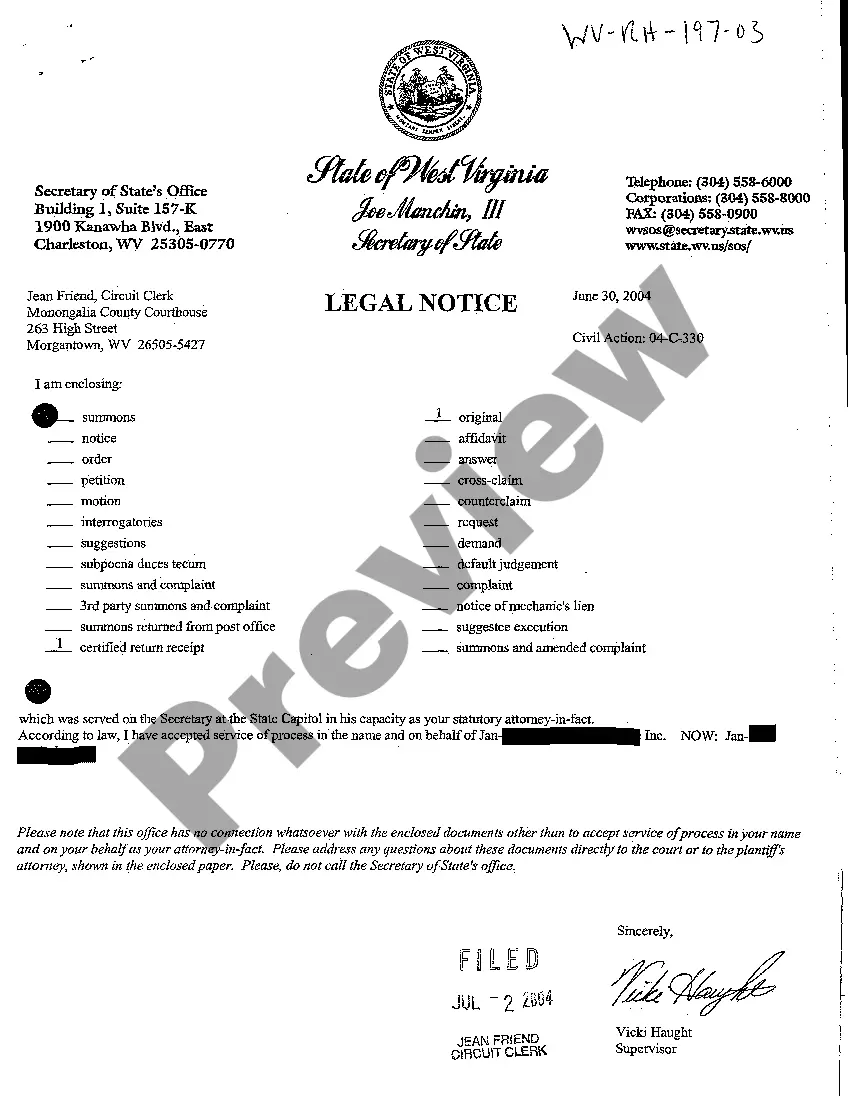

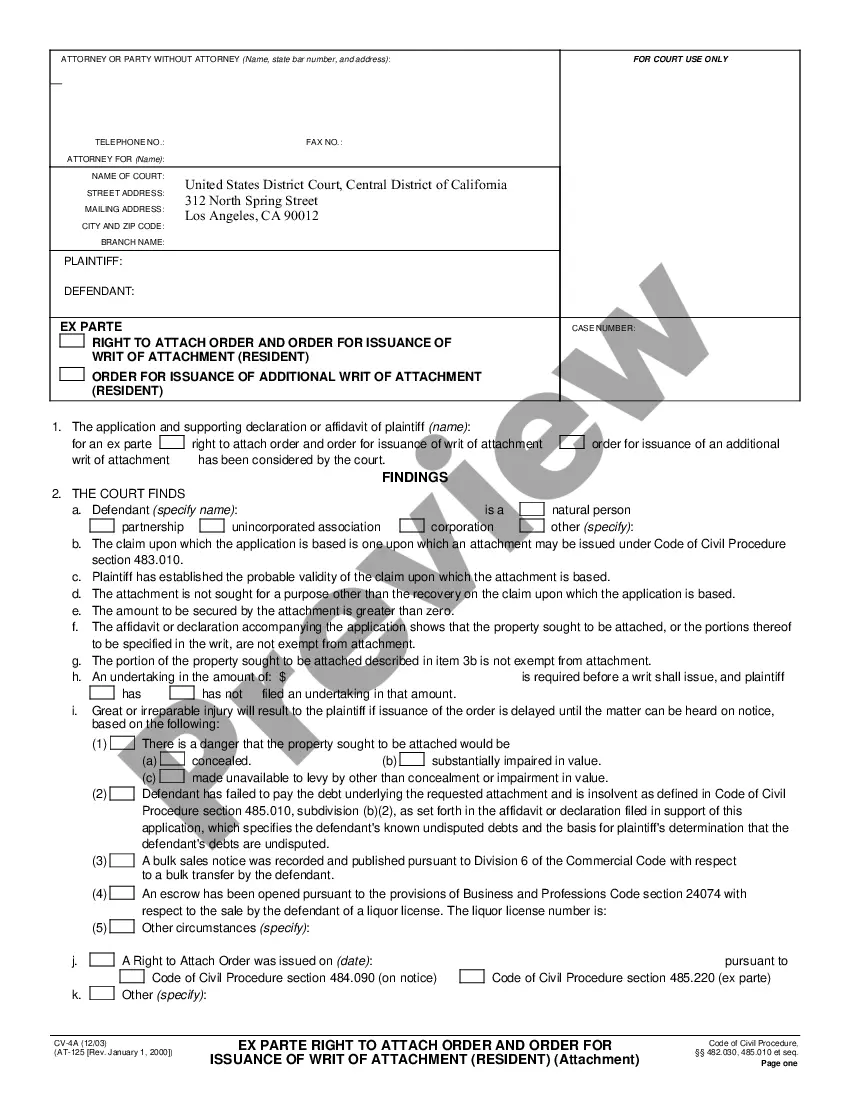

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

California Order Determining Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64

Description

How to fill out California Order Determining Claim Of Exemption - Wage Garnishment - F.R.C.P. Rule 64?

If you're looking for proper California Order Determining Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64 copies, US Legal Forms is exactly what you require; access documents created and reviewed by state-certified attorneys.

Utilizing US Legal Forms not only alleviates concerns about official documents; you also conserve both time and resources, as well as money! Downloading, printing, and completing a professional template is considerably more cost-effective than hiring a lawyer to accomplish it for you.

And there you go. In just a few simple steps, you have an editable California Order Determining Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64. Once you've created your account, all future purchases will be processed with even greater ease. With a US Legal Forms subscription, simply Log In to your account and click the Download option displayed on the form’s page. Then, whenever you need to access this sample again, you'll consistently find it in the My documents section. Don’t waste your time sifting through numerous forms on multiple websites. Purchase accurate templates from a single secure source!

- Begin by completing your registration process with your email and creating a password.

- Follow the instructions below to set up an account and acquire the California Order Determining Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64 template to fulfill your requirements.

- Utilize the Preview option or view the file description (if available) to ensure that the template meets your needs.

- Verify its relevance in your locality.

- Click on Buy Now to place your order.

- Select a preferred pricing plan.

- Establish your account and pay with your credit card or PayPal.

- Choose a suitable format and download the document.

Form popularity

FAQ

To write an effective objection letter for wage garnishment, start by addressing the court that issued the initial wage garnishment order. Clearly state your reasons for objection, referencing the California Order Determining Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64. Make sure to include any relevant details about your financial situation that support your claim. Lastly, consider using the resources provided by uslegalforms, which can guide you through this process and help ensure your letter meets all necessary legal standards.

While quitting your job may seem like a way to avoid wage garnishment, it is generally not a recommended solution. You could still face legal consequences from the creditor, and future earnings could also be subject to garnishment. Instead of taking drastic measures, consider utilizing the California Order Determining Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64 to protect your assets. Exploring this legal option could provide a more effective way to address your concerns.

To file a claim of exemption for wage garnishment in California, you need to complete a specific form that asserts your rights under the California Order Determining Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64. This form should detail the grounds on which you believe your income is exempt. After completing the form, you must submit it to the court, ensuring you meet all required deadlines. Using a reliable platform like US Legal Forms can simplify this process for you.

Certain types of income are exempt from garnishment in California, such as wages that fall below a specific threshold outlined in state law. For instance, any part of your income that meets the federal poverty level guidelines is protected under the California Order Determining Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64. Furthermore, public assistance and child support payments are also exempt. Knowing what income is protected can help you maintain financial stability.

In California, certain funds are exempt from garnishment under the California Order Determining Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64. These include Social Security benefits, unemployment benefits, and disability payments. Additionally, funds from retirement accounts may also be protected if they meet specific qualifications. Understanding these exemptions can help you safeguard your essential income.

The right to claim exemptions under the law allows you to protect a portion of your income from being garnished. In California, this right is encapsulated within the California Order Determining Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64, which ensures that individuals facing financial challenges can shield necessary living expenses. It is vital to understand your rights so you can effectively navigate wage garnishment proceedings.

The best way to stop a garnishment is to file a claim of exemption using the WG 006 form, allowing you to provide evidence to the court. By asserting your rights under the California Order Determining Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64, you can effectively communicate your situation and potentially halt any further deductions from your paycheck. Working with a platform like US Legal Forms can streamline the process and provide clarity on the required steps.

To apply for garnishment hardship in California, you can file a claim of exemption, specifically the WG 006 form, which outlines your financial difficulties. This claim needs to be submitted to the court, demonstrating that your income is below the threshold needed for your survival. Referencing the California Order Determining Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64 will enhance your understanding of your rights and guide you through the hardship process.

The speed at which a garnishment can be stopped varies based on your promptness in filing the necessary paperwork. Once you submit a claim of exemption, the court typically schedules a hearing promptly to assess your case. Keep in mind that using the California Order Determining Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64 can expedite the process and help you find a swift resolution.

You can stop a wage garnishment immediately in California by filing a claim of exemption, which you can do using the WG 006 form. This document allows the court to review your finances and potentially halt the garnishment if you qualify for an exemption. Engaging with the California Order Determining Claim of Exemption - Wage Garnishment - F.R.C.P. Rule 64 gives you a clear pathway to protect your income from unlawful deductions.