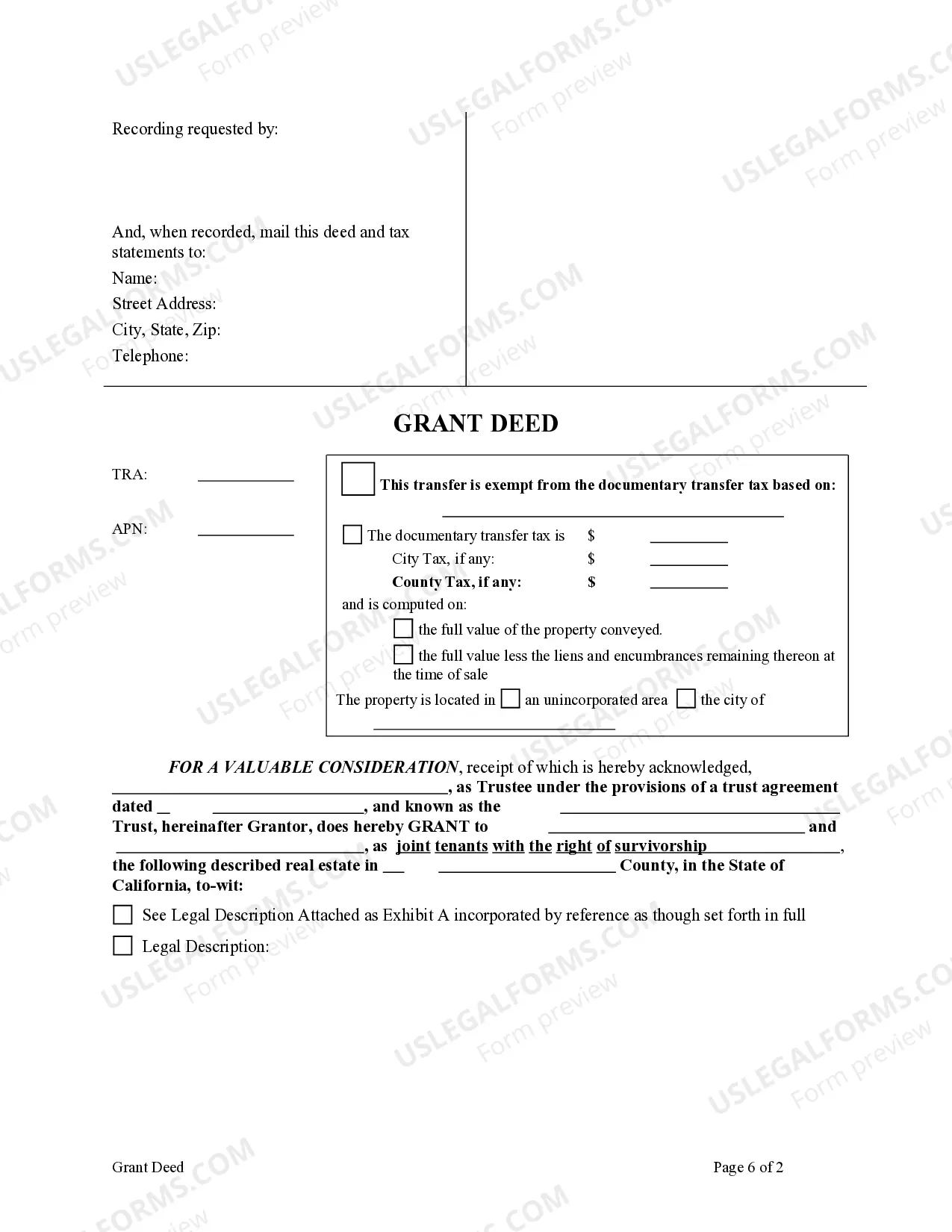

This form is a Grant Deed where the Grantor is a Trust and the Grantees are two individuals. This deed complies with all state statutory laws.

California Grant Deed from Trust to Two Individuals

Description Grant Deed Trust

How to fill out Deed Two Individuals?

If you're looking to obtain accurate California Grant Deed from Trust to Two Individuals examples, US Legal Forms is precisely what you require; locate documents created and verified by state-licensed attorneys.

Utilizing US Legal Forms not only prevents you from complications associated with legal documentation; you also save time, effort, and money! Downloading, printing, and filling out a professional form is much less expensive than hiring a lawyer to do it for you.

And that's it. In just a few simple clicks, you have an editable California Grant Deed from Trust to Two Individuals. Once you establish an account, all future orders will be processed even more effortlessly. When you have a US Legal Forms subscription, simply Log In to your account and click the Download button on the form’s page. Then, when you need to use this template again, you'll always be able to find it in the My documents section. Don't waste your time sifting through hundreds of forms on various websites. Purchase professional copies from a single reliable source!

- To begin, complete your registration process by entering your email and setting a password.

- Follow the steps below to create an account and access the California Grant Deed from Trust to Two Individuals template to address your concerns.

- Use the Preview feature or check the file description (if available) to confirm that the template is the one you require.

- Verify its validity in your residing state.

- Click Buy Now to place your order.

- Select a preferred pricing plan.

- Create an account and pay with your credit card or PayPal.

- Choose a suitable file format and save the document.

California Deed Two Form popularity

Grant Deed Two Other Form Names

Ca Deed Two FAQ

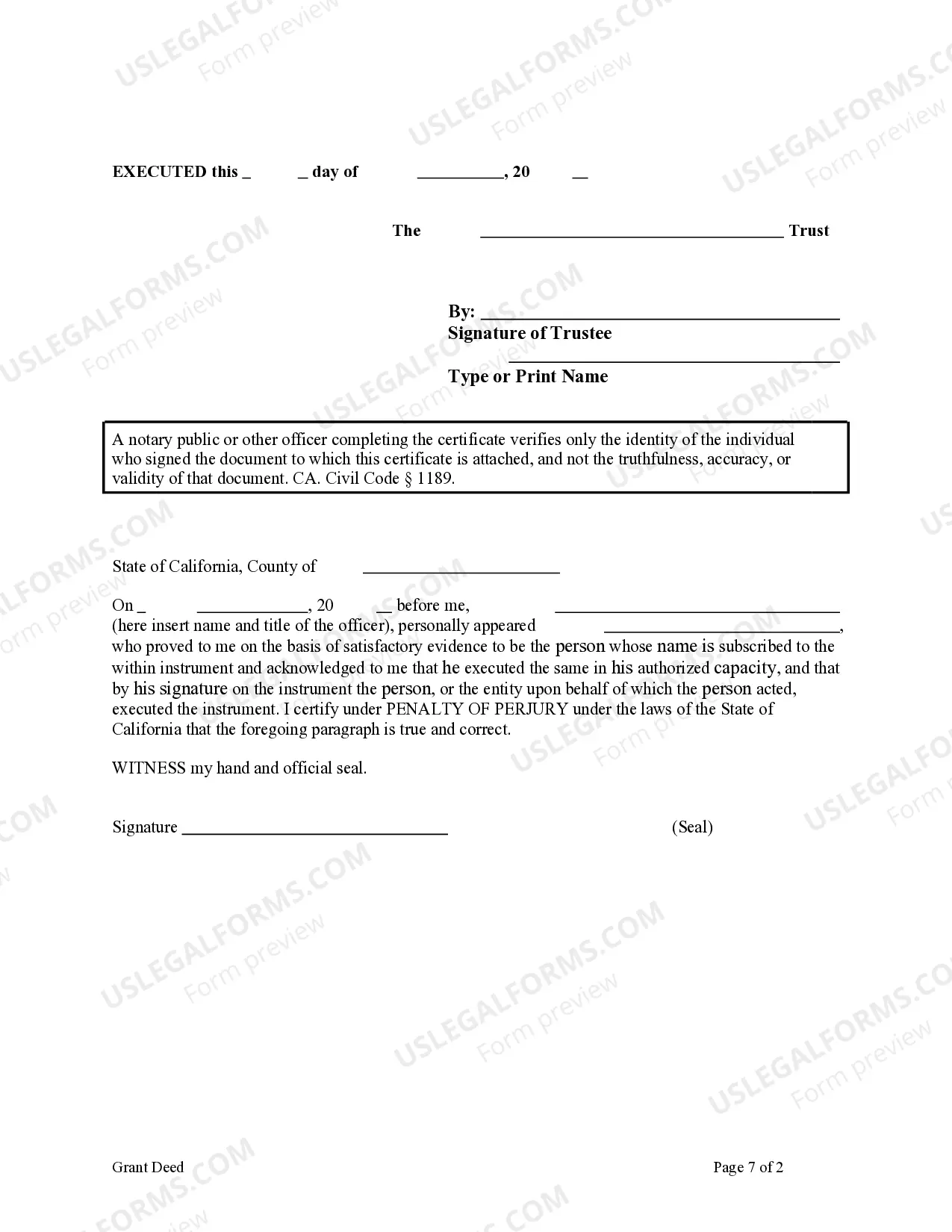

To add someone to a Grant Deed in California, you will need to complete a new Grant Deed that includes the new party as an owner. This document should be signed and notarized before being recorded with your county's recorder's office. If the property is part of a trust, ensure that the changes align with the trust's terms to maintain integrity in the property ownership. Using a platform like uslegalforms can simplify this process and provide the necessary legal forms.

In California, a trustee generally cannot sell trust property to himself without explicit permission from the beneficiaries. This rule helps prevent conflicts of interest and ensures property transactions remain transparent. If you find yourself in this situation, seek legal advice to maintain compliance with state laws and protect everyone's interests involved in a California Grant Deed from Trust to Two Individuals.

Transferring assets from an irrevocable trust is complex and typically not allowed without the beneficiaries' consent or a court order. However, if there is a strong reason for the transfer, such as altering the trust for the beneficiaries' best interests, legal avenues may exist. Consulting with an estate planning attorney can help navigate the rules and determine the best course of action based on your specific situation.

In California, the trustee holds legal title to the property within the trust, while the beneficiaries own the beneficial interest. This means that beneficiaries have the rights to enjoy the property, receive income generated from it, or ultimately inherit it. Understanding this distinction is vital when discussing a California Grant Deed from Trust to Two Individuals, as it outlines the ownership structure clearly.

When transferring property through a California Grant Deed from Trust to Two Individuals, the transfer can often avoid property tax reassessment. This occurs if the property remains within the family and qualifies under specific exemptions. It is crucial to ensure you follow the right procedures and file the necessary forms with your local assessor's office. Consulting with a legal professional can further clarify your options.

While it's not legally required to hire a lawyer to add someone to a deed, it's often a good idea. Legal expertise can help you navigate the specifics of creating a California Grant Deed from Trust to Two Individuals and ensure that all documents are correctly prepared and filed. Additionally, a lawyer can provide valuable advice on the potential legal and financial implications of your decision.

Adding a name to a grant deed in California is a straightforward process. Start by preparing a new deed that specifies the original owner and the individual you wish to add. This document, known as a California Grant Deed from Trust to Two Individuals, will need to be signed and notarized before recording it with the county to make the change official.

To add someone to a grant deed in California, you must create a new grant deed that includes both names. This may involve preparing a California Grant Deed from Trust to Two Individuals that lists the current owner and the individual being added. Be sure to have the deed notarized and then filed at your local county recorder's office to ensure legal recognition.

Adding someone to a deed in California can have significant tax implications, such as potential transfer taxes or changes in property tax assessments. When you create a California Grant Deed from Trust to Two Individuals, the county may reassess the property based on its current value, and this could lead to higher property taxes. It’s wise to consult a tax professional to understand how these changes could affect you.

To transfer property from a trust to an individual in California, you generally need to create a California Grant Deed from Trust to Two Individuals. This process involves drafting a deed that specifies the trust as the grantor and the individuals receiving the property as grantees. You'll then need to sign the deed in front of a notary and record it with the county recorder's office to make it official.