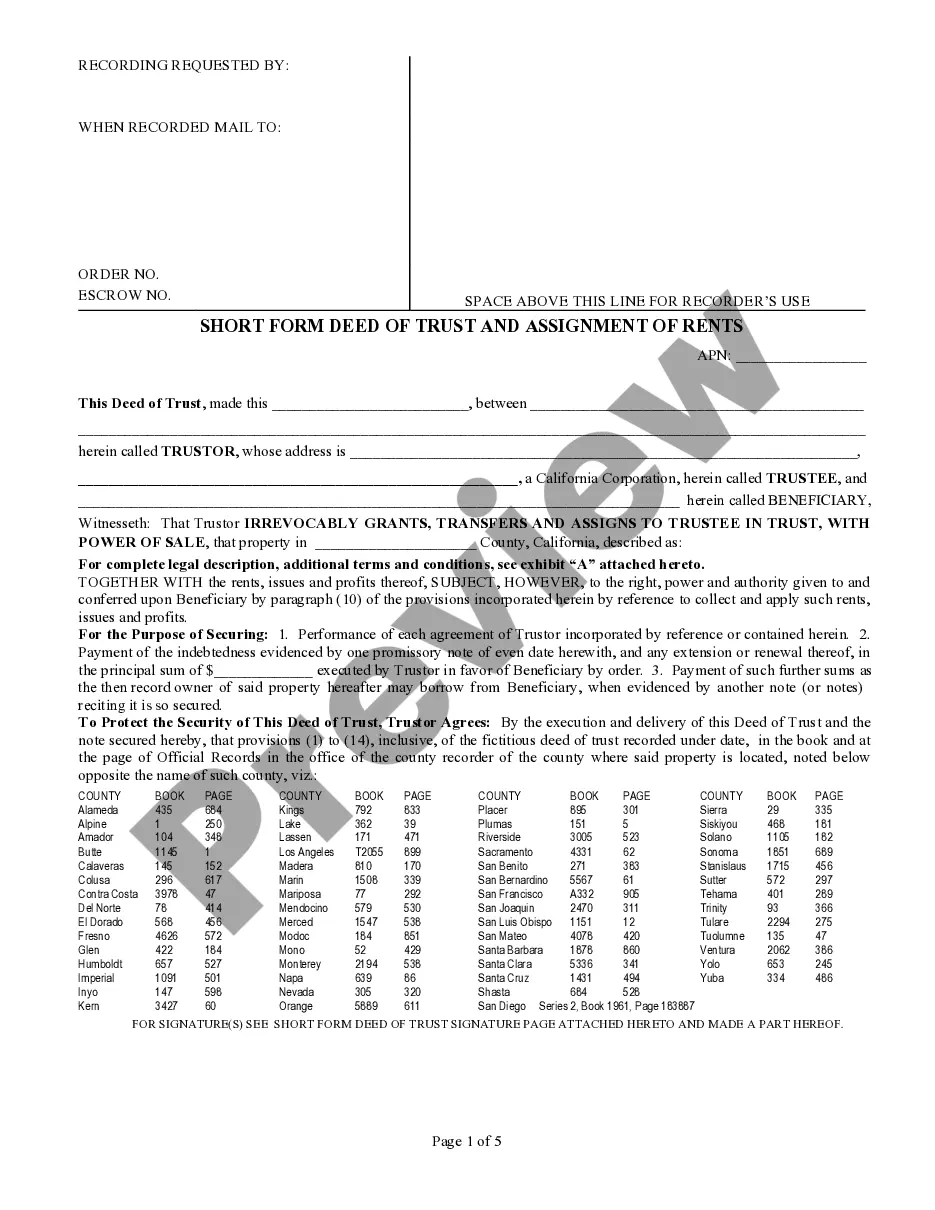

California Short Form Deed of Trust and Assignment of Rents

Understanding this form

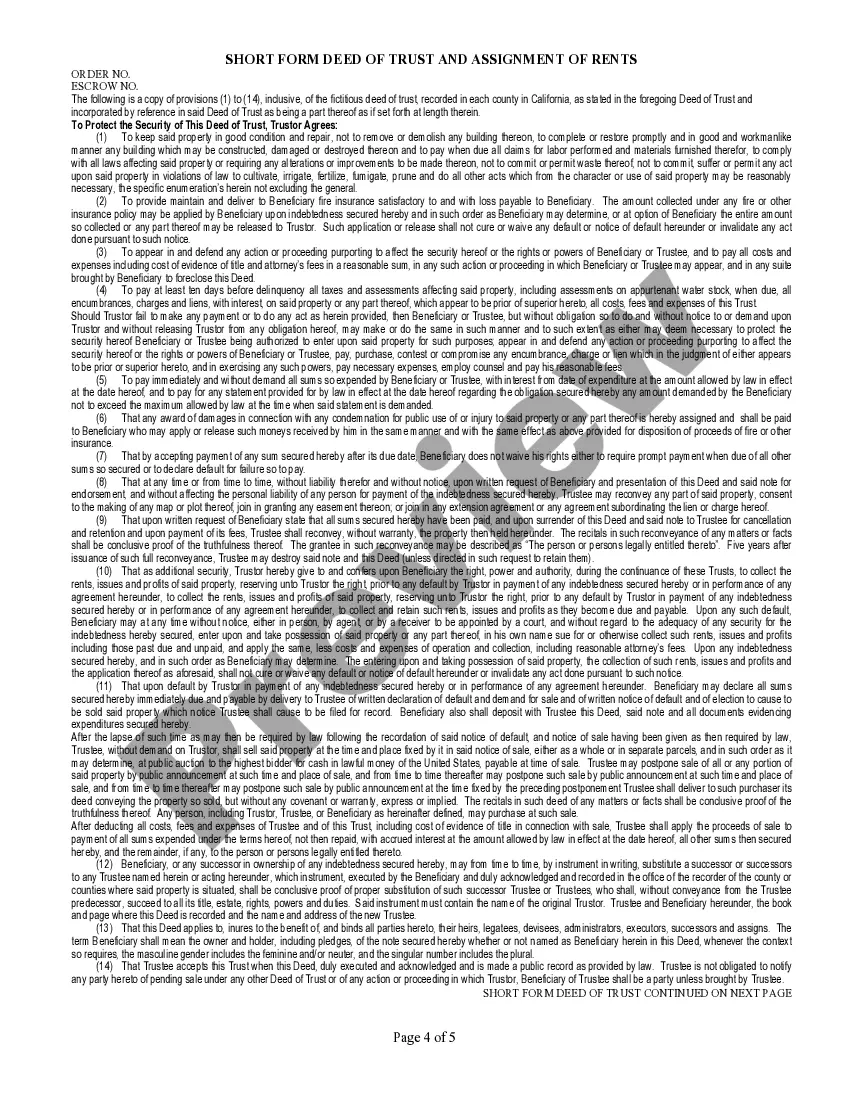

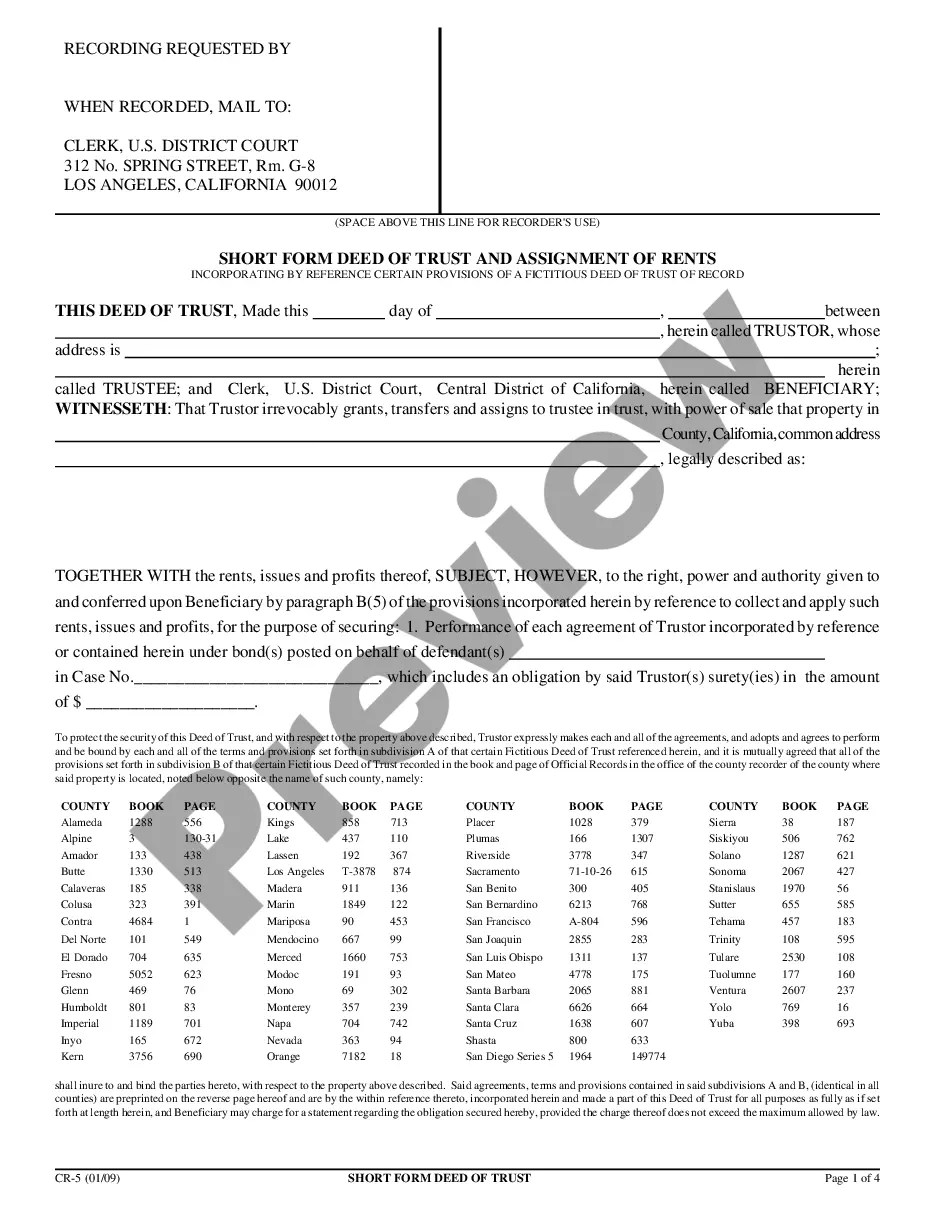

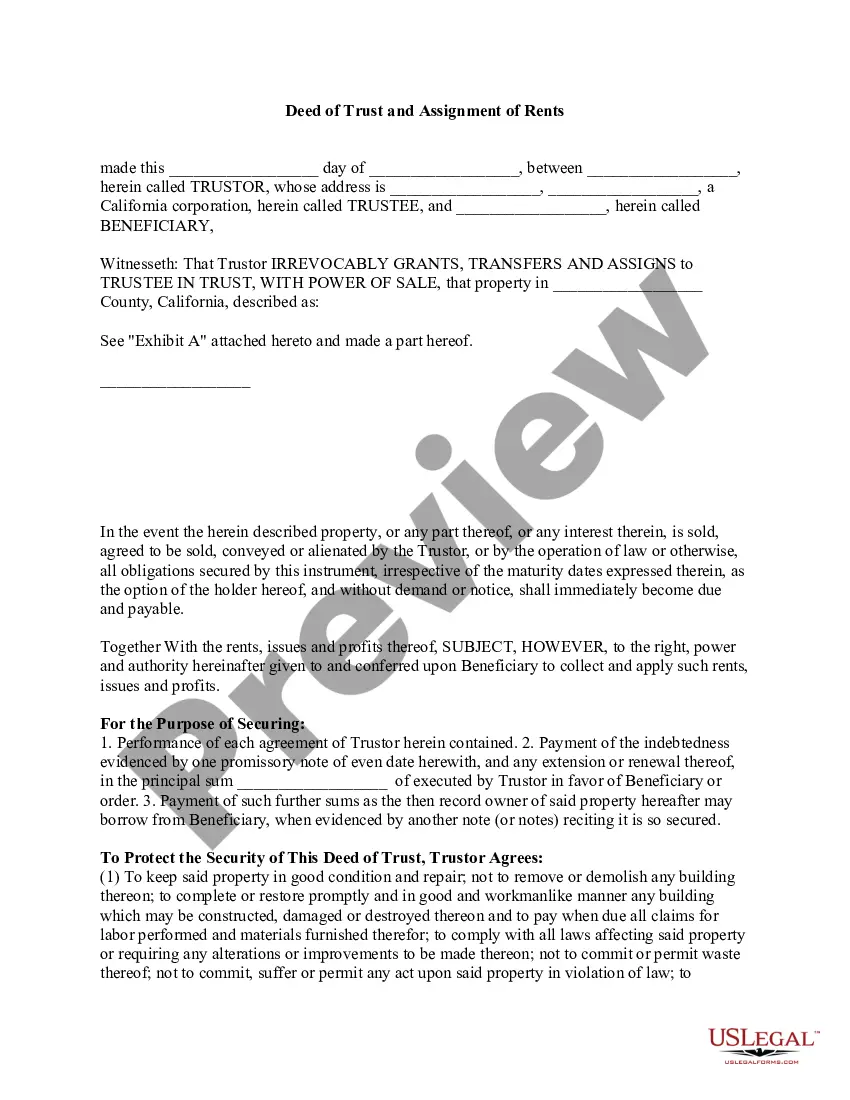

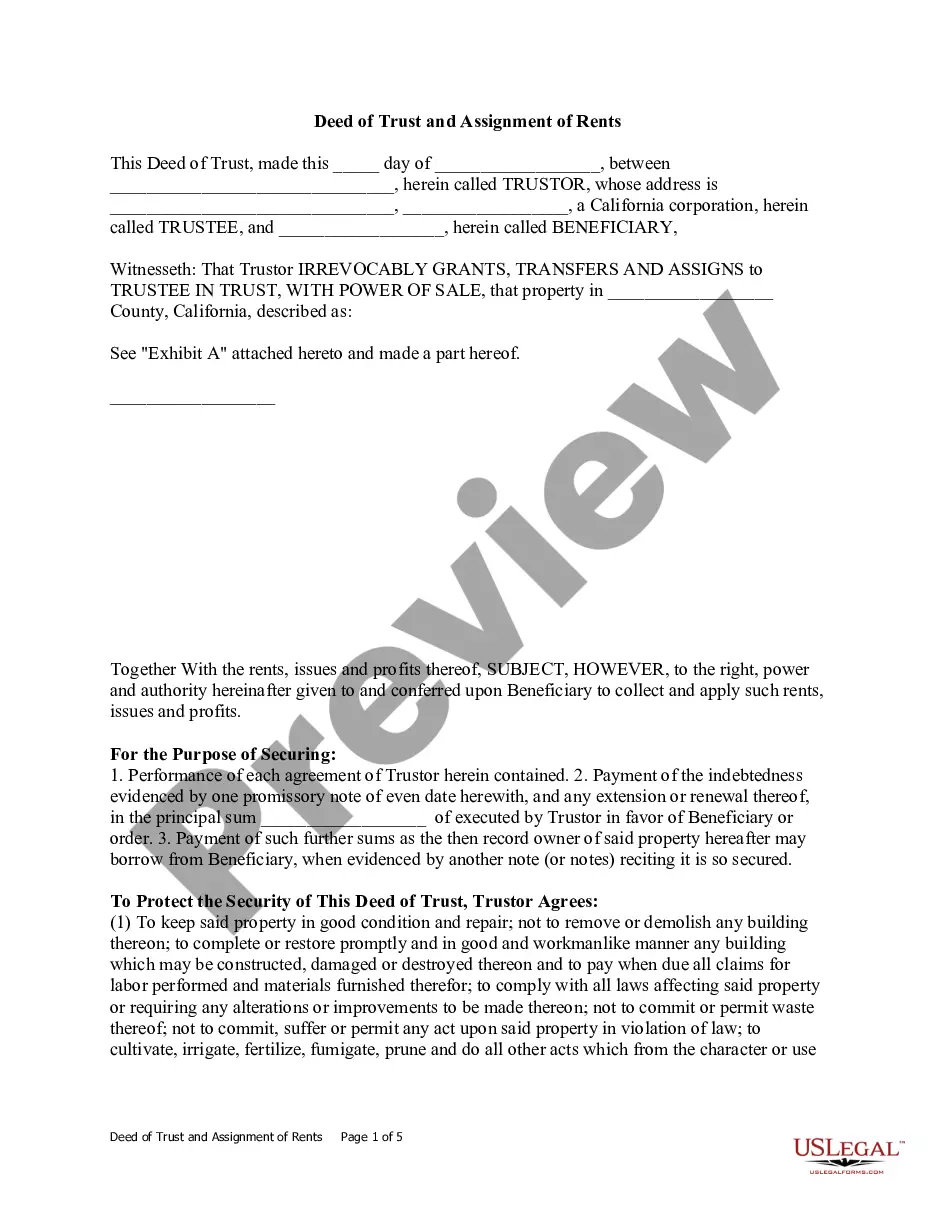

The Short Form Deed of Trust and Assignment of Rents is a legal document used in property transactions to establish a trust relationship between a lender (Beneficiary) and a borrower (Trustor). This form uniquely facilitates the transfer of property and includes provisions for managing rents from the property, ensuring that the lender's interests are protected. The Short Form Deed of Trust is a compact version designed for efficiency while still capturing essential terms, making it suitable for various transactions.

Main sections of this form

- Identification of parties involved: Trustor (borrower) and Beneficiary (lender).

- Description of the property being secured by the deed.

- Terms regarding the maintenance and insurance of the property.

- Provisions for the collection of rents and profits from the property.

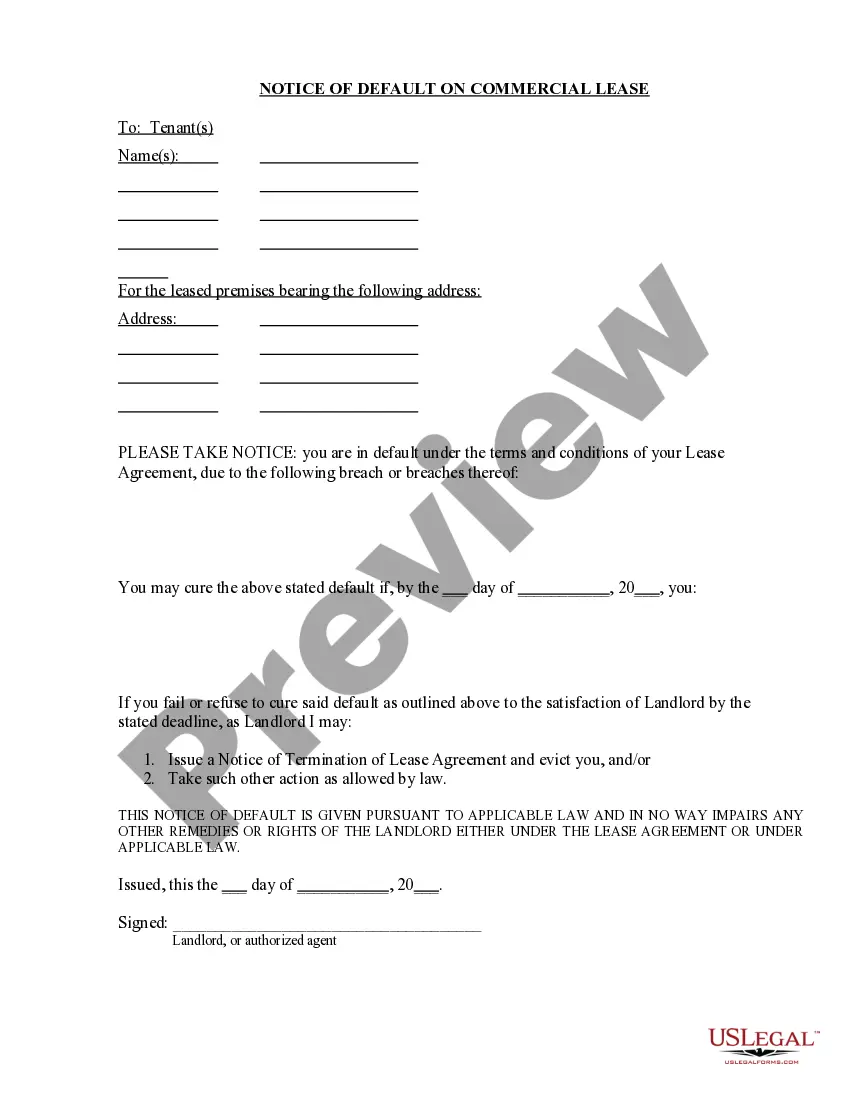

- Details on actions to be taken in case of default by the Trustor.

When this form is needed

This form is typically used when a borrower is securing a loan with real property as collateral. It is essential in situations where the lender wants to ensure they can collect rent and maintain control over the property if the borrower defaults on their obligations. Common scenarios include real estate investments, mortgage arrangements, or refinancing agreements where the property is being leveraged for financing.

Who this form is for

- Property owners or borrowers seeking to secure a loan with real estate.

- Real estate investors needing to protect their investments with a legal agreement.

- Lenders who want to outline the terms of repayment and property management.

- Real estate attorneys and brokers who facilitate property transactions.

Instructions for completing this form

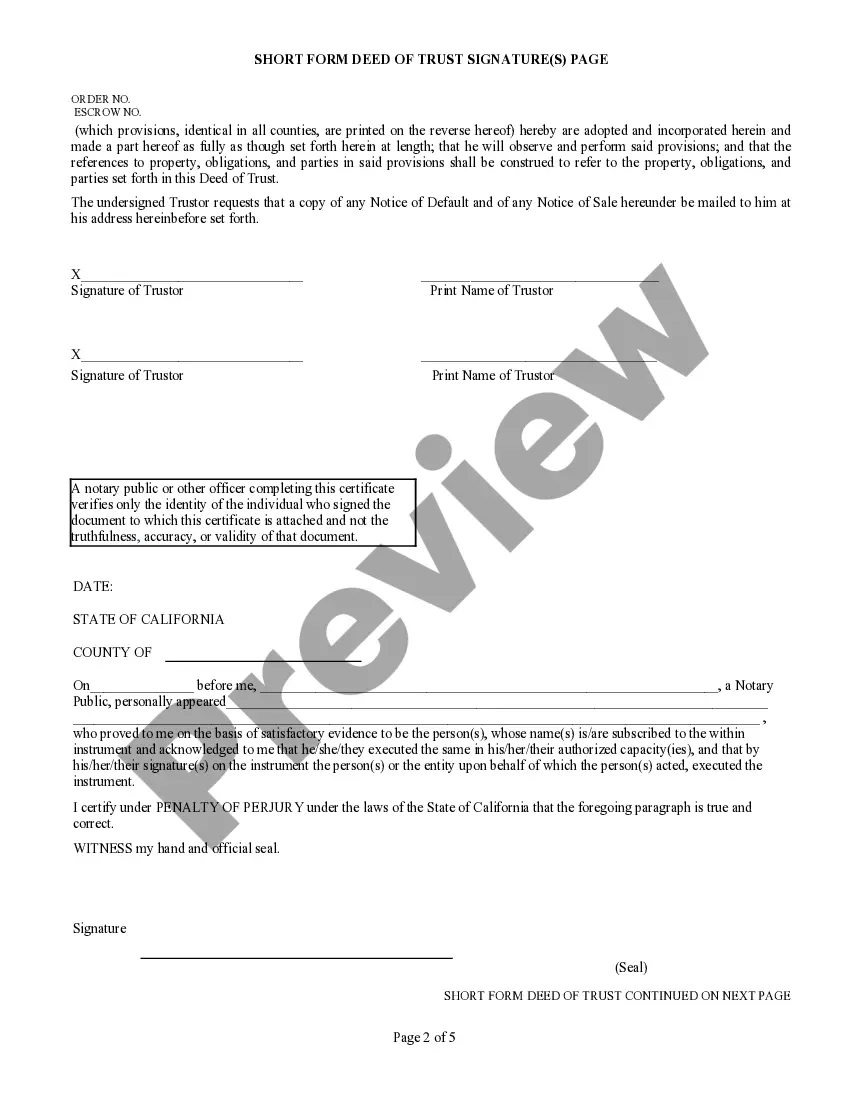

- Identify the parties: Enter the names and addresses of the Trustor and Beneficiary.

- Describe the property: Provide a detailed description of the real estate being secured.

- List terms of the agreement: Specify conditions regarding property maintenance and insurance.

- Include details on rents: State the procedures for collecting rents and managing the property.

- Sign and date the document: Ensure that all parties sign the deed in the presence of a notary if required.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Typical mistakes to avoid

- Failing to accurately describe the property, which can cause issues during enforcement.

- Not having all parties sign the document, leading to questions about its validity.

- Ignoring state-specific requirements that may necessitate additional provisions.

- Neglecting to keep copies of the signed deed for all parties involved.

Advantages of online completion

- Convenience: Download and complete the form at your own pace.

- Editability: Customize the terms to suit your specific situation before printing.

- Accuracy: Ensure that the form adheres to legal standards as drafted by licensed attorneys.

- Accessibility: Easily access the form from anywhere, without the need for physical paperwork.

State law considerations

This form is tailored for use in California, reflecting legal terms and conditions relevant to property transactions within the state. It is advisable to consult a local attorney to ensure compliance with any specific state laws regarding deeds of trust and rental agreements.

Form popularity

FAQ

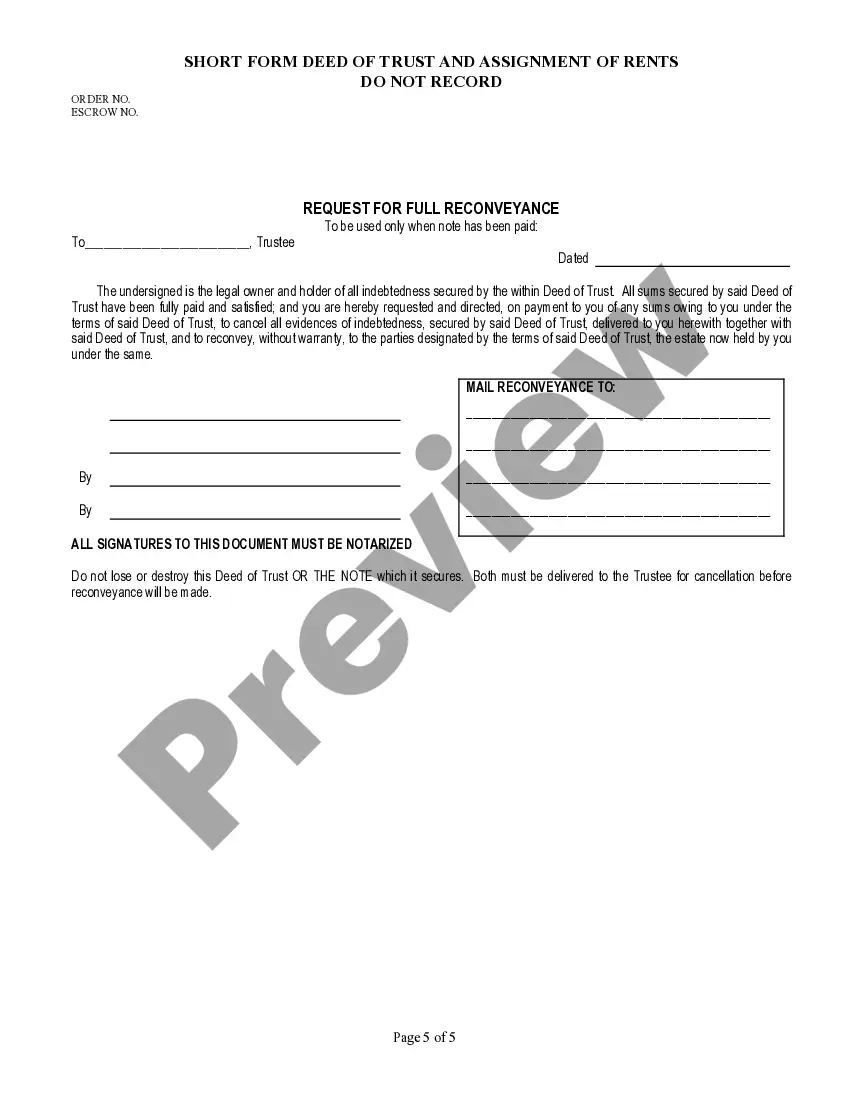

If you lost the deed to your house, don’t worry; you can easily replace it. Start by requesting a copy from your county recorder's office, where the California Short Form Deed of Trust and Assignment of Rents is filed. With the right information, they can help you obtain a duplicate, ensuring you have the documentation you need.

Getting a copy of your deed of trust in California involves contacting your local recorder's office or using their online services. You will need to provide details like the property address or the date of recording to retrieve the California Short Form Deed of Trust and Assignment of Rents. If you want assistance throughout the process, consider using platforms like USLegalForms for guidance.

To get a copy of a trust document in California, you typically must contact the trustee or the law firm that created the trust. If the trust involves a California Short Form Deed of Trust and Assignment of Rents, they will guide you through the process. Additionally, it’s wise to have relevant information on hand, such as the trust name and your identification.

To look up a deed of trust in California, start by visiting the website of your local county recorder's office. You can search for the California Short Form Deed of Trust and Assignment of Rents using the property address or the name of the borrower. If you prefer, you can also visit the office in person for assistance with your search.

Yes, you can obtain a copy of your deed online in California. Many counties provide online access to public records, including the California Short Form Deed of Trust and Assignment of Rents. By visiting your county's recorder's office website, you can often find the documents you need with just a few clicks.

The assignment of rents in a deed of trust refers to the borrower's legal transfer of rental income rights to the lender. This provision grants the lender the authority to collect rent directly from tenants if the borrower fails to meet their obligations. It acts as an additional layer of security for the lender and enhances the recovery process in case of default. By utilizing the California Short Form Deed of Trust and Assignment of Rents, you can better safeguard your financial interests.

Several factors can render a deed of trust invalid in California, including failure to comply with legal requirements, lack of proper signatures, and insufficient consideration. If the details within the California Short Form Deed of Trust and Assignment of Rents conflict with state laws, complications can arise. An invalid deed ultimately fails to protect the lender's interests. Therefore, it’s advisable to use reputable services to create and review your documents, ensuring their validity.

To record a deed of trust in California, you must prepare the document and file it with the county recorder's office where the property is located. It's essential to include all required information, such as legal descriptions and signatures. Once recorded, your California Short Form Deed of Trust and Assignment of Rents becomes part of the public record, ensuring that anyone searching for property ownership can find it. Consider using a service like uslegalforms to streamline this process and avoid common mistakes.

The assignment of rents clause in a trust deed is a legal provision that enables the lender to collect rental income directly from tenants in the event of borrower default. This clause is a key component of a California Short Form Deed of Trust and Assignment of Rents, as it enhances the lender's security interest. For property owners, understanding this clause can lead to better management of their rental properties. Using platforms like uslegalforms can help you navigate these concepts and ensure your interests are protected.

Both lenders and borrowers benefit from the assignment of rents clause in a California Short Form Deed of Trust and Assignment of Rents. Lenders gain assurance that they will receive rental income even in the case of default, reducing their risk. On the other hand, borrowers can use this clause to demonstrate their commitment to meeting obligations, potentially leading to improved financing options. This mutually beneficial arrangement encourages trust and fosters a more stable financial relationship.