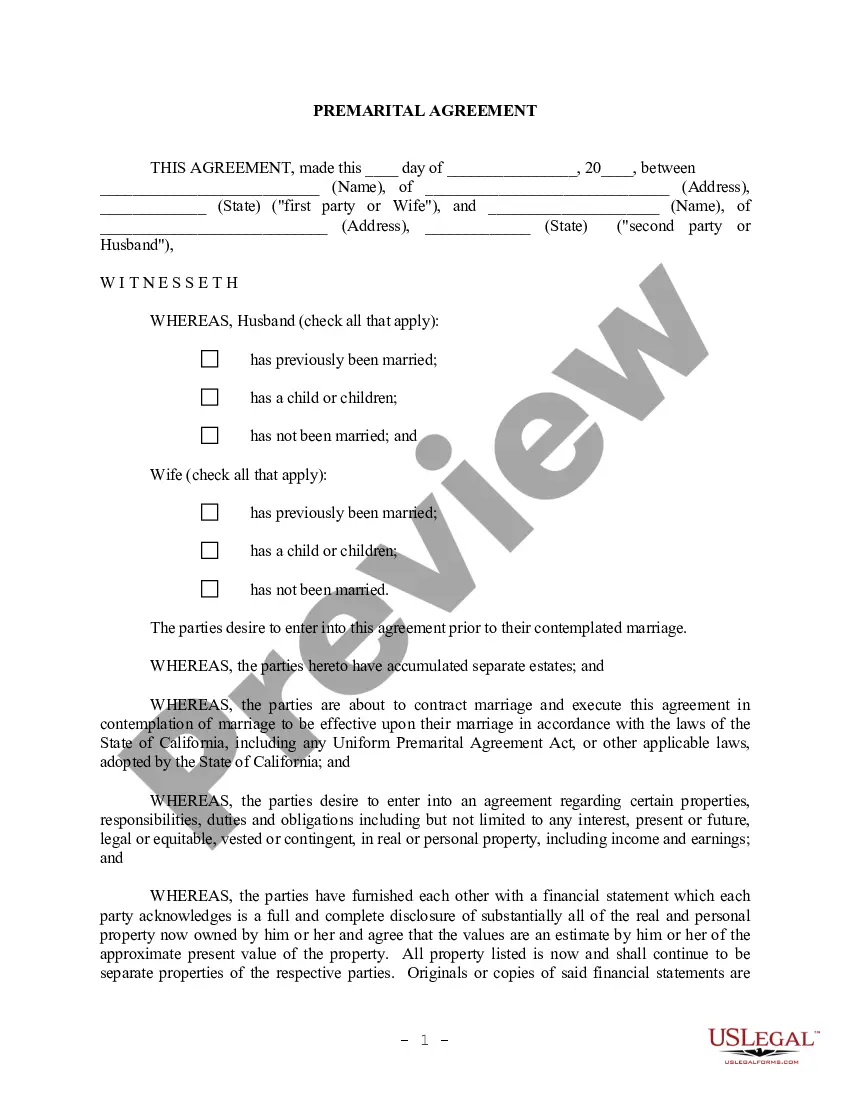

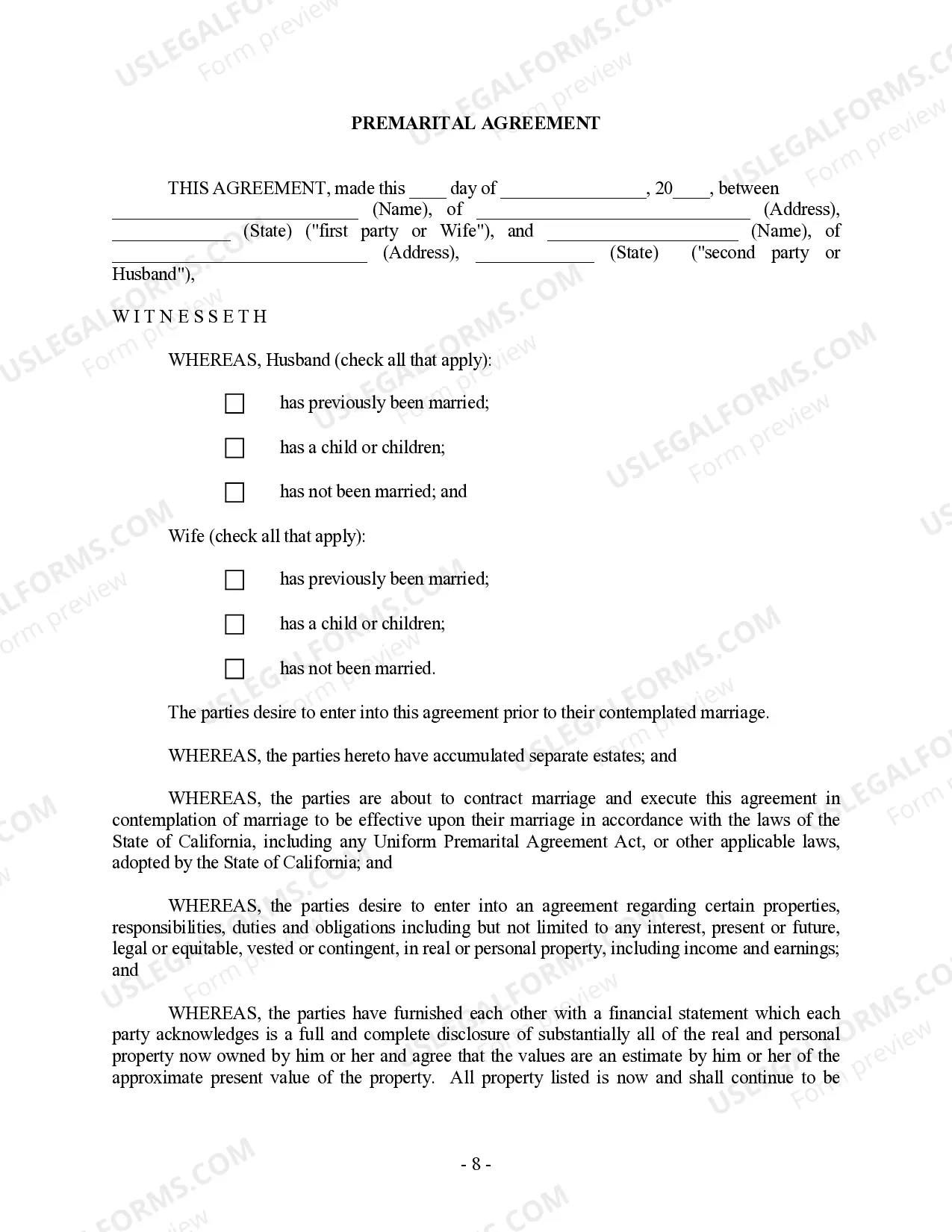

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

California Prenuptial Premarital Agreement with Financial Statements

Description

How to fill out California Prenuptial Premarital Agreement With Financial Statements?

If you're searching for precise California Prenuptial Premarital Agreement with Financial Statements online templates, US Legal Forms is exactly what you require; access documents created and verified by state-certified attorneys.

Utilizing US Legal Forms not only saves you from concerns regarding legal paperwork; you also conserve effort, time, and money! Downloading, printing, and completing a professional document is much more cost-effective than hiring a lawyer to draft it for you.

And there you have it. With a few simple steps, you have an editable California Prenuptial Premarital Agreement with Financial Statements. Once you set up your account, all future requests will be processed even more seamlessly. When you have a US Legal Forms subscription, simply Log In to your account and then click the Download button available on the form's page. Then, whenever you need to access this template again, you'll always be able to find it in the My documents section. Don't waste your time comparing numerous forms across different platforms. Purchase reliable copies from a single secure provider!

- To get started, complete your registration process by providing your email and creating a secure password.

- Follow the instructions below to establish your account and find the California Prenuptial Premarital Agreement with Financial Statements template to address your needs.

- Use the Preview tool or review the file details (if available) to ensure that the template meets your requirements.

- Verify its validity in your state.

- Click Buy Now to place an order.

- Select a suggested pricing plan.

- Create your account and pay using your credit card or PayPal.

- Choose an appropriate format and save the document.

Form popularity

FAQ

Indeed, you can include provisions for future earnings in a California Prenuptial Premarital Agreement with Financial Statements. This allows you to specify how earnings generated during the marriage will be categorized and managed. By clearly defining these terms, you can avoid misunderstandings and ensure financial stability in case of separation. Utilizing a service like USLegalForms can simplify the process and provide templates that cater to your specific needs.

Yes, a California Prenuptial Premarital Agreement with Financial Statements can secure your future inheritance. The agreement may include terms that clarify how any inheritance received during the marriage will be treated, thus protecting it from being viewed as marital property. Addressing this matter in a prenup helps ensure that both spouses understand their rights regarding inheritances. It is wise to discuss this with a legal expert to accurately reflect your intentions.

A prenup can indeed protect future business in the context of a California Prenuptial Premarital Agreement with Financial Statements. This agreement can outline how ownership and profits from a business started during the marriage will be handled. By specifying these details upfront, both partners can avoid potential disputes regarding business assets should the marriage end. Consulting with an attorney who specializes in prenuptial agreements is crucial to creating an effective and nuanced arrangement.

Yes, a California Prenuptial Premarital Agreement with Financial Statements can allow you to prenup future earnings. This type of agreement can specify how income generated during the marriage will be treated in the event of a divorce. By addressing future earnings in the prenup, both partners can establish clear financial expectations and protect their interests. It’s essential to work with a knowledgeable attorney to ensure your agreement is comprehensive and legally enforceable.

To protect future earnings in a California Prenuptial Premarital Agreement with Financial Statements, it's essential to clearly outline your earnings and assets. You can specify how future income will be treated, whether it remains separate or shared. Discussing these terms upfront with your partner sets a solid foundation and reduces potential conflicts later. Utilizing platforms like UsLegalForms can simplify this process and ensure that all aspects are professionally handled.

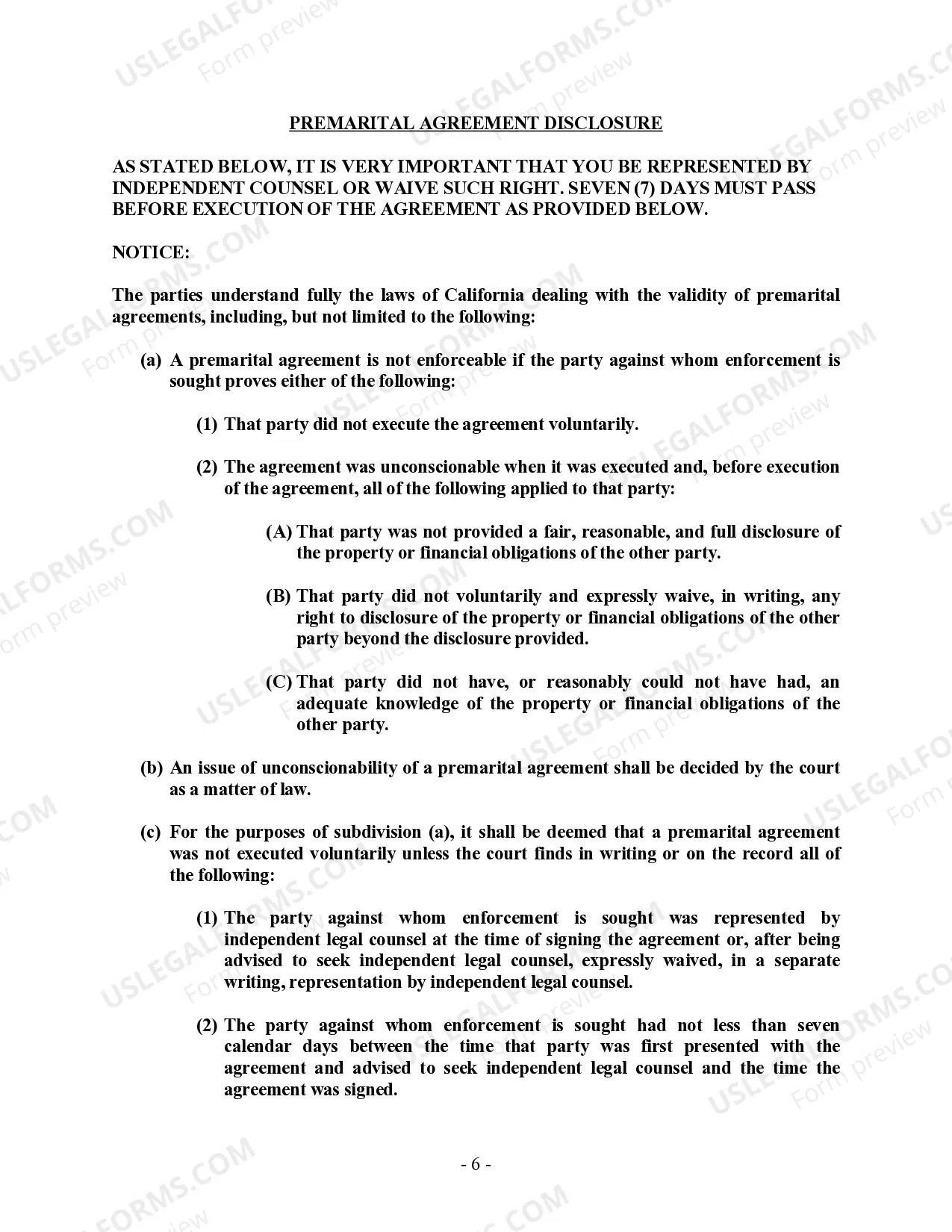

Several factors can invalidate a prenuptial agreement in California. If there was coercion, fraud, or an absence of informed consent, a court may not recognize the agreement. Additionally, if the financial statements were inaccurate or misleading, this can also disqualify the contract. To avoid these pitfalls, it is wise to create your California Prenuptial Premarital Agreement with Financial Statements through experienced legal professionals.

Certainly, prenups can be challenged in California if one party believes the agreement was not made in good faith. For instance, if there was a lack of full financial disclosure or if pressure was applied during the signing process, the agreement can be contested. A California Prenuptial Premarital Agreement with Financial Statements requires transparency to be valid. Legal advice is key when facing a challenge to ensure proper representation.

Yes, a California Prenuptial Premarital Agreement with Financial Statements can be voided under certain circumstances. If one party did not sign voluntarily, or if there was fraud involved in the agreement, a court may choose to void it. Additionally, if the terms are found to be unconscionable or unfair, they may not be enforceable. It's important to consult with legal experts to ensure the agreement holds up.

A financial statement for a prenuptial agreement outlines each partner's assets, liabilities, income, and expenses. In the context of a California Prenuptial Premarital Agreement with Financial Statements, it provides a complete financial picture before marriage. This document is crucial for transparency and helps both parties make informed decisions. You can find helpful resources and templates on platforms like US Legal Forms to assist you.

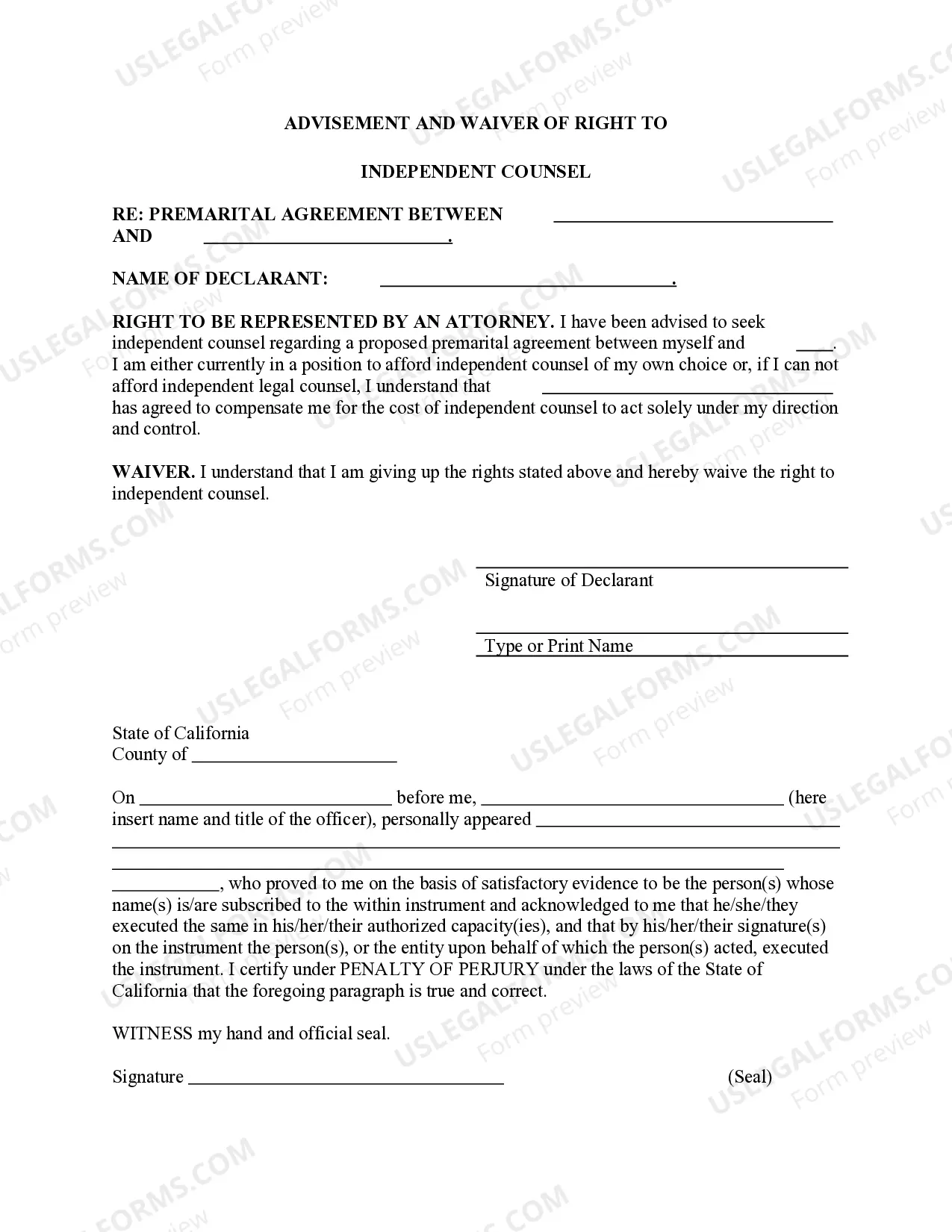

Writing a prenuptial agreement in California involves several clear steps. First, both partners should gather financial information and discuss their goals. Then, use a professional template or consult a legal expert to draft the California Prenuptial Premarital Agreement with Financial Statements. This ensures compliance with California law and protects both parties’ interests.