalty payments among the beneficiaries. It outlines the rights and obligations of both the lease operator and the nonparticipating royalty beneficiaries, ensuring timely and accurate royalty disbursements. 4. Dispute Resolution: In cases where disputes arise regarding the payment of nonparticipating royalties, this stipulation provides guidelines for resolving conflicts. It may include procedures for arbitration, mediation, or legal action, aiming to maintain fairness and equity for all parties involved. The Arizona Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease plays a crucial role in protecting the rights and interests of nonparticipating landowners. By defining the rules for royalty payment distribution, it ensures transparency, clarity, and compliance with state regulations in the oil and gas industry.

Arizona Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

How to fill out Arizona Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

Are you in the placement where you need to have paperwork for possibly company or individual reasons nearly every day time? There are a variety of legal papers web templates available on the Internet, but getting types you can rely is not simple. US Legal Forms offers a huge number of develop web templates, much like the Arizona Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease, which can be published to satisfy state and federal needs.

In case you are previously acquainted with US Legal Forms website and have a merchant account, just log in. Afterward, you can acquire the Arizona Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease template.

Should you not offer an account and want to start using US Legal Forms, abide by these steps:

- Obtain the develop you want and ensure it is for the correct town/state.

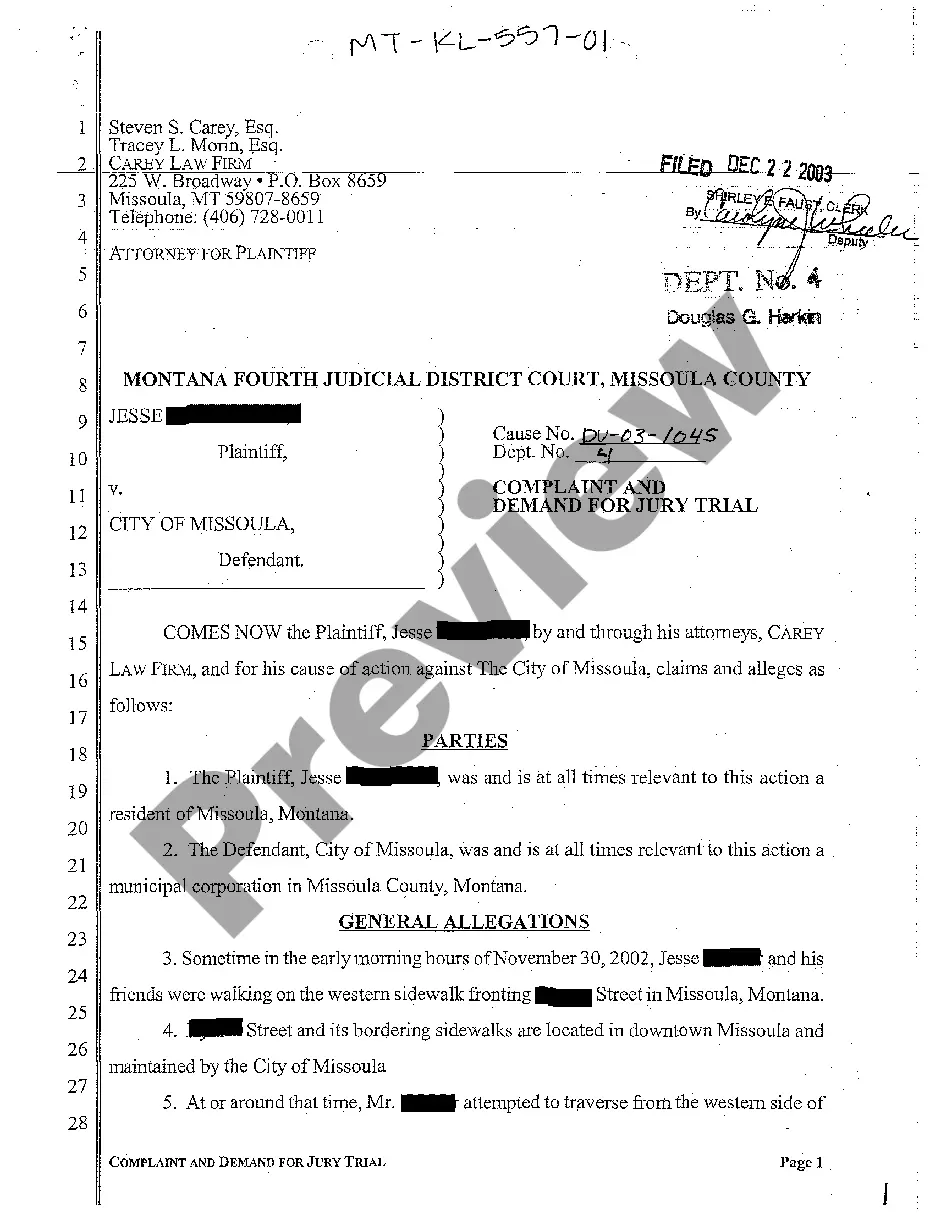

- Make use of the Preview key to check the shape.

- Look at the outline to ensure that you have chosen the proper develop.

- In case the develop is not what you are seeking, make use of the Research industry to obtain the develop that meets your requirements and needs.

- Whenever you get the correct develop, simply click Buy now.

- Select the prices plan you want, complete the desired information to produce your money, and pay for an order with your PayPal or Visa or Mastercard.

- Pick a handy data file format and acquire your copy.

Find all of the papers web templates you might have purchased in the My Forms menu. You can obtain a extra copy of Arizona Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease any time, if needed. Just select the necessary develop to acquire or produce the papers template.

Use US Legal Forms, by far the most substantial collection of legal forms, to save lots of time as well as avoid blunders. The support offers expertly produced legal papers web templates which can be used for a variety of reasons. Create a merchant account on US Legal Forms and start generating your life a little easier.