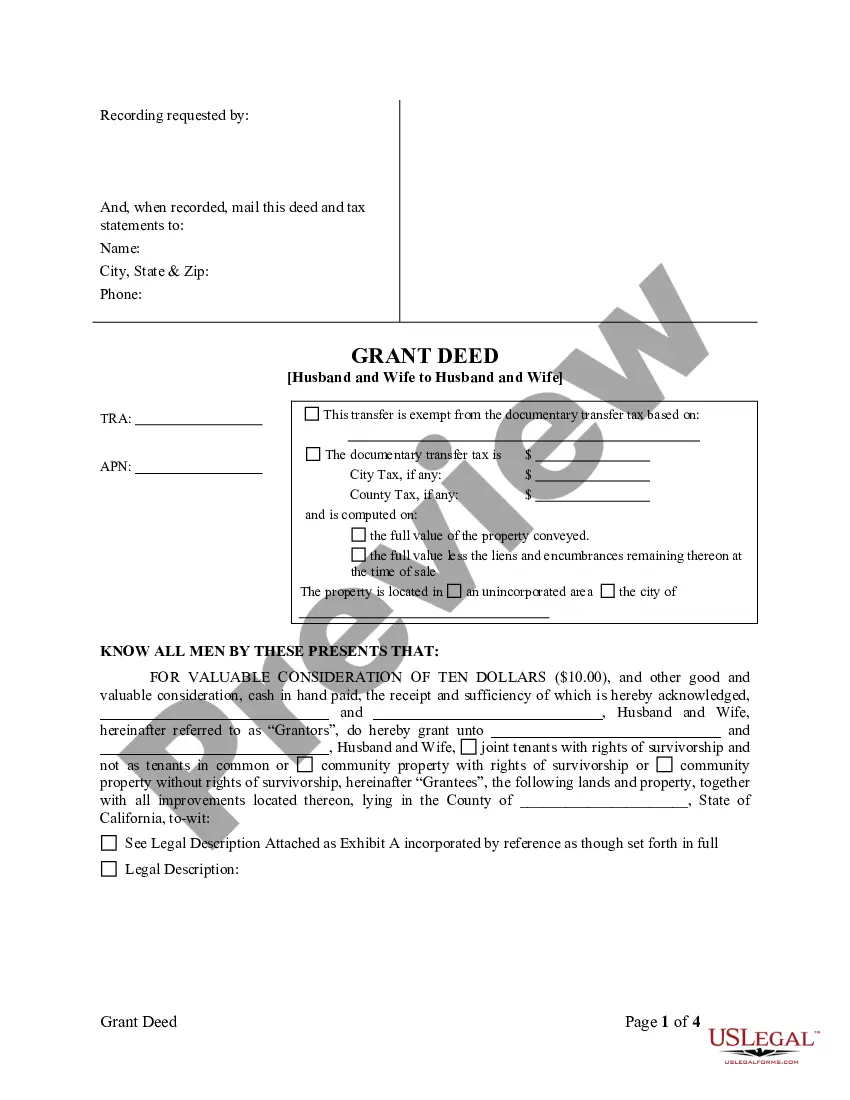

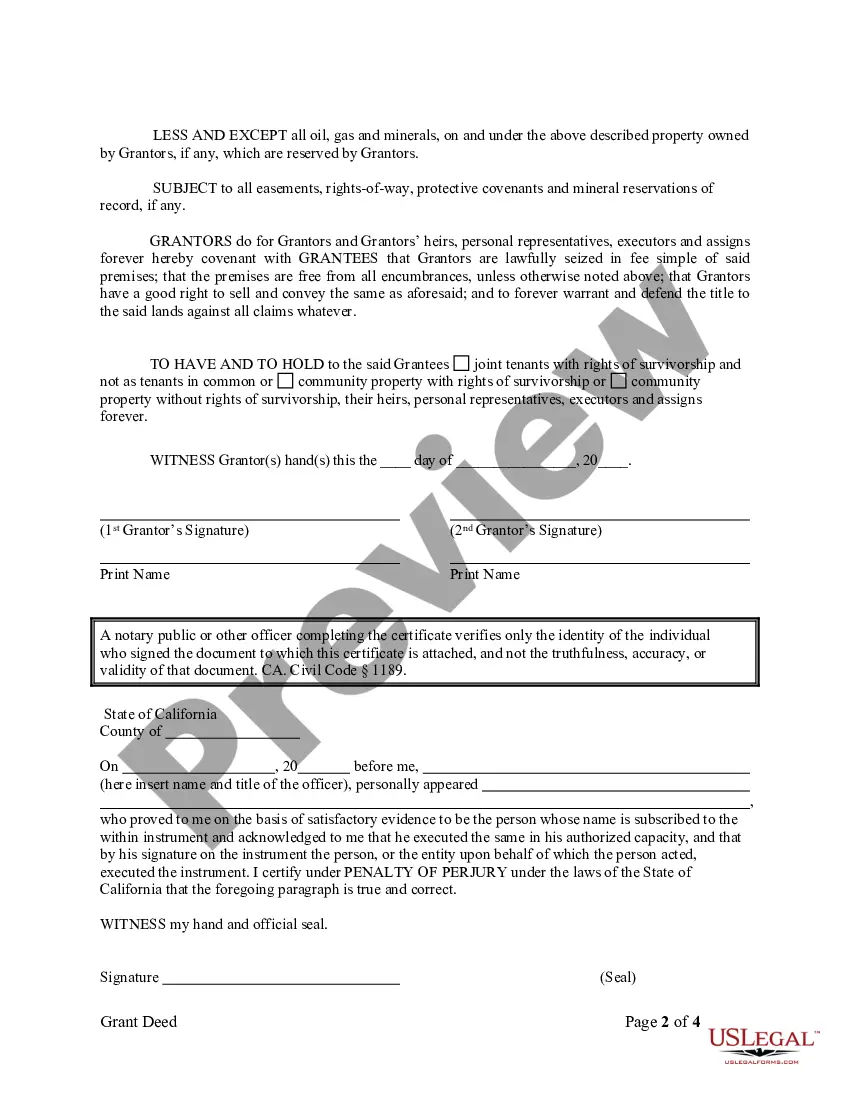

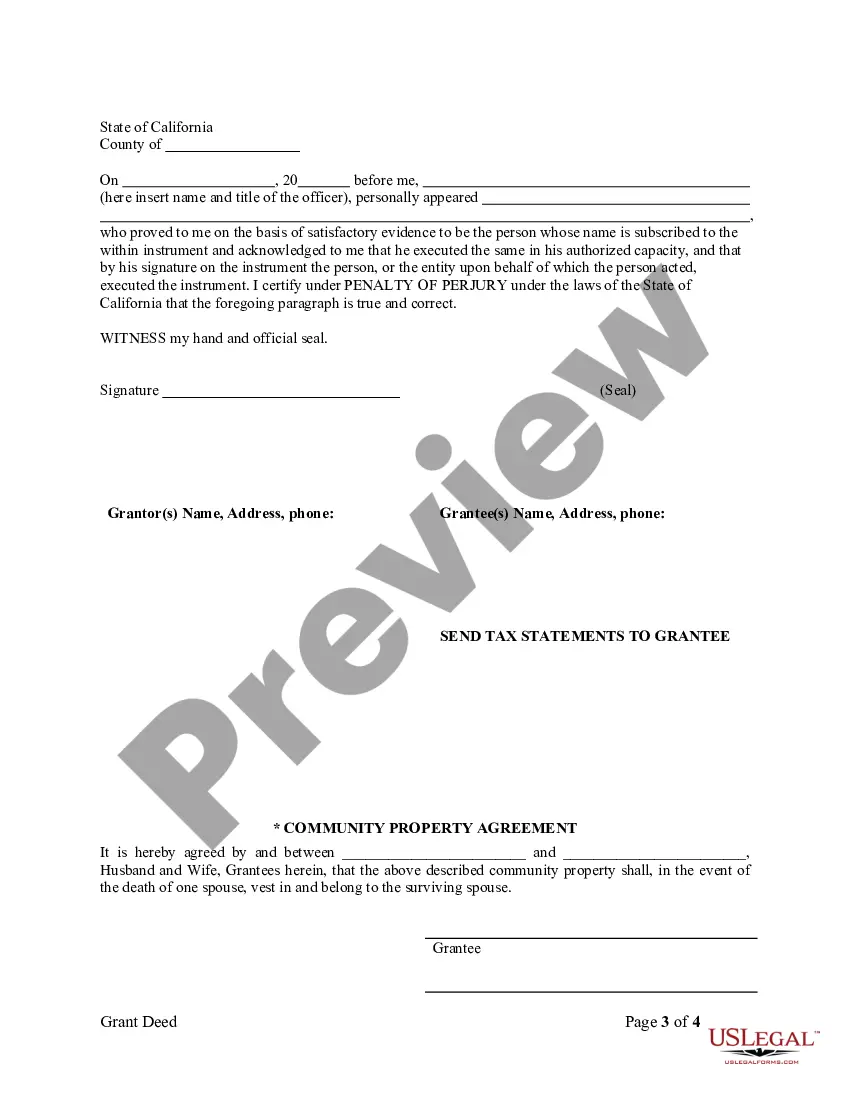

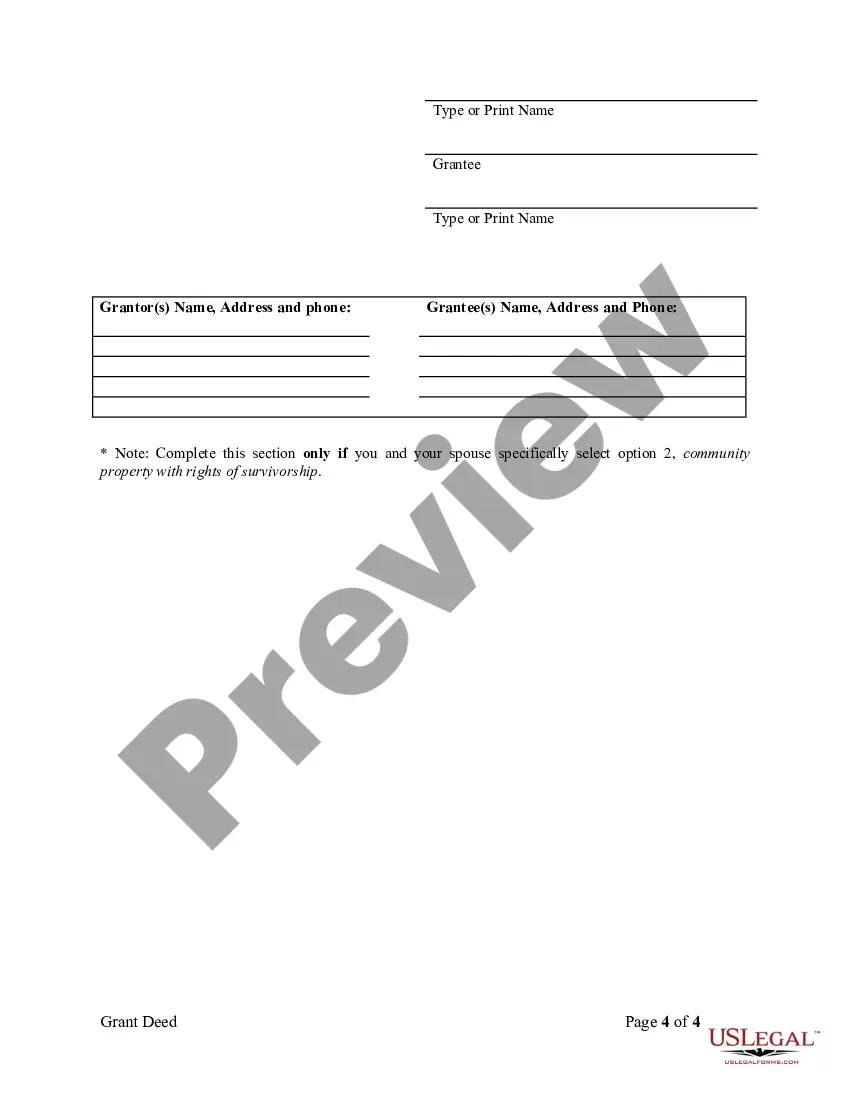

This form is a Warranty Deed where the grantors are husband and wife and the grantees are husband and wife. Grantors convey and warrant the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

California Grant Deed from Husband and Wife to Husband and Wife

Description

How to fill out California Grant Deed From Husband And Wife To Husband And Wife?

If you are looking for precise California Grant Deed templates from Husband and Wife to Husband and Wife, US Legal Forms is what you require; locate documents crafted and verified by state-authorized attorneys.

Utilizing US Legal Forms not only shields you from issues related to official documents; additionally, you save time and energy, as well as money! Downloading, printing, and completing a professional document is far less expensive than hiring a lawyer to handle it for you.

And that's it. With just a few simple steps, you possess an editable California Grant Deed from Husband and Wife to Husband and Wife. Once you create an account, all future requests will be processed even more smoothly. If you hold a US Legal Forms subscription, simply Log In to your account and click the Download button you see on the form's page. Then, whenever you wish to use this template again, you will always find it in the My documents section. Do not waste your time and effort comparing countless forms across various platforms. Purchase accurate documents from one secure service!

- To start, finalize your registration process by providing your email and creating a password.

- Follow the instructions below to establish your account and obtain the California Grant Deed from Husband and Wife to Husband and Wife template to fulfill your requirements.

- Utilize the Preview option or review the document description (if available) to ensure that the sample is the one you desire.

- Verify its validity in your jurisdiction.

- Click Buy Now to place your order.

- Select a preferred pricing plan.

- Create an account and complete payment using your credit card or PayPal.

- Choose a suitable file format and save the document.

Form popularity

FAQ

To obtain a copy of your grant deed in California, you must request it from your local county recorder's office. Many counties offer online services, allowing you to search and access your deed digitally. If you prefer, you can also visit the office in person or submit a formal request. This is a straightforward process that can help you manage your California Grant Deed from Husband and Wife to Husband and Wife efficiently.

Adding a name to a grant deed in California requires you to draft a new grant deed, which must include the current and new property owner's names. After preparing the deed, both the current owner and the new owner need to sign it in front of a notary public. Finally, submit the signed document to the county recorder's office for official recording. This change is important for updating your California Grant Deed from Husband and Wife to Husband and Wife.

To amend a grant deed in California, you need to create a new grant deed that reflects the changes you wish to make. This document must be completed, signed, and notarized just like the original. You then need to file the new deed with the county recorder's office. This process ensures that your latest changes are legally recognized, especially when dealing with a California Grant Deed from Husband and Wife to Husband and Wife.

When you add someone to your deed in California, it can affect property taxes. In many cases, transferring ownership might trigger a reassessment of the property, which could lead to higher taxes. However, if you are just adding your spouse, the transfer may qualify for an exclusion, helping to keep your property tax rate stable. It’s wise to consult a tax professional for advice tailored to your specific situation regarding a California Grant Deed from Husband and Wife to Husband and Wife.

In California, adding a spouse to a deed involves completing a new grant deed that lists both spouses as owners. You must fill out the grant deed form accurately, ensuring you include both names and their shares in the property. Once completed, sign the document in front of a notary public, and then record the new deed with the county recorder's office. This process effectively updates the ownership structure to reflect your California Grant Deed from Husband and Wife to Husband and Wife.

While adding a name to a deed can be beneficial, it also has potential drawbacks. For instance, it may complicate future property sales or refinancing processes, and could expose the property to the new owner's financial situations. It is wise to consider these factors and seek advice, perhaps from platforms like US Legal Forms, to make informed decisions.

Yes, you can add someone to a deed even if they are not on the mortgage. A California Grant Deed from Husband and Wife to Husband and Wife allows for this flexibility, as the deed and mortgage are separate instruments. However, keep in mind that the lender may still consider the added individual when making decisions about future financing.

To add your spouse to your deed without refinancing, you can complete a California Grant Deed from Husband and Wife to Husband and Wife. Fill out the appropriate form, sign it, and submit it to your local county recorder. Online services like US Legal Forms can help streamline this process and ensure you meet all legal requirements.

Adding a spouse to a deed is relatively straightforward when using a California Grant Deed from Husband and Wife to Husband and Wife. You typically need to fill out the grant deed form, have it signed, and file it with your county recorder's office. While the process is manageable, it's often beneficial to consult an attorney or use a reliable platform like US Legal Forms for the necessary documents and guidance.

Yes, you can transfer shares from husband to wife without significant legal barriers, but it must be done properly to ensure compliance with applicable laws. This may require documentation such as a stock transfer form along with board or company approval, depending on the business structure. It’s essential to understand the implications this transfer may have on taxes and ownership rights. Utilizing services like USLegalForms can clarify this process and guide you through related documentation.