This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64

Description

How to fill out California Notice Of Termination Or Modification Of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64?

If you are seeking the correct California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64 web templates, US Legal Forms is what you require; locate documents created and reviewed by state-licensed legal professionals.

Using US Legal Forms not only alleviates concerns associated with legal forms; it also saves time, effort, and money! Downloading, printing, and completing a professional template is far less expensive than hiring an attorney to do it for you.

And that's it! With just a few simple steps, you have an editable California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64. After creating an account, all future purchases will be processed even more easily. Once you have a US Legal Forms subscription, just Log In to your profile and then click the Download button you can find on the form’s page. Then, when you need to use this template again, you'll always be able to find it in the My documents section. Don't waste your time and energy comparing numerous forms on different platforms. Obtain professional copies from a single secure service!

- To begin, finalize your registration process by providing your email and setting up a password.

- Follow the instructions below to create an account and locate the California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64 sample to address your issue.

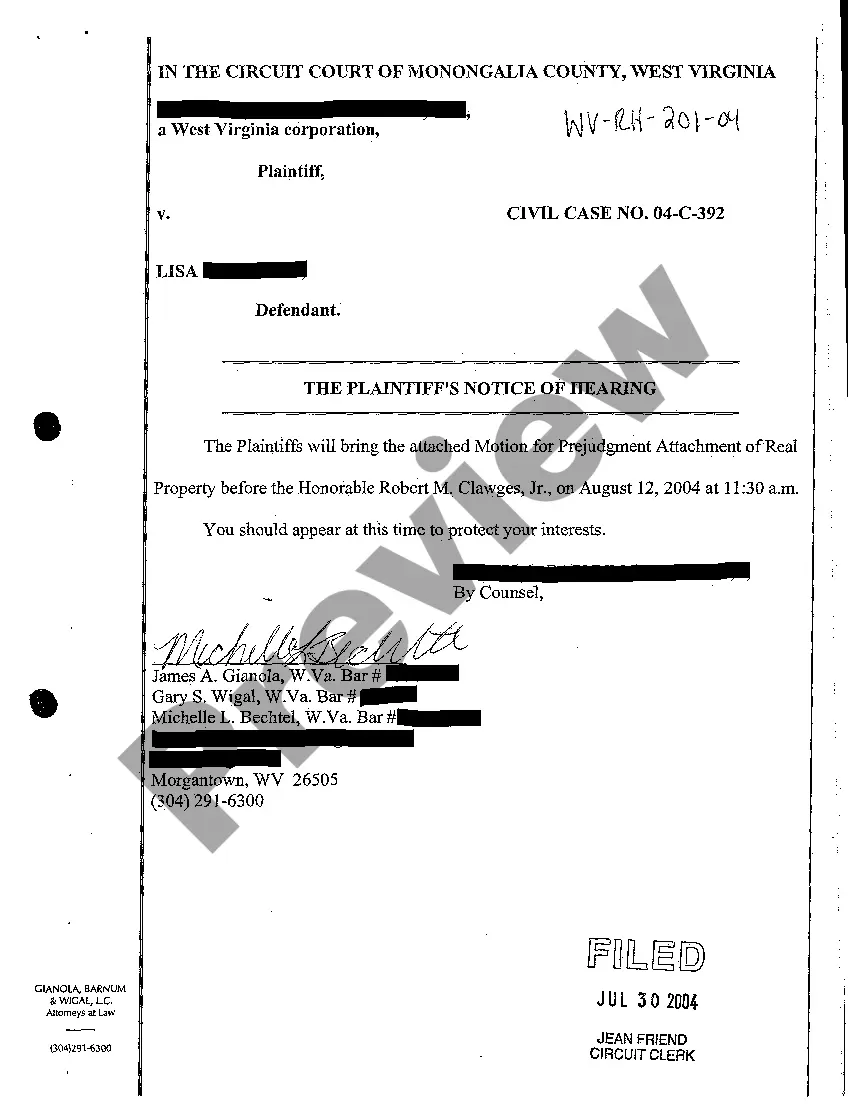

- Utilize the Preview tool or examine the file description (if it exists) to ensure that the form is the one you need.

- Verify its relevance in the state where you reside.

- Click on Buy Now to place your order.

- Select a suitable pricing plan.

- Set up an account and pay using your credit card or PayPal.

- Choose an appropriate file format and save the document.

Form popularity

FAQ

To terminate EWO means to officially end an Earnings Withholding Order that has been enforced against your income. This process involves a formal request, often guided by the California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64. When successfully terminated, you regain access to your full earnings rather than having wages deducted. Utilizing resources like uslegalforms can simplify this process and ensure you meet necessary requirements.

An order to withhold taxes is a legal instruction that mandates a portion of your earnings to be automatically deducted for tax obligations. This process is usually set forth by tax authorities or negotiated agreements. The California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64 outlines how such orders function to ensure compliance. Knowing how this works can inform your financial planning and tax preparedness.

Termination of the order to withhold tax in California indicates that the legal obligation to deduct taxes from your earnings has ended. This process is often formalized through the California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64. If your financial situation improves or the debt is cleared, seeking termination can be beneficial. You can use platforms like uslegalforms to help you navigate this process smoothly.

While withholding and garnishment both involve deductions from your earnings, they serve different purposes. Withholding refers to collecting taxes or other mandatory deductions from your paycheck, while garnishment specifically pertains to repaying debts. The California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64 governs the garnishment process. Understanding the distinction can help you better navigate your financial obligations.

Choosing not to withhold taxes can lead to significant financial implications for you. If tax obligations are not met, the California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64 may be enforced against you, resulting in garnishment of your wages. Not only might you face penalties and interest from tax authorities, but your credit score could also suffer. It is crucial to handle your tax responsibilities to avoid these repercussions.

An earnings withholding order wage garnishment is a legal directive that allows a creditor to collect debt directly from your wages. Under California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64, this order ensures that a portion of your earnings goes directly to satisfy a debt. These types of orders can be issued for various reasons, including unpaid loans and child support. Understanding the implications of such an order is essential for effective financial management.

To file wage garnishment in California, you must prepare and submit a request for a California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64 to the appropriate court. Ensure you have gathered all necessary information about the debtor, including income and other financial details. Following the filing, the court will review your request and issue an order if approved, which is then served to the employer holding the wages.

A notice of termination or modification of earnings withholding order is a legal document that outlines changes to wage garnishment, governed by the California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64. This notice informs employers to stop or modify the amount being withheld from an employee's paychecks. Understanding this document is crucial for anyone seeking to adjust or terminate an existing garnishment.

When writing a letter to stop wage garnishment, begin by addressing it to the creditor’s collection department. Include your account details and emphasize that you are requesting a California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64. Clearly state your reasons for the request and attach any necessary documentation to support your claim. Make sure to keep a copy for your records.

Filing a motion to stop garnishment requires you to complete specific forms that align with the California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64. Submit these forms to the court where the garnishment was processed. Ensure you clearly state the reasons for your request and include any relevant evidence to support your case.