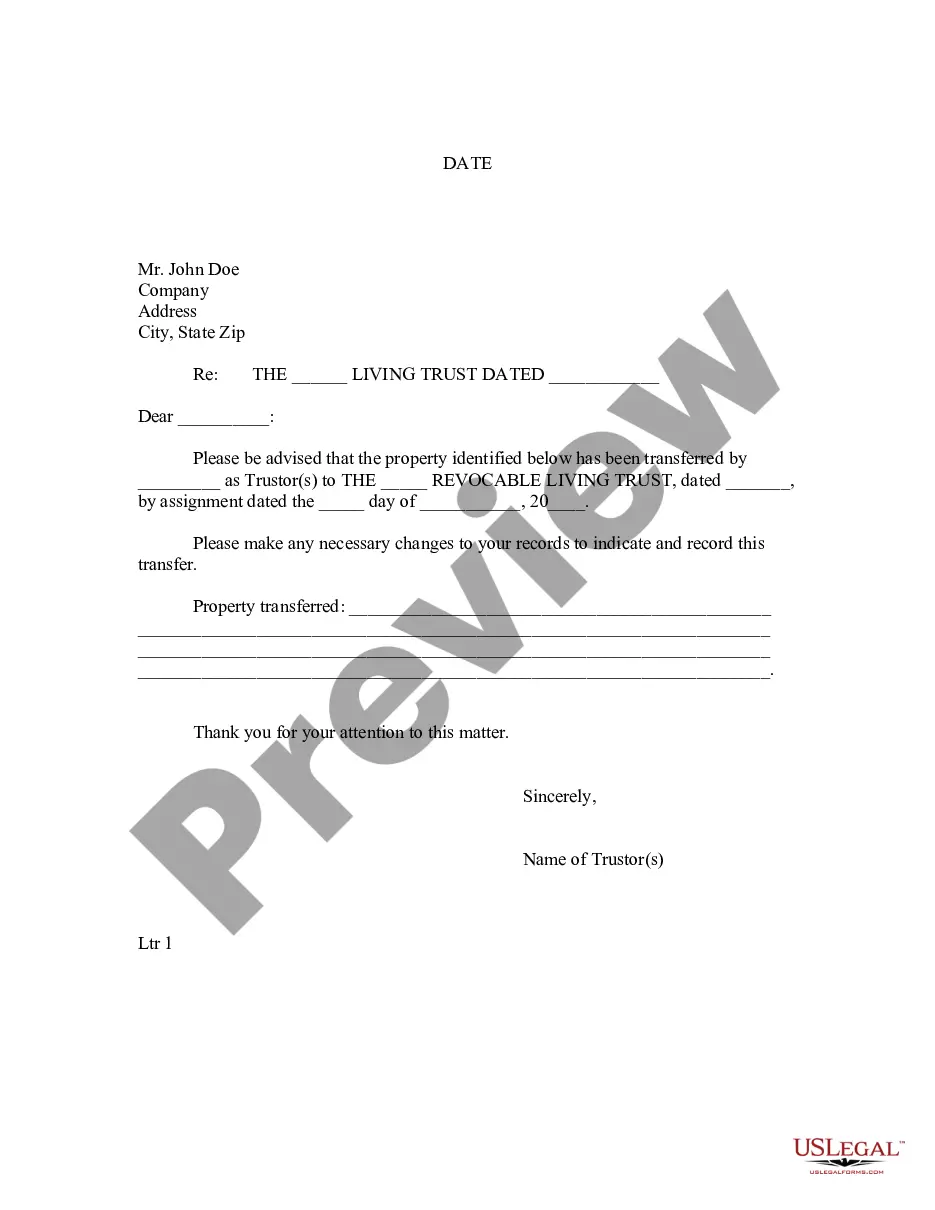

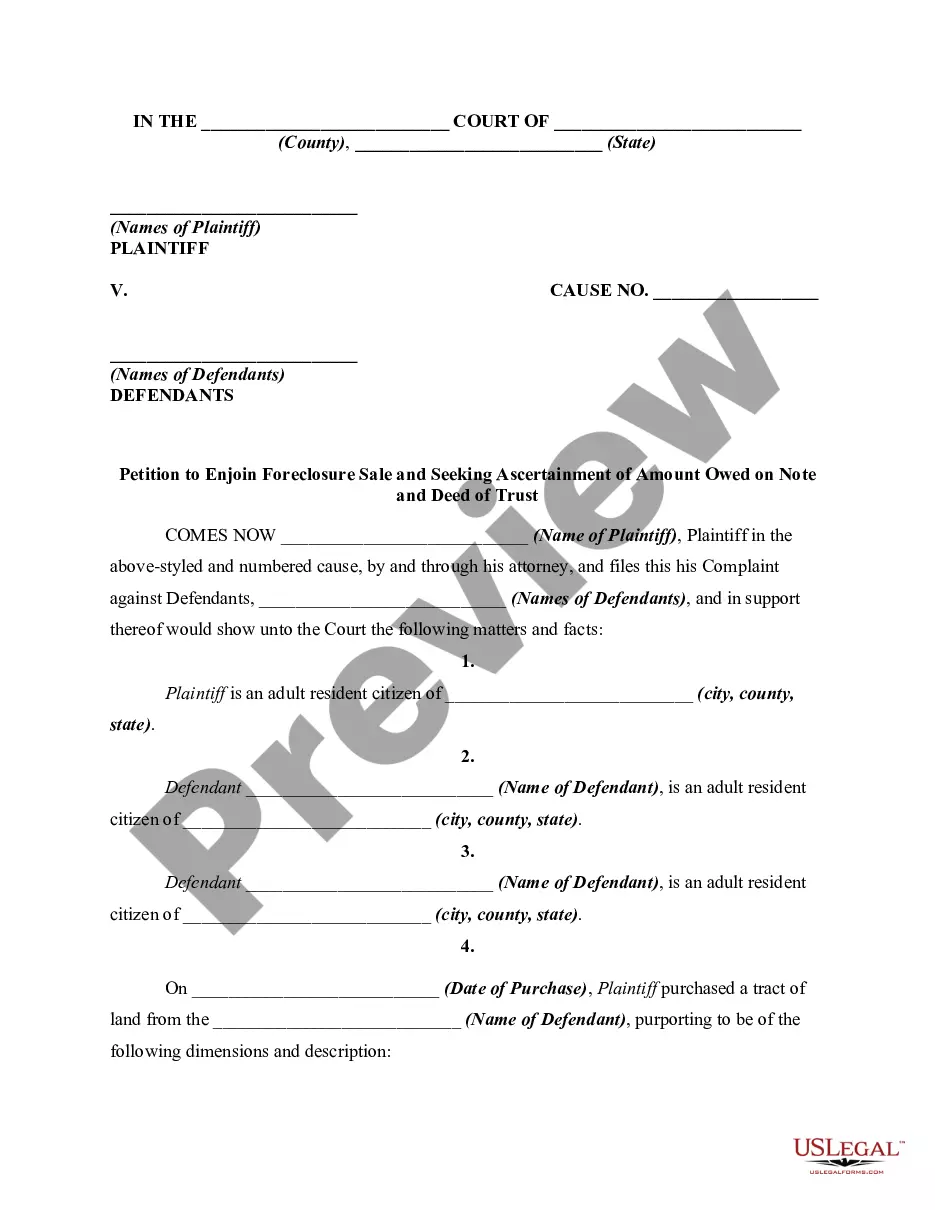

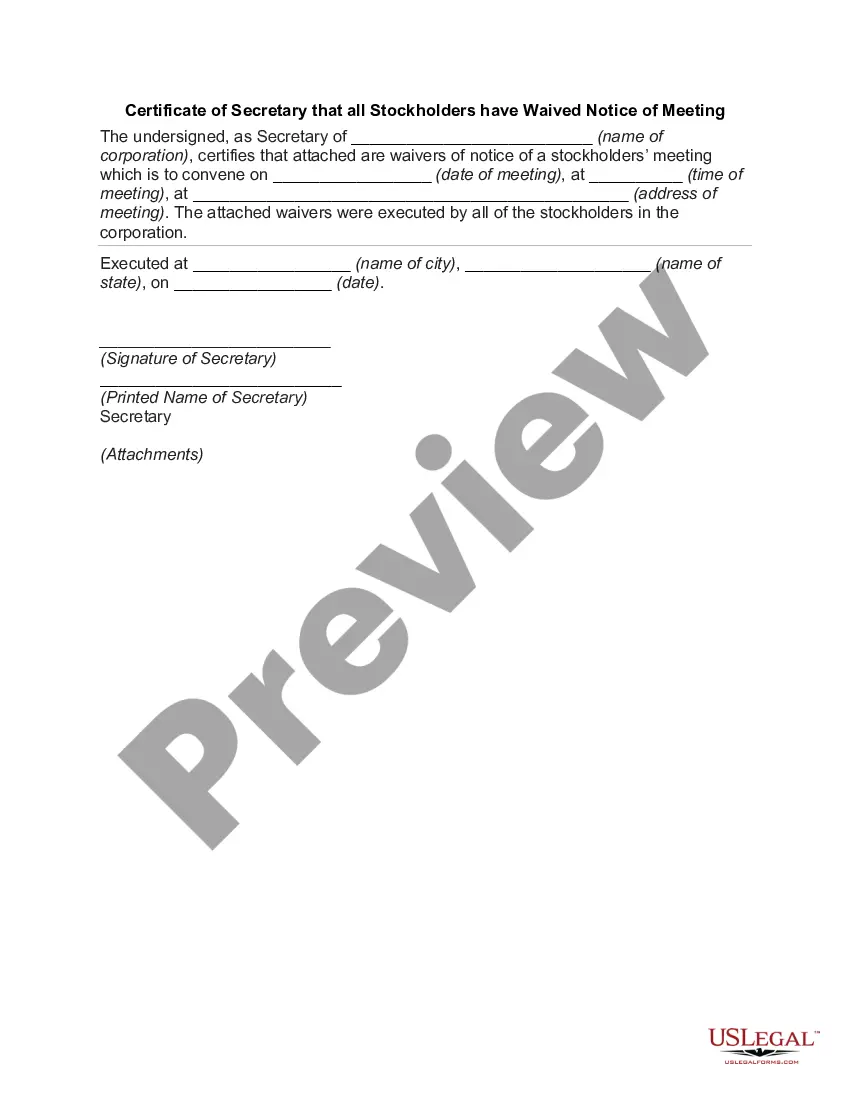

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

California Letter to Lienholder to Notify of Trust

Description

Key Concepts & Definitions

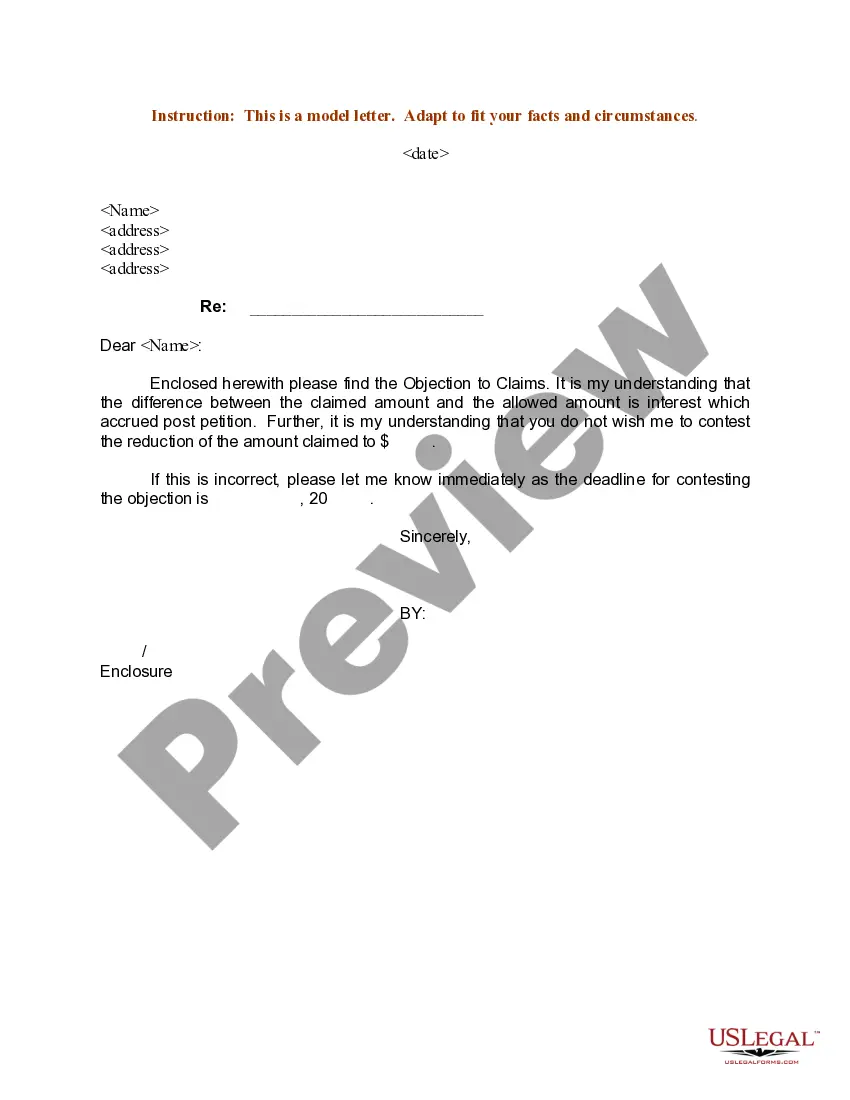

Letter to Lienholder to Notify of Trust: This is a formal written document that notifies the lienholder, often a financial institution or lender, of the transfer of a particular property into a trust. This is common in real estate transactions to ensure legal clarity and adherence to the terms of the lien.

Trust: A fiduciary relationship in which one party, known as a trustor, gives another party, the trustee, the right to hold title to property or assets for the benefit of a third party, the beneficiary. Lienholder: A legal term for an entity that has a financial interest in a property until a debt owed by the property owner is paid off.

Step-by-Step Guide to Notify a Lienholder

- Prepare Documentation: Gather the necessary real estate documents including the trust agreement and any other relevant legal forms.

- Create an eSignature Account: Use platforms like Signnow to create an eSignature account for digitally signing documents.

- Fill Document Fields: Using tools such as DocHub, accurately fill the required fields in the letter and trust agreement.

- Share via Cloud: Use cloud services to securely share documents with legal advisors or stakeholders for review.

- Notify the Lienholder: Send the completed and signed document to the lienholder via secured email or other secure online applications.

- Confirm Receipt and Understanding: Ensure the lienholder acknowledges and understands the change in property status due to the trust.

Risk Analysis

Legal Non-Compliance: Improper notification can lead to issues with legal compliance, affecting the validity of the property transfer into the trust.

Data Security: Mishandling of sensitive documents electronically might lead to data breaches. Utilizing secure platforms like airSlate SignNow features can mitigate this risk.

Best Practices

- Verify Platform Security: Always ensure that the platform used for filling out, signing, and sharing documents adheres to the highest security standards.

- Consult Legal Advice: Consult with a legal expert familiar with trust and real estate laws in the United States before notifying a lienholder.

- Keep Records: Maintain copies of all communications and documents related to the notification for future reference and legal safety.

FAQ

What should be included in a letter to a lienholder to notify of trust?

Include details such as the identification of the designated trust, trustee details, description of the property, purpose of the notification, and any specific instructions or legal references related to the lien or trust arrangement.

Can I use eSignatures for legal forms related to real estate transactions?

Yes, eSignatures are legally recognized in the United States for real estate transactions and many other legal documents, provided they meet certain standards set forth by laws such as the ESIGN Act.

Summary

Notifying a lienholder about the transfer of a property to a trust is a critical step in maintaining legal and financial clarity. Utilizing online tools for creating, signing, and sharing documents can streamline the process. However, careful attention must be given to the security of the data and compliance with legal standards.

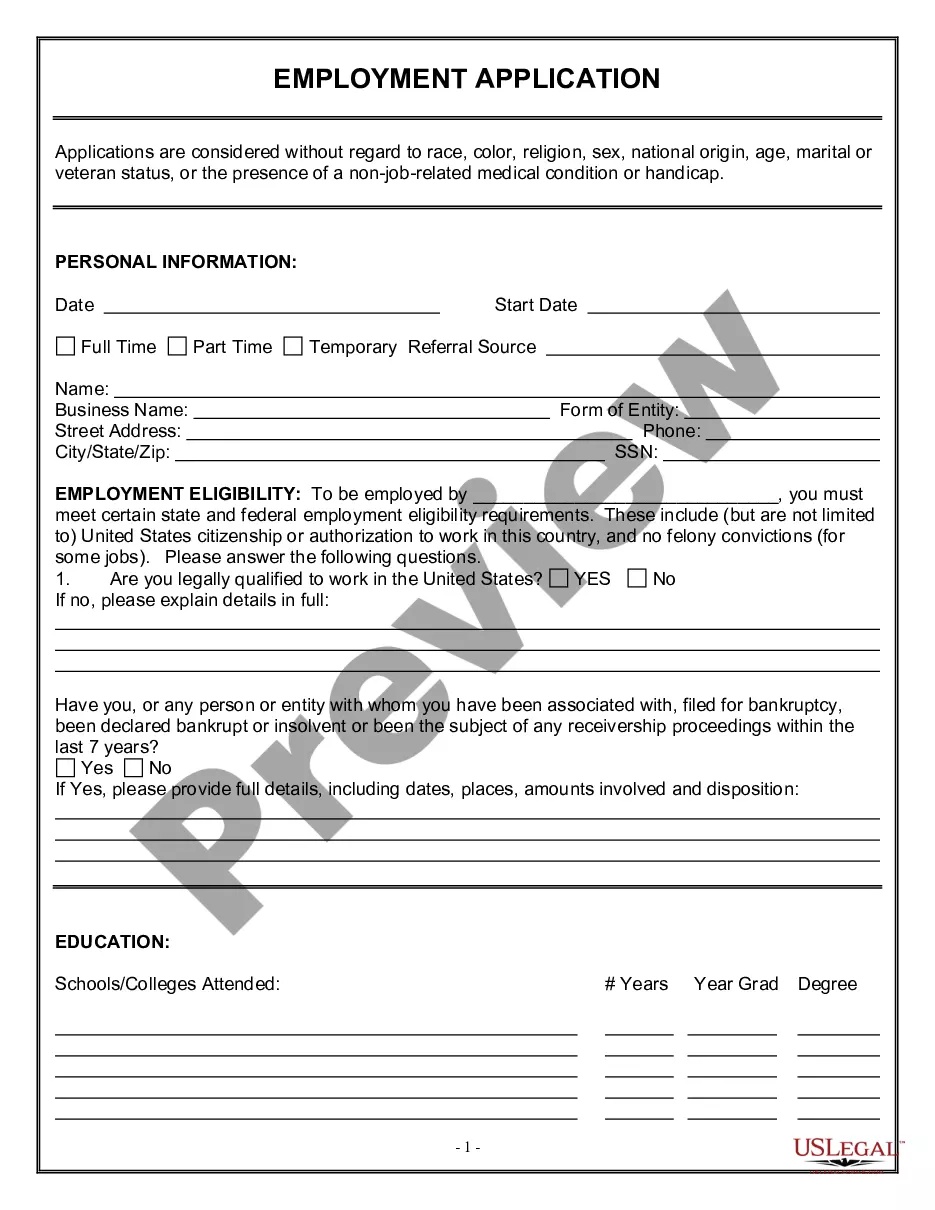

How to fill out California Letter To Lienholder To Notify Of Trust?

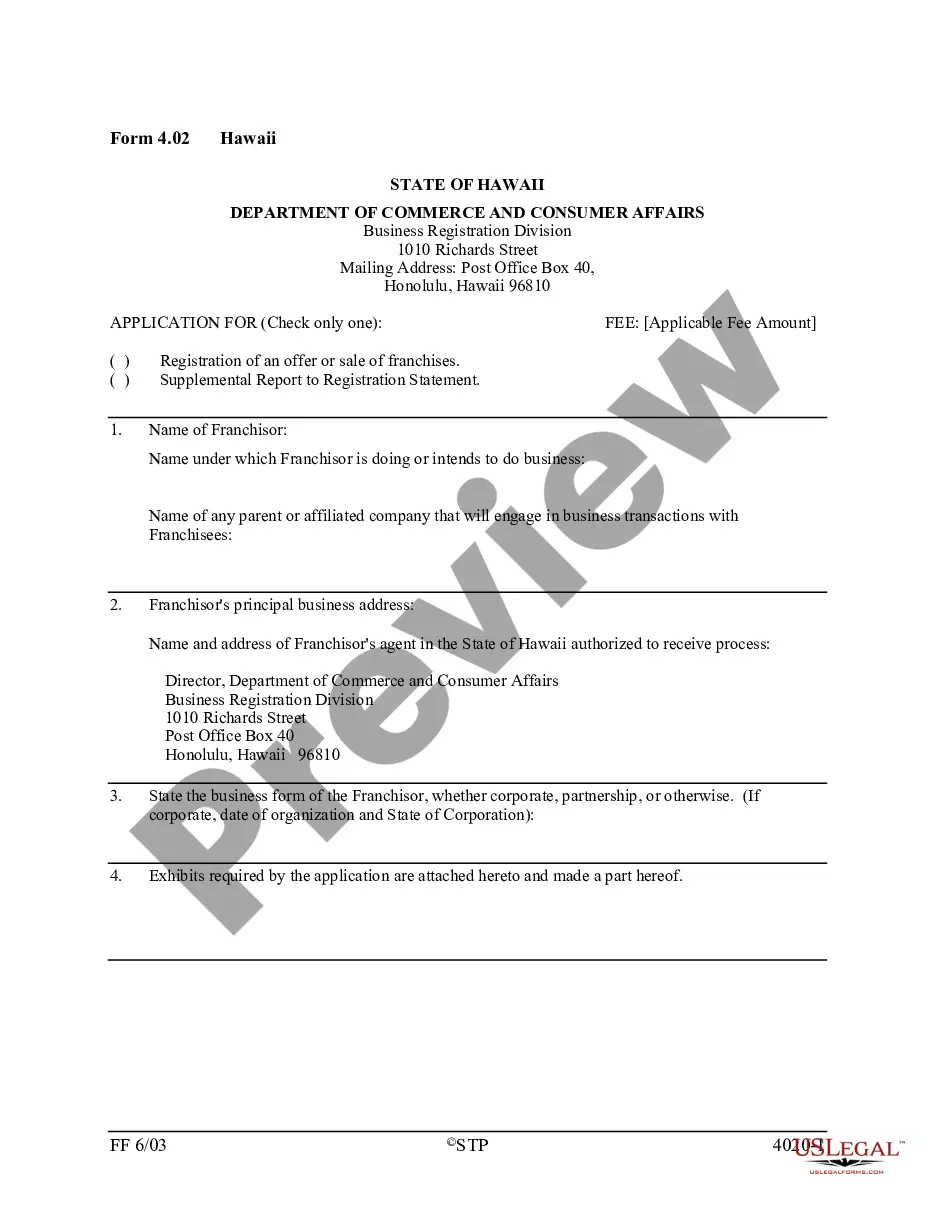

If you're looking for precise California Letter to Lienholder to Notify of Trust document templates, US Legal Forms is exactly what you require; obtain files crafted and assessed by state-licensed lawyers.

Using US Legal Forms not only protects you from issues related to legal paperwork; but you also conserve time and effort, as well as money!

That's all there is to it. With just a few simple clicks, you obtain an editable California Letter to Lienholder to Notify of Trust. Once you have an account, all subsequent orders will be processed even more easily. If you possess a US Legal Forms subscription, simply Log In and click the Download option found on the form’s page. Then, when you need to use this template again, you can always find it in the My documents section. Don't waste your time searching through endless forms on various websites. Purchase professional templates from a single secure platform!

- Begin by completing your registration process by entering your email and setting up a secure password.

- Follow the instructions provided to create an account and locate the California Letter to Lienholder to Notify of Trust template for your needs.

- Use the Preview feature or review the document details (if available) to ensure it is the correct form you are seeking.

- Verify its legitimacy in your residing state.

- Click Buy Now to finalize your purchase.

- Select a suitable pricing plan.

- Establish your account and make payment via credit card or PayPal.

Form popularity

FAQ

Yes, you can place a lien on a trust if the trust holds property that is subject to a debt. The lien typically attaches to the real property owned by the trust and must be properly recorded with the county. It is crucial to follow all legal procedures for ensuring that the lien is valid. If appropriate, a California Letter to Lienholder to Notify of Trust should be sent to inform relevant parties about the lien.

California Form 541 must be filed by all estates and trusts that have gross income of $20,000 or more or have a beneficiary who resides in California. Additionally, any fiduciary responsible for managing the trust must ensure that the form is accurately filled and submitted on time. It is advisable to consult a tax professional to ensure compliance. Don’t forget to issue a California Letter to Lienholder to Notify of Trust if there are outstanding liens.

The IRS form required for filing a trust return is Form 1041, known as the U.S. Income Tax Return for Estates and Trusts. This form records income, deductions, credits, and distributions that the trust makes to its beneficiaries. It is important to accurately complete this form to comply with federal tax obligations. Additionally, remember that notifications may require a California Letter to Lienholder to Notify of Trust.

Finalizing a trust in California entails ensuring that all assets are properly titled in the name of the trust. You’ll also complete all necessary tax filings, such as the California Form 541. Lastly, consider drafting a termination document if the trust is revocable and is meant to end. If you're dealing with outstanding liens, using a California Letter to Lienholder to Notify of Trust might be essential.

Recording a trust in California involves creating a written declaration of trust and possibly funding the trust with assets. You typically do not file the trust document itself with any court or government entity; however, assets held in the trust, like real estate, need to be transferred to the trust. Always check with a legal professional to ensure compliance with state laws, and remember to send a California Letter to Lienholder to Notify of Trust if necessary.

In California, the form you need to file for a trust return is Form 541, also known as the California Fiduciary Income Tax Return. This form accounts for the income earned by the trust, distributions to beneficiaries, and any applicable deductions. Ensure you maintain records of all transactions related to the trust. Don’t forget, when notifying involved parties, you might need to issue a California Letter to Lienholder to Notify of Trust.

Changing your property title to a trust in California requires preparing a new deed that transfers ownership from you to the trust. You must fill out a grant deed or a quitclaim deed, depending on your situation. After preparing the deed, sign it in front of a notary, then record it with the county recorder's office. Keep in mind that a California Letter to Lienholder to Notify of Trust may be needed if there are existing liens on the property.

To file a tax return for a trust in California, you need to use California Form 541. This form specifically addresses income tax reporting for trusts. Additionally, ensure that you gather all relevant financial documents, such as income generated by the trust and any deductions. You might want to consult a tax professional for guidance, especially when drafting a California Letter to Lienholder to Notify of Trust.

The trustee has a legal obligation to keep beneficiaries informed about the trust's activities and financial status. This includes disclosing information such as asset values, income, and significant decisions affecting the trust. A well-crafted California Letter to Lienholder to Notify of Trust is an excellent tool for fulfilling this duty, especially when there are liens or loans associated with trust assets.

Beneficiaries in California should generally expect to be notified about a trust within 60 days after the person's death if they are named in the trust. The trustee is responsible for this communication, which may include sending a California Letter to Lienholder to Notify of Trust if there are assets involved. This timely notification helps beneficiaries understand their rights and the next steps in managing the trust.