US Legal Forms - among the greatest libraries of legal forms in America - offers an array of legal file themes it is possible to down load or printing. Utilizing the site, you can get a large number of forms for business and individual reasons, sorted by categories, states, or key phrases.You will discover the most recent versions of forms just like the Arizona Personal Property Inventory Questionnaire in seconds.

If you have a subscription, log in and down load Arizona Personal Property Inventory Questionnaire from the US Legal Forms local library. The Acquire option will appear on each develop you perspective. You have accessibility to all previously downloaded forms in the My Forms tab of the account.

If you would like use US Legal Forms the first time, listed below are simple recommendations to help you get started:

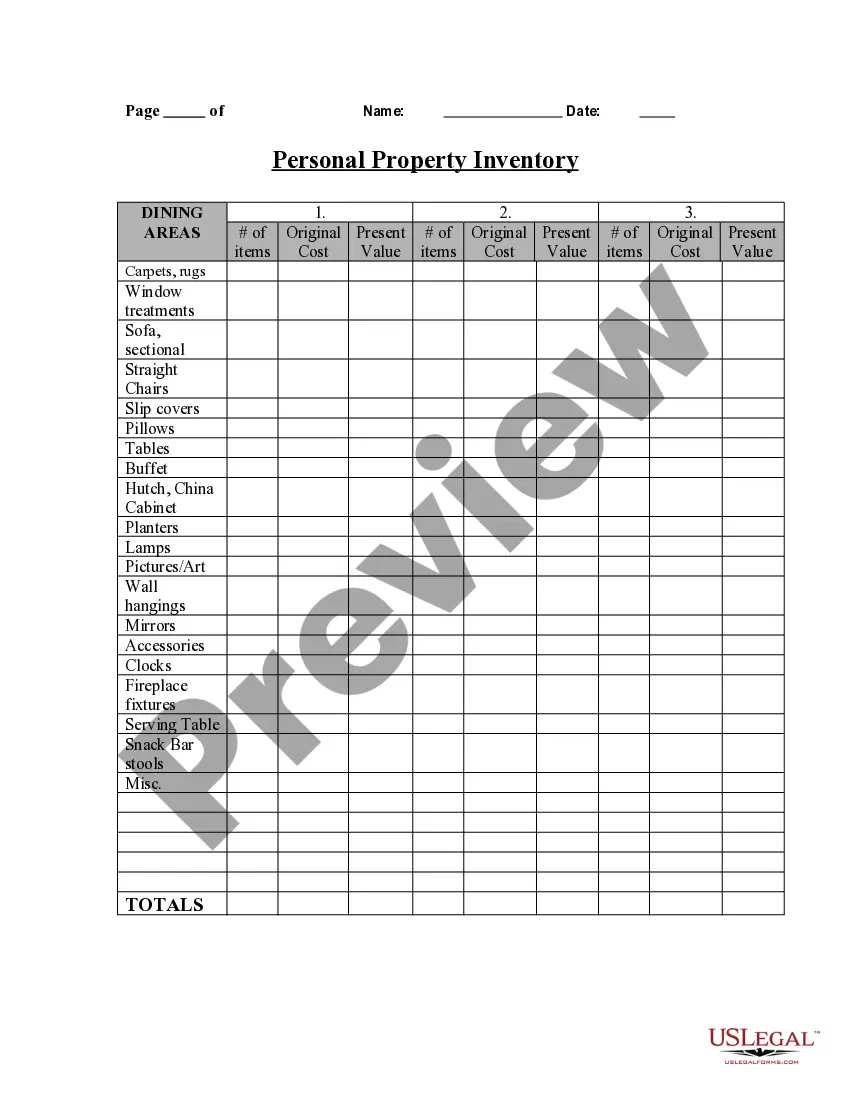

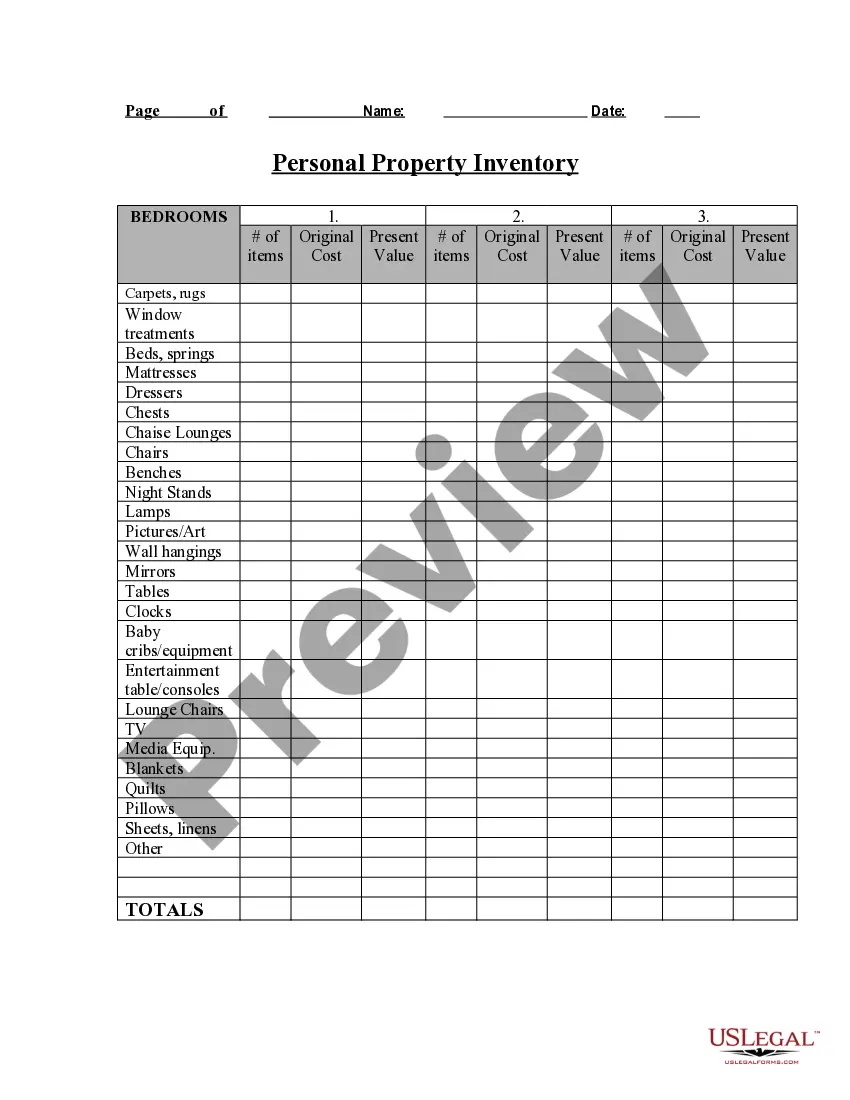

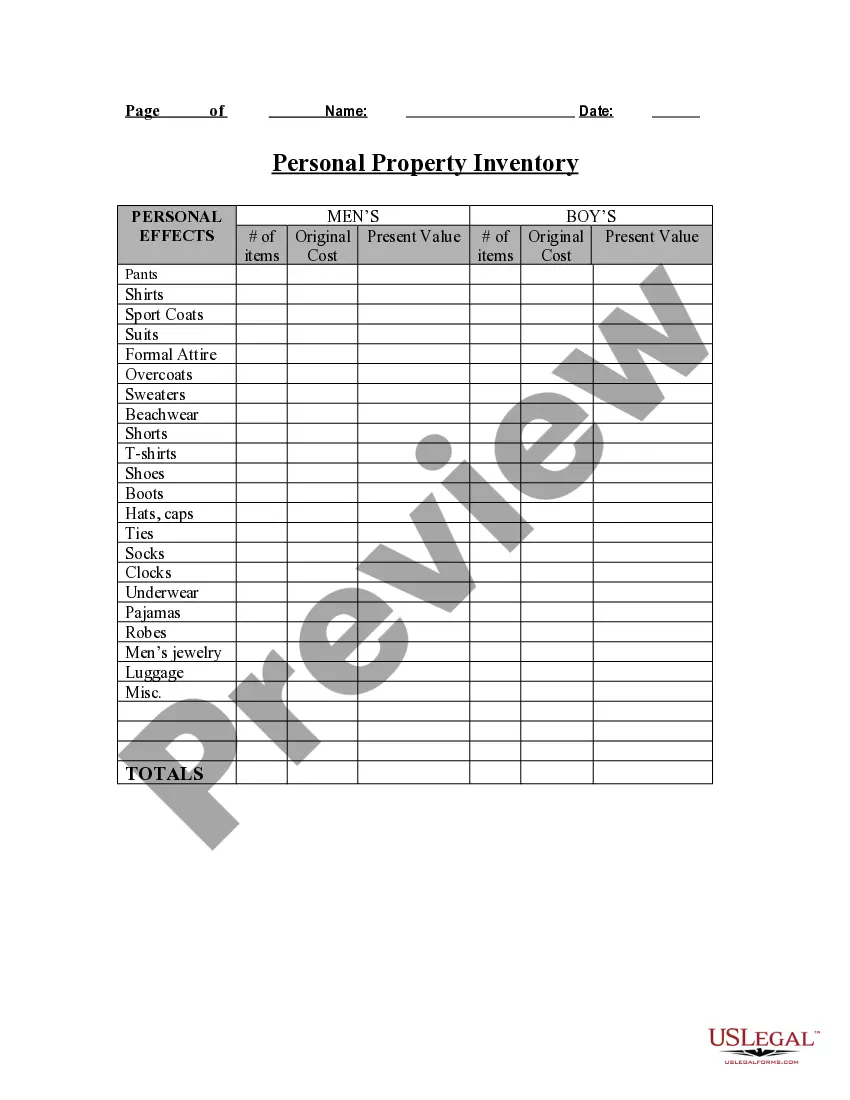

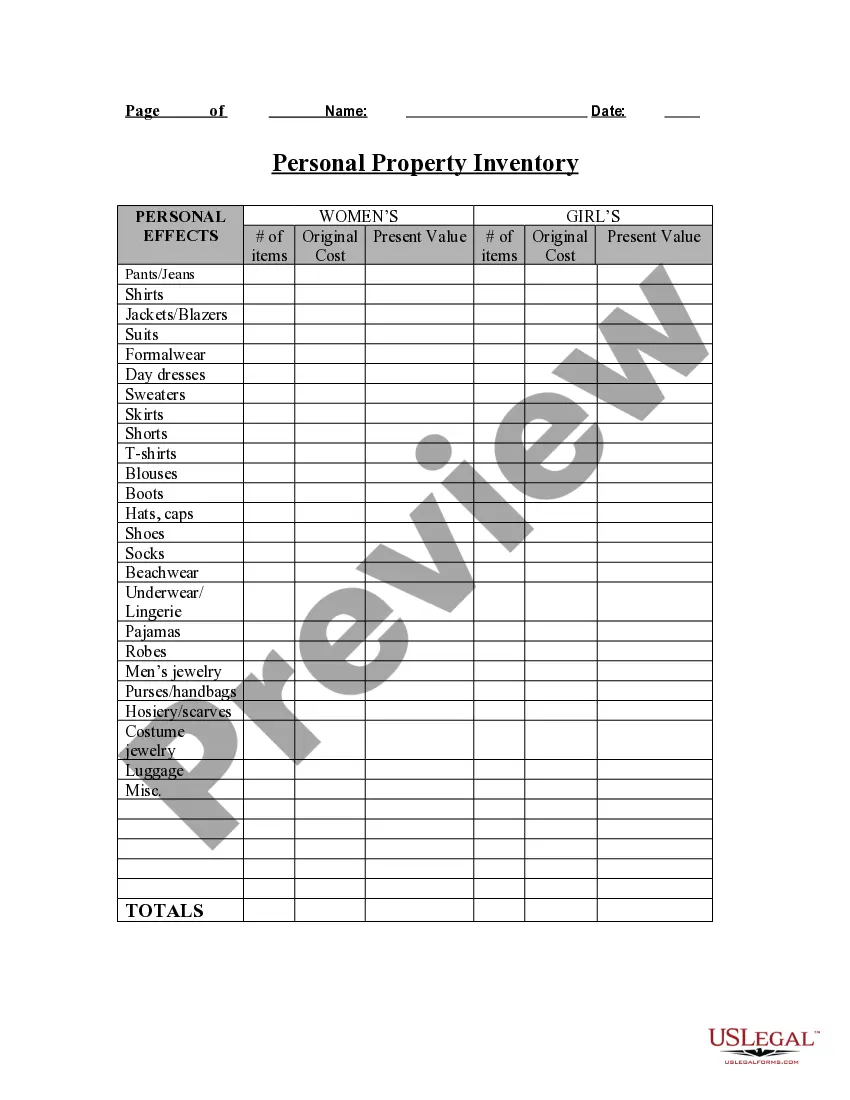

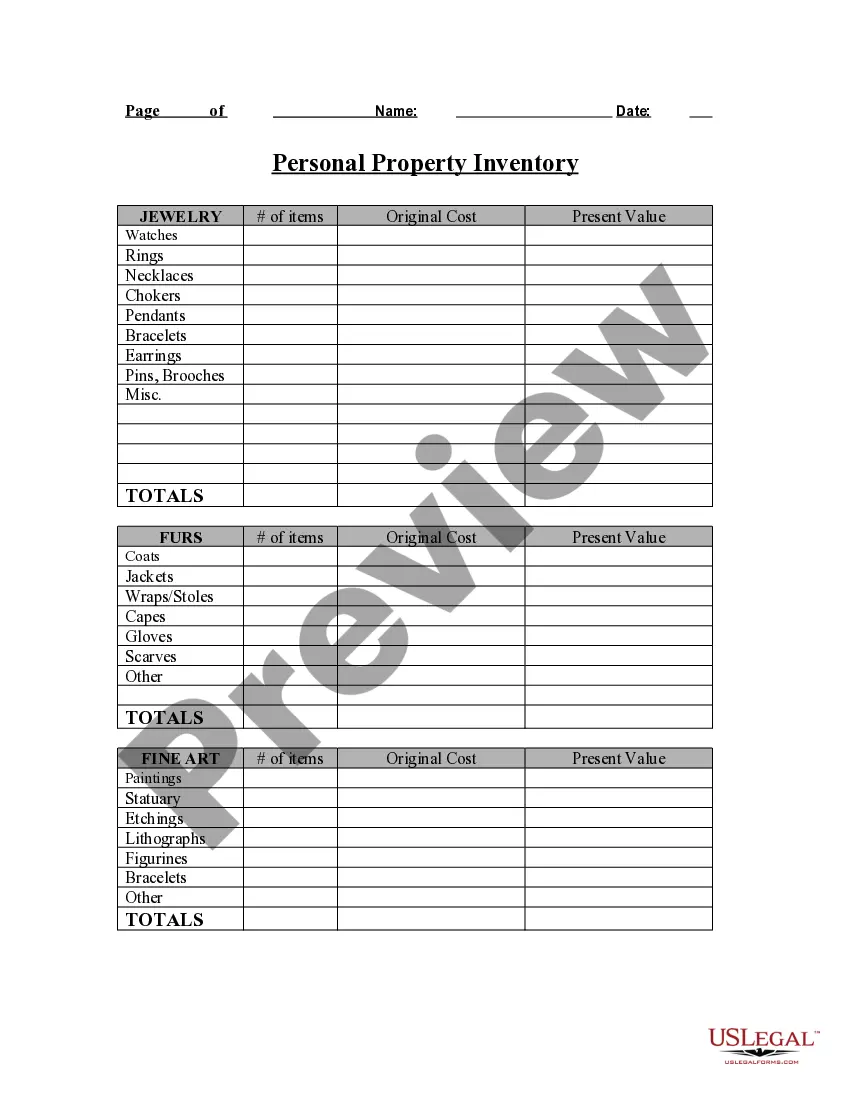

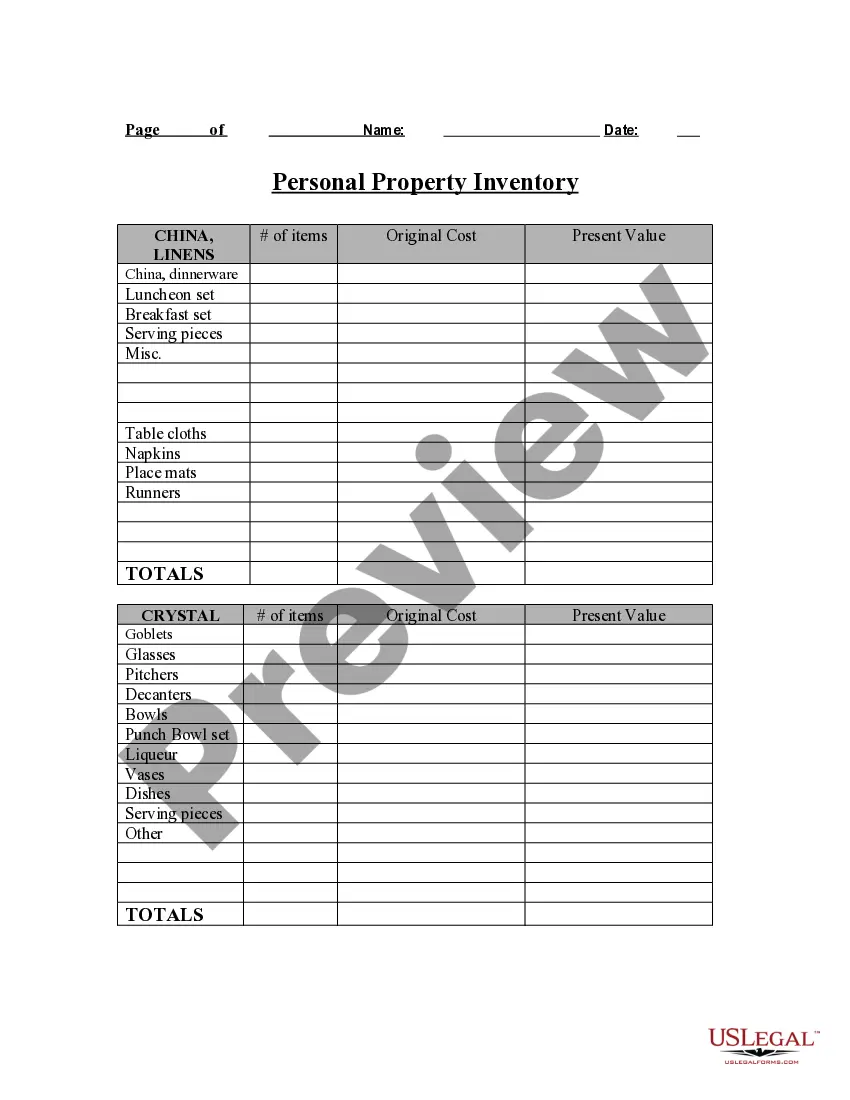

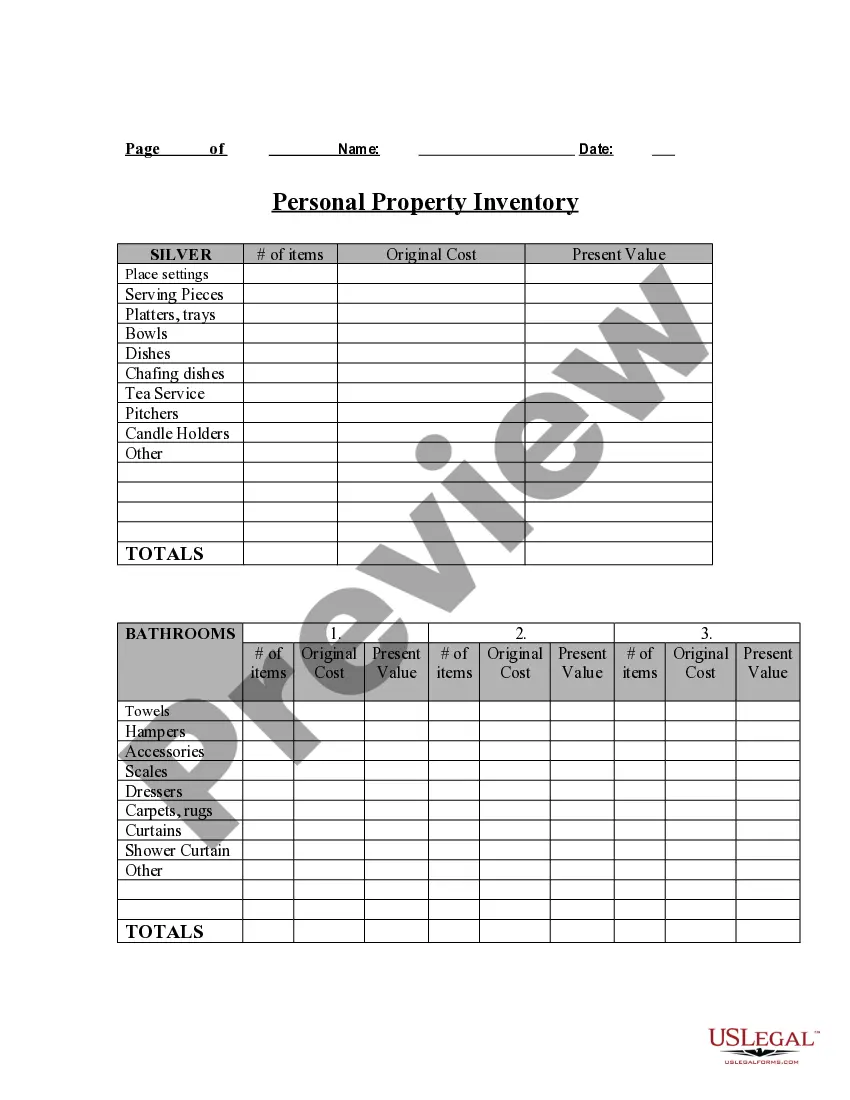

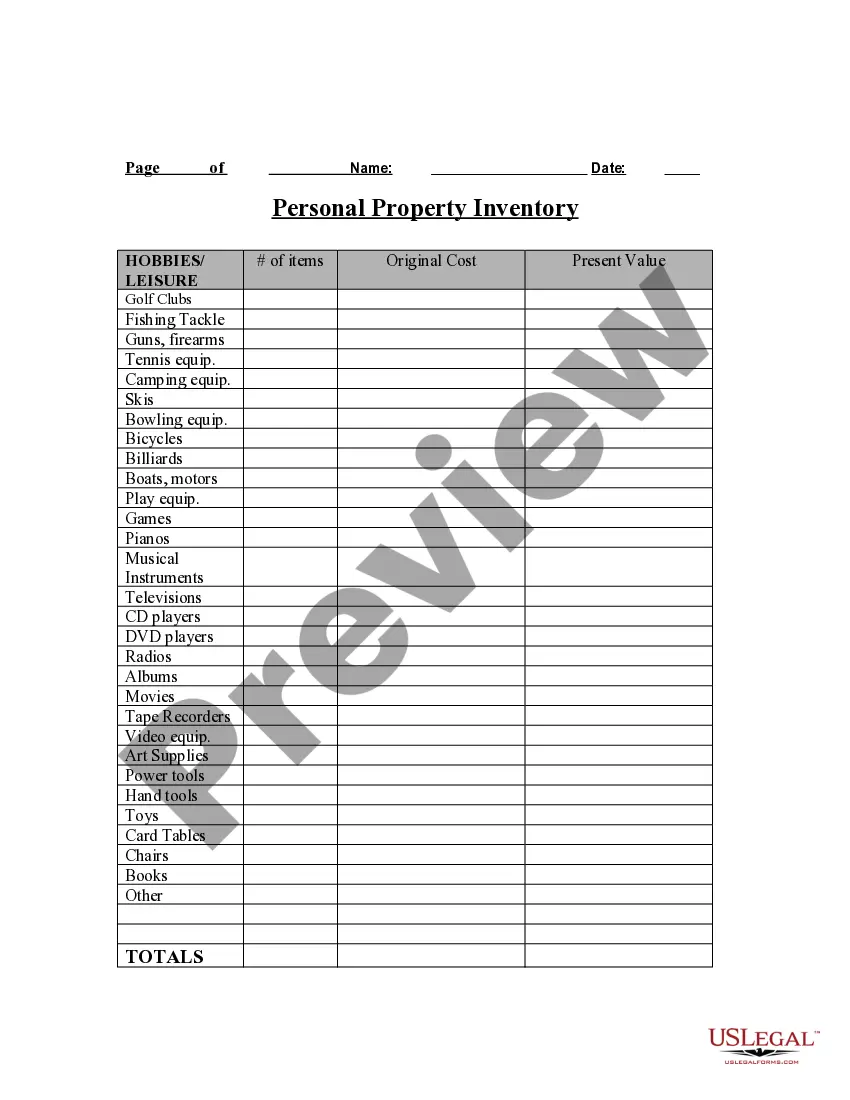

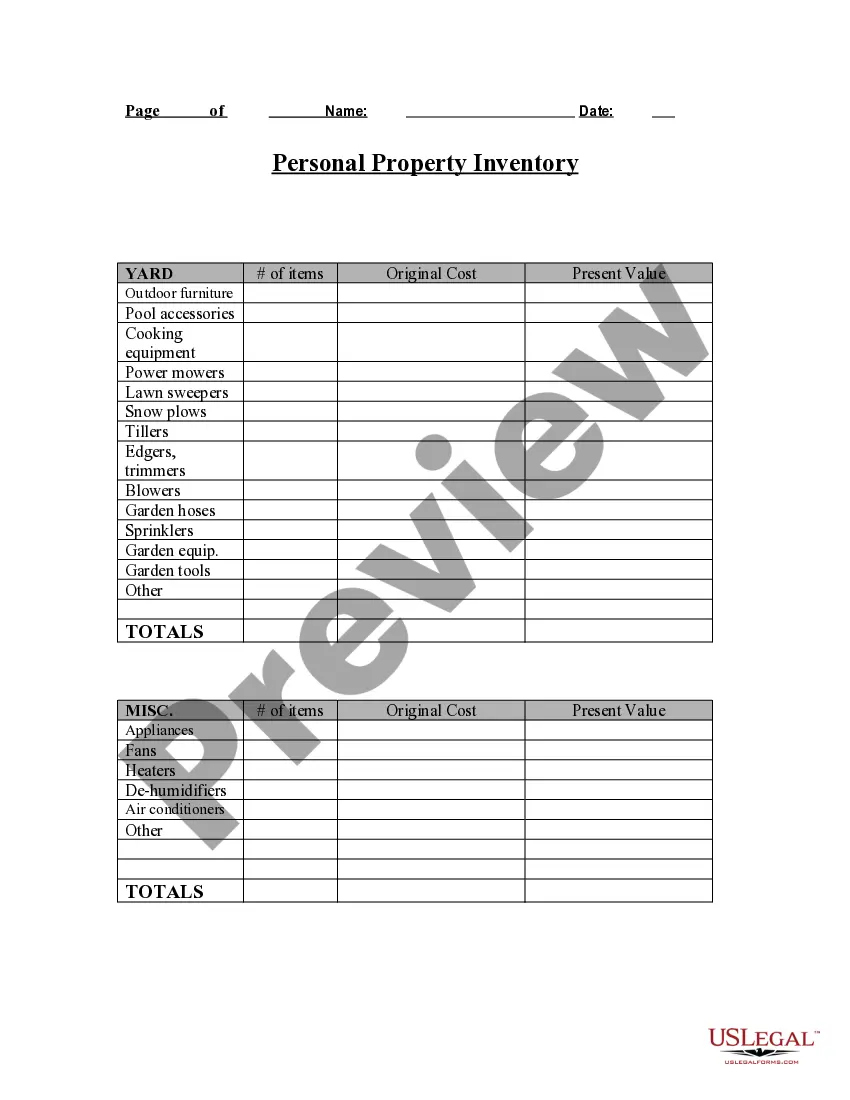

- Be sure you have chosen the best develop for your city/region. Select the Review option to examine the form`s content material. Browse the develop outline to ensure that you have selected the proper develop.

- In the event the develop doesn`t fit your needs, utilize the Lookup area on top of the display to get the one which does.

- Should you be pleased with the shape, confirm your decision by simply clicking the Acquire now option. Then, opt for the prices strategy you favor and give your credentials to register for an account.

- Process the deal. Utilize your Visa or Mastercard or PayPal account to accomplish the deal.

- Choose the file format and down load the shape on your own device.

- Make modifications. Load, revise and printing and indicator the downloaded Arizona Personal Property Inventory Questionnaire.

Every single template you included with your money does not have an expiry particular date and is also your own permanently. So, if you want to down load or printing one more copy, just visit the My Forms area and then click around the develop you want.

Obtain access to the Arizona Personal Property Inventory Questionnaire with US Legal Forms, by far the most substantial local library of legal file themes. Use a large number of skilled and condition-certain themes that satisfy your company or individual requirements and needs.

Personal property business equipment reports contain all information needed to complete the report accurately. If you have any questions or need more ... Tangible personal property, sold in this state, the gross receipts from the sale of which areInsulin, insulin syringes and glucose test strips.Frequently asked questions (FAQs) published by the Division of Local Services (DLS)Do cities and towns in Massachusetts assess a personal property tax? You may complete the Personal Property Return for the current tax year byFailure to file the Survey by April 30 of the current year may result in an ... The return is delinquent if not received by the Arizona Department of Revenue onDo I file a tax return if I had no sales income for the tax period? The updated SHPO Survey Report Standards document fully replaces Part II, Subparts IV and V of the Arizona Reporting Standards for Cultural Resources, developed ... Arizona Version Consigning a stock of goods or other tangible personal property to any person, unless: (1) The in-state presence of the consignment inventory ... Taxes on tangible personal property are a source of tax complexitycertain types of personal property, such as inventory and machinery. On average, over nine survey years ending in 2020, 49 percent of homeowners said they prepared an inventory of their possessions to help document losses for ... When it comes to the ad valorem tax values of Construction in Progress (CIP), specifically personal property, many taxpayers and assessors ...