This form is a Quitclaim Deed where the Grantors are the husband and wife and the grantee is a trust. Grantors convey and quitclaim the property to the grantee. This form complies with all state statutory laws.

California Quitclaim Deed - Husband and Wife to Trust

Description

How to fill out California Quitclaim Deed - Husband And Wife To Trust?

If you are seeking precise California Quitclaim Deed - Husband and Wife to Trust forms, US Legal Forms is precisely what you require; discover documents crafted and verified by state-licensed legal experts.

Utilizing US Legal Forms not only alleviates your concerns about proper documentation; additionally, you conserve time and effort, as well as money! Acquiring, printing, and completing a professional template is far more economical than hiring a lawyer to do it for you.

And there you go. With just a few simple clicks, you will have an editable California Quitclaim Deed - Husband and Wife to Trust. Once you create your account, all subsequent transactions will be processed even more smoothly. After obtaining a US Legal Forms subscription, simply Log In to your profile and click the Download button found on the form’s page. Then, whenever you need to access this blank form again, you'll always be able to locate it in the My documents section. Don't waste your time and energy comparing countless forms across multiple websites. Acquire professional templates from one reliable platform!

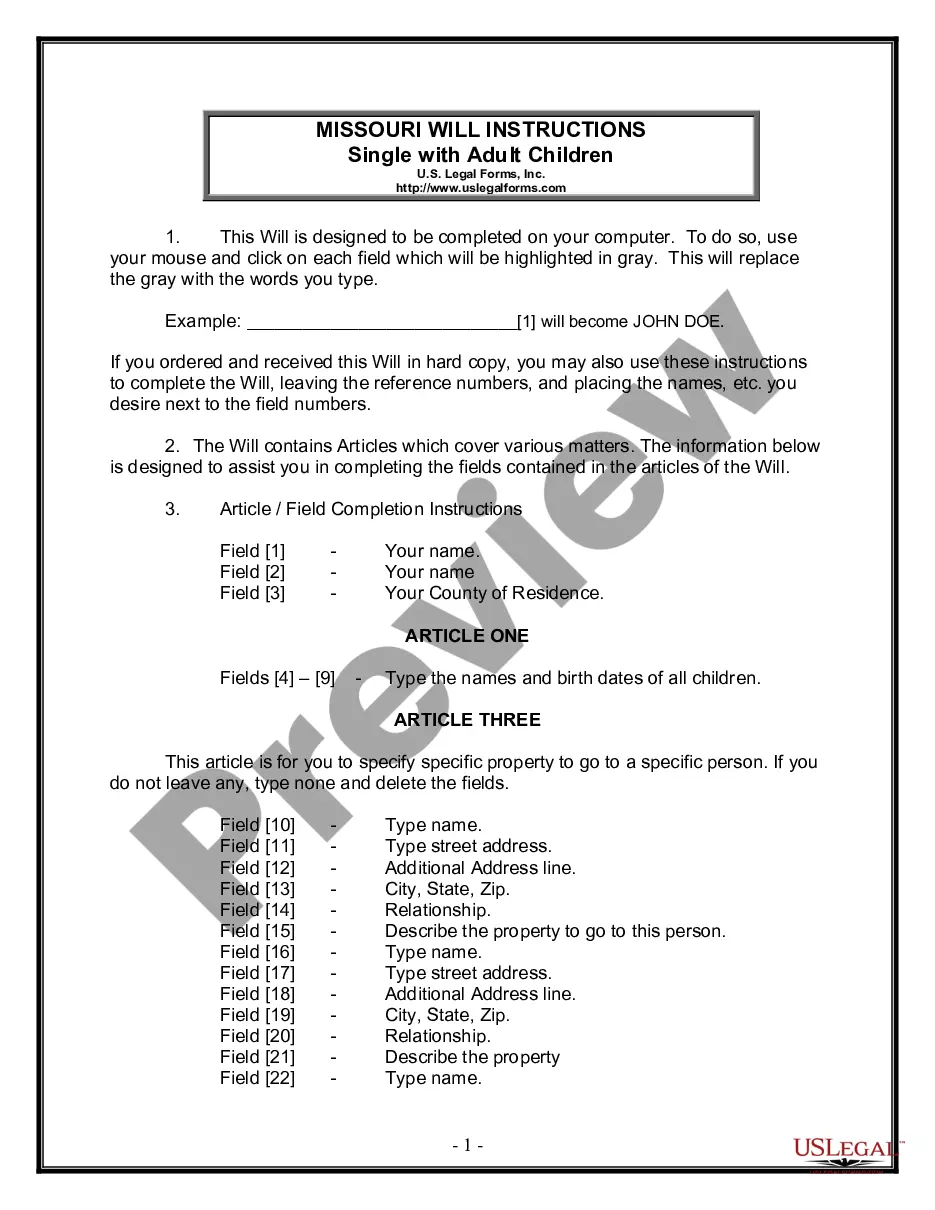

- To begin, finalize your registration process by entering your email and creating a password.

- Follow the instructions below to create an account and obtain the California Quitclaim Deed - Husband and Wife to Trust template to handle your matter.

- Utilize the Preview feature or view the document description (if available) to confirm that the template is the correct one you require.

- Verify its validity in your state.

- Click Buy Now to place your order.

- Select a recommended pricing option.

- Establish an account and make a payment with your credit card or PayPal.

- Choose a suitable file format and save the document.

Form popularity

FAQ

The parties to a trust relationship include the trustor, trustee, and beneficiaries. The trustor creates the trust, the trustee manages and administers it, and the beneficiaries receive the benefits of the trust. Each party plays a vital role in ensuring that the trust functions according to its intended purpose, especially in the context of a California Quitclaim Deed - Husband and Wife to Trust.

In California, the property in a trust is owned by the trust itself rather than any individual. The trustee holds legal title to the property, managing it on behalf of the beneficiaries. This setup is crucial for effective estate planning and can significantly streamline the transfer of property, particularly in cases involving a California Quitclaim Deed - Husband and Wife to Trust.

The three parties to a trust deed in California are the trustor, beneficiary, and trustee. The trustor conveys the property into the trust, while the beneficiary receives the rights and benefits from that property. The trustee acts as the administrator who ensures that the terms of the trust are followed, making these roles vital for any California Quitclaim Deed - Husband and Wife to Trust transaction.

In California, a trustee on a deed of trust can be an individual or a corporation. The key requirement is that the trustee must be capable of fulfilling the responsibilities related to managing the trust property. This flexibility allows many individuals or organizations to serve in this role, ensuring that your California Quitclaim Deed - Husband and Wife to Trust remains effective and secure.

In an express trust relationship, the three main actors are the trustor, trustee, and beneficiaries. The trustor, or grantor, creates the trust and specifies the terms. The trustee manages the trust property according to those terms and acts in the best interest of the beneficiaries, who are individuals or entities that receive benefits from the trust. Understanding these roles is essential when considering a California Quitclaim Deed - Husband and Wife to Trust.

Transferring a deed to a living trust in California involves executing a California Quitclaim Deed - Husband and Wife to Trust. Clearly state the property details and the living trust information on the deed. After signing and notarizing the document, you must record it with the appropriate county office to formalize the transfer.

To transfer a deed to a trust in California, you will typically draft a California Quitclaim Deed - Husband and Wife to Trust. This deed must clearly identify the property and the trust, then be signed and notarized. Once completed, the deed should be recorded with the county recorder's office to ensure the transfer is legally recognized.

While a trust can provide estate planning benefits, there are some disadvantages to consider. Establishing a trust can involve legal fees, and ongoing maintenance may be required to manage the trust properly. Additionally, there could be limitations on your ability to sell or refinance the property without going through specific legal steps, making it crucial to weigh these factors carefully.

To add your spouse to your deed of trust, you will need to draft and execute a California Quitclaim Deed - Husband and Wife to Trust. This deed should explicitly state both names and the intention to include your spouse as co-owner. Once executed, you must record the new deed with your county’s recorder office to finalize the addition.

Yes, a quit claim deed can be used to transfer property from a trust to an individual or another entity. This process ensures that the legal title of the property changes while the existing trust remains intact. Using a California Quitclaim Deed - Husband and Wife to Trust, you can streamline this transfer efficiently.