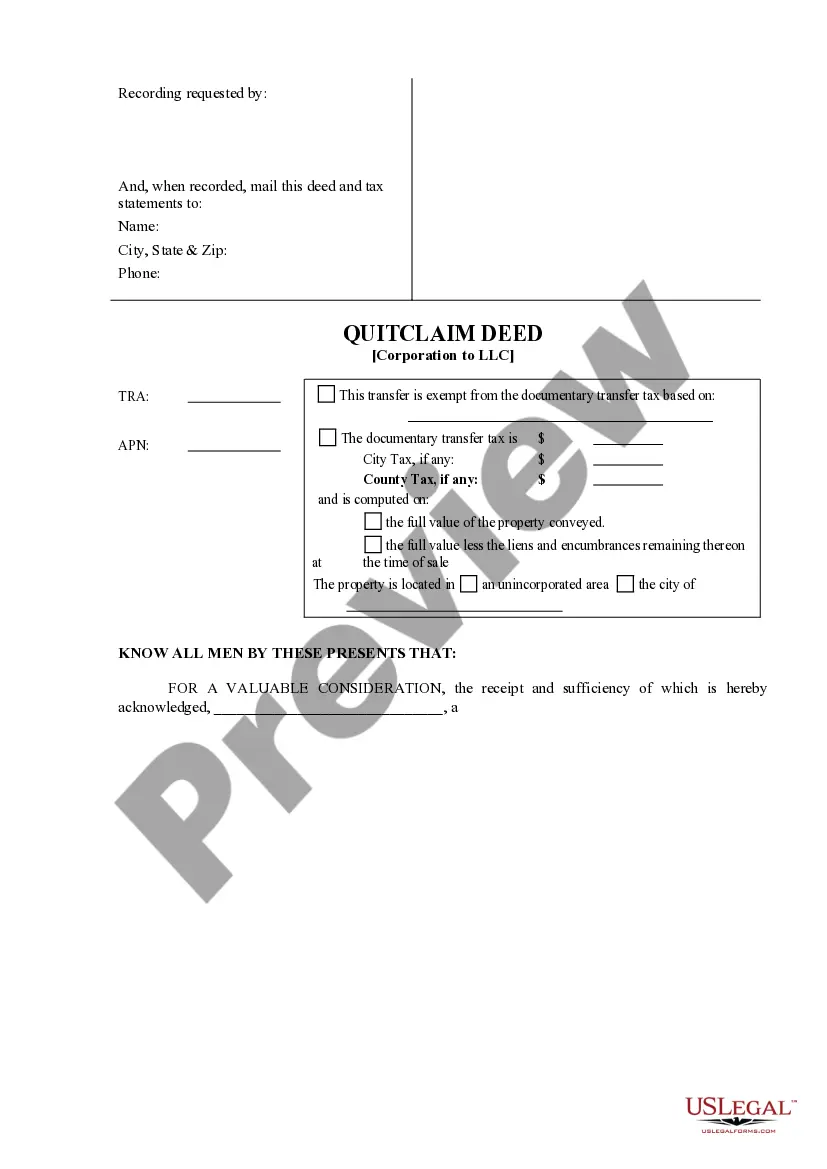

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

California Quitclaim Deed from Corporation to LLC

Description

How to fill out California Quitclaim Deed From Corporation To LLC?

If you are looking for precise California Quitclaim Deed samples from Corporation to LLC, US Legal Forms is exactly what you require; locate documents created and validated by state-certified legal professionals.

Utilizing US Legal Forms not only frees you from worries about legal documents; you also conserve effort, time, and money! Downloading, printing, and filled-out a professional form is actually more cost-effective than requesting an attorney to do it for you.

And that's it! With just a few simple clicks, you have an editable California Quitclaim Deed from Corporation to LLC. After you set up your account, all subsequent orders will be handled even more smoothly. With a US Legal Forms subscription, simply Log In to your account and click the Download button found on the form's page. Then, when you need to use this document again, you can always find it in the My documents section. Don't waste your time and effort comparing numerous documents across different platforms. Purchase accurate copies from a single secure source!

- To begin, complete your registration process by entering your email and creating a secure password.

- Follow the steps below to set up an account and access the California Quitclaim Deed from Corporation to LLC template suited for your needs.

- Use the Preview option or view the file description (if available) to ensure that the template is the correct one you wish.

- Verify its validity in your jurisdiction.

- Click on Buy Now to place an order.

- Select a preferred pricing plan.

- Set up your account and pay using a credit card or PayPal.

- Choose a suitable format and save the document.

Form popularity

FAQ

When you transfer property to an LLC in California, it's important to consider the tax implications. Generally, transferring property using a California Quitclaim Deed from Corporation to LLC may trigger reassessment under Proposition 13, which could lead to an increase in property taxes. Additionally, any gains from the transfer may be subject to capital gains tax. To navigate these complexities, you may want to consult a tax professional or use platforms like UsLegalForms to ensure a smooth process.

Yes, a title company can facilitate a quitclaim deed process. They can help prepare and review the quitclaim deed, ensuring that all necessary information is included. Moreover, they often offer additional services, such as title searches, to confirm the property's status. Choosing a title company for your California Quitclaim Deed from Corporation to LLC can simplify the process and provide peace of mind.

A quitclaim deed is most commonly used to transfer property between family members or in divorce settlements where both parties agree on the transfer. This deed allows individuals to relinquish their claim to a property without guaranteeing any rights over the title. In instances of transferring a property via a California Quitclaim Deed from Corporation to LLC, it facilitates a straightforward change of ownership, making it an effective tool for quick transfers.

In property matters, the title is often viewed as more important than the deed. The title is the legal right to own and use the property, while the deed is the document that formally conveys ownership. When using a California Quitclaim Deed from Corporation to LLC, understand that while the deed can transfer interest, it does not guarantee clear title. Therefore, verify the title before proceeding with any transfer.

To transfer property from a trust to an LLC, start by reviewing the trust documents for any specific provisions regarding transfers. You’ll need to complete a quitclaim deed or a similar form to legally transfer the property. Once filled out, sign the deed in front of a notary and file it with the local county recorder's office. By following these steps, you can efficiently execute a California Quitclaim Deed from Corporation to LLC.

The strongest form of deed is typically the warranty deed. This type of deed offers the highest level of protection for the buyer, as it guarantees that the seller holds clear title to the property. In comparison, a California Quitclaim Deed from Corporation to LLC provides no guarantees about the title, which means it only transfers interest without warranties. Therefore, while warranty deeds provide assurance, quitclaim deeds serve specific purposes in property transfers.

To quitclaim a deed to your LLC, you first need to obtain the existing property deed. Then, you fill out a quitclaim deed form, ensuring you provide accurate information about the property and the LLC. After completing the form, sign it in front of a notary public, and finally record the quitclaim deed with your local county recorder's office. This process effectively transfers the property ownership using a California Quitclaim Deed from Corporation to LLC.

Transferring property to an LLC in California involves preparing a California Quitclaim Deed from Corporation to LLC. You must fill out the deed with accurate details and ensure all owners sign it. After notarizing the document, file it with your county's recorder's office. Utilizing platforms like uslegalforms can simplify creating the necessary documents for this process.

To submit a quit claim deed in California, you need to complete the appropriate forms with accurate information regarding the property and its ownership. Ensure you follow all state requirements for signatures, notary public acknowledgment, and filing. Once completed, file the deed with the county recorder's office. This process is vital when using a California Quitclaim Deed from Corporation to LLC to ensure proper legal documentation.

To avoid property tax reassessment in California, it is important to follow specific guidelines. Utilizing a California Quitclaim Deed from Corporation to LLC can often facilitate this process when done correctly. Specific exemptions exist, such as transferring property to an LLC owned by the same individuals. Consulting with a tax professional can further clarify your options.