A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee

Description California Beneficiary Rights Trust

How to fill out California Disclaimer Trust Form?

If you're looking for precise California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee examples, US Legal Forms is exactly what you require; access documents crafted and verified by state-certified legal experts.

Utilizing US Legal Forms not only protects you from issues related to legal documentation; furthermore, you save effort, time, and expenses! Downloading, printing, and completing a professional template is considerably less expensive than hiring legal assistance to create it for you.

And that’s it. With a few simple clicks, you have an editable California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. Once you establish an account, all future orders will be even easier to process. When you have a US Legal Forms subscription, just Log In and click the Download option you can find on the form's page. Then, when you want to use this sample again, you'll always be able to find it in the My documents menu. Don't waste your time browsing countless forms on different websites. Order professional copies from a single secure platform!

- To begin, finish your sign-up process by entering your email and creating a secure password.

- Follow the instructions below to set up an account and locate the California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee example to address your concerns.

- Use the Preview option or review the document description (if available) to ensure that the template is the one you need.

- Verify its validity in your location.

- Click Buy Now to place an order.

- Select a recommended pricing plan.

- Create an account and pay with your credit card or PayPal.

- Choose the desired format and save the form.

Beneficiary Trustee Trustor Form popularity

Disclaimer Beneficiary Form Other Form Names

Beneficiary Rights Under FAQ

In California, there is no state inheritance tax, meaning you can inherit any amount from your parents without incurring state taxes. However, if the inherited amount exceeds the federal estate tax exemption limit, federal taxes might apply. It is crucial to consider the California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee in your estate planning, as it can influence tax implications on inheritances. Consulting with a legal professional or using Uslegalforms can help clarify your specific situation.

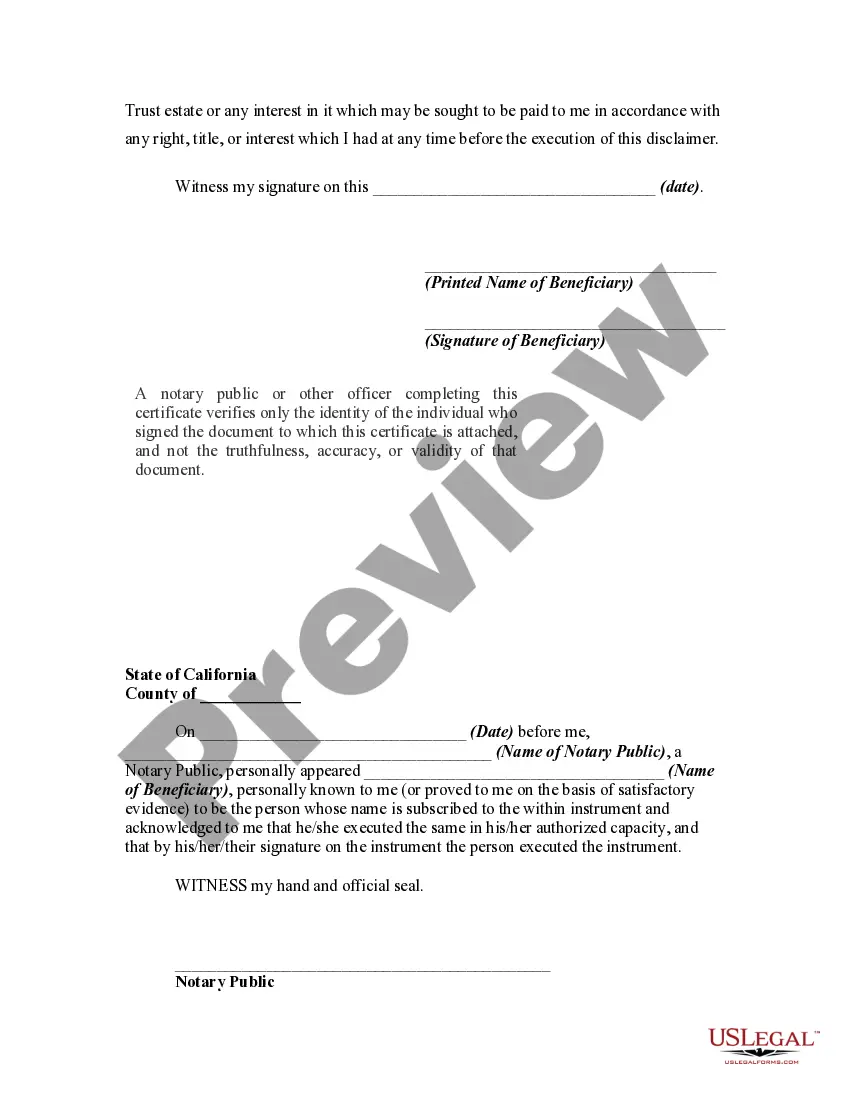

To disclaim an inheritance in California, you must provide a written disclaimer, which is a legal document that states your intention to refuse the inheritance. This document should be signed and delivered to the relevant parties, such as the executor or trustee, within nine months of the decedent's death. Understanding the California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is vital here, as it outlines your rights and responsibilities in this process. For assistance, you might consider using the Uslegalforms platform.

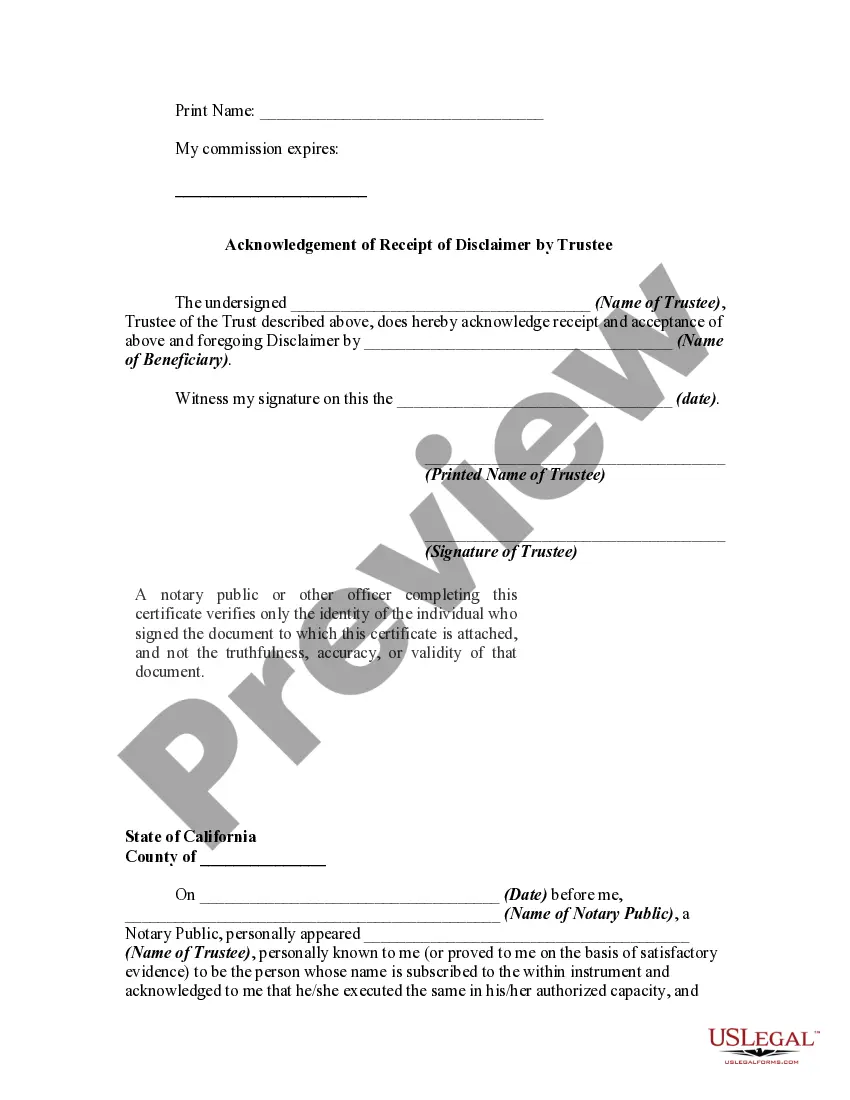

If you refuse your inheritance, also known as disclaiming it, the property will not go to you. Instead, it will typically pass to the next beneficiary named in the trust or will. This process is guided by the California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. It's crucial to follow the proper legal procedures to ensure the inheritance goes to a rightful owner without complications.

Filing probate in California without a will involves specific steps. First, you must determine if the estate requires probate by checking its value and assets. If it does, you can complete necessary forms, including a Petition for Probate and other relevant documents. It's essential to understand the California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, as this can impact how the estate is handled, especially if there are disclaimers involved.

Yes, a trust beneficiary can disclaim their interest in the trust under California law. This decision allows the beneficiary to relinquish any rights without accepting the associated benefits or responsibilities. The disclaimer must be executed in writing and should meet specific legal guidelines to be valid. Utilizing resources such as uslegalforms can simplify the process of filing a California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

To disclaim inheritance in California, beneficiaries must provide a written disclaimer to the trustee, expressing their intent to reject the inheritance. This disclaimer must be filed within nine months of the person’s death to be effective. Completing this process properly is essential, as it affects the distribution of the trust. For assistance, consider platforms like uslegalforms which provide tools to guide you through the California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

Beneficiaries should expect to be notified within 120 days of the trustor's death. The trustee is responsible for informing them of their rights and the details of the trust. Factors like the complexity of the trust or outstanding debts may influence this timeline. Knowing about the California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee can help beneficiaries understand their position.

In California, a trustee typically has a reasonable time frame to distribute trust assets, usually within a year after the trust has been settled. This duration ensures that all debts are settled and beneficiaries are informed about the trust’s terms. If complications arise, the process may take longer. Understanding the implications of a California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee can help beneficiaries navigate any delays.

Yes, a beneficiary has the right to access the trust document in California. This right ensures beneficiaries can understand their interests in the trust. However, this right may be subject to specific limitations based on the trust's terms. In certain cases, consulting a legal expert can clarify how a California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee might affect access.

To write a financial disclaimer, begin with a clear headline stating that it is a disclaimer of liability. Include an explanation of what is being disclaimed and the conditions surrounding it. Ensure that your language aligns with the legal requirements of the California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, providing a complete understanding of your limitations.