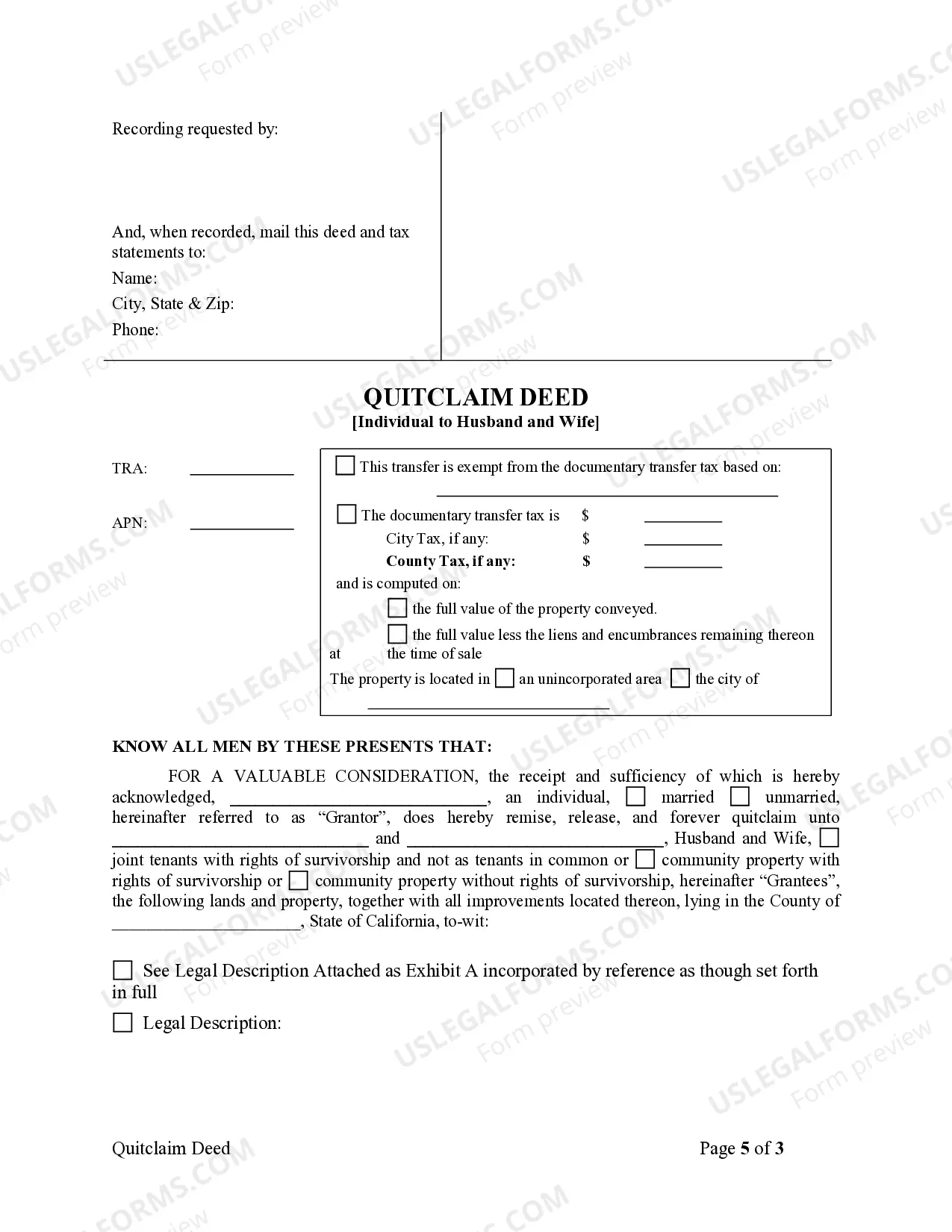

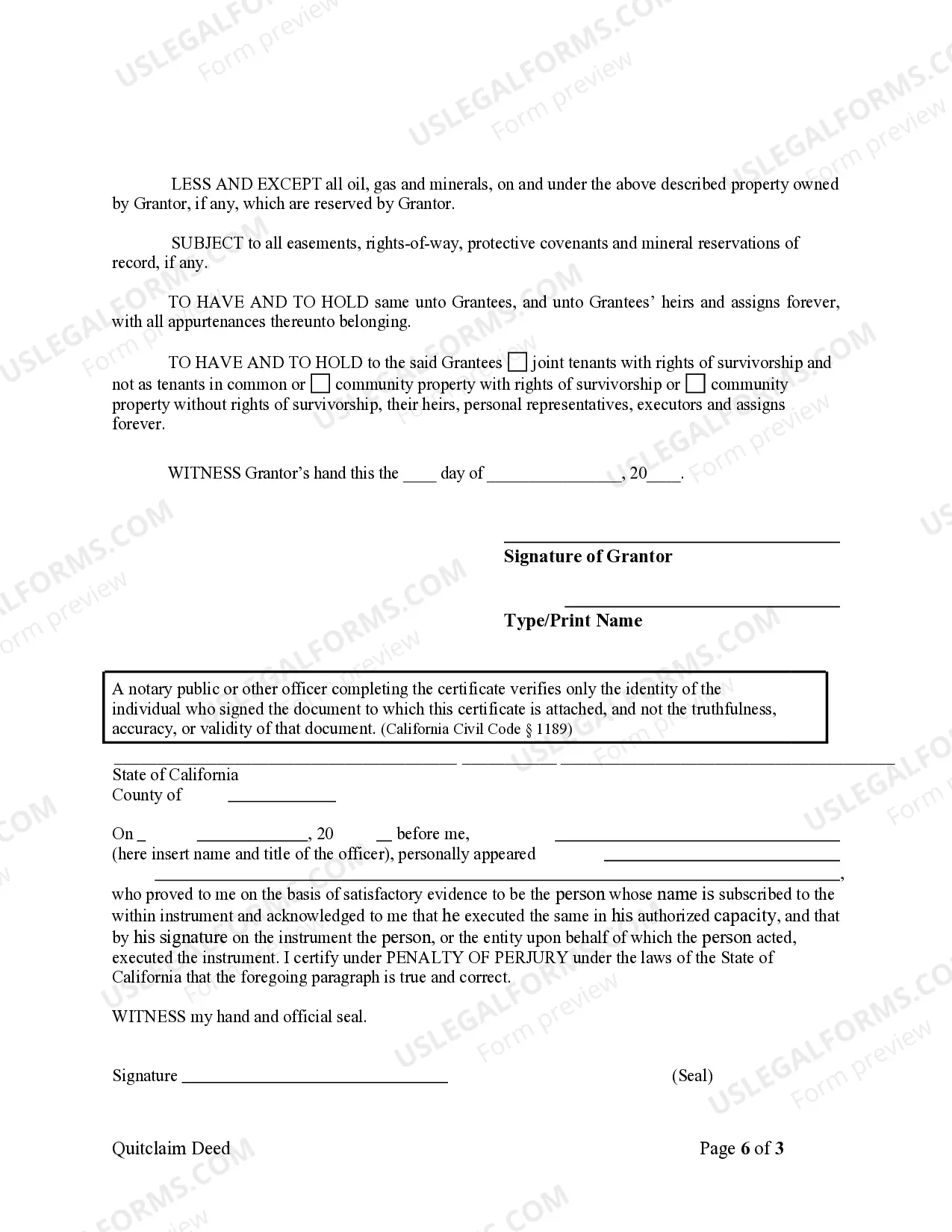

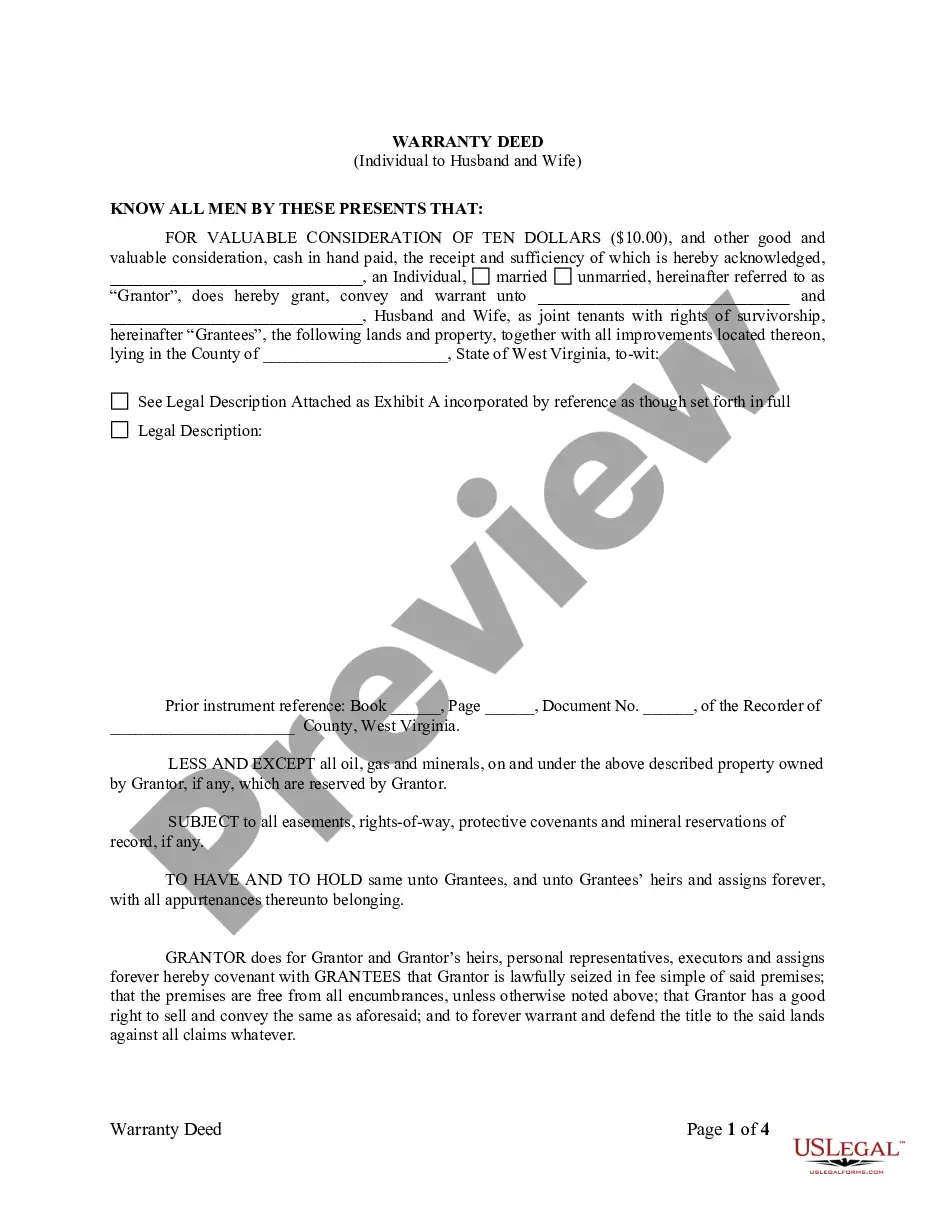

This Quitclaim Deed from Individual to Husband and Wife form is a Quitclaim Deed where the Grantor is an individual and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees, less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

California Quitclaim Deed from Individual to Husband and Wife

Description

How to fill out California Quitclaim Deed From Individual To Husband And Wife?

If you are in search of accurate California Quitclaim Deed samples from Individual to Spouse, US Legal Forms is exactly what you require; find documents created and validated by state-licensed attorneys.

Utilizing US Legal Forms not only prevents you from stress related to legal documentation; additionally, you conserve time, effort, and money! Downloading, printing, and completing a professional template is considerably more economical than hiring an attorney to do it for you.

And that’s all. In just a few simple steps, you receive an editable California Quitclaim Deed from Individual to Spouse. Once you set up your account, all future requests will be handled even more effortlessly. With a US Legal Forms subscription, simply Log In to your account and click the Download button visible on the form’s page. Then, whenever you wish to access this template again, you will always find it in the My documents section. Don’t waste your time comparing countless forms on different sites. Purchase accurate documents from one reliable source!

- Begin by completing your registration process by providing your email and setting a password.

- Follow the instructions below to establish your account and obtain the California Quitclaim Deed from Individual to Spouse template to manage your situation.

- Use the Preview option or review the document description (if available) to confirm that the template is suitable for your needs.

- Check its relevance in your state.

- Click on Buy Now to place an order.

- Select a preferred payment plan.

- Create your account and pay using a credit card or PayPal.

- Choose an appropriate file type and save the document.

Form popularity

FAQ

A quitclaim deed is often most beneficial for spouses, family members, or parties who trust each other. This deed allows one individual to transfer their interest in a property to another without assuring the ownership title's validity. For example, when transferring property using a California Quitclaim Deed from Individual to Husband and Wife, this method is straightforward and efficient, particularly in personal dealings where trust is established.

The most common deed used to convey property in California is the Grant Deed. This type of deed provides assurances to the buyer regarding the title of the property. Unlike a quitclaim deed, a Grant Deed includes guarantees that the property hasn’t been sold to someone else and that there are no hidden liabilities. If you're considering a California Quitclaim Deed from Individual to Husband and Wife for a quick transfer without such assurances, it is important to understand the limitations.

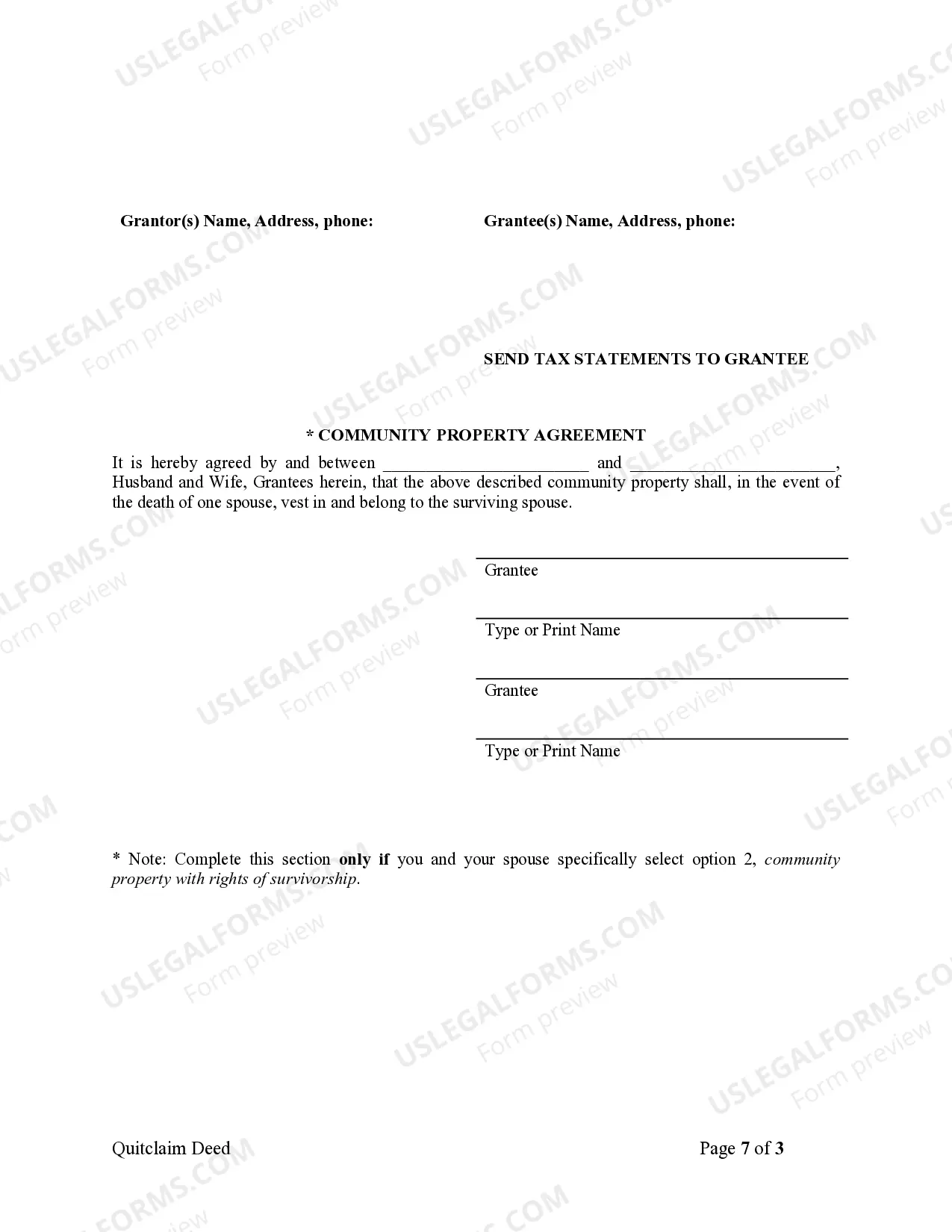

An Interspousal transfer deed in California is a specific type of deed used to transfer property between spouses. This deed simplifies the process of transferring ownership. Typically, it does not involve a sale, as the transfer is often for estate planning purposes or during a divorce. If you're looking to execute a California Quitclaim Deed from Individual to Husband and Wife, using an Interspousal transfer deed may streamline your transaction significantly.

In California, anyone can prepare a quitclaim deed as long as they include all necessary information and comply with state regulations. However, it's beneficial to consult a legal professional for help, especially if you want to ensure accuracy. Services like US Legal Forms offer ready-made templates along with instructions for completing the deed correctly. This can save you time and effort while ensuring that the transfer is legally sound.

The most common way to transfer ownership of real property is through a quitclaim deed, especially a California Quitclaim Deed from Individual to Husband and Wife. This method is straightforward and allows for a simple transfer of title without the need for a sale. Using this deed ensures that the new owners are legally recognized, making it a reliable choice for property transfers between spouses.

Yes, you can transfer shares from husband to wife, typically through a stock transfer form. This form must be completed with relevant information about the shares and the parties involved. In some cases, a quitclaim deed may be involved if the shares are part of the property being transferred. Consulting resources like US Legal Forms can offer clarity and guidance for your specific circumstances.

Transferring property from husband to wife after death may require specific legal steps. Typically, you may need to refer to the deceased's will or trust documents, which can dictate the transfer process. If there is a trust in place, it can streamline the transfer. Online services like US Legal Forms can provide the necessary forms and guidance, ensuring the process adheres to California laws.

Transferring ownership in California typically involves using a quitclaim deed, which is an effective tool for a California Quitclaim Deed from Individual to Husband and Wife. Start by drafting the quitclaim deed, including the legal description of the property. Next, both parties must sign the deed in front of a notary, and finally, file the deed with your local county recorder. This process securely updates the ownership records.

To add your spouse to your deed in California, you can use a California Quitclaim Deed from Individual to Husband and Wife. This document allows you to transfer ownership of the property directly to both you and your spouse. You must fill out the quitclaim deed form, have it notarized, and then file it with the county recorder’s office. This process helps ensure that both names appear on the property title.

Adding someone to a deed, such as your spouse, may have tax implications. When you use a California Quitclaim Deed from Individual to Husband and Wife, it can affect property tax assessments. Additionally, transferring real property could trigger reassessment, which could lead to an increase in property taxes. Consulting with a tax advisor or real estate attorney can provide clarity on your specific situation.