This office lease clause states the conditions under which the landlord can and can not furnish any particular item(s) of work or service which would constitute an expense to portions of the Building during the comparative year.

Arizona Clause for Grossing Up the Tenant Proportionate Share

Description

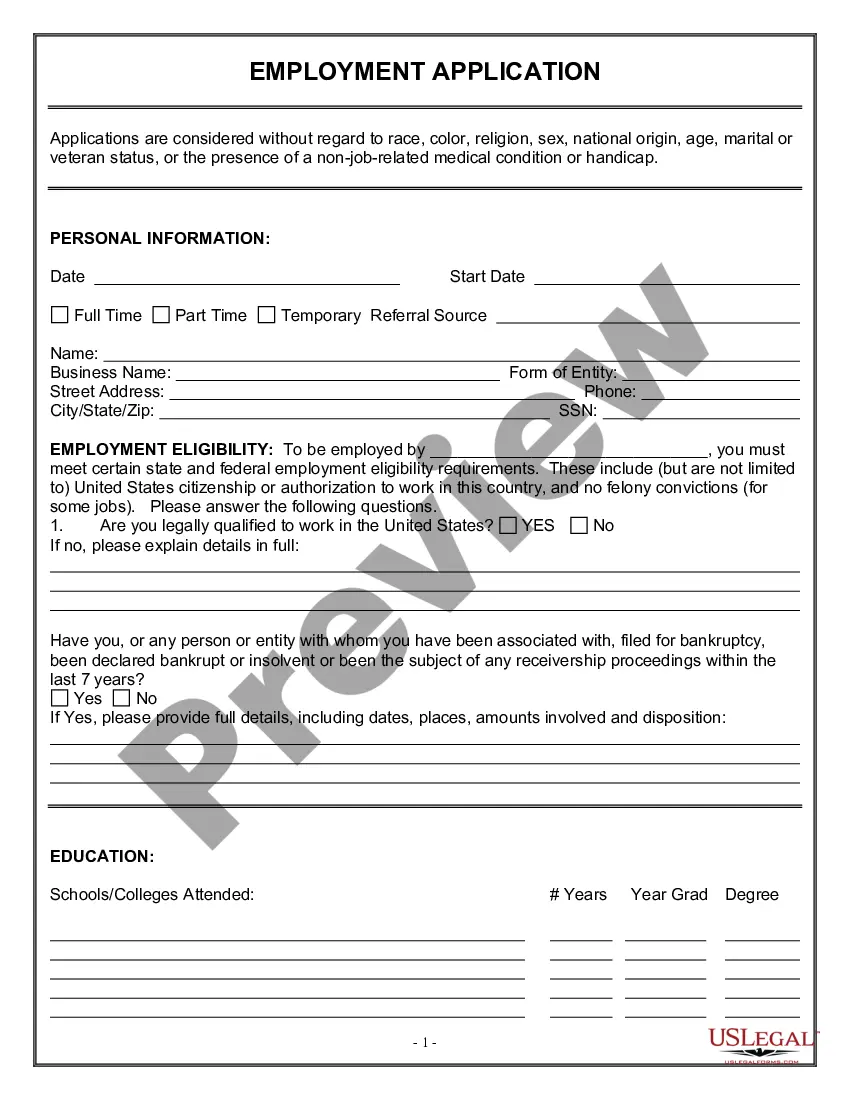

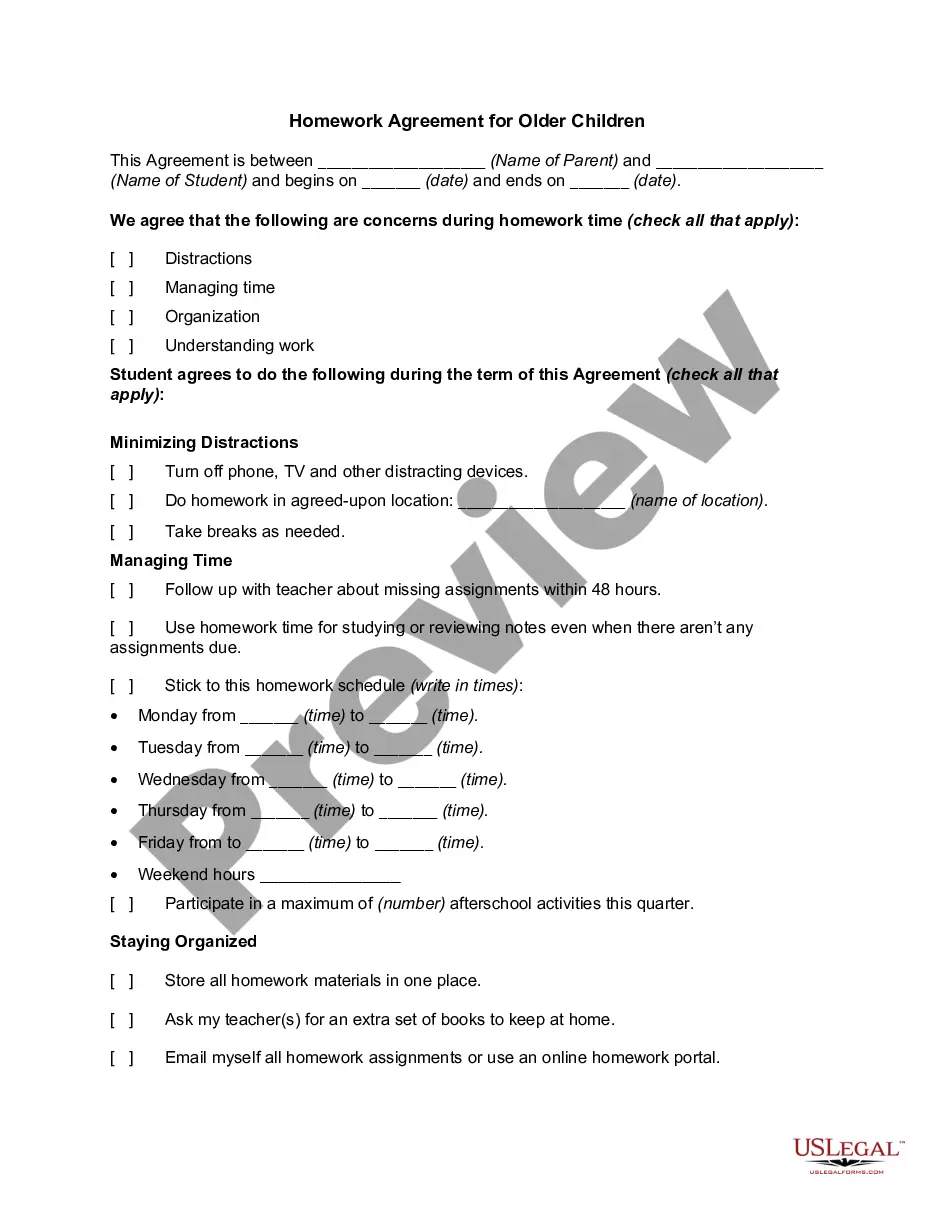

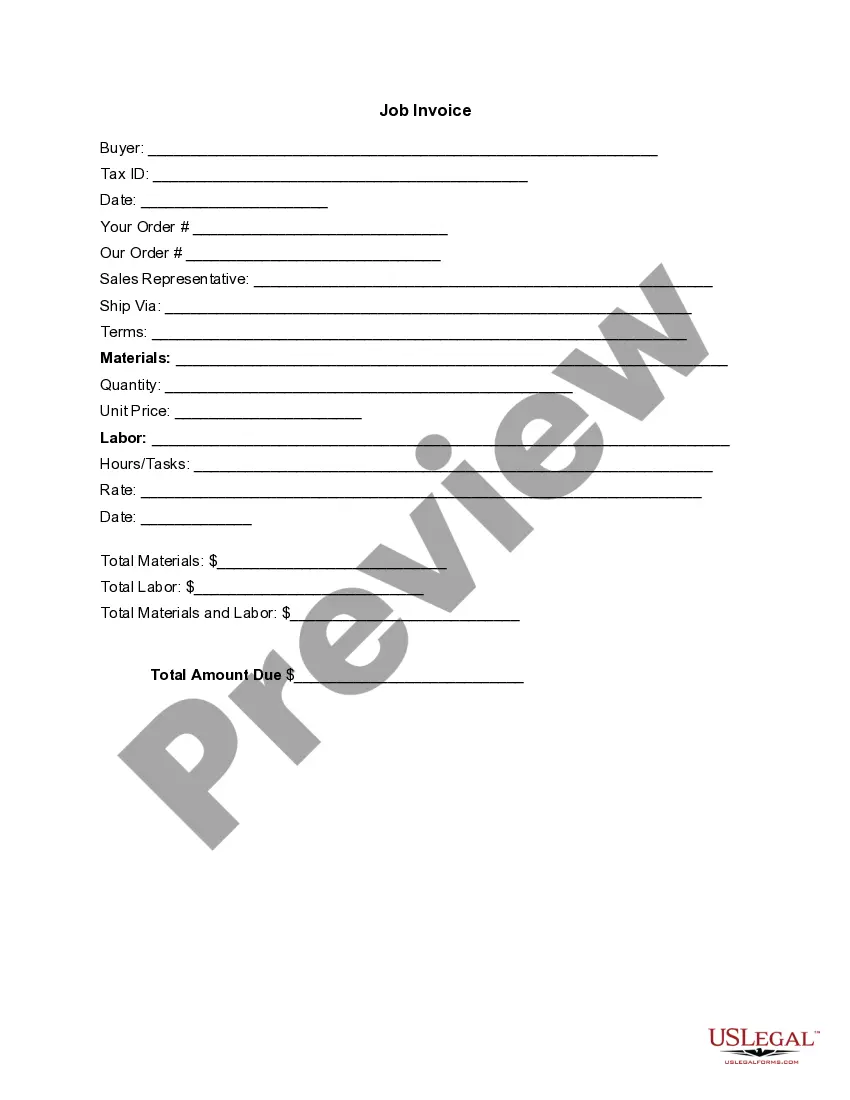

How to fill out Clause For Grossing Up The Tenant Proportionate Share?

If you have to total, down load, or produce authorized document themes, use US Legal Forms, the most important variety of authorized varieties, which can be found on-line. Make use of the site`s simple and easy convenient lookup to get the documents you will need. A variety of themes for company and personal reasons are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to get the Arizona Clause for Grossing Up the Tenant Proportionate Share with a couple of clicks.

Should you be already a US Legal Forms buyer, log in in your account and click on the Acquire switch to have the Arizona Clause for Grossing Up the Tenant Proportionate Share. You can even accessibility varieties you formerly downloaded from the My Forms tab of your own account.

Should you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for that proper city/country.

- Step 2. Use the Review solution to examine the form`s content material. Never overlook to learn the information.

- Step 3. Should you be unsatisfied with the develop, make use of the Search field on top of the display to discover other variations in the authorized develop format.

- Step 4. Upon having discovered the form you will need, go through the Purchase now switch. Choose the prices strategy you choose and include your references to sign up on an account.

- Step 5. Method the purchase. You can utilize your bank card or PayPal account to accomplish the purchase.

- Step 6. Choose the file format in the authorized develop and down load it on the device.

- Step 7. Comprehensive, edit and produce or signal the Arizona Clause for Grossing Up the Tenant Proportionate Share.

Each and every authorized document format you purchase is yours permanently. You might have acces to every single develop you downloaded inside your acccount. Click on the My Forms section and decide on a develop to produce or down load again.

Contend and down load, and produce the Arizona Clause for Grossing Up the Tenant Proportionate Share with US Legal Forms. There are millions of professional and condition-distinct varieties you can utilize for your company or personal requirements.

Form popularity

FAQ

Grossing Up is a process for calculating a tenant's share of a building's variable operating expenses, where the expenses are increased for expense recovery purposes, or Grossed Up, to what they would be if the building's occupancy remained at a specific level, typically 95%- 100%.

Since the tenant's agreement is tied to the property, they have the right to stay there after the property is sold. If no arrangements are made for the lease to terminate legally, the new landlord must honor the lease until it expires. If the new landlord wants the tenant out, they can form a "cash for keys" agreement.

Arizona is landlord-friendly because tenants cannot withhold rent for any reason. If a tenant in Arizona fails to pay rent, their landlord may deliver a five-day notice to pay or move out. If the tenant does not pay the landlord within five days, then the landlord can file an eviction lawsuit against the tenant.

Stated simply, the concept of ?gross up? is that, when calculating a tenant's share of operating expenses for an office building that is less than fully occupied, the landlord first increases - or "grosses up" - those operating expenses that vary with occupancy (e.g., utilities, janitorial service, etc.) to the amount ...

In addition to renting the space in which their occupying, tenants also pay for a portion of the common areas that they use. Gross-up can include hallways, washrooms, lobby, amenities such as gyms, common showers, bike lock up, etc. Usable area is space a tenant occupies, what they can ?use?.

To deal with operating expenses when a building is not at full occupancy, a landlord can incorporate a ?gross-up? provision in the lease. This allows the landlord to estimate the variable operating expenses as if the building were at 95%-100% occupancy.

Correctly drafted, a gross up provision relates only to Operating Expenses that ?vary with occupancy??so called ?variable? expenses. Variable expenses are those expenses that will go up or down depending on the number of tenants in the Building, such as utilities, trash removal, management fees and janitorial services.

Simply stated, the concept of ?gross up provision? stipulates that if a building has significant vacancy, the landlord can estimate what the variable operating expense would have been had the building been fully occupied, and charge the tenants their pro-rata share of that cost.