This term sheet summarizes the principal terms with respect to a potential private placement of convertible preferred equity securities. It is not a legally binding document, but rather a basis for further discussions.

Arizona Convertible Preferred Equity Securities Term Sheet

Description

How to fill out Convertible Preferred Equity Securities Term Sheet?

US Legal Forms - one of the greatest libraries of lawful kinds in America - provides a variety of lawful document themes you can download or print out. While using site, you can get a large number of kinds for enterprise and personal reasons, sorted by classes, suggests, or keywords and phrases.You can get the most recent models of kinds much like the Arizona Convertible Preferred Equity Securities Term Sheet in seconds.

If you currently have a monthly subscription, log in and download Arizona Convertible Preferred Equity Securities Term Sheet through the US Legal Forms collection. The Obtain switch can look on every form you perspective. You have access to all previously delivered electronically kinds in the My Forms tab of your bank account.

If you wish to use US Legal Forms the very first time, listed below are basic recommendations to get you started:

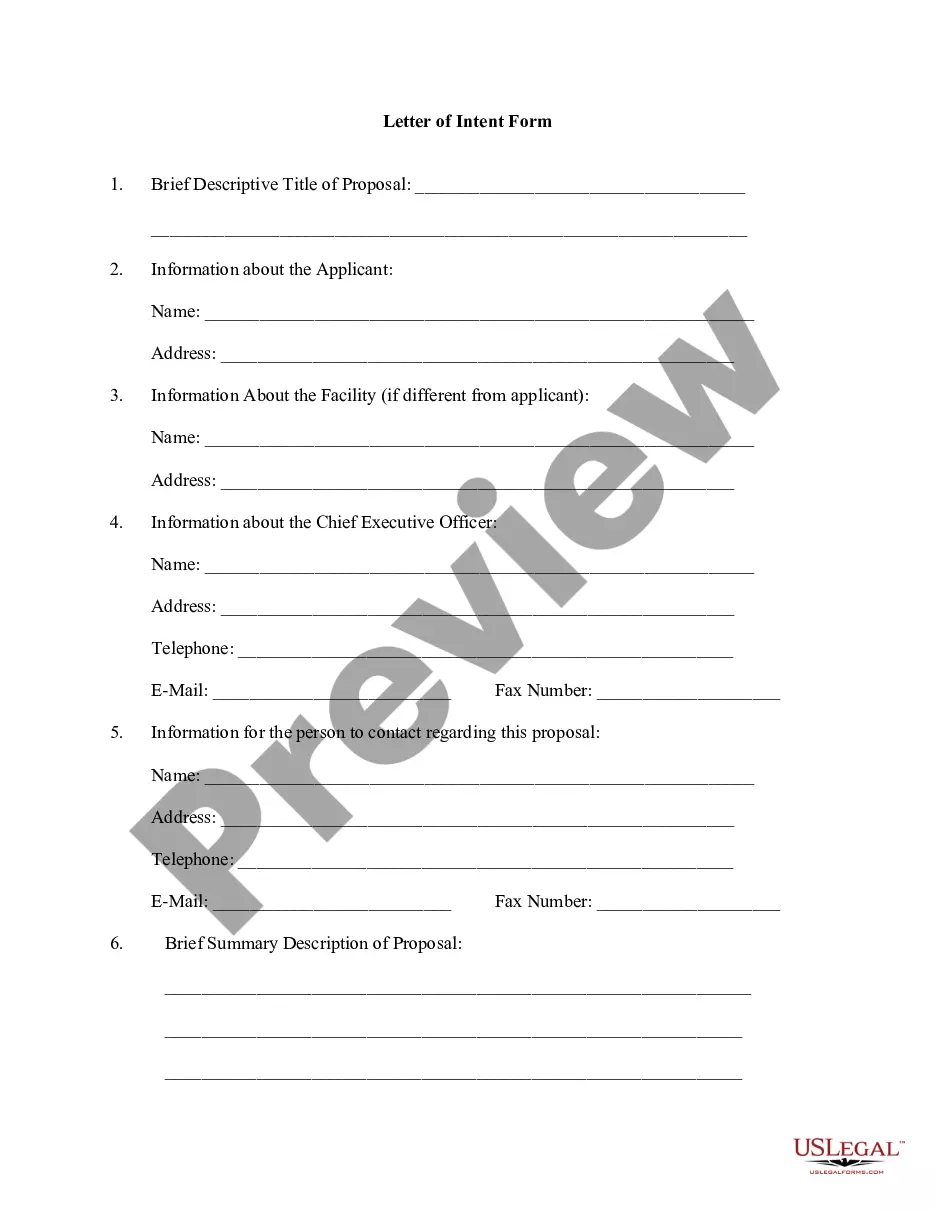

- Be sure to have picked the correct form for your personal city/area. Select the Preview switch to examine the form`s content. Look at the form description to actually have chosen the appropriate form.

- In case the form doesn`t fit your requirements, make use of the Search field at the top of the display to obtain the one who does.

- Should you be content with the form, validate your decision by clicking the Buy now switch. Then, choose the prices program you like and offer your accreditations to sign up to have an bank account.

- Method the transaction. Use your bank card or PayPal bank account to complete the transaction.

- Find the formatting and download the form on the system.

- Make modifications. Load, revise and print out and sign the delivered electronically Arizona Convertible Preferred Equity Securities Term Sheet.

Every web template you included in your money does not have an expiry particular date and it is yours for a long time. So, in order to download or print out another version, just check out the My Forms segment and then click in the form you will need.

Obtain access to the Arizona Convertible Preferred Equity Securities Term Sheet with US Legal Forms, one of the most comprehensive collection of lawful document themes. Use a large number of specialist and status-specific themes that satisfy your business or personal demands and requirements.

Form popularity

FAQ

What Are Convertible Preferred Shares? These shares are corporate fixed-income securities that the investor can choose to turn into a certain number of shares of the company's common stock after a predetermined time span or on a specific date.

Risk of Conversion Convertible preferred stock carries the risk that it may not be converted into common stock. This means that if the company's common stock does not perform well, the value of the preferred stock may not increase. This can lead to lower returns on investment for the investor.

Convertible preferred shares can be converted into common stock at a fixed conversion ratio. Once the market price of the company's common stock rises above the conversion price, it may be worthwhile for the preferred shareholders to convert and realize an immediate profit.

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).

A preference share that is issued on the terms that it is liable to be converted to an agreed number of ordinary shares or cash: At a certain time or on the happening of a particular event (for example, on the sale or initial public offering of the issuing company).

Issuing convertible preferred stock is one of the many ways companies can raise capital to fund their operations and expansion. Companies will choose to sell convertible preferred stock because it enables them to avoid taking on debt while limiting the potential dilution of selling additional common stock.

Conversion price can be calculated by dividing the convertible preferred stock's par value by the stipulated conversion ratio. Conversion premium: The dollar amount by which the market price of the convertible preferred stock exceeds the current market value of the common shares into which it may be converted.

Convertible preference shares usually carry rights to a fixed dividend for a particular term. At the end of the term, the company can choose to convert it into ordinary shares or leave them as they are. Conversion prices must be specified in the company's constitution.