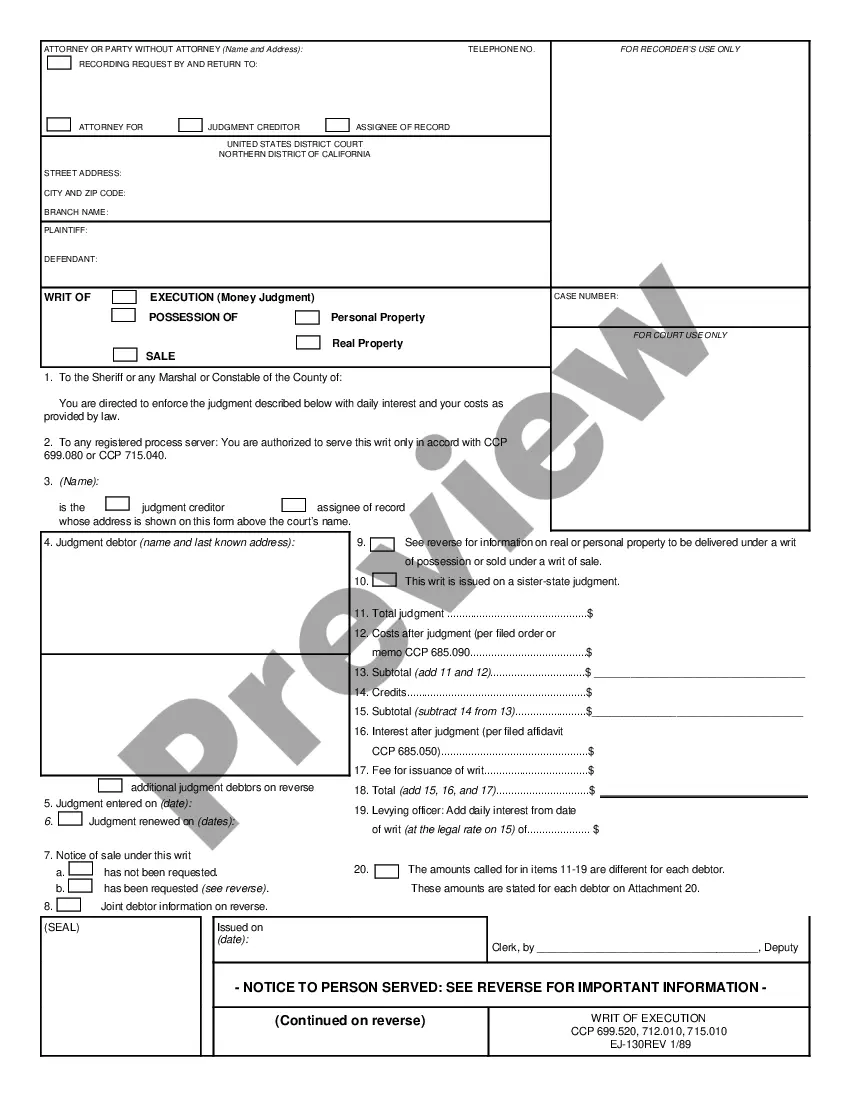

Writ of Execution: This is an official Federal form that complies with all applicable Federal codes and statutes. USLF amends and updates all Federal forms as is required by law.

California Writ of Execution

Description

How to fill out California Writ Of Execution?

If you are looking for precise California Writ of Execution examples, US Legal Forms is precisely what you require; access documents created and validated by state-certified legal experts.

Utilizing US Legal Forms not only protects you from issues related to legal documents; it also conserves your time, effort, and money!

And there you have it! In just a few easy steps, you have an editable California Writ of Execution. Once you create an account, all subsequent transactions will be processed even more effortlessly. With a US Legal Forms subscription, simply Log In to your profile and click the Download button you see on the form's page. Then, whenever you need to use this document again, you will always be able to locate it in the My documents section. Don't waste your time sifting through countless documents across various websites. Acquire accurate forms from a single secure platform!

- Initiate by finalizing your registration process by entering your email and creating a password.

- Follow the steps below to establish an account and obtain the California Writ of Execution template to address your needs.

- Utilize the Preview feature or review the document description (if available) to confirm that the template is suitable for you.

- Verify its validity in your state.

- Click Buy Now to place your order.

- Select a recommended pricing plan.

- Create an account and pay using your credit card or PayPal.

- Select a convenient format and save the document.

Form popularity

FAQ

To complete a California Writ of Execution, you must first obtain a judgment from the court proving the debt. Next, you can fill out the appropriate forms, including the writ itself, and submit them to the court clerk. Using platforms like US Legal Forms can streamline this process, providing you with guided assistance and accurate documentation to ensure compliance with legal protocols.

A California Writ of Execution generally remains valid for a specific period, typically five years from the date of issuance. However, this duration can vary based on circumstances and the type of debt involved. It’s important to act within this timeframe to ensure enforceability, allowing creditors to secure their claims efficiently.

The purpose of a California Writ of Execution is to facilitate the collection of a debt after a legal judgment. It provides a framework for creditors to reclaim amounts awarded by the court. By using this writ, creditors can legally access the debtor's assets to fulfill the financial obligation.

If you ignore a California Writ of Execution, the creditor may take further action to collect the debt. This could include seizing your bank accounts, garnishing your wages, or taking possession of your property. Not responding could also lead to additional legal consequences, so it’s crucial to address the writ promptly.

A California Writ of Execution is a legal document that allows a creditor to enforce a judgment after a court has ruled in their favor. In simple terms, it grants permission to seize the debtor's property or assets to satisfy the amount owed. It is an essential tool for creditors seeking payment, ensuring that the legal rulings are effectively acted upon.

After a California writ of garnishment is served, the garnishee, or the entity holding the debtor's funds, must freeze the specified amount and notify the debtor. This action ensures that the creditor can collect the owed amount once the legal process confirms the debt. The debtor might have an opportunity to dispute the garnishment and protect their rights. For assistance with these legal matters, you might consider using US Legal Forms for comprehensive documents and guidance.

Yes, a writ of possession can be reversed under certain circumstances. If a debtor successfully proves that the writ was improperly issued, or if they can show that they have resolved the underlying debt, the court may vacate the writ. This process allows debtors to regain their property and rectify the situation. Consulting with legal professionals can help navigate this challenging process.

A writ of execution in California allows creditors to seize specific property to satisfy a debt, while a writ of garnishment restricts access to funds or property that the debtor holds with a third party, such as a bank. In essence, a writ of execution targets tangible assets, whereas garnishment focuses on liquid assets or income. Understanding the distinction can help creditors choose the most effective method for debt collection.

A creditor may seek a California writ of execution once they have obtained a judgment against the debtor in court. Typically, this occurs after the creditor has exhausted other collection methods, such as negotiations or payment plans. The writ can then be issued to facilitate the collection process. It is important for the creditor to ensure they comply with all legal requirements during this process.

To obtain a writ of execution in California, you must first secure a final judgment in your favor. Once you have your judgment, complete the relevant forms to file a request with the court. The court will review your request and may issue the California Writ of Execution if all criteria are met. For assistance with this process, US Legal Forms provides resources to help you navigate your filing.