Arizona Assignment of Life Insurance as Collateral

Description

How to fill out Assignment Of Life Insurance As Collateral?

Are you presently inside a placement the place you will need files for sometimes organization or specific functions virtually every day time? There are tons of authorized papers layouts available on the net, but locating ones you can trust isn`t simple. US Legal Forms offers a huge number of kind layouts, just like the Arizona Assignment of Life Insurance as Collateral, that happen to be written to fulfill state and federal specifications.

If you are already informed about US Legal Forms internet site and get a merchant account, merely log in. Following that, it is possible to acquire the Arizona Assignment of Life Insurance as Collateral format.

If you do not provide an bank account and want to begin using US Legal Forms, abide by these steps:

- Obtain the kind you will need and make sure it is for your appropriate area/county.

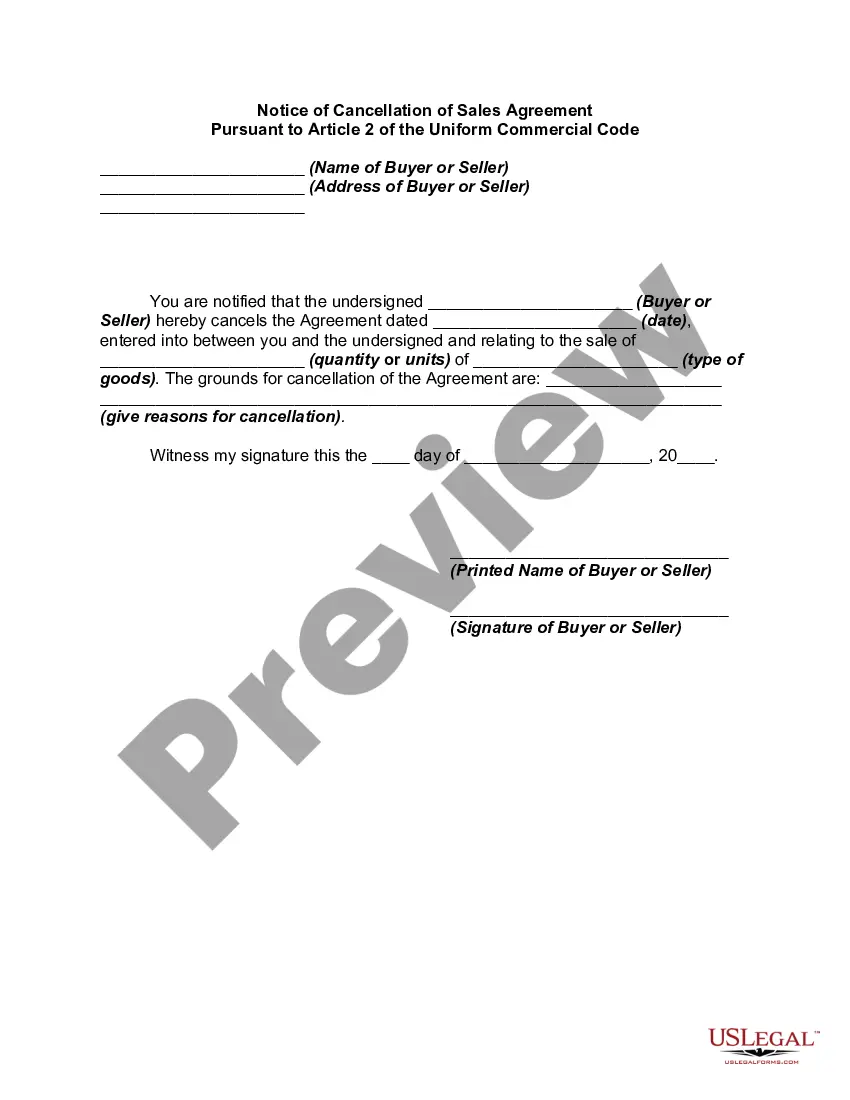

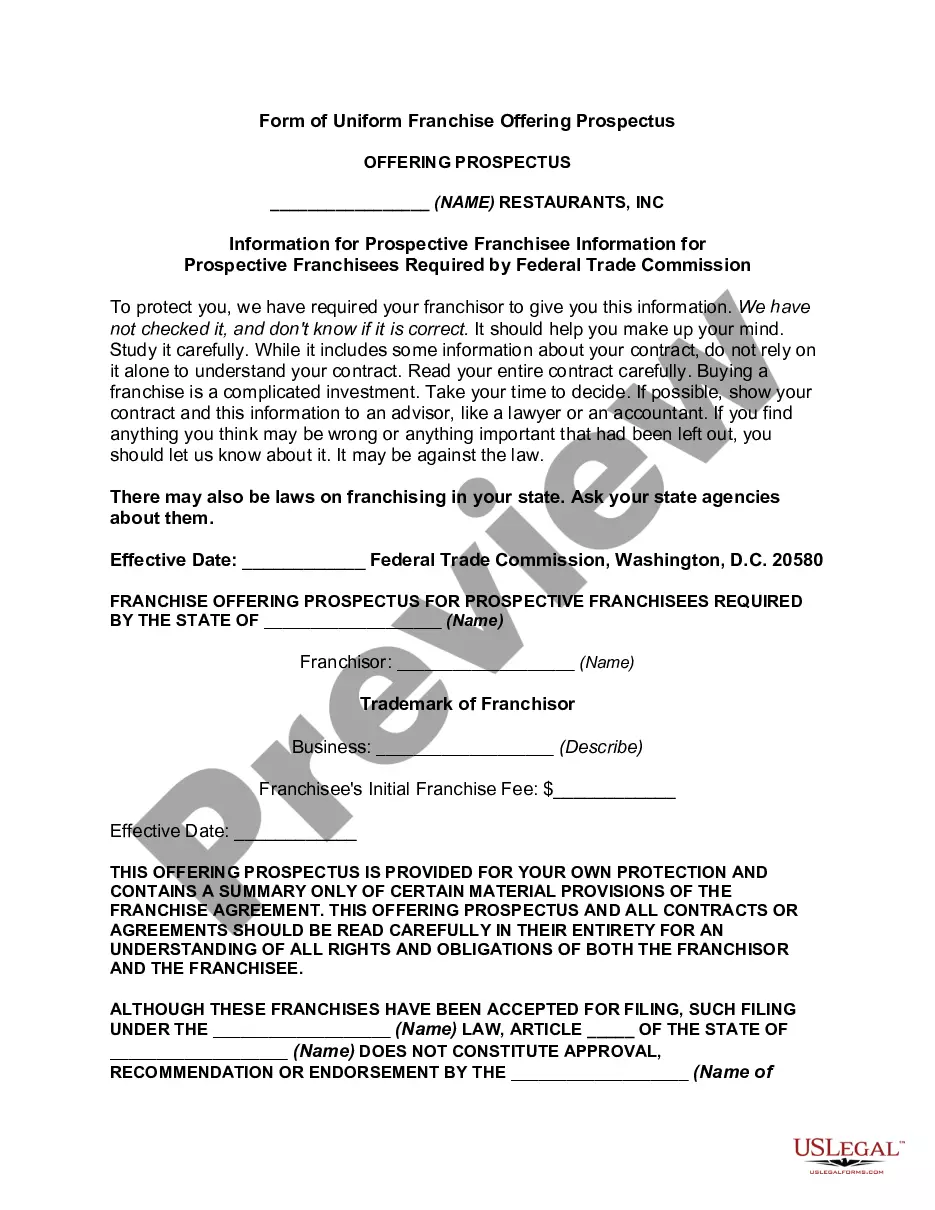

- Make use of the Review button to analyze the form.

- Browse the description to actually have selected the correct kind.

- In the event the kind isn`t what you`re looking for, utilize the Research area to obtain the kind that suits you and specifications.

- When you get the appropriate kind, click Purchase now.

- Opt for the pricing plan you want, complete the necessary details to create your money, and purchase the transaction using your PayPal or charge card.

- Select a hassle-free data file file format and acquire your duplicate.

Get all of the papers layouts you may have bought in the My Forms menus. You can get a more duplicate of Arizona Assignment of Life Insurance as Collateral anytime, if possible. Just go through the needed kind to acquire or print out the papers format.

Use US Legal Forms, probably the most substantial variety of authorized types, in order to save time as well as stay away from errors. The services offers expertly created authorized papers layouts which you can use for a selection of functions. Create a merchant account on US Legal Forms and initiate creating your life easier.

Form popularity

FAQ

A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to some or all of the death benefit until the loan is repaid. The death benefit is used as collateral for a loan.

Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. In this case, the collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt.

The collateral assignment is irrevocable as established by a written agreement preventing the holder of the life insurance policy from affecting or using the cash surrender value after the irrevocable assignment.

A collateral assignment supersedes your beneficiaries' rights to the death benefit. If you die, the life insurance company pays the lender, or assignee, the loan balance. As noted earlier, any remaining benefit goes to your beneficiaries.

Unless instructed differently, your life insurance company creates a revocable beneficiary designation when you purchase the policy. If you want to assign an irrevocable beneficiary, let your insurance company know. You may be able to update an existing life insurance policy to include an irrevocable beneficiary.

Which of these actions is taken when a policyowner uses a Life Insurance policy as collateral for a bank loan? Collateral assignment" A policyowner using the Life Insurance policy as collateral for a bank loan normally would make a collateral assignment.

If you have a term policy, you will not be able to borrow against it. However, you may want to consider converting your policy to whole life insurance to take advantage of this option in the future. Look up the current cash value: Find out how much your policy is currently worth.

The irrevocable assignment includes: Irrevocably assigns and transfers all the benefits and proceeds of the life insurance policy to the funeral home/funeral director. The cash value is not counted as an available asset. The life insurance cannot be canceled.