This Warranty Deed from Individual to LLC form is a Warranty Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and warrants the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

California Grant Deed from Individual to LLC

Description California Llc Application

How to fill out Grant Deed Template?

If you are seeking precise California Grant Deed from Individual to LLC web templates, US Legal Forms is precisely what you require; access documents supplied and verified by state-licensed attorneys.

Utilizing US Legal Forms not only saves you from concerns regarding legal documents; you also conserve time, effort, and money! Downloading, printing, and filling out a professional form is significantly less expensive than hiring a lawyer to prepare it for you.

And that's it. With a few simple clicks, you possess an editable California Grant Deed from Individual to LLC. After creating your account, all subsequent purchases will be processed even more effortlessly. When you have a US Legal Forms subscription, simply Log In to your account and click the Download button available on the form's page. Then, when you need to use this template again, you'll always find it in the My documents menu. Don't waste your time and energy sifting through hundreds of forms across various web sources. Purchase professional copies from a single trusted platform!

- To begin, complete your registration process by entering your email and creating a secure password.

- Follow the instructions below to set up your account and obtain the California Grant Deed from Individual to LLC template to address your needs.

- Use the Preview option or review the document details (if available) to ensure the template is what you want.

- Verify its validity in your residing state.

- Click Buy Now to place an order.

- Select a suggested pricing plan.

- Create an account and pay using your credit card or PayPal.

Limited Company Form popularity

Ca Llc Form Other Form Names

Limited Liability Company Form Statement FAQ

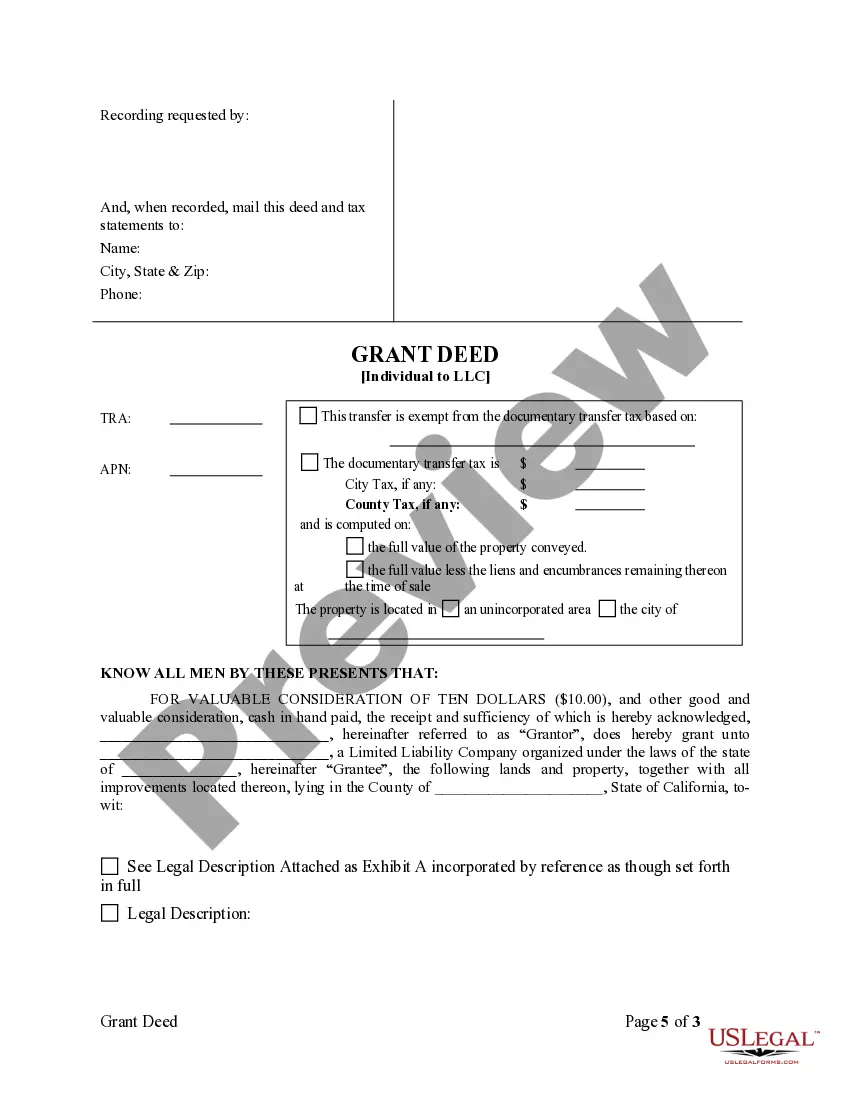

To transfer a grant deed in California, begin by preparing the deed with the proper language and details about the property and the new owner. The California Grant Deed from Individual to LLC must be signed and notarized. Finally, submit it to the county recorder’s office to complete the transfer process.

Yes, you can transfer personal assets to an LLC, such as real estate or personal property. It's important to create the necessary legal documents, including a California Grant Deed from Individual to LLC, to properly execute the transfer. Make sure to consult with a professional to ensure compliance with applicable laws.

People often put their property in an LLC to protect their assets from personal liability, facilitate estate planning, and enhance privacy. By doing so, they can separate business and personal assets, curbing risks associated with property ownership. This strategic move can also offer tax benefits, making it appealing for many.

Transferring ownership of a property to an LLC starts with drafting a California Grant Deed from Individual to LLC. Be sure to include accurate property details and signatures from all involved parties. After notarizing, the deed should be filed with the county recorder to officially change ownership.

To transfer a deed from an individual to an LLC, complete a California Grant Deed from Individual to LLC. This deed needs to detail the property and the new owner, which is the LLC. Once signed and notarized, file the grant deed with your local county recorder to finalize the transfer.

To transfer personal assets to an LLC, you should first determine the assets you want to transfer, which may include property or equipment. After this, prepare the appropriate documents, including a California Grant Deed from Individual to LLC for any real estate. Proper documentation safeguards your ownership rights and the LLC’s legal standing.

Yes, you can transfer personal funds to your LLC. Typically, this is done through a capital contribution, which you should document for proper accounting. Keep in mind that maintaining clear records helps separate personal and business finances, ensuring your LLC's liability protection remains intact.

Putting personal assets in an LLC involves two main steps: identifying the assets and preparing the necessary documentation. You should create an operating agreement that outlines the transfer process and complete the California Grant Deed from Individual to LLC for any real estate. This process formalizes ownership and provides legal protection.

To transfer your property to an LLC in California, you need to prepare a California Grant Deed from Individual to LLC. This deed serves as the official document for the ownership transfer. After filling out the deed, you must sign it in front of a notary public and then file it with the county recorder's office.

To transfer a Grant Deed in California, you must first complete the required documents, including the Grant Deed form. Next, ensure that the deed accurately reflects the transfer from an individual to an LLC. After signing the deed, file it with the county recorder's office where the property is located. For a smooth process, consider using US Legal Forms to access professionally drafted templates and additional guidance on completing a California Grant Deed from Individual to LLC.