California Guideline Findings Attachment — GovernmentalCFATG-G) is a document used by California state and local governments to report information about their finances and operations. The document outlines the financial and operational findings of governmental agencies and provides a snapshot of the agency’s performance, such as revenue, expenses, and liabilities. CFATG also provides an overview of the agency’s budget and other important financial information. CFATG documents are typically published annually and are available online. There are two types of CFATG documents: the Comprehensive Annual Financial Report (CAR) and the Single Audit Report. The CAR contains audited financial statements and other information about the government’s finances and operations. The Single Audit Report contains a detailed review of an agency’s financial management and compliance with laws and regulations. Both documents are important resources for understanding the financial health of California’s government entities.

California Guideline Findings Attachment - Governmental

Description

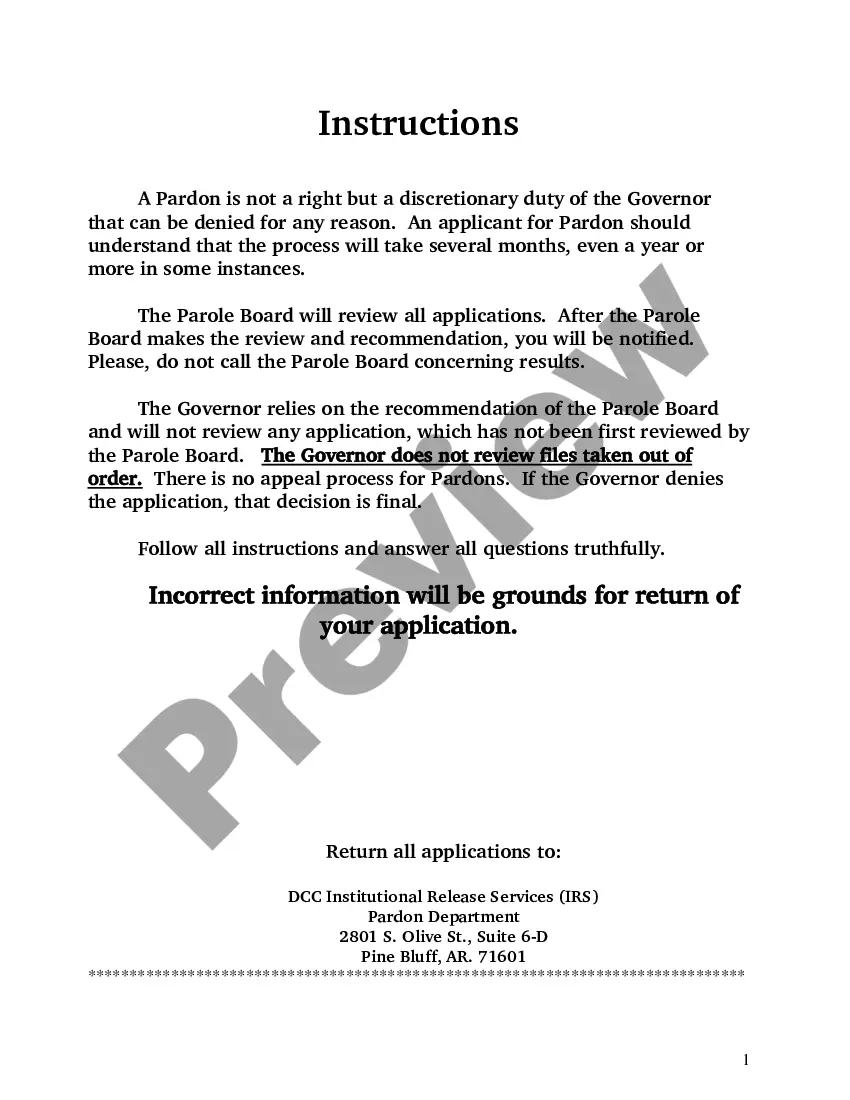

How to fill out California Guideline Findings Attachment - Governmental?

How much duration and assets do you typically allocate to creating formal documentation.

There’s a more efficient method to obtain such forms than engaging legal experts or investing hours scouring the internet for a suitable template.

Another advantage of our library is that you can access previously acquired documents that you safely keep in your profile in the My documents section. Retrieve them at any time and re-complete your paperwork as often as you need.

Save time and effort finalizing formal paperwork with US Legal Forms, one of the most dependable online services. Sign up with us today!

- Browse through the form content to ensure it aligns with your state regulations. To achieve this, examine the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, find another one using the search bar located at the top of the page.

- If you are already registered with our service, Log In and download the California Guideline Findings Attachment - Governmental. Otherwise, continue to the next steps.

- Click Buy now once you identify the suitable blank. Choose the subscription plan that best fits you to access our library’s comprehensive service.

- Register for an account and pay for your subscription. You can complete the payment with your credit card or via PayPal - our service is fully reliable for that.

- Download your California Guideline Findings Attachment - Governmental onto your device and fill it out on a printed hard copy or electronically.

Form popularity

FAQ

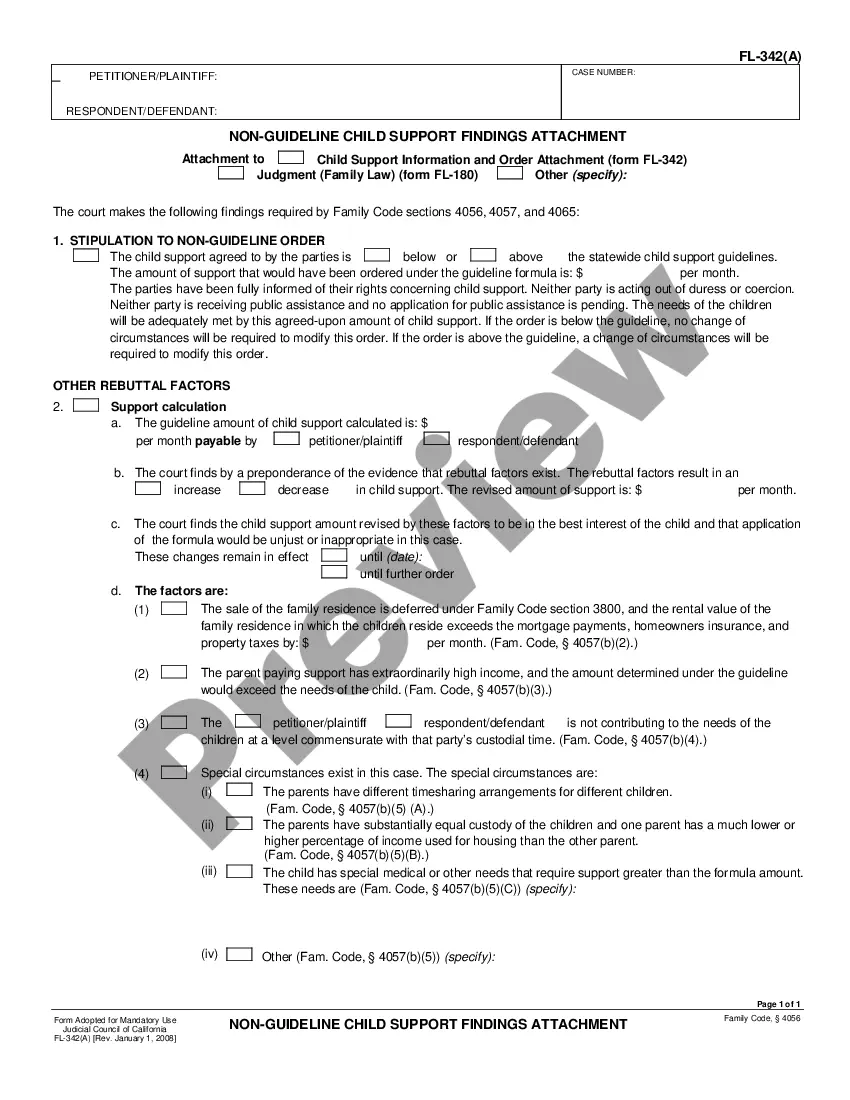

In California, the maximum amount that can be deducted from your paycheck for child support is generally 50% to 65% of your income, depending on whether you are supporting another child or spouse as well. The California Guideline Findings Attachment - Governmental outlines these limits and ensures that your basic living expenses are considered. It's crucial to stay informed about these deductions to manage your finances effectively.

The amount of child support awarded varies widely, but many states, including California, use guidelines to establish averages based on parental income. Under the California Guideline Findings Attachment - Governmental, support amounts can vary depending on circumstances, typically ranging from a few hundred to several thousand dollars a month. It's essential to understand that each case is unique, so consult relevant resources or a legal professional for tailored advice.

The primary factor in calculating child support in California is the income of both parents. The state uses a formula based on the California Guideline Findings Attachment - Governmental to determine fair support amounts. Other considerations include the number of children, health care costs, and any special needs. Understanding these factors can help you prepare for discussions about support.

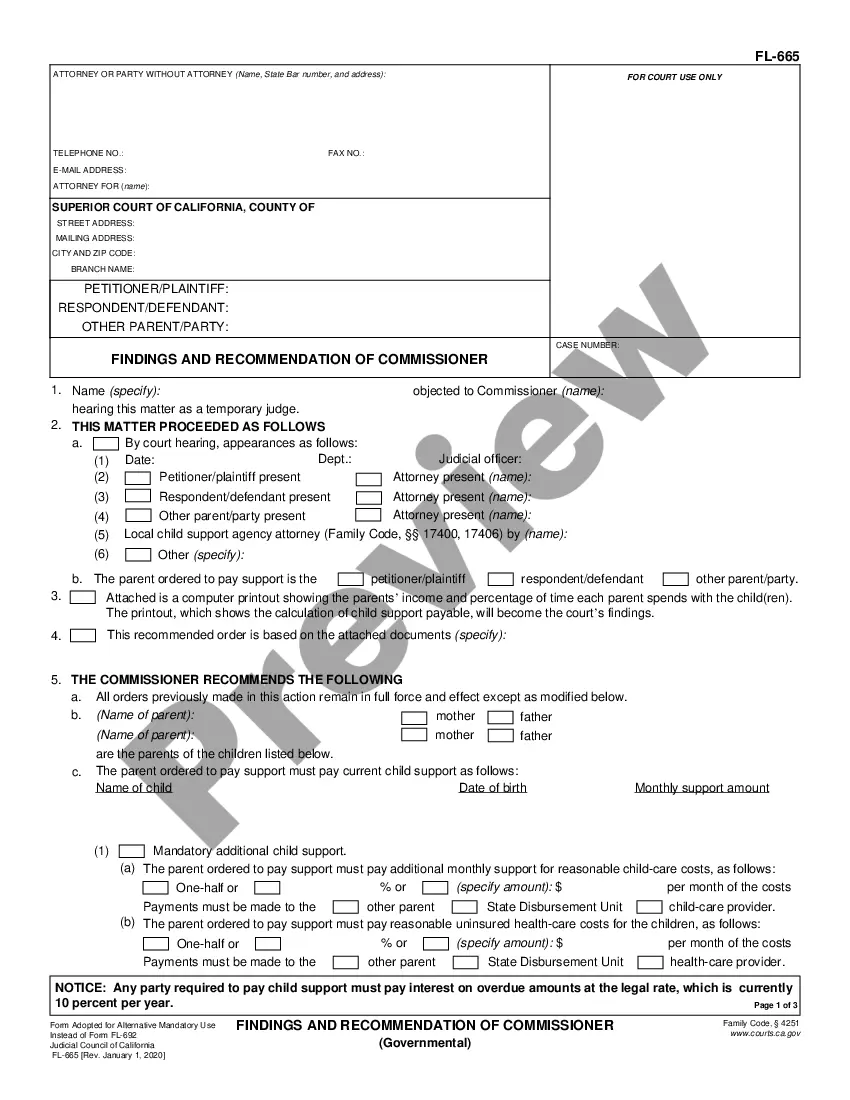

After a hearing in California, the court issues findings and an order that outlines the obligations of each parent regarding child support and custody. The California Guideline Findings Attachment - Governmental provides these essential details, ensuring that both parents understand their roles and responsibilities. It's crucial to review these findings carefully, as they ensure the best interests of the child are prioritized. If you have questions about the order, consult with a legal professional for guidance.

California is often viewed as one of the stricter states regarding child support enforcement. The system emphasizes the importance of meeting obligations, which is reflected in the California Guideline Findings Attachment - Governmental. This means that parents should be prepared for rigorous assessments and potential legal consequences for non-compliance. Knowing this can help you better navigate your responsibilities.

To fill out a child support form, start by gathering necessary financial documents, such as income statements and expenses. You can find the relevant forms in your local courthouse or online, often under the California Guideline Findings Attachment - Governmental section. Be sure to provide accurate and complete information, as this will help ensure a fair assessment. Utilize platforms like US Legal Forms to access user-friendly templates and instructions.

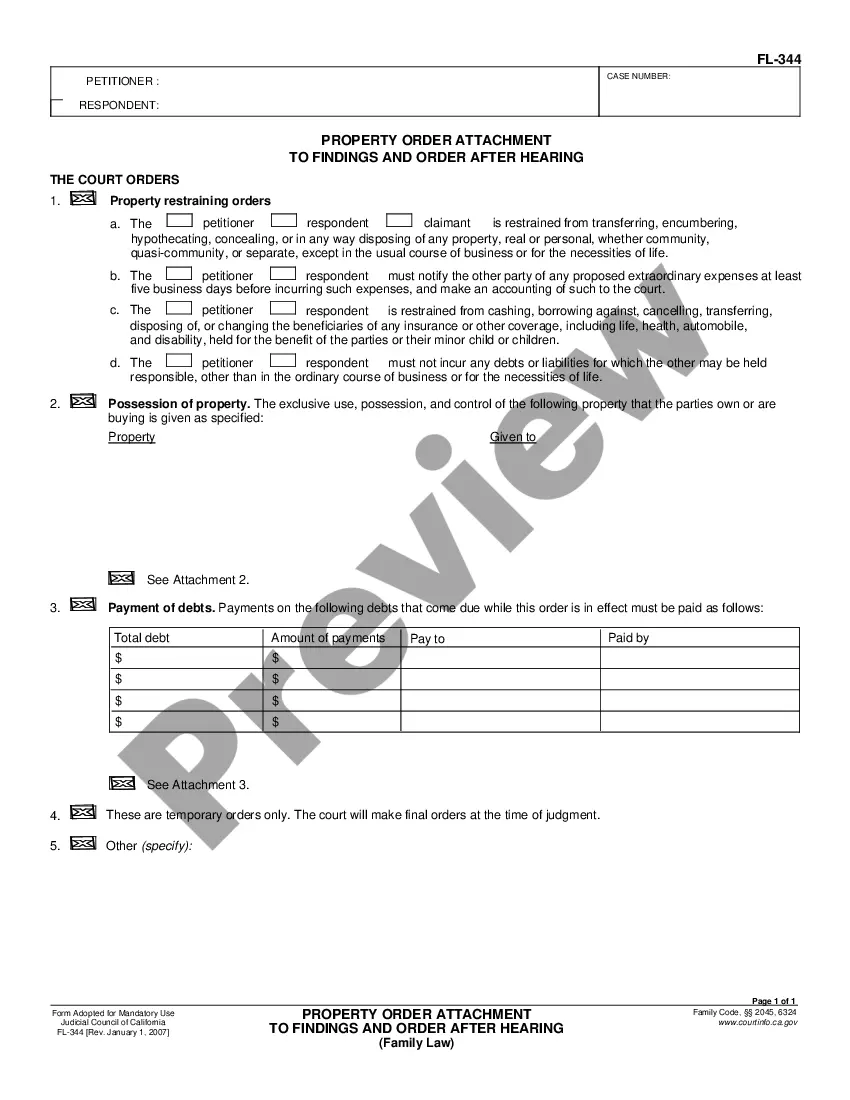

A writ of attachment allows a creditor to seize a debtor's assets to secure a potential judgment. When the court issues the writ, it instructs law enforcement to take possession of the identified assets. This process is governed by the California Guideline Findings Attachment - Governmental, which outlines the legal standards for attachment. Understanding how a writ operates can help you navigate your rights effectively.

Obtaining a writ of attachment in California involves filing a request with the court and presenting a valid legal basis for the attachment. You must provide evidence that supports your claim and shows the necessity of the attachment. The California Guideline Findings Attachment - Governmental provides guidelines that can help clarify your eligibility. Consider using US Legal Forms to streamline the process of document preparation.

In California, you generally have 10 days after obtaining a judgment to file a writ of attachment. This timing is vital to ensure that your rights are protected. If you miss this deadline, you may lose the opportunity to secure the assets in question under the California Guideline Findings Attachment - Governmental. Prompt action often yields better results.

To request a writ of attachment in California, you must file a motion in the court where your case is pending. This involves submitting the required paperwork that outlines the reasons for requesting the attachment. The court will review your request based on the California Guideline Findings Attachment - Governmental standards. Utilizing resources such as US Legal Forms can assist you in preparing the necessary documents effectively.