California Financial Account Transfer to Living Trust

Description California Trust Buy

How to fill out Account Trust Fill?

If you're seeking precise California Financial Account Transfer to Living Trust web templates, US Legal Forms is exactly what you require; obtain documents crafted and reviewed by state-authorized attorneys.

Utilizing US Legal Forms not only alleviates your concerns regarding legal forms; you also save time, effort, and money! Downloading, printing, and completing a competent template is significantly more cost-effective than hiring a lawyer to do it for you.

And there you have it. In just a few simple clicks, you receive an editable California Financial Account Transfer to Living Trust. Once you establish an account, all future purchases will be even easier. When you have a US Legal Forms subscription, just Log In/">Log In to your account and then click the Download button you see on the form’s page. Then, whenever you need to use this template again, you'll always be able to locate it in the My documents menu. Don't waste your time and effort searching through countless forms on various web platforms. Purchase accurate copies from a single secure platform!

- To initiate, finish your registration process by entering your email and creating a secure password.

- Follow the instructions provided below to establish an account and access the California Financial Account Transfer to Living Trust template to address your needs.

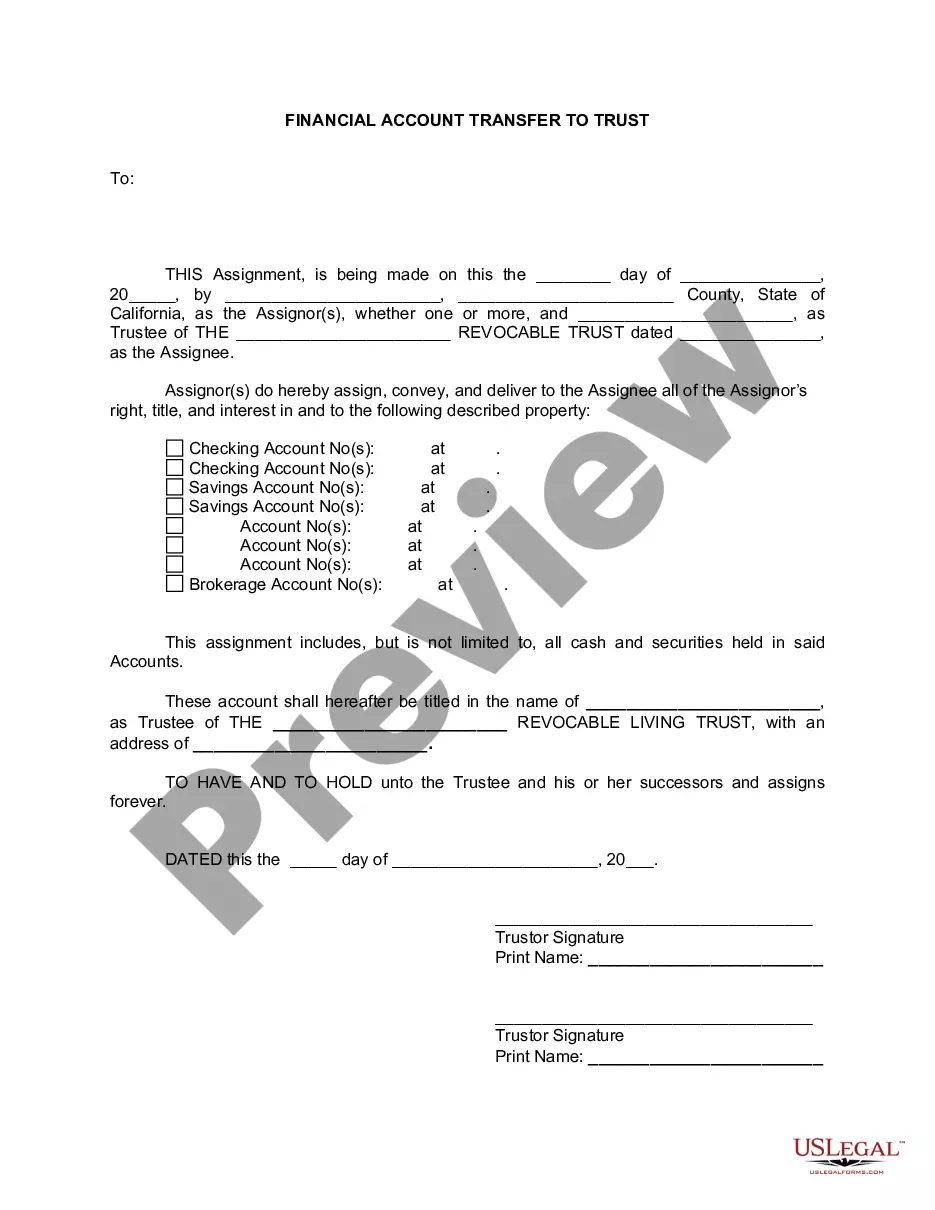

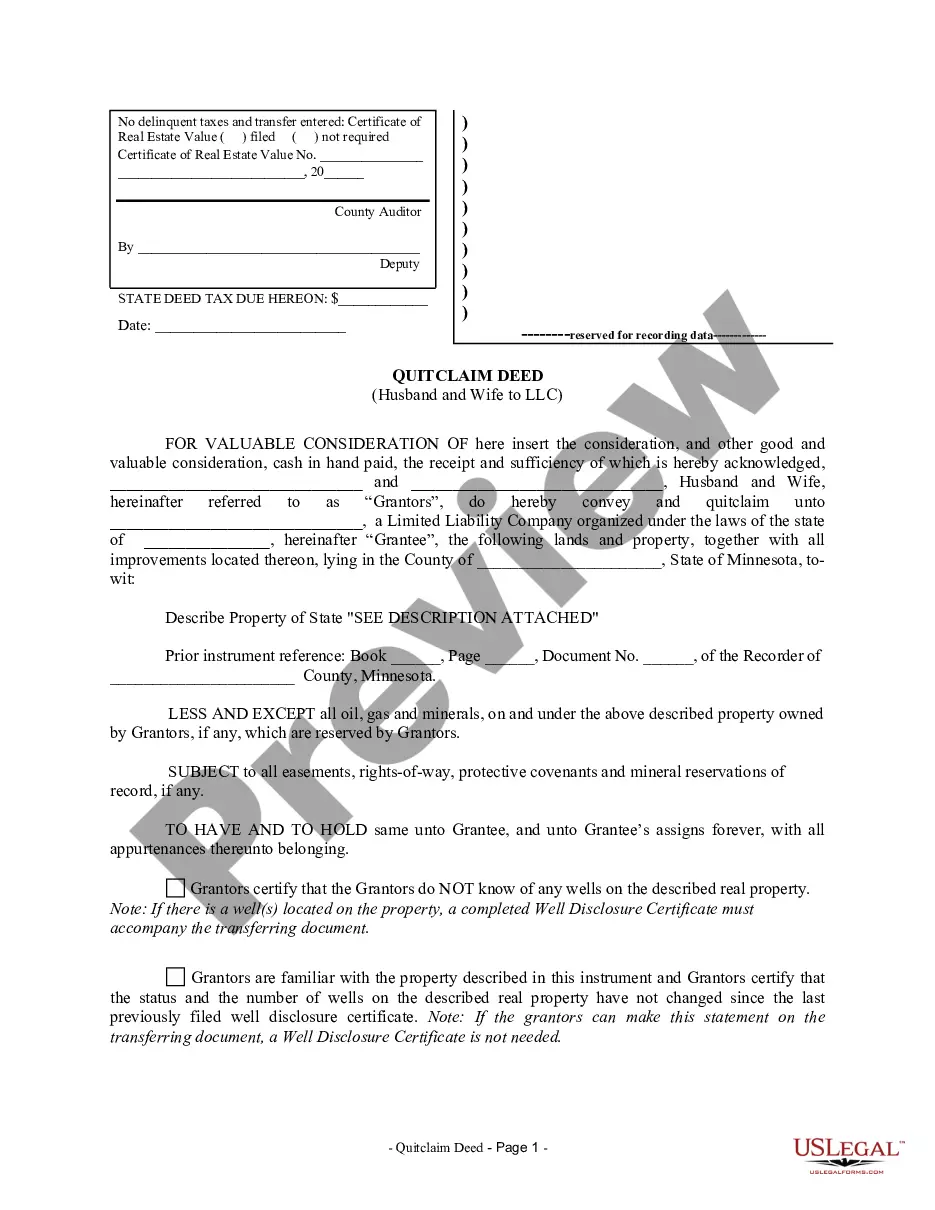

- Utilize the Preview feature or view the document description (if available) to ensure that the sample is the one you require.

- Verify its validity in your state.

- Click Buy Now to place your order.

- Select a suitable pricing plan.

- Create an account and complete your payment using a credit card or PayPal.

- Choose a convenient file format and save the document.

California Living Trust Form popularity

California Trust Other Form Names

Account Trust Draft FAQ

To transfer property to a living trust in California, you typically need to complete a deed transfer for real estate and change account registrations for financial accounts. This process involves executing a new deed and updating the ownership information with your financial institutions. Ensure that all documents are accurately prepared, as this will facilitate a smooth California Financial Account Transfer to Living Trust. If you feel uncertain, using platforms like US Legal Forms can provide the guidance you need.

Yes, you can designate a trust as a beneficiary on your accounts. This designation allows the assets to directly transfer to the trust upon your passing, streamlining the distribution process. Implementing this during your California Financial Account Transfer to Living Trust can help protect your assets and ensure they are allocated according to your plan.

To transfer your brokerage account to a living trust, you will first need to contact your brokerage for guidance on their process. You'll typically fill out forms to update the account title. This California Financial Account Transfer to Living Trust empowers you to manage your investments while preparing for future estate planning.

Yes, you can transfer ownership of a bank account, including moving it into a revocable trust. This process usually involves completing specific forms provided by your bank. Completing a California Financial Account Transfer to Living Trust secures your assets and simplifies their management.

Generally, transferring stock to a revocable trust does not incur immediate tax consequences, as the trust is still considered part of your estate. However, it’s crucial to maintain accurate records of your assets. Understanding these implications is vital for effective California Financial Account Transfer to Living Trust, and you may want to consult a tax professional for detailed guidance.

To transfer a brokerage account to a trust, reach out to your brokerage firm. They will guide you through the necessary documentation and procedures. This California Financial Account Transfer to Living Trust can help ensure your investment assets are managed according to your wishes, providing peace of mind for you and your loved ones.

Transferring a checking account to your living trust involves contacting your bank to get their specific requirements. Generally, you must fill out forms to change the account title to reflect the trust. This California Financial Account Transfer to Living Trust enhances control over your assets and provides an efficient way of handling your finances.

A regular checking or savings account typically works best for a trust, particularly a revocable trust. These accounts provide flexibility for managing funds while ensuring seamless California Financial Account Transfer to Living Trust. Opt for an account with no monthly fees and features that facilitate easy fund management and withdrawals.

Yes, you can place your brokerage account in a revocable trust. This action allows your assets to bypass probate, making it easier for your beneficiaries to access them after your passing. To initiate this California Financial Account Transfer to Living Trust, you will need to contact your brokerage firm for specific procedures and necessary documentation.

One downside of putting assets in a trust is the potential for complexity in managing the trust's terms and documentation. Trusts also involve initial setup costs and may require ongoing maintenance. However, many find that the benefits, including probate avoidance and streamlined asset management, outweigh these challenges in the California Financial Account Transfer to Living Trust.