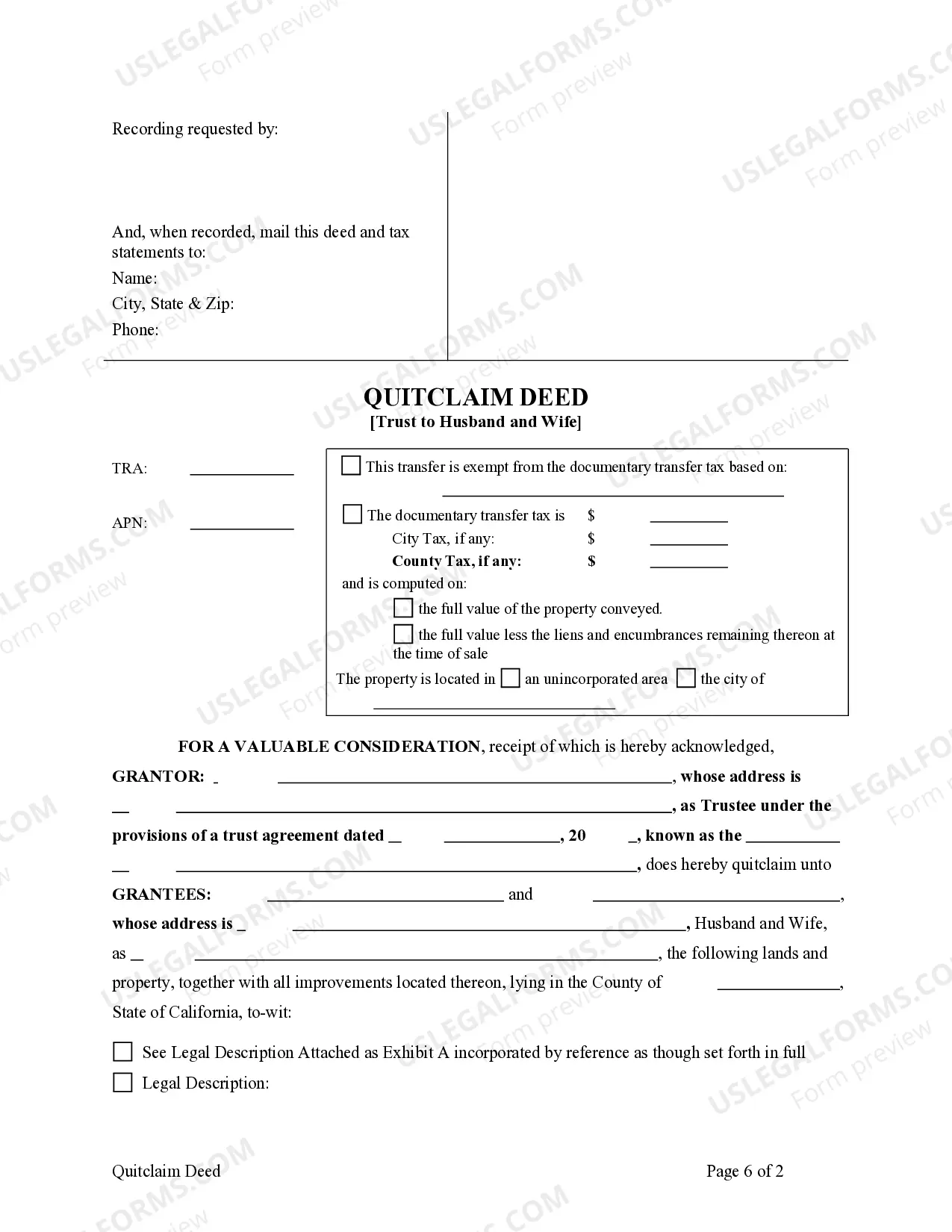

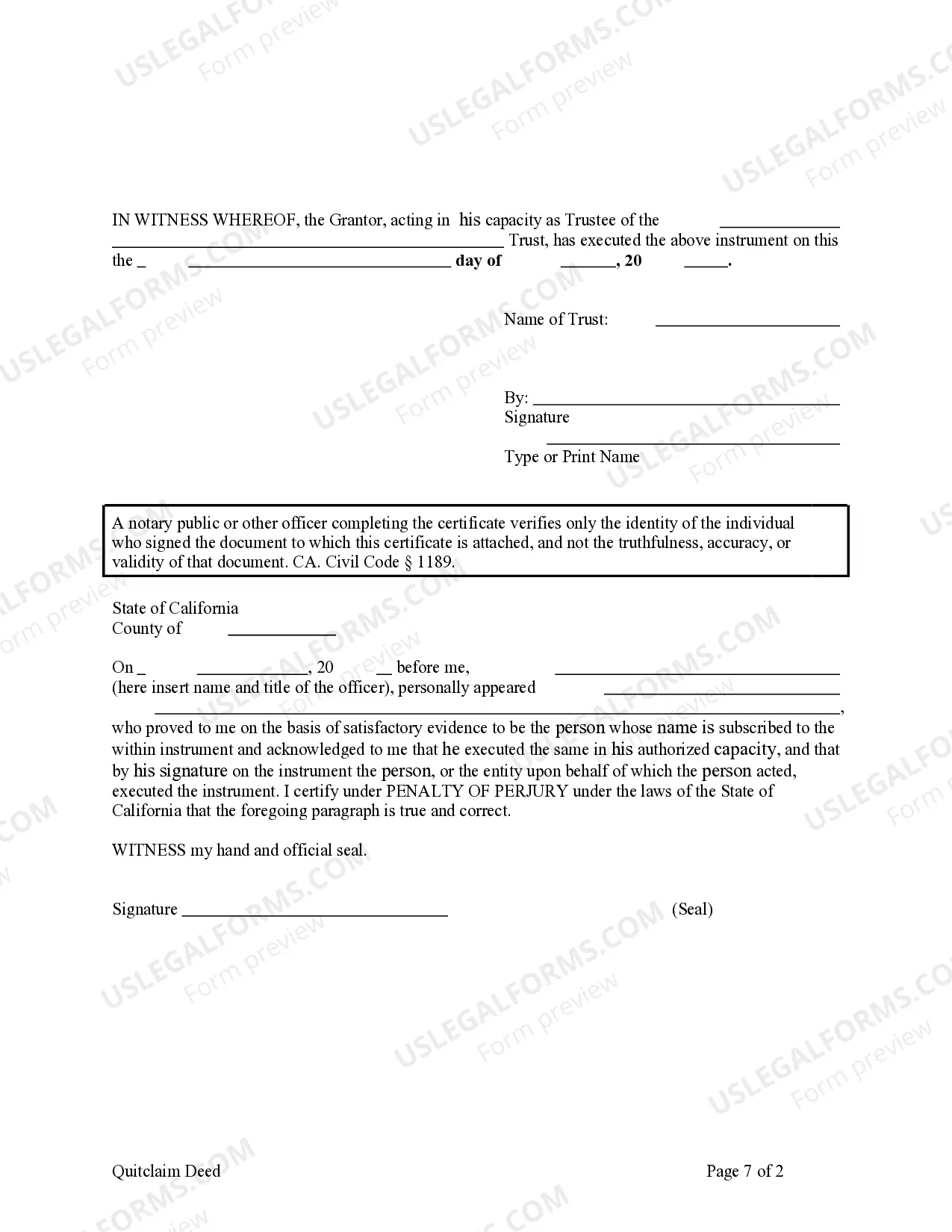

This form is a Quitclaim Deed where the grantor is a trust and the grantees are husband and wife. Grantor conveys and quitclaims the described property to grantees. Grantees take the property as community property with the right of survivorship, community property, joint tenants with the right of survivorship, or tenants in common. This deed complies with all state statutory laws.

California Quitclaim Deed - Trust to Husband and Wife

Description

How to fill out California Quitclaim Deed - Trust To Husband And Wife?

If you're looking for precise California Quitclaim Deed - Trust to Spouse examples, US Legal Forms is exactly what you require; access documents created and verified by state-certified attorneys.

Utilizing US Legal Forms not only spares you from hassles concerning legal documents; in addition, you save time, effort, and money! Downloading, printing, and completing a professional document is far more cost-effective than hiring an attorney to do it for you.

And that’s it. In just a few simple clicks, you have an editable California Quitclaim Deed - Trust to Spouse. After setting up your account, all future orders will be processed even more easily. When you possess a US Legal Forms subscription, simply Log In and click the Download button you see on the form's page. Then, whenever you need to access this blank again, you will always be able to find it in the My documents section. Don’t waste your time sifting through various forms on multiple websites. Acquire accurate documents from a single secure platform!

- Begin by completing your registration process by entering your email and creating a password.

- Follow the guidelines provided to establish an account and locate the California Quitclaim Deed - Trust to Spouse sample to address your needs.

- Utilize the Preview feature or examine the document details (if available) to ensure that the template is the one you need.

- Verify its legality in your state.

- Click on Buy Now to place your order.

- Choose a recommended pricing plan.

- Set up an account and pay using your credit card or PayPal.

Form popularity

FAQ

If your name is not on a deed in California, your rights to that property can still be significant, especially under community property laws. As a spouse, you may have rights to half of the property acquired during the marriage, even without being listed as an owner on the deed. This is why understanding the California Quitclaim Deed - Trust to Husband and Wife is crucial, as it can help clarify ownership and rights concerning property.

In California, when one spouse signs a quitclaim deed transferring property to the other spouse, it typically means that the transferring spouse relinquishes any claim to that property. However, this does not affect the spouse's marital rights to the property under California community property laws. Therefore, if you are considering the California Quitclaim Deed - Trust to Husband and Wife, understanding these nuances is important to protect both spouses' interests.

In divorce situations, a quitclaim deed is commonly utilized to transfer property interests between former spouses. This type of deed allows for a straightforward relinquishment of claims, facilitating the division of assets during legal proceedings. A California quitclaim deed can help clarify ownership rights for a husband and wife, ensuring that both parties understand their responsibilities and claims post-divorce. Consider consulting US Legal Forms for guidance on creating effective quitclaim deeds during this transition.

A quitclaim deed for a married couple allows one spouse to transfer their property interest to the other without any warranties. This method is often used to simplify ownership, especially when preparing a trust for estate planning. By using a California quitclaim deed, both partners can clarify their property rights and secure their intentions regarding asset distribution. This makes it easier to manage shared investments and properties.

For married couples, a joint tenancy deed is often the best choice, allowing both partners to share equal ownership. However, a California quitclaim deed can also serve effectively when one spouse wishes to transfer their interest to the other. This is particularly relevant in creating a trust between husband and wife, as it simplifies the transfer process and formalizes their shared intentions. Ultimately, the decision may depend on specific needs and circumstances.

A quitclaim deed is most often used to transfer property interests without any guarantees about the title's quality. It enables a person to relinquish any claim they have to a property, making it particularly useful for settling disputes or changing property ownership among family members. Using a California quitclaim deed allows a husband and wife to update ownership, especially when creating trusts or managing joint assets. It's a straightforward legal tool for property transactions.

A quitclaim deed primarily benefits individuals transferring property ownership without the need for extensive documentation. This type of deed is often used in situations involving family transfers, such as between spouses or parents to children, making it simple to transfer rights. In the context of California quitclaim deeds, both the trust and the husband and wife can enjoy smooth ownership transitions. Furthermore, it eliminates the need for complex legal procedures.

To record a deed of trust in California, you must first prepare the document, ensuring it complies with state requirements. Next, submit the deed to the county recorder's office where the property is located, along with any applicable fees. After recording, the deed becomes part of public records, providing protection for all parties involved. For detailed guidance, consider using US Legal Forms, where you can find templates and assistance.

A spouse might execute a quitclaim deed to formalize changes in property ownership, simplify the transfer during divorce, or clarify ownership for estate planning purposes. This deed can effectively seal the intention of one spouse to give up their claim on the property, which can be essential for financial decisions. Involving a California Quitclaim Deed - Trust to Husband and Wife can enhance the management of shared property, providing a clear path for both legal ownership and trust-related duties.

A quitclaim deed between husband and wife typically involves one spouse transferring their interest in a property to the other spouse. This can occur during divorce settlements, estate planning, or simply to clarify ownership. Utilizing a quitclaim deed, especially in the context of a California Quitclaim Deed - Trust to Husband and Wife, allows couples to efficiently manage property ownership and align it with their trust agreements. This can help avoid future disputes and clarify intentions.