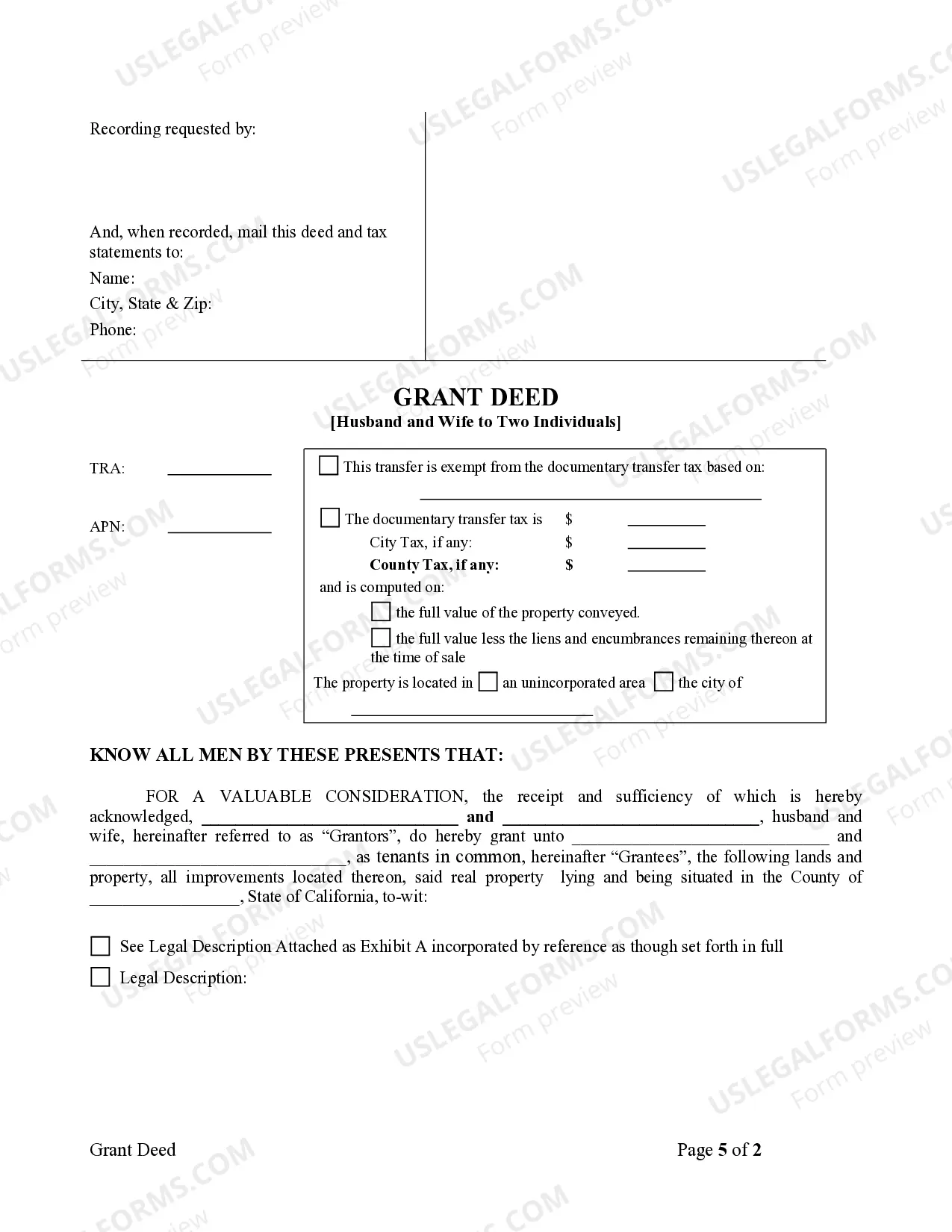

This form is a Grant Deed where the grantors are husband and wife and the grantees are two individuals. Grantors convey and grant the described property to the grantees. The grantees take the property as joint tenants with a right of survivorship or as tenants in common. This deed complies with all state statutory laws.

California Grant Deed - Husband and Wife to Two Individuals

Description

How to fill out California Grant Deed - Husband And Wife To Two Individuals?

If you are seeking suitable samples of California Grant Deed - Husband and Wife to Two Individuals, US Legal Forms is exactly what you require; find documents prepared and reviewed by attorneys qualified by the state.

Utilizing US Legal Forms not only spares you from hassles concerning legal paperwork; you also save time, energy, and money! Downloading, printing, and completing a professional document is far less expensive than hiring a lawyer to draft it for you.

And just like that, in a few simple steps, you possess an editable California Grant Deed - Husband and Wife to Two Individuals. Once you have your account, all future requests will be processed even more easily. After you subscribe to US Legal Forms, simply Log In and click the Download option available on the form's page. Then, whenever you need to use this template again, you will always be able to locate it in the My documents section. Don’t waste your time and effort comparing different forms across various sites. Purchase professional templates from a single trusted source!

- To get started, complete your registration by entering your email and creating a password.

- Follow the instructions below to establish your account and locate the California Grant Deed - Husband and Wife to Two Individuals template to address your concerns.

- Utilize the Preview option or review the document details (if available) to ensure it is the correct form.

- Check its validity in your residing state.

- Click Buy Now to complete your purchase.

- Select a preferred pricing plan.

- Create your account and pay using your credit card or PayPal.

- Choose a suitable file format and download the document.

Form popularity

FAQ

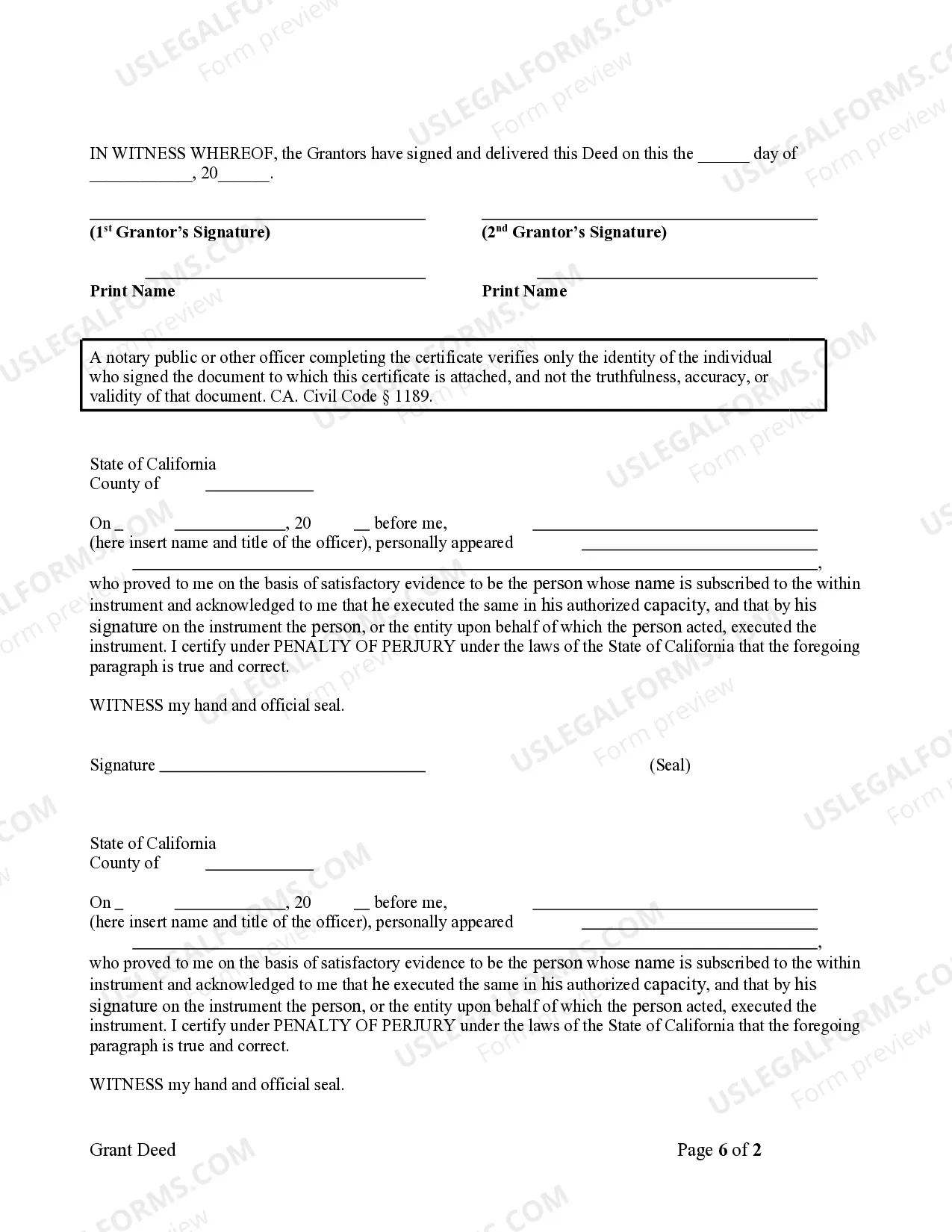

To add your spouse to a grant deed in California, you will create a new California Grant Deed - Husband and Wife to Two Individuals. This deed needs to include both names and should be executed following California's legal requirements. Once signed and notarized, file the deed with your local county recorder’s office to complete the process.

Adding someone to a deed in California can have significant tax implications, including potential gift taxes and property tax adjustments. When you add a person to a California Grant Deed - Husband and Wife to Two Individuals, the property may also be reassessed at its current market value. It’s wise to consult a tax professional or attorney to understand the full impact.

To amend a grant deed in California, prepare an amended deed that outlines the changes you wish to make. You will need to have the new deed signed and notarized. Finally, file this amended deed with the county recorder's office to make the changes legally official.

For married couples, a California Grant Deed - Husband and Wife to Two Individuals is often a suitable choice. This deed clearly defines both parties' ownership interests and provides protection for both spouses. Additionally, it can help avoid probate issues when one spouse passes away.

The best way for a husband and wife to hold title in California is typically through a joint tenancy with right of survivorship. This arrangement ensures that if one spouse passes away, their interest in the property automatically transfers to the surviving spouse. It's advisable to consult a legal expert to understand the implications of this form of ownership.

To add a spouse to a deed in California, create a new grant deed that includes both spouses' names as co-owners. This process is often referred to as 'title holding' and can be done easily through the right forms. After completing the deed, submit it to the county recorder for official recognition.

To add a name to a California Grant Deed - Husband and Wife to Two Individuals, you need to prepare a new grant deed reflecting the additional name. This deed must meet California's legal requirements, including signatures and notarization. Once prepared, you will need to file the new grant deed with the county recorder's office where the property is located.

Adding a spouse to a deed is usually a straightforward process, especially with a California Grant Deed - Husband and Wife to Two Individuals. You will need to fill out the appropriate legal forms and possibly get the deed notarized. Many find it easier to use resources like US Legal Forms to simplify the process.

If your wife is not on the deed, she may not have legal rights to the property. Depending on California law, this can affect inheritance and ownership claims. You may want to consider a California Grant Deed - Husband and Wife to Two Individuals to ensure both partners have equal rights to the property.

Adding a name to a deed can lead to potential tax liabilities and affect your estate planning. If conflicts arise between co-owners, it could complicate ownership decisions. Overall, it’s important to consider all aspects of property rights before proceeding with a California Grant Deed - Husband and Wife to Two Individuals.