This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

California Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out California Quitclaim Deed From Husband And Wife To LLC?

If you are searching for accurate California Quitclaim Deed templates from Spouses to LLC, US Legal Forms is precisely what you require; find documents created and verified by state-certified attorneys.

Utilizing US Legal Forms not only alleviates concerns about legal documentation; additionally, you conserve time, energy, and money!

And that’s it! With a few straightforward steps, you have an editable California Quitclaim Deed from Spouses to LLC. After setting up an account, all future orders will be processed even more smoothly. With a US Legal Forms subscription, just Log In and click the Download button visible on the form's webpage. Then, when you need to use this template again, you will always find it in the My documents menu. Don't waste your time and effort sifting through various forms on different websites. Purchase professional versions from a single secure platform!

- Downloading, printing, and completing a professional template is significantly cheaper than hiring a lawyer to handle it for you.

- To initiate, finish your registration process by providing your email and establishing a password.

- Follow the instructions outlined below to set up an account and obtain the California Quitclaim Deed from Spouses to LLC template to manage your situation.

- Use the Preview feature or review the document details (if available) to confirm that the template is what you need.

- Verify its validity in your state.

- Click Buy Now to place an order.

- Choose a preferred pricing plan.

- Create an account and pay using your credit card or PayPal.

Form popularity

FAQ

In California, anyone can prepare a quitclaim deed, but it is often advisable to seek assistance from a legal professional. A knowledgeable attorney can ensure that your California Quitclaim Deed from Husband and Wife to LLC complies with state requirements and correctly reflects your intentions. Alternatively, you can use online legal services like uslegalforms to guide you through the process efficiently.

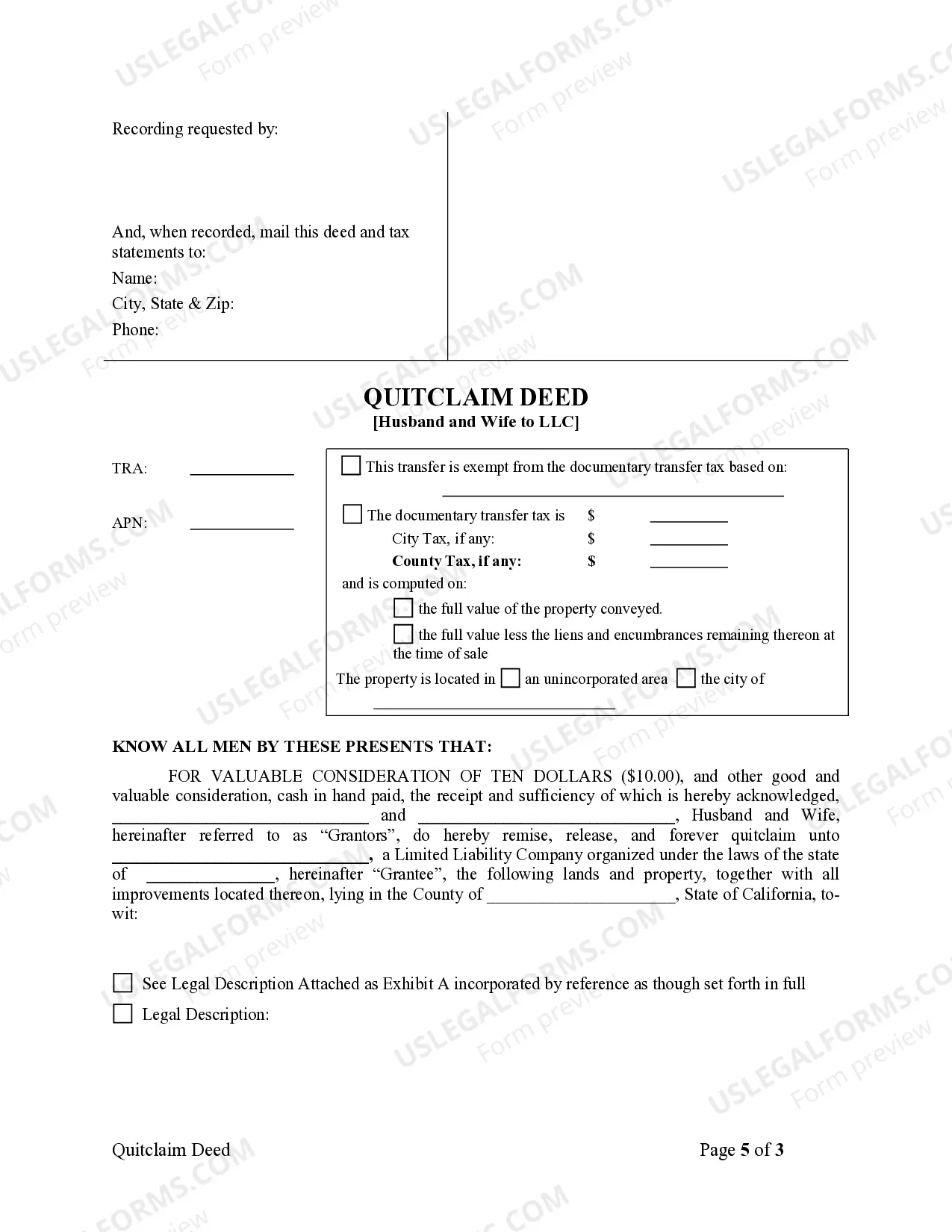

To transfer property to an LLC in California, you need to execute a California Quitclaim Deed from Husband and Wife to LLC. Start by completing the quitclaim deed form, ensuring all relevant parties are listed correctly. After filling it out, you must sign the document in front of a notary public. Finally, file the signed deed with the county recorder's office to make the transfer official.

In California, anyone can prepare a quitclaim deed, provided they understand the legal requirements and implications. While it's possible for individuals to draft their own documents, seeking assistance from a legal professional or a trusted platform like US Legal Forms can ensure accuracy and compliance. Utilizing a California Quitclaim Deed from Husband and Wife to LLC through expert guidance can facilitate a smoother transaction and avoid potential legal issues.

People often place their property in an LLC to protect their personal assets from liability. This process can provide additional legal protection and simplify property management. Moreover, using a California Quitclaim Deed from Husband and Wife to LLC can facilitate the transfer of property ownership while offering potential tax benefits. Additionally, many find that LLCs can enhance credibility and attract investors.

Yes, you can execute a California Quitclaim Deed from Husband and Wife to an LLC. This process transfers property ownership from you and your spouse directly to your limited liability company. It is essential to ensure that the deed is properly recorded with the county recorder's office to maintain clear property records. Using a reliable platform like USLegalForms can help you prepare the necessary documents with ease.

To quitclaim a deed to an LLC, both spouses must execute a quitclaim deed that identifies the property being transferred. This deed should clearly name the LLC as the new owner and be signed in front of a notary. After completion, you must file the new deed with the local county recorder's office to ensure the change is legally recognized. Using the California Quitclaim Deed from Husband and Wife to LLC streamlines this process and enhances clarity in property ownership.

In California, once a spouse signs a quitclaim deed, they generally relinquish their interest in the specified property. This means that the other spouse may retain full ownership and control over the property. However, it is important to understand that both spouses should agree on this action, as it can impact rights in community property. Having a clear understanding through the California Quitclaim Deed from Husband and Wife to LLC can help both parties navigate their ownership rights.

A quitclaim deed for a married couple allows both partners to transfer their interest in a property to another party, such as an LLC. This process can simplify ownership in cases like business incorporation or estate planning. With the California Quitclaim Deed from Husband and Wife to LLC, both spouses can effectively relinquish their rights jointly. The document eliminates any claim to the property and can provide a clear title for the new owner.