Are you within a situation the place you require documents for sometimes enterprise or specific uses nearly every day? There are a lot of legitimate document layouts available on the Internet, but finding kinds you can rely on isn`t effortless. US Legal Forms provides 1000s of develop layouts, such as the Arizona HAMP Loan Modification Package, which can be created in order to meet federal and state requirements.

In case you are currently familiar with US Legal Forms site and also have a free account, merely log in. Following that, you may down load the Arizona HAMP Loan Modification Package format.

Should you not offer an profile and want to begin using US Legal Forms, adopt these measures:

- Obtain the develop you need and ensure it is to the correct town/area.

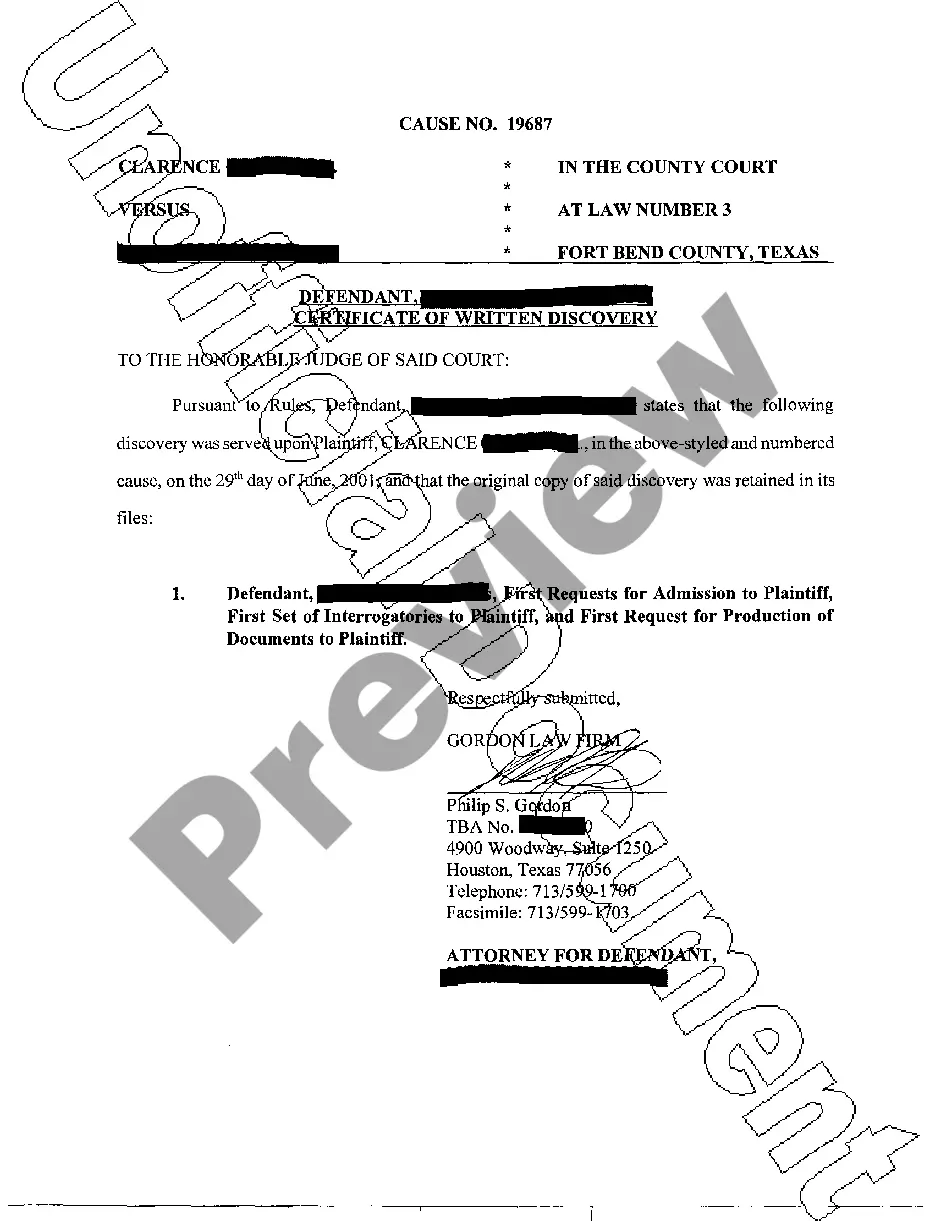

- Use the Review button to check the form.

- Read the description to ensure that you have selected the appropriate develop.

- If the develop isn`t what you are looking for, use the Look for discipline to discover the develop that meets your needs and requirements.

- Whenever you get the correct develop, simply click Get now.

- Opt for the costs prepare you want, complete the required information and facts to produce your money, and purchase the transaction using your PayPal or bank card.

- Pick a convenient data file format and down load your backup.

Locate each of the document layouts you possess bought in the My Forms food selection. You can obtain a additional backup of Arizona HAMP Loan Modification Package whenever, if needed. Just click the essential develop to down load or printing the document format.

Use US Legal Forms, one of the most considerable assortment of legitimate kinds, to save time as well as steer clear of blunders. The support provides skillfully made legitimate document layouts that you can use for a selection of uses. Create a free account on US Legal Forms and start producing your daily life a little easier.