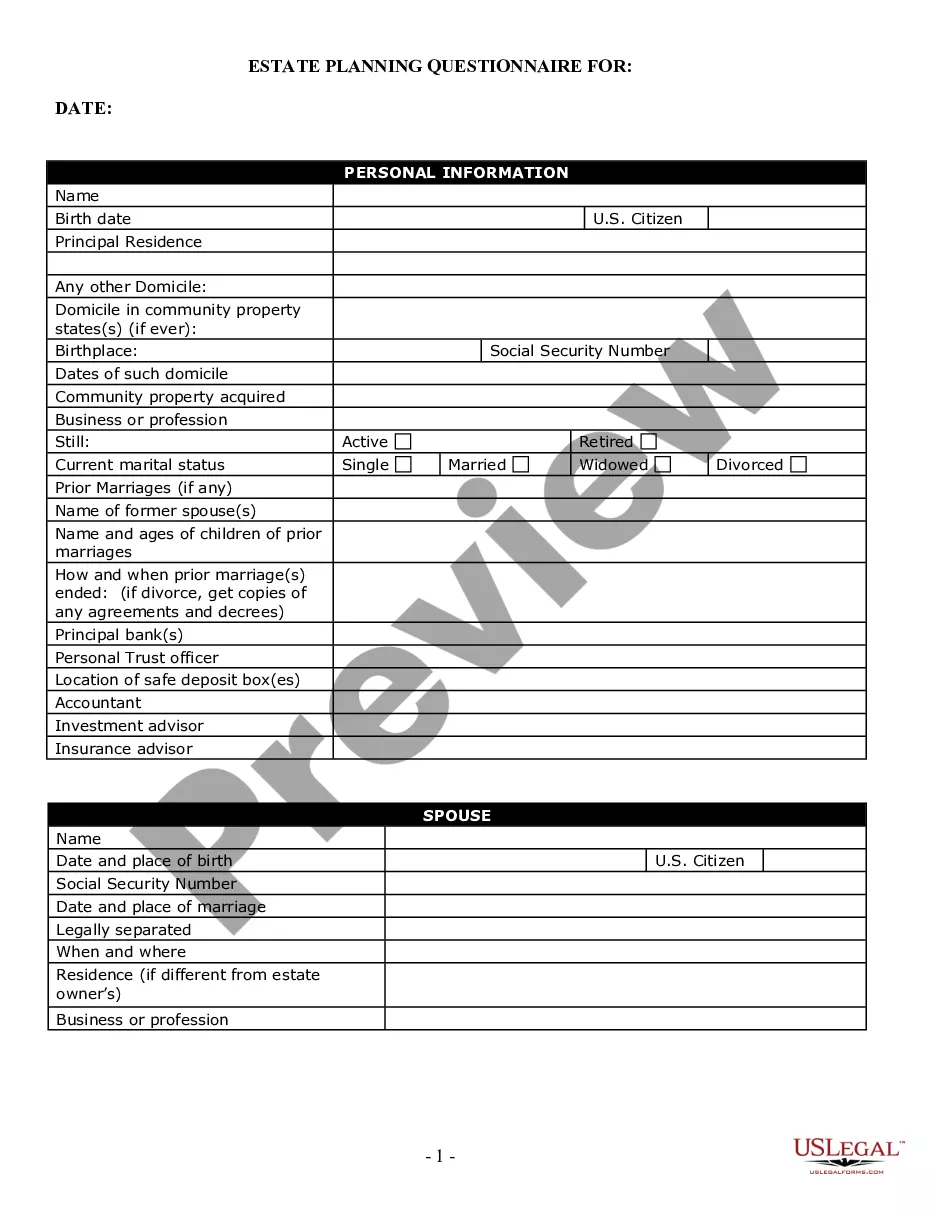

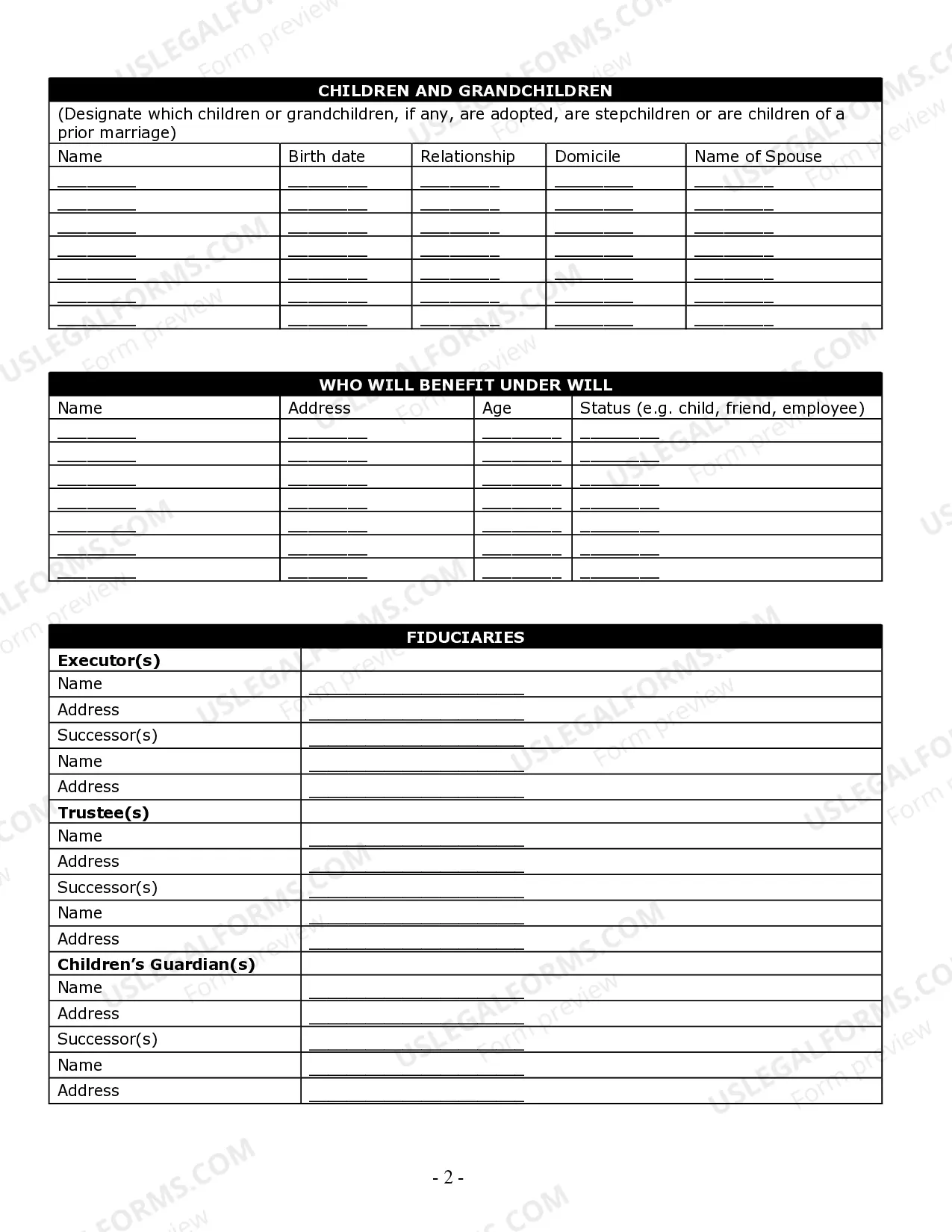

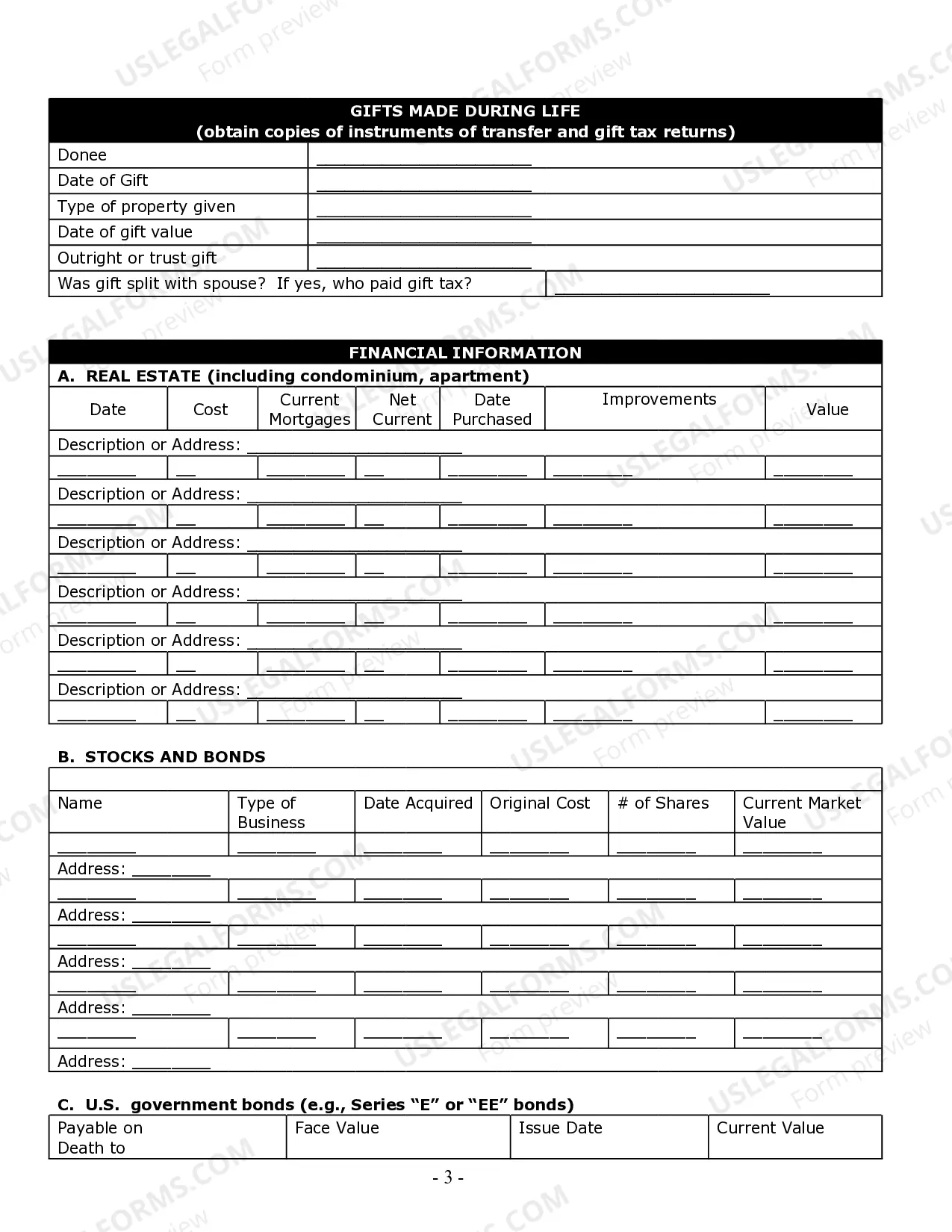

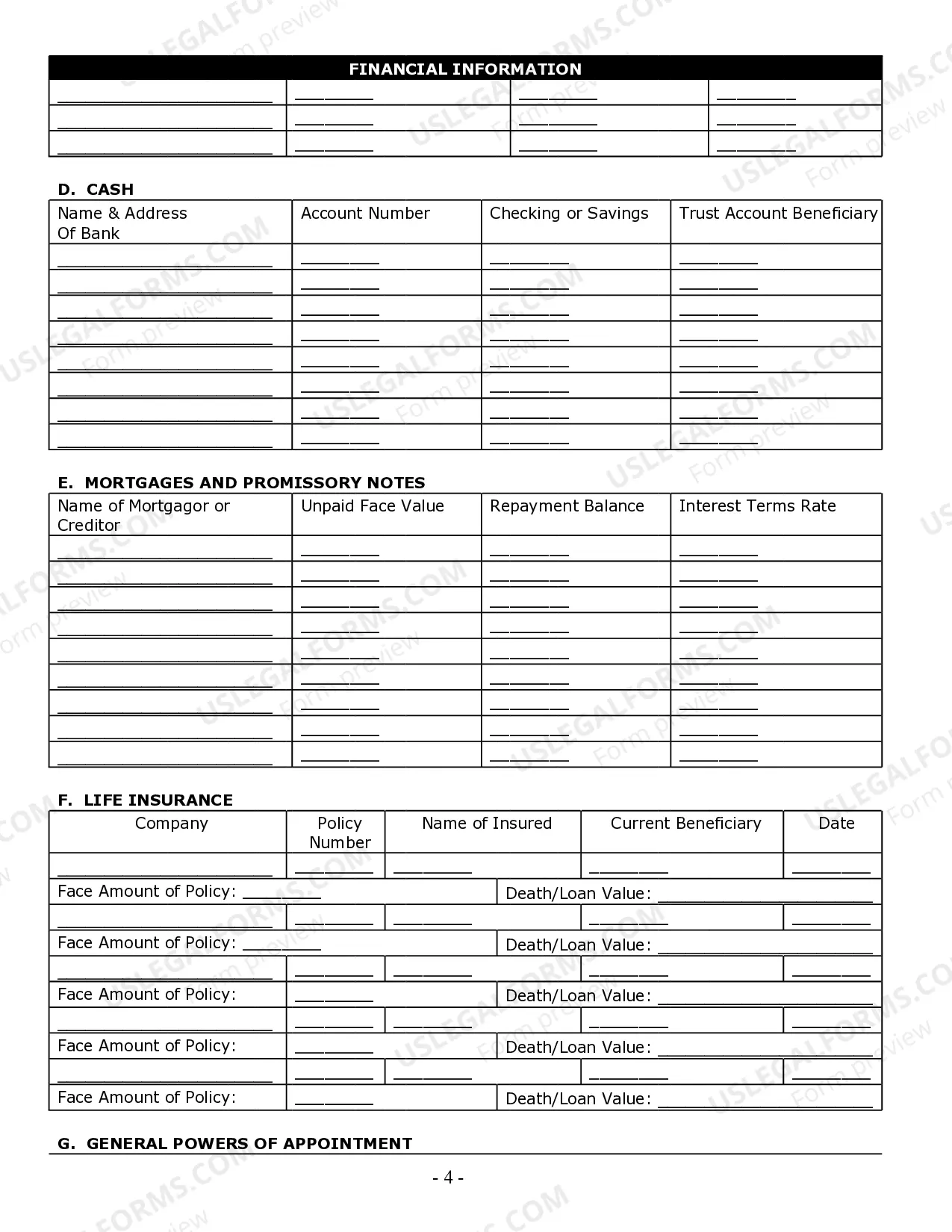

This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

Arizona Estate Planning Questionnaire and Worksheets

Description

How to fill out Arizona Estate Planning Questionnaire And Worksheets?

If you're in need of precise Arizona Estate Planning Questionnaire and Worksheets templates, US Legal Forms is what you require; acquire documents crafted and validated by state-certified legal experts.

Utilizing US Legal Forms not only alleviates concerns regarding legal documentation; it also conserves your time, effort, and funds! Downloading, printing, and filling out a professional template is considerably more economical than hiring an attorney to do it for you.

And that's all. With just a few easy clicks, you have an editable Arizona Estate Planning Questionnaire and Worksheets. Once you create an account, all future purchases will be processed even more effortlessly. If you possess a US Legal Forms subscription, simply Log In to your profile and then click the Download button you see on the form’s page. Then, when you wish to use this template again, you will always be able to find it in the My documents section. Don't waste your time comparing various forms from multiple online sources. Obtain accurate templates from a single reliable service!

- Initiate your sign-up process by entering your email and creating a password.

- Follow the provided instructions to establish your account and obtain the Arizona Estate Planning Questionnaire and Worksheets template to address your situation.

- Utilize the Preview feature or review the document description (if available) to ensure it is the correct form for your needs.

- Verify its validity in your state.

- Click Buy Now to place your order.

- Select your preferred pricing option.

- Set up an account and make a payment via credit card or PayPal.

- Choose a convenient format and save the form.

Form popularity

FAQ

The most important decision in estate planning involves choosing your beneficiaries and determining how your assets will be allocated among them. This consideration often requires crafting your Arizona Estate Planning Questionnaire and Worksheets to reflect your true intentions. Carefully selecting who will inherit your assets and safeguarding your loved ones’ financial stability is critical. Furthermore, this decision can help prevent disputes and ensure your wishes are honored.

Estate planning is the process of organizing how your assets will be managed and distributed after you die. It includes designing your Arizona Estate Planning Questionnaire and Worksheets to cover various aspects, such as wills, trusts, and healthcare directives. This planning empowers you to make informed decisions about your future and protect your loved ones. Additionally, a clear estate plan can help ease the administrative burdens for your family.

The main objective of estate planning is to ensure that your assets are distributed according to your wishes after your passing. This involves preparing your Arizona Estate Planning Questionnaire and Worksheets to clarify your intentions. By having a solid plan in place, you can also minimize tax burdens and avoid potential conflicts among your beneficiaries. Ultimately, estate planning provides peace of mind during a difficult time.

The 5x5 power rule grants beneficiaries the ability to withdraw certain amounts from a trust each year without tax implications. This rule allows for a withdrawal of the greater of $5,000 or 5% of the trust's value, which can be beneficial in managing your assets effectively. Incorporating the 5x5 power rule into your estate plan with Arizona Estate Planning Questionnaire and Worksheets simplifies tracking these financial aspects and ensures compliance.

The 5 and 5 limitation refers to a provision in estate planning that allows individuals to withdraw assets from a trust within specific limits. Typically, it permits withdrawals of either $5,000 or 5% of the trust’s total value, whichever is greater, per year. Understanding this limitation is crucial for effective estate management, and incorporating it into your strategy can be streamlined by using Arizona Estate Planning Questionnaire and Worksheets.

One major mistake parents often make is failing to clearly communicate their intentions to their beneficiaries. This lack of transparency can lead to confusion and conflict among family members. A well-structured plan, including well-thought-out Arizona Estate Planning Questionnaire and Worksheets, can ensure that your wishes are understood and help in mitigating potential disputes.

The 5 by 5 rule is a guideline related to trust distributions. It allows beneficiaries to withdraw up to the greater of $5,000 or 5% of the trust's value each year. This can help in estate planning, as it offers flexibility while preventing excessive distributions that may affect the trust's longevity. By utilizing Arizona Estate Planning Questionnaire and Worksheets, you can effectively incorporate strategies like the 5 by 5 rule into your trust planning.

The 5 by 5 rule in estate planning refers to a guideline that allows the beneficiary of a trust to withdraw up to $5,000 or 5% of the trust’s value each year without incurring certain tax implications. Understanding this rule can help you strategically plan distributions to your heirs while minimizing taxes. Utilizing the Arizona Estate Planning Questionnaire and Worksheets can aid you in making informed decisions about how and when to use this rule effectively. Knowledge of this rule empowers you to create a more flexible estate plan that meets your family's needs.

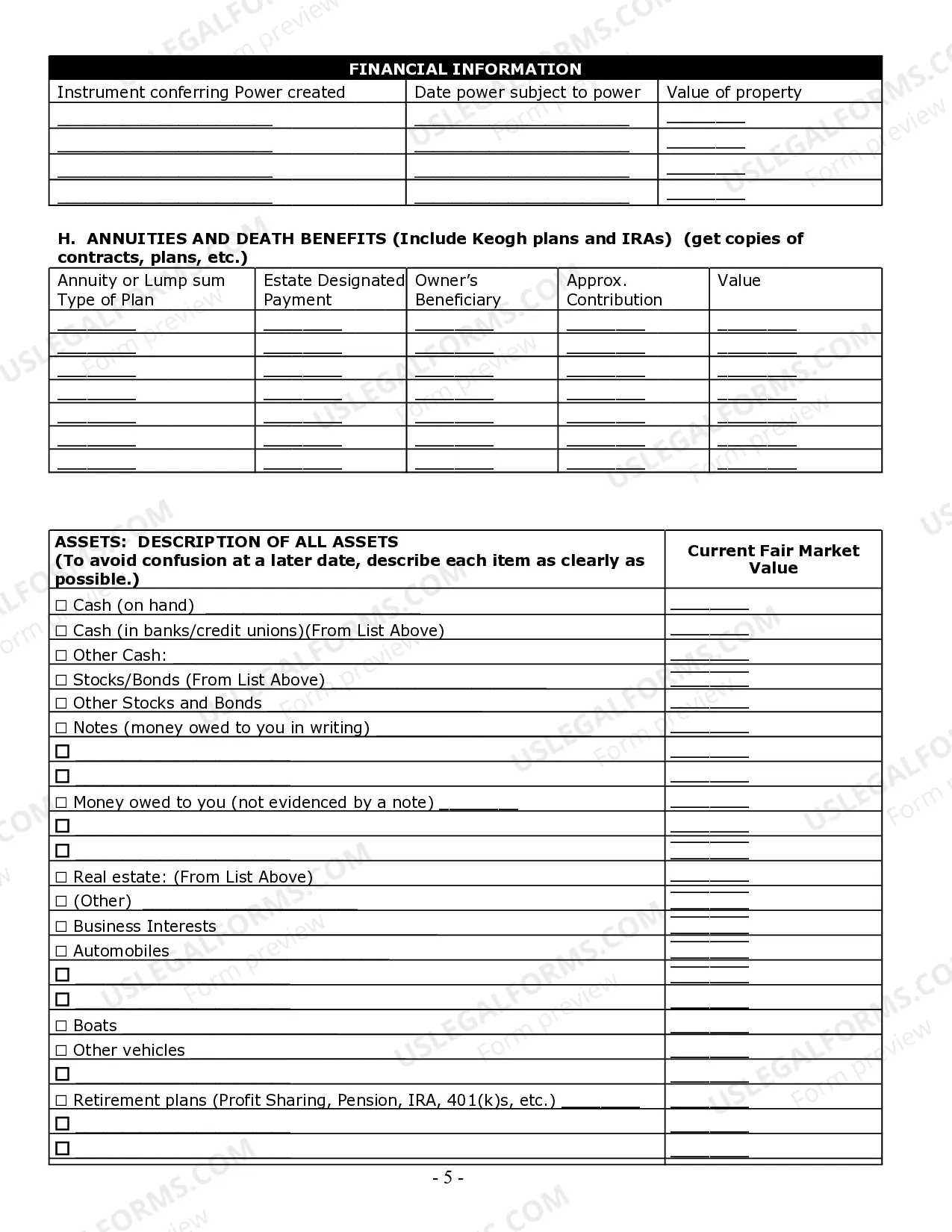

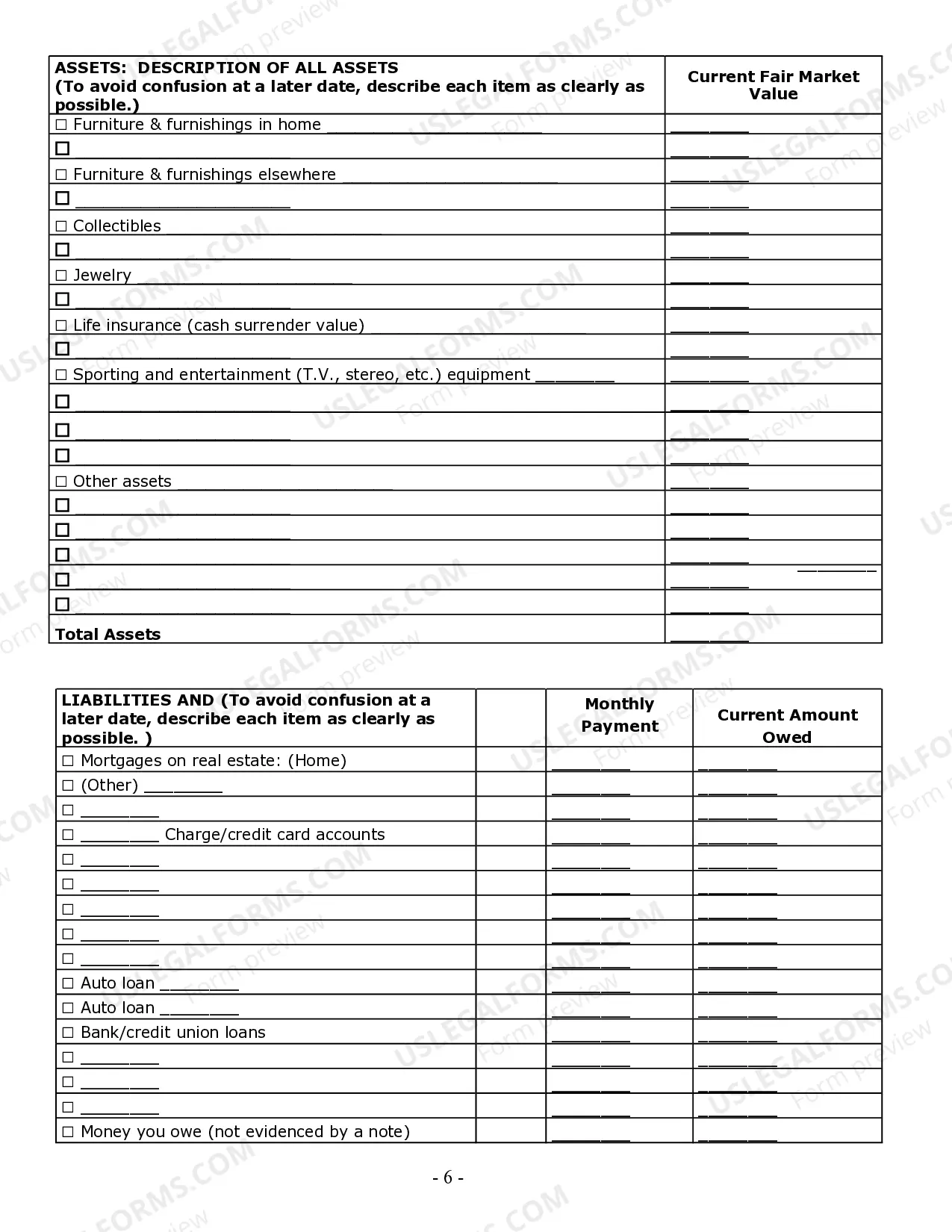

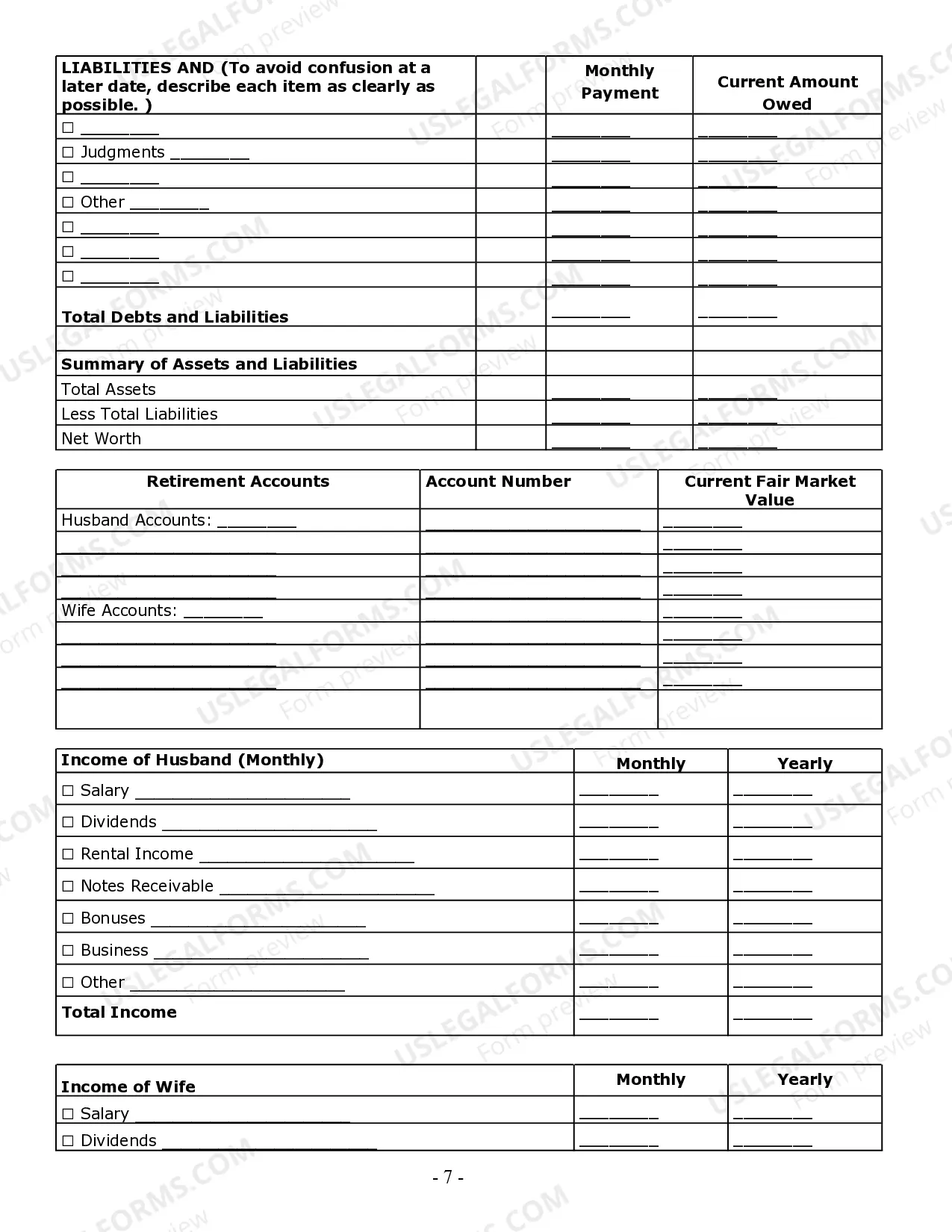

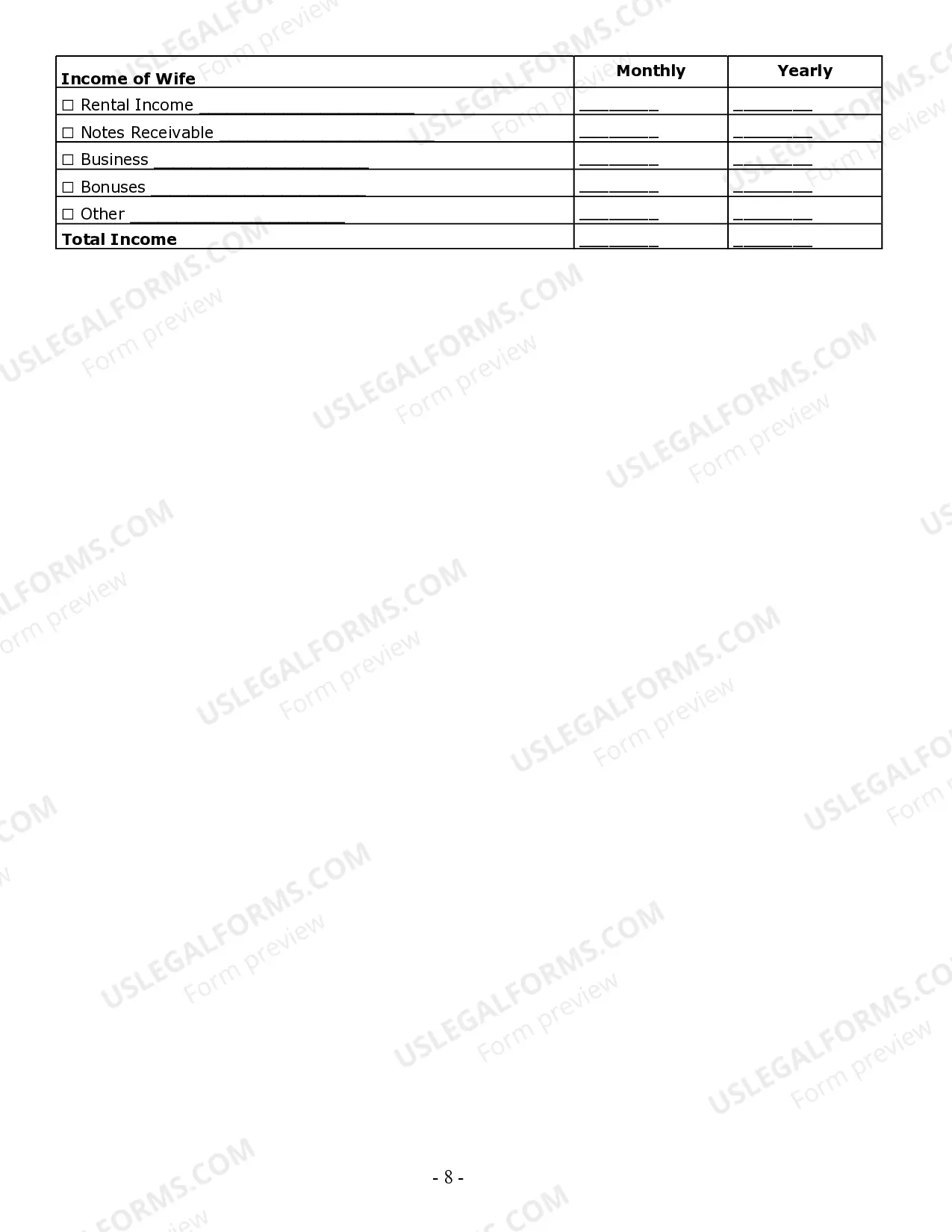

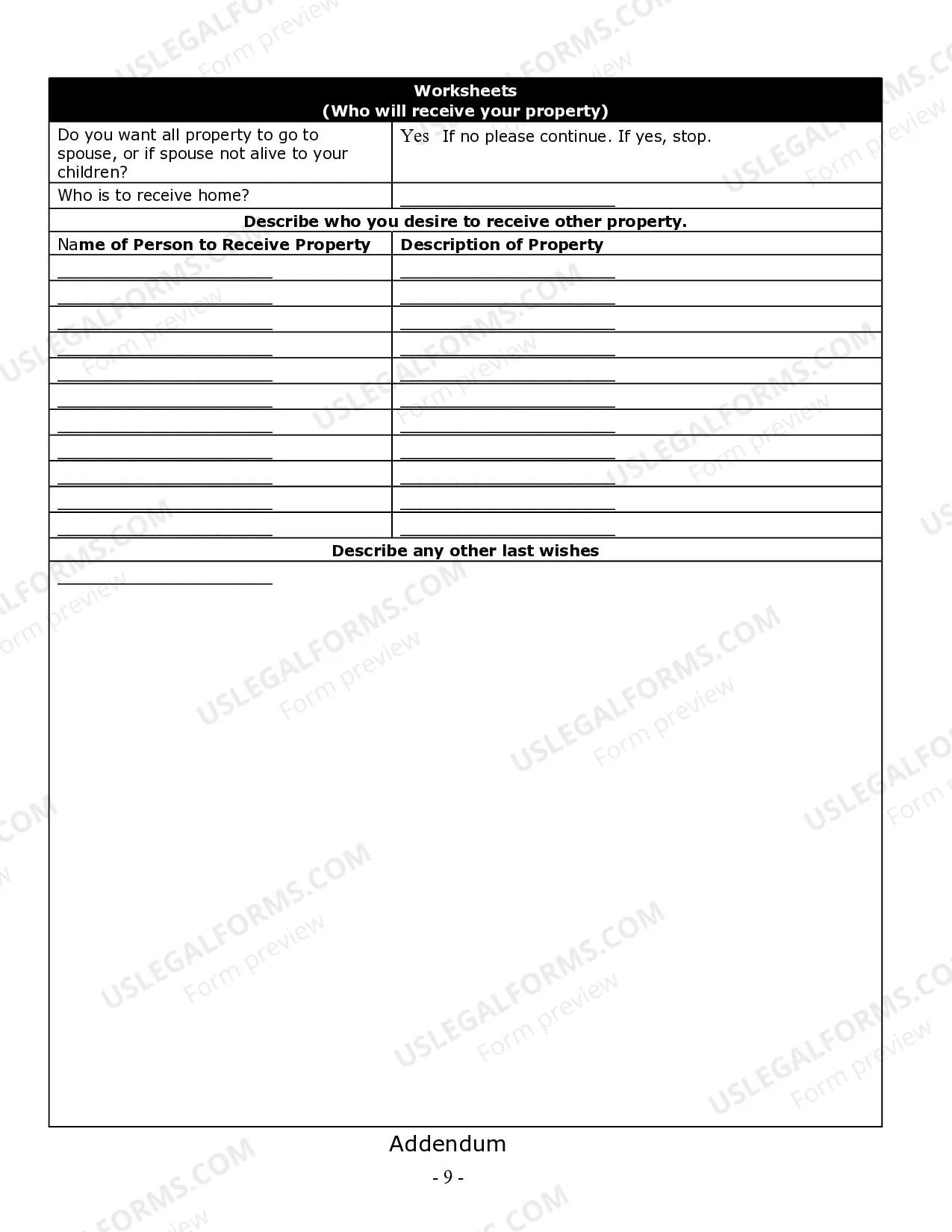

Filling out an estate planning questionnaire involves gathering information about your financial situation, family dynamics, and personal wishes. With the Arizona Estate Planning Questionnaire and Worksheets, you’ll find sections that guide you to organize details such as assets, debts, and medical preferences. Take your time to answer each question thoroughly, as this will inform how your estate will be managed. Completing it accurately is vital to ensuring that your estate plan aligns with your goals.

The estate planning process consists of seven key steps: defining your goals, listing your assets, choosing beneficiaries, selecting an executor, creating essential documents, reviewing your plan regularly, and updating it as necessary. By following these steps and utilizing the Arizona Estate Planning Questionnaire and Worksheets, you can create a seamless and effective estate plan. Each step plays a significant role in safeguarding your estate and providing clarity for your loved ones. Remember, thoughtful preparation today makes a difference for tomorrow.