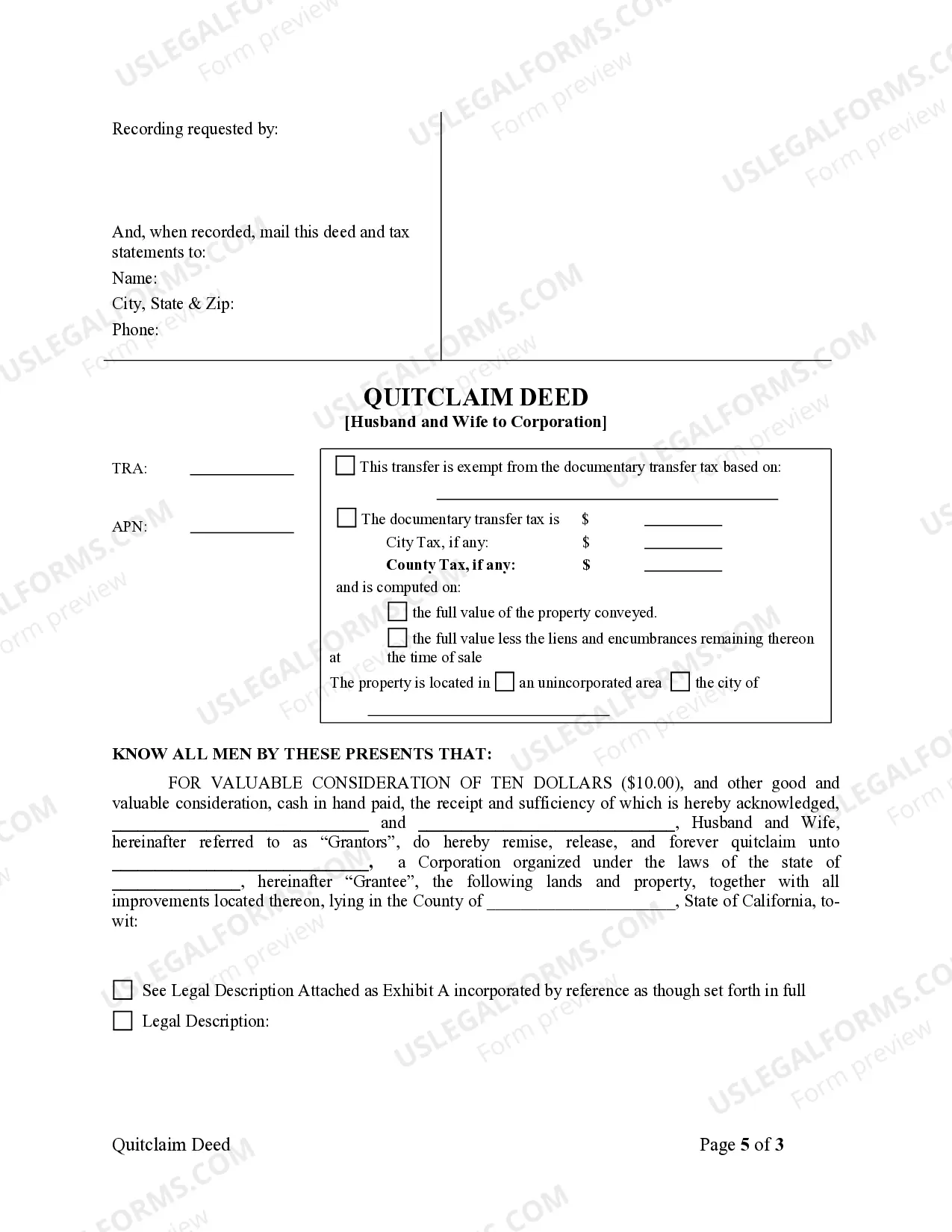

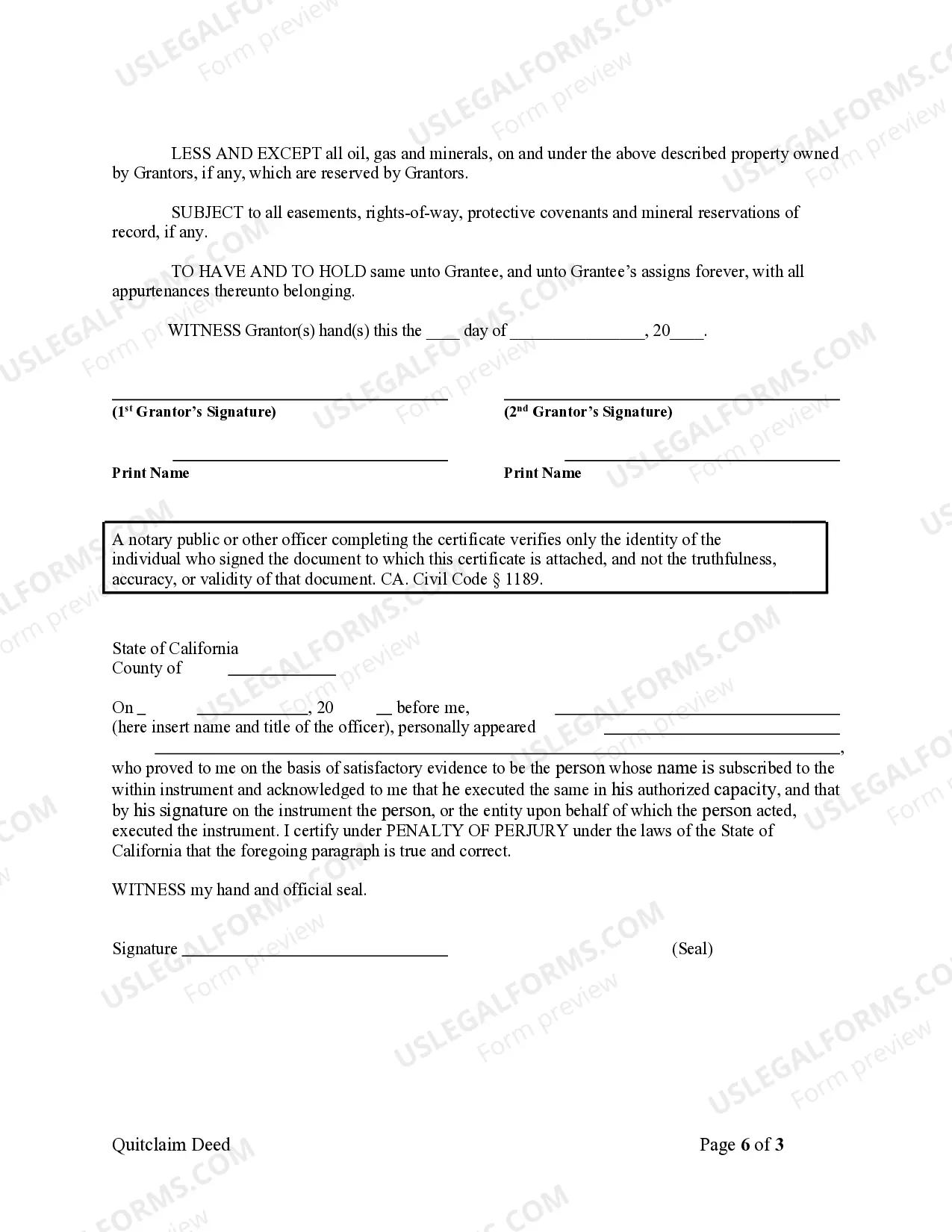

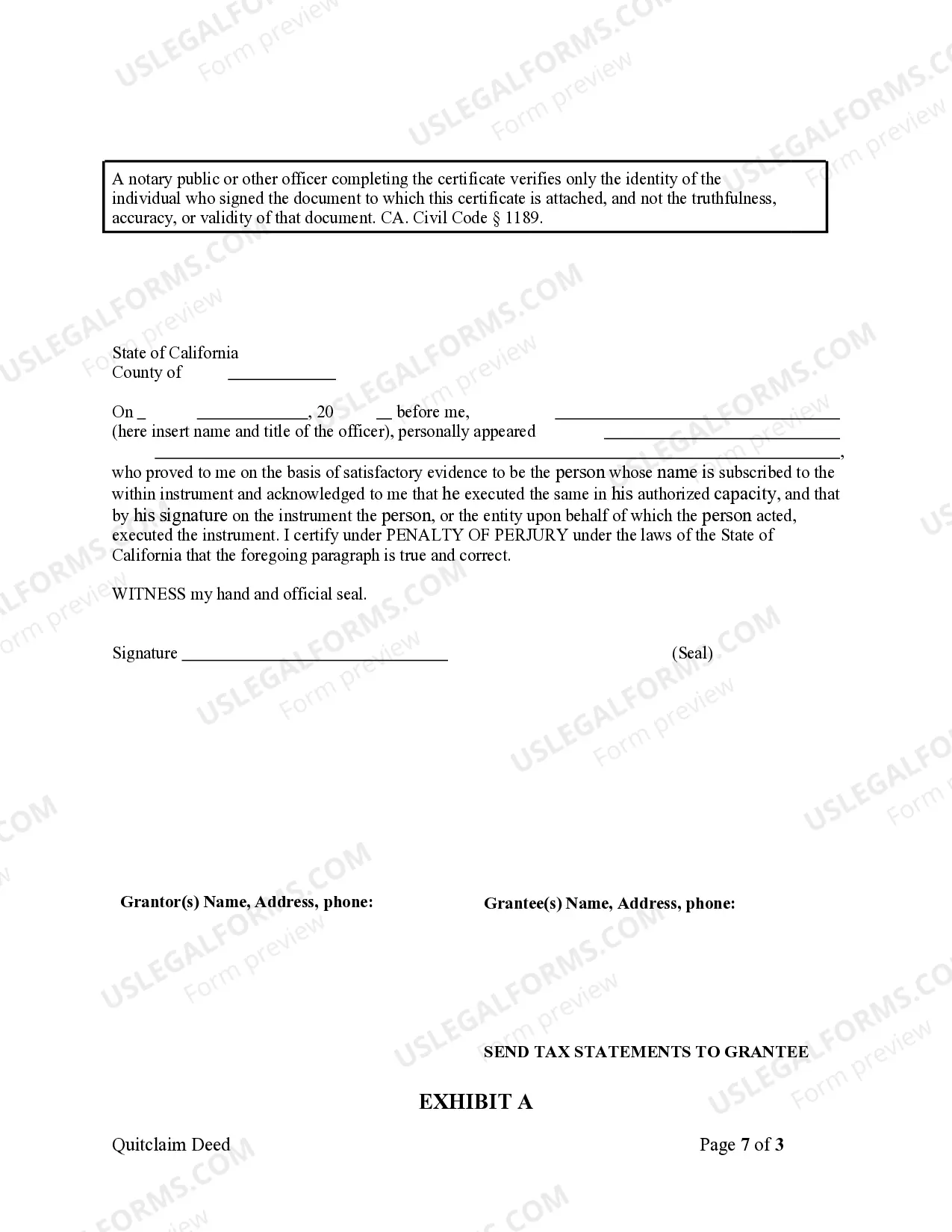

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

California Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out California Quitclaim Deed From Husband And Wife To Corporation?

If you're searching for precise California Quitclaim Deed from Spouse to Corporation web forms, US Legal Forms is precisely what you require; obtain documents created and verified by state-certified legal professionals.

Utilizing US Legal Forms not only spares you from troubles related to legal documents; additionally, you save time and resources, and funds!

And that's it. In just a few easy steps, you have an editable California Quitclaim Deed from Spouse to Corporation. After creating your account, all subsequent orders will be processed even more conveniently. Once you have a US Legal Forms subscription, just Log In to your account and then click the Download option you see on the form’s page. Then, when you need to use this document again, you'll always be able to find it in the My documents menu. Don't waste your time comparing numerous forms on different websites. Purchase precise templates from one secure platform!

- To begin, complete your registration by providing your email and creating a password.

- Follow the instructions below to set up your account and locate the California Quitclaim Deed from Spouse to Corporation template to address your concerns.

- Utilize the Preview tool or review the document details (if available) to ensure that the form is the one you need.

- Verify its relevance in your area.

- Click Buy Now to place your order.

- Choose a suitable pricing plan.

- Create your account and pay using your credit card or PayPal.

- Select a convenient format and save the document.

Form popularity

FAQ

Filling out an interspousal transfer deed requires clarity and specific information to ensure a valid transfer. You should start by listing both spouses’ names, then detail the property being transferred, along with its legal description. It’s important to declare that the transfer is between spouses, which is a requirement in California. Using resources like USLegalForms can simplify the process, guiding you through the necessary declarations and legal criteria.

The primary difference between a quitclaim deed and an interspousal transfer lies in their intent and use. A quitclaim deed simply transfers whatever interest one spouse has in a property to the other, without guaranteeing the property's title. On the other hand, an interspousal transfer is specifically designed for transfers between spouses and often has additional protections under California law. Understanding these distinctions can help you choose the right tool for a California Quitclaim Deed from Husband and Wife to Corporation.

Filling out a deed involves several key steps to ensure its accuracy and legality. First, clearly identify the parties involved, including the grantor and grantee. Next, include a complete legal description of the property in question. For a California Quitclaim Deed from Husband and Wife to Corporation, you must also ensure that the corporation is properly named and that you follow the guidelines required by California law, which can be conveniently navigated using platforms like USLegalForms.

A quit claim deed for a married couple is a legal document that allows one spouse to transfer their interest in a property to the other spouse, or to an entity, such as a corporation. This type of deed is often used when a couple decides to change the ownership structure of their property. In the context of a California Quitclaim Deed from Husband and Wife to Corporation, this allows for a straightforward transfer of assets into a corporate ownership framework. It is essential to understand its implications for tax and property rights.

A quitclaim deed between husband and wife, such as a California Quitclaim Deed from Husband and Wife to Corporation, allows one spouse to transfer their interest in jointly owned property to the other spouse or to a third party. This legal document does not guarantee that the title is clear of defects, but it simplifies property ownership changes without the need for extensive legal procedures. It is often used to ensure smoother transitions in property ownership during life changes or after marriage dissolution.

A quitclaim deed, especially a California Quitclaim Deed from Husband and Wife to Corporation, may not be appropriate in situations involving contested ownership or property that has mortgage liens. It cannot be used to clear title disputes or transfer property that requires warranties of title. Additionally, if there are financial obligations tied to the property that need to be resolved, using a quitclaim deed might complicate the matter further.

Yes, a quitclaim deed does transfer ownership but only to the extent of the grantor's interest. If a husband and wife execute a California quitclaim deed transferring property to a corporation, the corporation gains ownership rights. However, if the grantor does not own the property, the deed does not confer any real rights.

In California, the individuals transferring their interest in the property must sign the quitclaim deed. Typically, this includes both spouses if they are jointly transferring ownership to a corporation. It's also important to ensure that the corporation's authorized representative signs to acknowledge receipt of the property.

Anyone can prepare a quitclaim deed in California, but it’s advisable to seek assistance from professionals. Many people choose to hire attorneys or legal document services, like USLegalForms, to ensure accuracy and compliance with state laws. This way, you avoid potential issues that could arise from improperly drafted documents.

In California, when a spouse signs a quitclaim deed transferring property to a corporation, they generally relinquish their ownership rights. This act means they no longer hold claim to the property, and it is now under the corporation's ownership. However, it's essential to consult with a legal professional to understand specific implications and rights that may still exist.