California Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description Assumption Of Debt Agreement

How to fill out Assume Deed Of Trust?

If you're trying to find correct California Assumption Agreement of Deed of Trust and Release of Original Mortgagors templates, US Legal Forms is the thing you need; reach documents provided and checked by state-licensed legal representatives. Utilizing US Legal Forms not only keeps you from problems regarding legal documentation; furthermore, you preserve effort and time, and funds! Downloading, printing out, and filling out an expert document is much more affordable than inquiring legal counsel to do it for you personally.

To start, finish your sign up procedure by providing your email and making a security password. Follow the steps beneath to make your account and find the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors exemplar to remedy your circumstances:

- Utilize the Preview solution or look at the file information (if offered) to rest assured that the sample is the one you want.

- Examine its validity in the state you live.

- Click Buy Now to create an order.

- Select a preferred pricing plan.

- Make an account and pay out with the credit card or PayPal.

- Select a convenient file format and conserve the file.

And while, that is it. With a few simple clicks you get an editable California Assumption Agreement of Deed of Trust and Release of Original Mortgagors. After you make your account, all upcoming requests will be worked up even easier. When you have a US Legal Forms subscription, just log in account and click the Download button you see on the for’s webpage. Then, when you need to use this template again, you'll always be able to find it in the My Forms menu. Don't squander your time and energy comparing hundreds of forms on various web sources. Order professional templates from just one secure service!

Deed Of Trust Form California Form popularity

Trust Dissolution Document Other Form Names

California Loan Assumption Agreement Form FAQ

To obtain a copy of your deed of trust in California, you can visit your county recorder's office. They maintain records of all deeds, including the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors. Additionally, you can access some records online through the county’s official website. If you prefer convenience, consider using services like uslegalforms, which simplifies the search for legal documents.

Choosing whether to be on the mortgage or the deed largely depends on your financial situation and investment strategy. Being on the mortgage means you bear the financial responsibility, while being on the deed grants you ownership rights. Consider your long-term goals and risk tolerance when making this decision. If you're involved in agreements like the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, having clear insights will aid in making an informed choice.

Using a deed of trust can provide several advantages over a mortgage. For instance, it typically allows for faster foreclosure in case of default, which can be beneficial for lenders and can lead to lower costs. This structure also allows more flexibility in terms of financing options. If you're considering a transaction involving a California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, recognizing the benefits can help guide your decision.

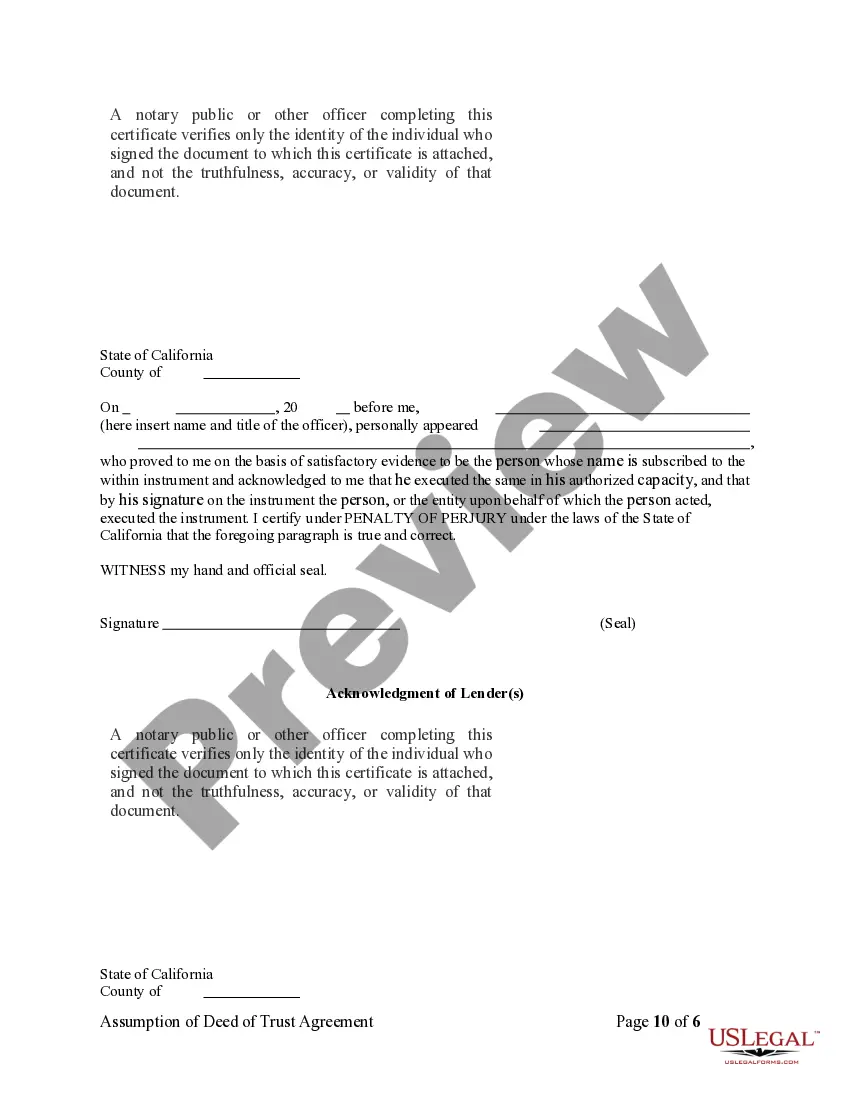

To file a deed of trust in California, you need to prepare the necessary documents, including the deed of trust itself, and gather the required signatures. Following that, file the documents with the county recorder’s office where the property is located. It's essential to ensure everything is filled out correctly to avoid delays. The California Assumption Agreement of Deed of Trust and Release of Original Mortgagors can assist in managing these steps effectively.

Lenders often prefer deeds of trust because they provide a faster and less expensive route to foreclosure. This minimizes their risk, as they can reclaim the property more efficiently in case of default. Additionally, deeds of trust can lead to lower financial losses for lenders, making them more appealing than traditional mortgages. Exploring the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors can further enlighten you on these benefits.

A disadvantage of a deed of trust lies in the non-judicial foreclosure process it enables. This means that lenders can foreclose without court involvement, often making the process quicker and less transparent. As a borrower, this shift in power can leave you with limited options if you face financial difficulties. Understanding details like the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors can help you navigate these challenges.

Releasing a trust typically requires the formal termination of the trust agreement by the trustee. This may involve distributing the trust's assets to the beneficiaries and ensuring all legal obligations are met. If the trust includes a deed of trust, the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors can be a useful tool during the release process.

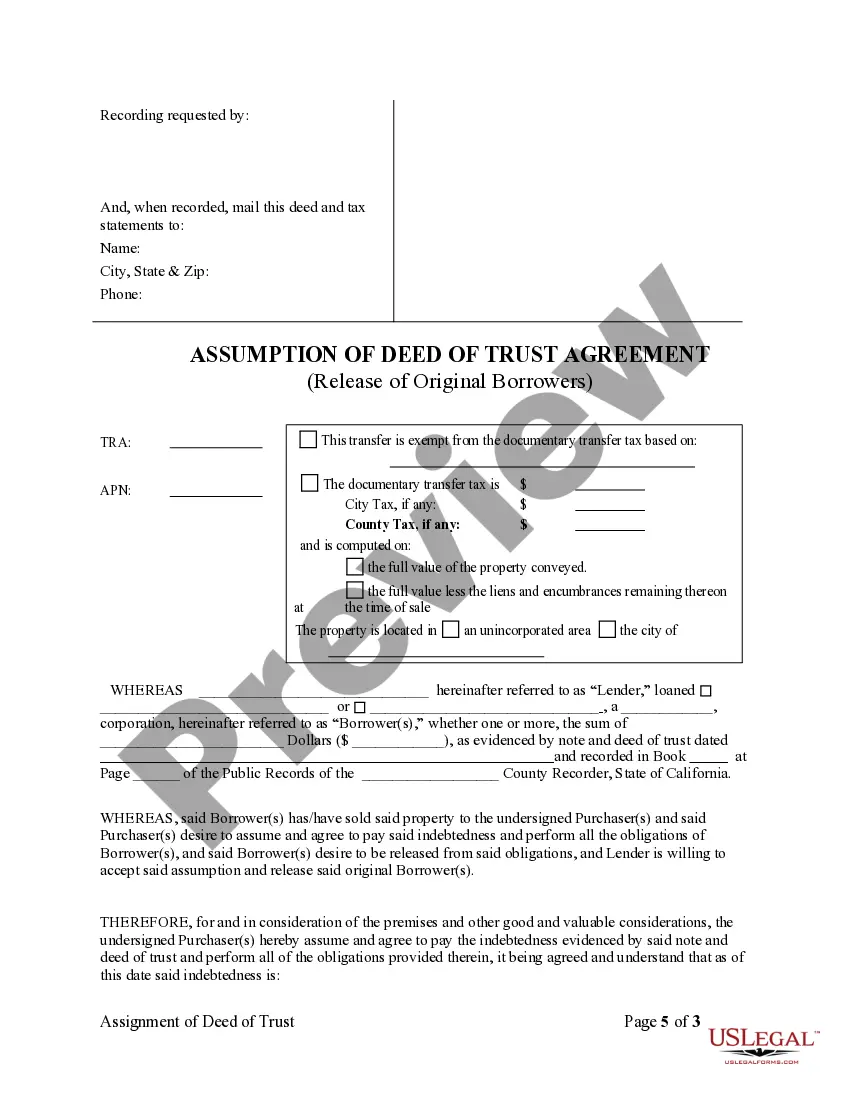

California primarily uses deeds of trust instead of traditional mortgages for real estate transactions. A deed of trust involves three parties: the borrower, the lender, and a trustee, which can simplify foreclosure processes. Understanding this structure is essential when dealing with the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

An assumption and release agreement for a mortgage in California allows one borrower to take over another’s mortgage responsibilities while releasing the original mortgagors from liability. This can be an essential part of the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors. By utilizing such an agreement, all parties can clarify their obligations and ensure a smooth transition.

Yes, you can sell a house with a deed of trust, but there are specific steps to follow. The sale typically involves the buyer assuming the current mortgage obligations, which requires formal agreements like the California Assumption Agreement of Deed of Trust and Release of Original Mortgagors. This process helps ensure that both the seller and buyer are protected during the transaction.