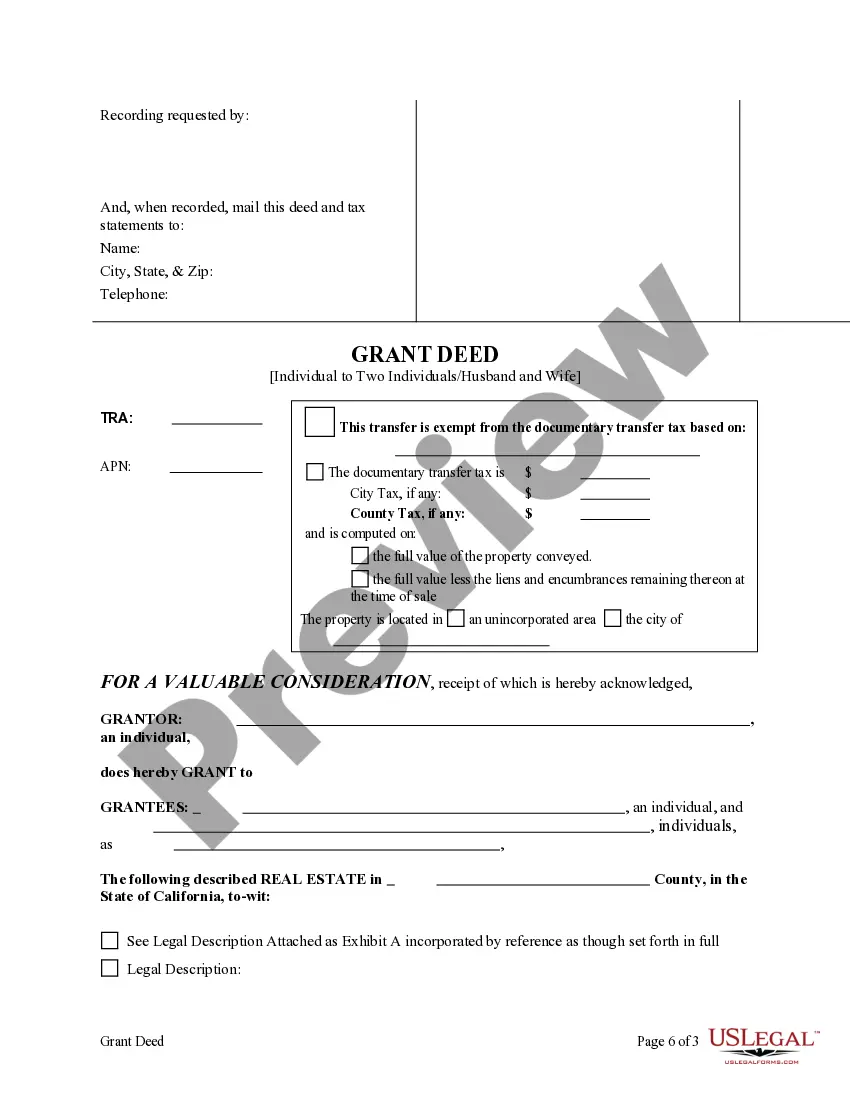

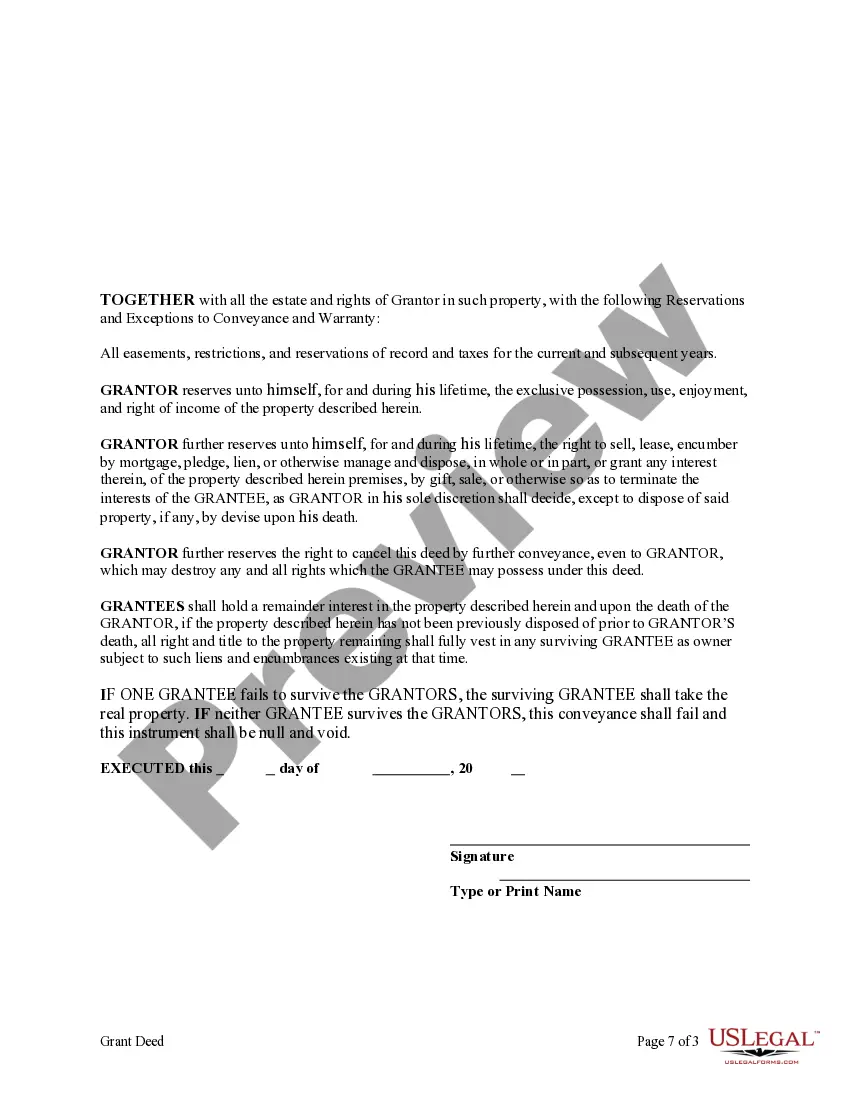

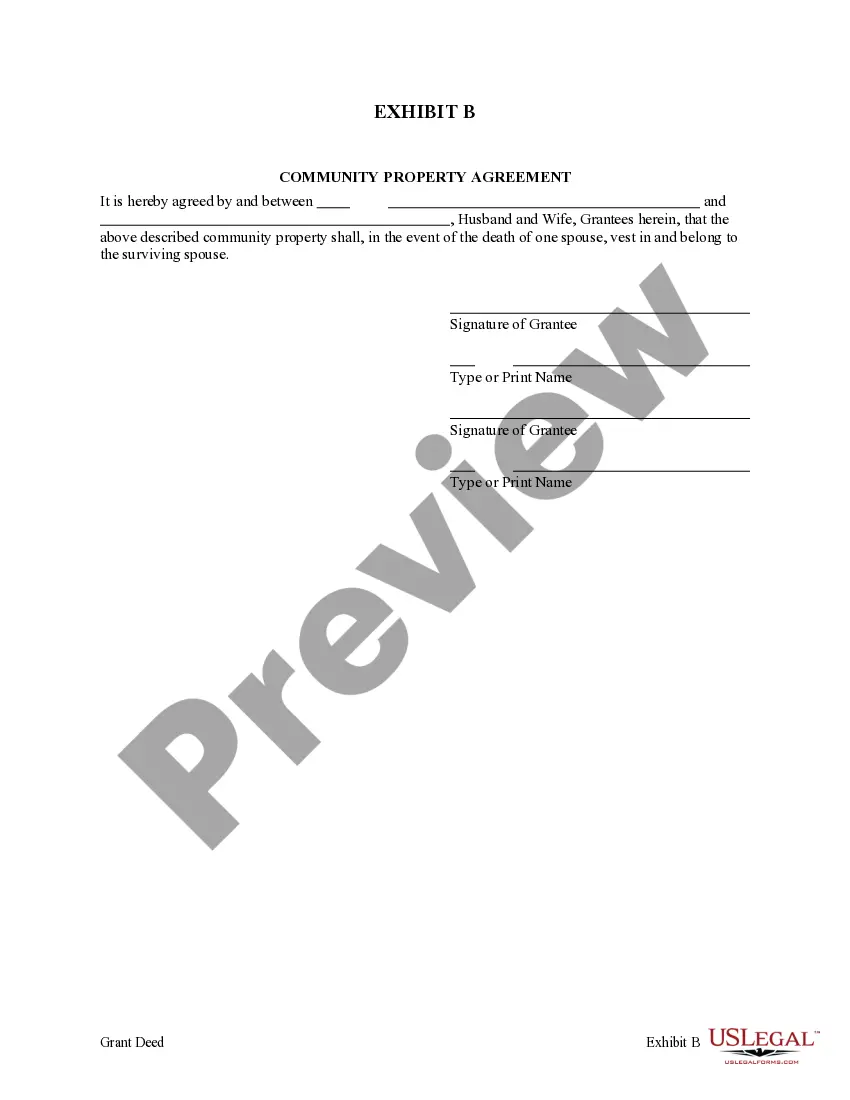

This form is a Grant Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantees are two individuals or husband and wife. Grantor conveys the property to Grantees subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantor in order to receive an interest in the real property. This deed complies with all state statutory laws.

California Enhanced Life Estate or Lady Bird Grant Deed from Individual to Two Individuals or Husband and Wife

Description

How to fill out California Enhanced Life Estate Or Lady Bird Grant Deed From Individual To Two Individuals Or Husband And Wife?

If you're looking for suitable California Enhanced Life Estate or Lady Bird Grant Deed templates from an Individual to Two Individuals or a Married Couple, US Legal Forms is exactly what you require; obtain documents crafted and reviewed by state-licensed attorneys. Utilizing US Legal Forms not only spares you from troubles related to legal paperwork; additionally, you conserve time, effort, and money! Downloading, printing, and completing a professional template is significantly less expensive than asking an attorney to draft it for you.

To get started, finish your registration process by entering your email and creating a password. Follow the instructions below to set up an account and locate the California Enhanced Life Estate or Lady Bird Grant Deed from Individual to Two Individuals or Married Couple model to address your needs.

After creating an account, all subsequent orders will be processed even more easily. If you possess a US Legal Forms subscription, simply Log In to your profile and click the Download button displayed on the form’s page. Then, when you need to use this template again, you'll always be able to find it in the My documents section. Don’t waste your time comparing countless forms on different sites. Acquire expert templates from a single reliable source!

- Utilize the Preview feature or read the document details (if available) to ensure that the form is the one you require.

- Verify its validity in your residing state.

- Click Buy Now to place an order.

- Select a desired pricing option.

- Establish your account and pay with a credit card or PayPal.

- Choose a suitable file format and save the documents.

- And that's it. In just a few simple clicks you obtain an editable California Enhanced Life Estate or Lady Bird Grant Deed from Individual to Two Individuals or Married Couple.

Form popularity

FAQ

Yes, a Lady Bird deed can have multiple beneficiaries, allowing for flexible estate planning. When you create the deed, ensure that all beneficiary names are clearly stated. This can make the transfer of property much easier upon your passing and help avoid probate. A California Enhanced Life Estate or Lady Bird Grant Deed from Individual to Two Individuals or Husband and Wife is particularly well-suited for this purpose.

To add a spouse to a deed in California, create a new grant deed that lists both names as owners. Make sure to sign this deed before a notary public. Once completed, file the deed with your county's recorder office. Using a California Enhanced Life Estate or Lady Bird Grant Deed from Individual to Two Individuals or Husband and Wife can make this process straightforward and beneficial.

While a Lady Bird deed provides numerous benefits, it does have some disadvantages. One potential issue is that it may not provide as strong of a protection against creditors as other estate planning options. Moreover, not all states recognize the Lady Bird deed, which might complicate estate planning if you move. If you are considering this option, consult with professionals to ensure it suits your needs.

To add your spouse to a grant deed in California, prepare a new grant deed that includes both names. Both spouses must sign the deed in front of a notary public and submit it to the county recorder’s office. Utilizing a California Enhanced Life Estate or Lady Bird Grant Deed from Individual to Two Individuals or Husband and Wife can offer additional benefits, such as avoiding probate.

Amending a grant deed in California requires creating a new deed that includes the changes you wish to implement. You will need to sign this new deed in front of a notary public and file it with the county recorder's office for it to be legally recognized. If you are considering making changes for spouses or multiple beneficiaries, using a California Enhanced Life Estate or Lady Bird Grant Deed can simplify the process.

To add a name to a grant deed in California, you typically need to prepare a new grant deed form and execute it properly. You must also have the current owner sign the new deed, which can be done through a notary public. Afterward, you file the updated deed with the county recorder’s office. Consider using a California Enhanced Life Estate or Lady Bird Grant Deed from Individual to Two Individuals or Husband and Wife for a seamless process.

When you add someone to a deed in California, it can trigger gift tax implications. The value of the property added may be considered a gift, which could require filing a gift tax return. Additionally, property tax reassessment may occur, affecting your property taxes under California's Proposition 13. Therefore, it's essential to understand how a California Enhanced Life Estate or Lady Bird Grant Deed from Individual to Two Individuals or Husband and Wife can minimize these tax impacts.

Including your wife's name on the house deed can offer several advantages, including shared ownership and rights. A California Enhanced Life Estate or Lady Bird Grant Deed from Individual to Two Individuals or Husband and Wife can facilitate this arrangement. This decision can also help avoid complications related to inheritance or property disputes in the future. Ultimately, it is wise to consider your unique circumstances and consult with a legal advisor.

Filling out a Lady Bird Deed is relatively straightforward. You will need to provide information such as the names of the current owner(s), the names of the beneficiaries, and a legal description of the property. Using a California Enhanced Life Estate or Lady Bird Grant Deed from Individual to Two Individuals or Husband and Wife may simplify this process, and platforms like USLegalForms can provide templates and guidance to ensure everything is completed correctly.

Yes, you can add your wife to the title of the property without adding her to the mortgage. This is common when homeowners wish to share ownership through a California Enhanced Life Estate or Lady Bird Grant Deed from Individual to Two Individuals or Husband and Wife. However, it's important to understand that doing so does not change the parties responsible for the mortgage. Be sure to consult with your lender to understand any implications.