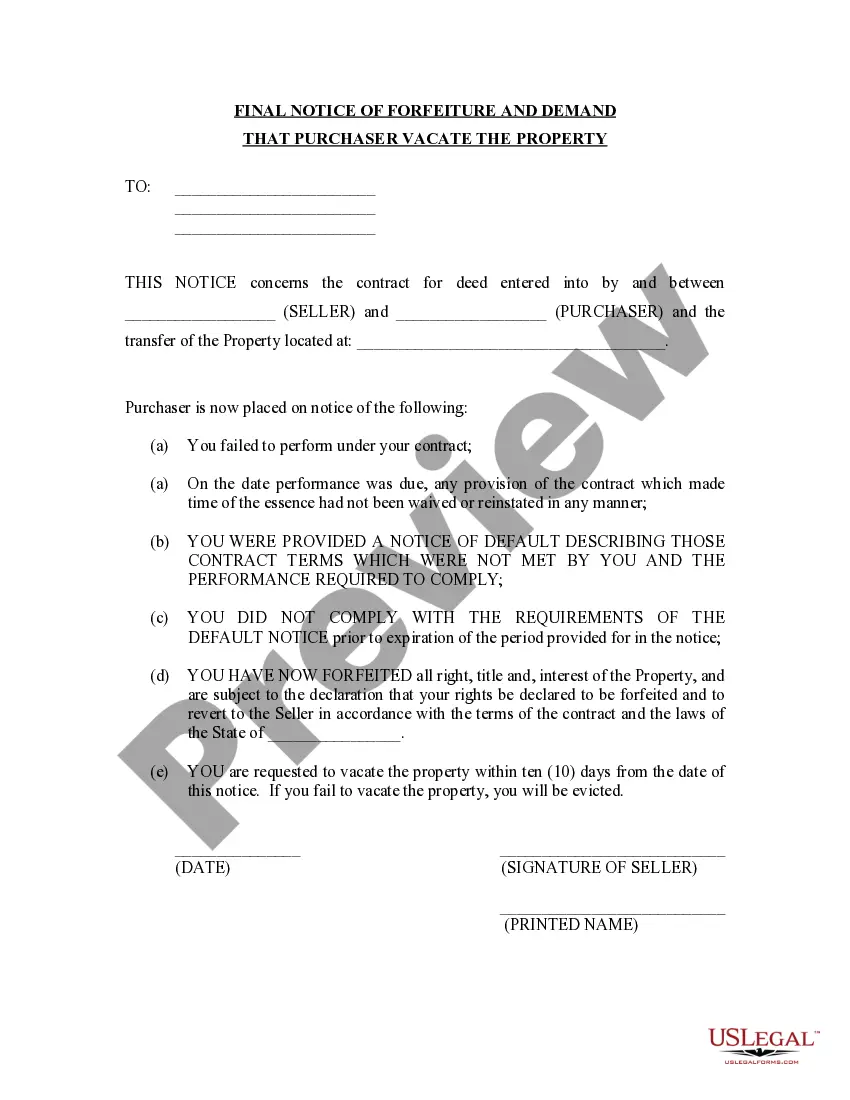

Account Agreement; Terms of Sale: This is an agreement between the Buyer and Seller. It lists, in detail, every element concerning the sale and purchase of the property in question. In particular, the duties of each party are defined, and a description of the property to be sold is included. This form is available in both Word and Rich Text formats.

California Account Agreement and Terms of Sale

Description

How to fill out California Account Agreement And Terms Of Sale?

If you're searching for precise California Account Agreement and Terms of Sale copies, US Legal Forms is just the right thing you need; get documents produced and examined by state-certified lawyers. Making use of US Legal Forms not simply will save you from bothers regarding legal paperwork; you additionally save up effort and time, and funds! Downloading, printing, and submitting a professional form is really cheaper than requesting a lawyer to accomplish it for you.

To start, finish your sign up process by adding your e-mail and making a secret password. Adhere to the instructions below to create your account and find the California Account Agreement and Terms of Sale web template to remedy your needs:

- Take advantage of the Preview option or look at the document information (if provided) to rest assured that the template is the one you need.

- Examine its validness in the state you live.

- Just click Buy Now to make an order.

- Choose a preferred rates plan.

- Create an account and pay with your credit card or PayPal.

- Go with a handy format and preserve the document.

And while, that is it. In a couple of easy clicks you have an editable California Account Agreement and Terms of Sale. When you make an account, all next purchases will be processed even simpler. When you have a US Legal Forms subscription, just log in profile and click the Download key you see on the for’s page. Then, when you need to use this template once again, you'll constantly manage to find it in the My Forms menu. Don't waste your time checking hundreds of forms on various web sources. Purchase precise copies from one trusted service!

Form popularity

FAQ

To contact CA sales and use tax, you can visit the CDTFA website or call their customer service line directly. They provide resources and assistance tailored to your inquiries regarding sales and use tax obligations. Engaging with your California Account Agreement and Terms of Sale can offer insight into what information you’ll need when reaching out.

Filing a CDTFA return involves completing the appropriate forms based on your sales and use tax activities. You can do this online through the CDTFA's website. A solid grasp of your California Account Agreement and Terms of Sale will help you accurately report your figures and avoid potential errors.

To get rid of a sales tax license, you generally need to cancel it with the CDTFA. You must file a final return and check any remaining tax liabilities. It's advisable to review your California Account Agreement and Terms of Sale, as this will guide you through potential implications and responsibilities.

To close your sales and use tax account in California, submit a final sales tax return and indicate your desire to close the account. You can complete this through the CDTFA's online portal. Having a thorough understanding of your California Account Agreement and Terms of Sale helps ensure a smooth process.

To close your California payroll tax account, you should notify the Employment Development Department (EDD). You must submit a final payroll tax return and indicate your intention to close the account. Reviewing your California Account Agreement and Terms of Sale can provide important insights on how to manage accounts effectively.

CDTFA usually processes applications and documents within 4 to 6 weeks. However, processing times can vary depending on the volume of applications. If you have a California Account Agreement and Terms of Sale, you can check the status of your application online for quicker updates.

Yes, the California Franchise Tax Board does offer payment plans to assist taxpayers. If you are looking to manage your tax obligations referenced in your California Account Agreement and Terms of Sale, setting up a payment plan can provide financial relief. It is advisable to reach out to them directly or seek help through USLegal to navigate the application process easily.

Form 3567 is the form used to request a payment plan from the California Franchise Tax Board. Completing this form is an essential step when you are looking to manage your financial responsibilities detailed in your California Account Agreement and Terms of Sale. The information you provide will help the board assess your eligibility for a payment plan. Access our platform for guidance on filling out this form correctly.

Yes, California recognizes installment sales under specific conditions. This can be beneficial in managing your financial obligations detailed in your California Account Agreement and Terms of Sale. Make sure to fully understand how these sales work to avoid complications. If you have further questions about how this impacts your situation, USLegal provides insightful articles and FAQs to help you navigate.

Yes, you can negotiate with the California Franchise Tax Board. It is possible to discuss payment arrangements or dispute a tax determination concerning your California Account Agreement and Terms of Sale. Approaching these negotiations can be complex, but the USLegal platform offers helpful resources and templates to assist you in crafting your case effectively.