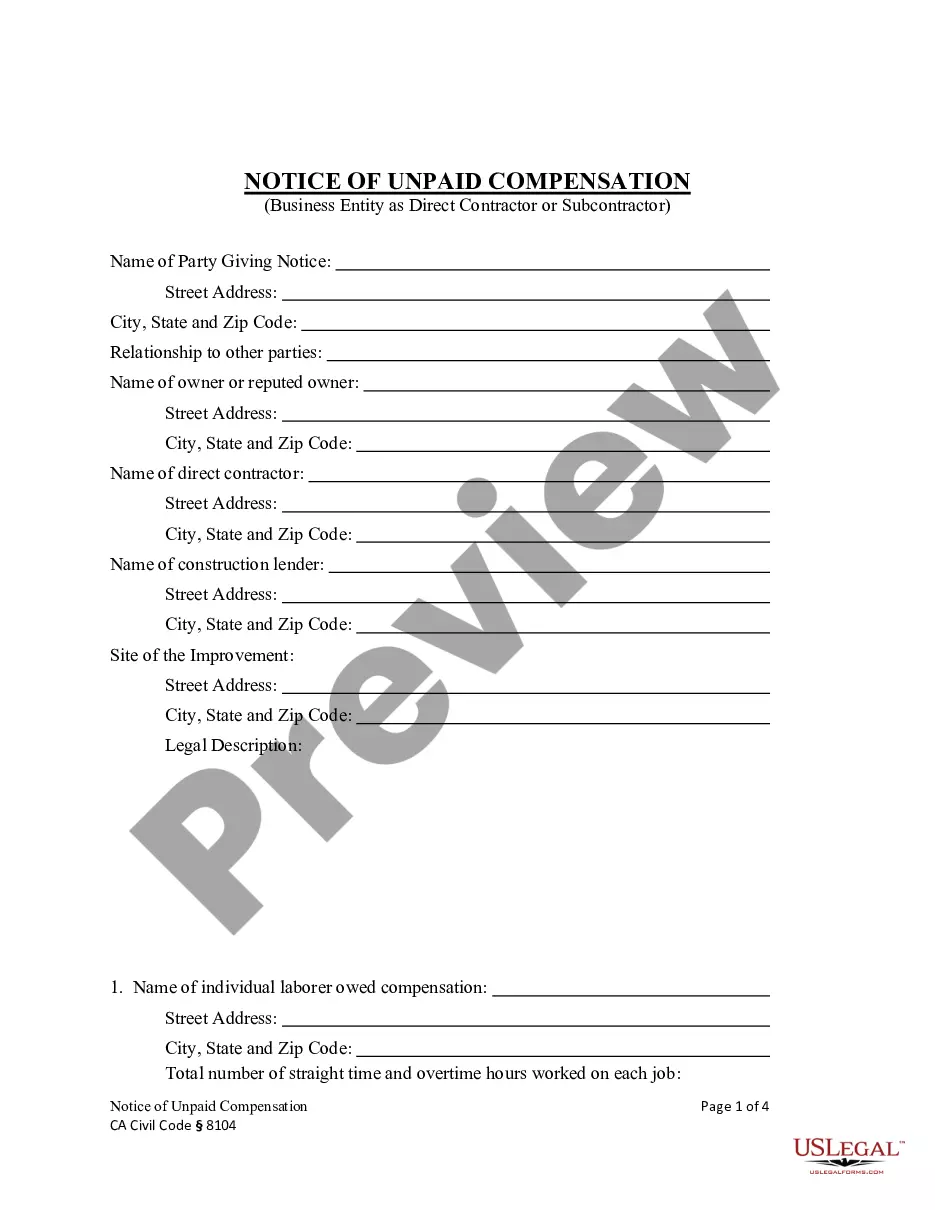

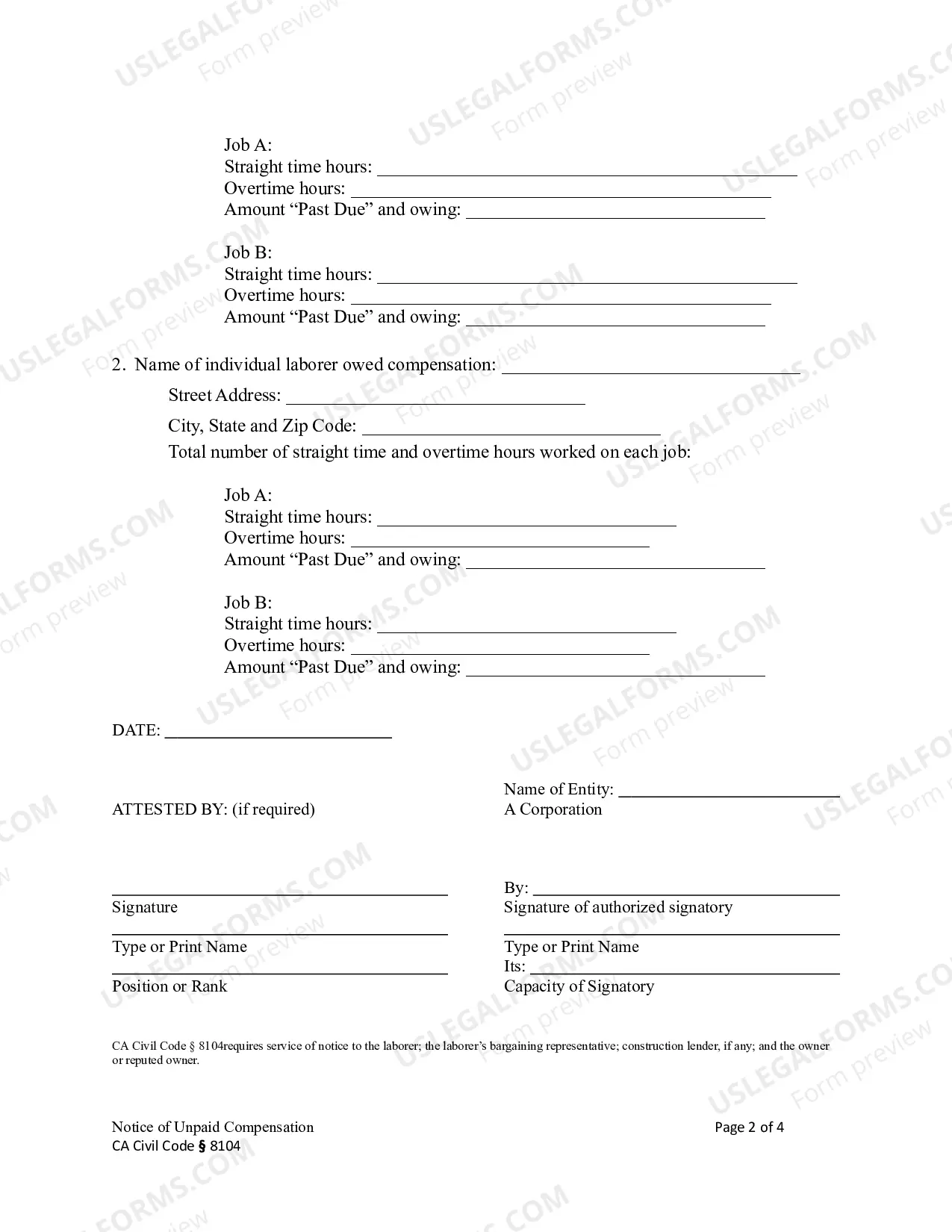

This form is used by the direct contractor or the subcontractor to give notice that a laborer employed on the project has not been paid. Notice must be given to the laborer; the laborer's bargaining representative, if any; the construction lender; and, the owner. Formatted for signature by a limited liability company or corporation.

California Notice of Unpaid Compensation - Construction Liens - Civil Code Section 8104 - Business Entity

Description California Business Entity

How to fill out Ca Compensation Entity Code?

If you're searching for exact California Notice of Unpaid Compensation - Construction Liens - Business Entity - Corporation or LLC - Civil Code Section 8104 duplicates, US Legal Forms is exactly what you require; discover documents crafted and validated by state-approved legal experts.

Utilizing US Legal Forms not only alleviates you from concerns about legal documents; furthermore, you conserve effort, time, and money! Acquiring, printing, and submitting a professional document is considerably more cost-effective than hiring an attorney to accomplish it for you.

And that’s all. With a few simple clicks, you possess an editable California Notice of Unpaid Compensation - Construction Liens - Business Entity - Corporation or LLC - Civil Code Section 8104. Once your account is created, all subsequent requests will be handled even more easily. If you have a US Legal Forms subscription, just Log In to your profile and select the Download option displayed on the form’s webpage. Then, when you need to use this template again, you'll always be able to find it in the My documents section. Don’t waste your time and effort sifting through countless forms on various websites. Obtain accurate documents from a single trusted source!

- Begin by completing your registration process by entering your email address and creating a secure password.

- Follow the directions provided below to establish your account and locate the California Notice of Unpaid Compensation - Construction Liens - Business Entity - Corporation or LLC - Civil Code Section 8104 template to resolve your issues.

- Employ the Preview option or review the file description (if available) to ensure that the template is the one you require.

- Verify its validity in the state where you reside.

- Click on Buy Now to place an order.

- Select a preferred pricing plan.

- Set up an account and pay using your credit card or PayPal.

- Choose an appropriate file format and save the document.

Ca Llc Form Form popularity

Business Llc Form Application Other Form Names

California Notice Compensation FAQ

Section 2850 of the California Civil Code discusses the establishment and enforcement of mechanics' liens. This section is vital for those in construction and contracting, as it allows workers to reclaim payment through lien actions when they do not receive compensation for their services. Utilizing the California Notice of Unpaid Compensation - Construction Liens - Civil Code Section 8104 - Business Entity can help clarify your options and streamline the process of claiming what you are owed.

Section 1541 pertains to the obligations of parties involved in contractual agreements, particularly focusing on the enforcement of duties and compensation. This section helps clarify what happens when one party fails to meet their obligations. If unpaid compensation arises, understanding this section alongside the California Notice of Unpaid Compensation - Construction Liens - Civil Code Section 8104 - Business Entity can empower you to take appropriate action to secure your rights.

Section 1170 of the California Civil Code outlines specific provisions regarding the establishment of liens and their enforcement. This section is significant as it clarifies the rights of parties involved in unpaid compensation situations, allowing them to pursue claims effectively. If you're facing issues with unpaid compensation, the California Notice of Unpaid Compensation - Construction Liens - Civil Code Section 8104 - Business Entity will provide you guidance in navigating these scenarios.

In California, the civil code that governs liens is found in Civil Code Section 8100 and its subsequent sections. This section specifically addresses the conditions and procedures related to construction liens, including the California Notice of Unpaid Compensation - Construction Liens - Civil Code Section 8104 - Business Entity. Understanding this code is crucial for anyone involved in construction projects to protect their rights and ensure they can claim unpaid compensation.

The purpose of a preliminary notice is to inform property owners and relevant parties about the potential for a lien under the California Notice of Unpaid Compensation - Construction Liens - Civil Code Section 8104 - Business Entity. This notice serves to establish your right to payment and alert others that you are providing services or materials that may lead to a lien. By issuing a preliminary notice, you not only protect your interests but also promote transparency in the payment process.

Yes, a handyman can file a lien in California under the California Notice of Unpaid Compensation - Construction Liens - Civil Code Section 8104 - Business Entity. As a service provider, if payment is not received for your work, you have the right to claim a lien on the property. It is important to follow the proper procedures, including giving preliminary notice to the property owner. This step protects your rights and enhances your chances of receiving payment.

To place a lien on a business in California, you must file a claim under the California Notice of Unpaid Compensation - Construction Liens - Civil Code Section 8104 - Business Entity. This process involves preparing a formal notice and submitting it to the appropriate county recorder's office. Ensure you meet all required filing deadlines and include accurate details about the unpaid compensation. If managed correctly, a lien can help secure your payment.

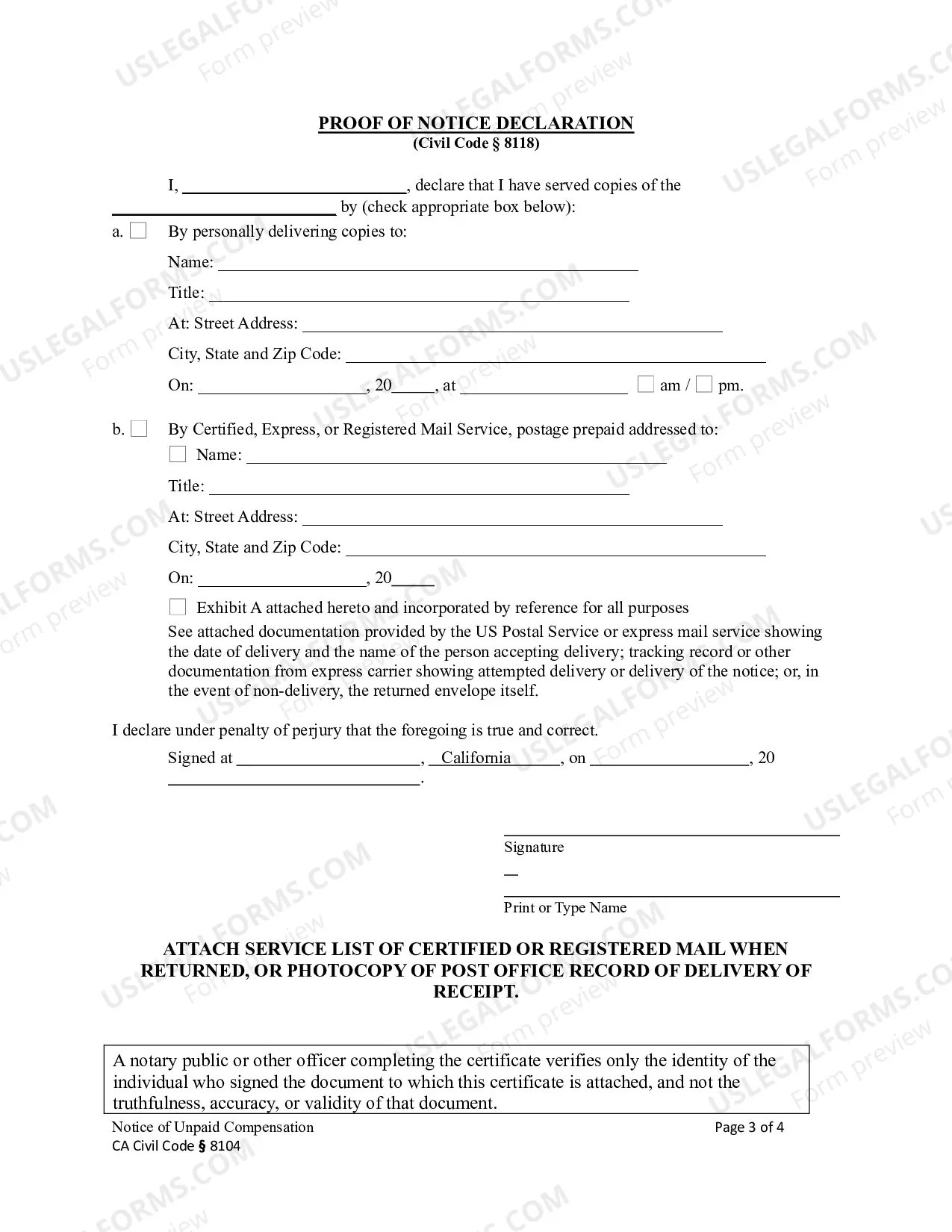

Filing a preliminary lien notice in California involves a few straightforward steps. First, prepare the notice by including details such as the project address, property owner's name, and the amount owed for services rendered. You must then send this notice to the property owner and ensure it is filed with the appropriate county recorder's office. Using resources like uslegalforms can simplify this process and guide you through California Notice of Unpaid Compensation - Construction Liens - Civil Code Section 8104 - Business Entity requirements.

In California, a Notice of Intent to Lien is not mandatory; however, it is highly recommended. This document serves as an initial step in the lien process, allowing parties to resolve disputes before formal action. By issuing this notice, you provide an opportunity to communicate with property owners regarding unpaid compensation. Effectively, it may help you align with California Notice of Unpaid Compensation - Construction Liens - Civil Code Section 8104 - Business Entity regulations and avoid complicated legal situations.

The primary civil code governing liens in California is Civil Code Section 8104. This section outlines the requirements and processes related to construction liens, including the California Notice of Unpaid Compensation. Understanding this code is crucial for business entities in the construction industry because it protects your rights and ensures you can claim payment for services rendered. You can find additional resources on US Legal Forms to help you navigate this legal framework effectively.