This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

California Schedule of Fees

Description

How to fill out California Schedule Of Fees?

If you're looking for proper California Schedule of Fees samples, US Legal Forms is the thing you need; find files made and verified by state-accredited legal representatives. Making use of US Legal Forms not only helps save from worries regarding legal documentation; you also help save time and effort, and cash! Downloading, printing out, and filling in a professional document is much less expensive than inquiring a solicitor to accomplish it for you personally.

To start, complete your sign up process by adding your email and making a password. Follow the steps listed below to make an account and get the California Schedule of Fees sample to deal with your situation:

- Make use of the Preview solution or see the file description (if provided) to make sure that the template is the one you want.

- Check its validity in your state.

- Just click Buy Now to create an order.

- Pick a preferred pricing program.

- Create an account and pay out with your bank card or PayPal.

- Go with a handy formatting and store the the form.

And while, that’s it. In just a few easy actions you own an editable California Schedule of Fees. After you make your account, all upcoming orders will be processed even easier. Once you have a US Legal Forms subscription, just log in profile and then click the Download key you see on the for’s web page. Then, when you need to use this sample again, you'll constantly be able to find it in the My Forms menu. Don't waste your time and energy comparing hundreds of forms on various platforms. Buy professional documents from a single trusted service!

Form popularity

FAQ

In California, jury fees need to be posted before a trial begins, typically at least five days prior to the scheduled court date. This ensures that the court has the necessary resources to arrange a jury for your case. Understanding the California Schedule of Fees will help you identify the exact amount and process for posting these fees. By being proactive, you can avoid delays and keep your legal proceedings on track.

Filling out Schedule CA 540 involves a few key steps to ensure accuracy. First, gather your financial documents, including your income statements and any deductions you may claim. Next, follow the instructions provided in the California Schedule of Fees, carefully inputting your income and adjustments. Consider using resources from USLegalForms to simplify this process, as they offer detailed guidance and templates tailored for California tax requirements.

Schedule CA 540 should be filed by California residents when they prepare their state tax returns. This includes individuals reporting their income, adjustments, and credits accurately. Understanding the California Schedule of Fees is essential, as it impacts the calculations and potential refunds you might expect. If you need assistance, platforms like uslegalforms can provide tailored resources to help you navigate the filing process smoothly.

The Schedule CA is not explicitly a business tax return, but it is an important part of California's income tax form. It serves as an adjustment schedule for California's tax purposes and helps taxpayers align their financial data with state regulations. Knowledge of the California Schedule of Fees is crucial, as it helps ensure you understand any associated costs in filing your taxes. Consider consulting a tax expert for additional clarity.

To form an LLC in California affordably, consider using online services that provide step-by-step guidance. These platforms typically offer reasonable rates and may include essential documents needed for filing. Additionally, be aware of the California Schedule of Fees, as it outlines costs associated with forming an LLC, such as filing fees and necessary permits. By researching options and possible discounts, you can save on overall costs.

The fee for filing in small claims court depends on the amount of the claim: $30 if the claim is for $1,500 or less, $50 if the claim is for more than $1,500 but less than or equal to $5,000, or $75 if the claim is for more than $5,000.

File your divorce papers and settlement agreement You will have to pay a filing fee, currently $435 when you file your petition for summary dissolution and other documents with the court clerk. If you can't afford to pay the filing fee, you can request a fee waiver from the court.

The fee for filing in small claims court depends on the amount of the claim: $30 if the claim is for $1,500 or less, $50 if the claim is for more than $1,500 but less than or equal to $5,000, or $75 if the claim is for more than $5,000.

(b) At least one party demanding a jury on each side of a civil case shall pay a nonrefundable fee of one hundred fifty dollars ($150), unless the fee has been paid by another party on the same side of the case. The fee shall offset the costs to the state of providing juries in civil cases.

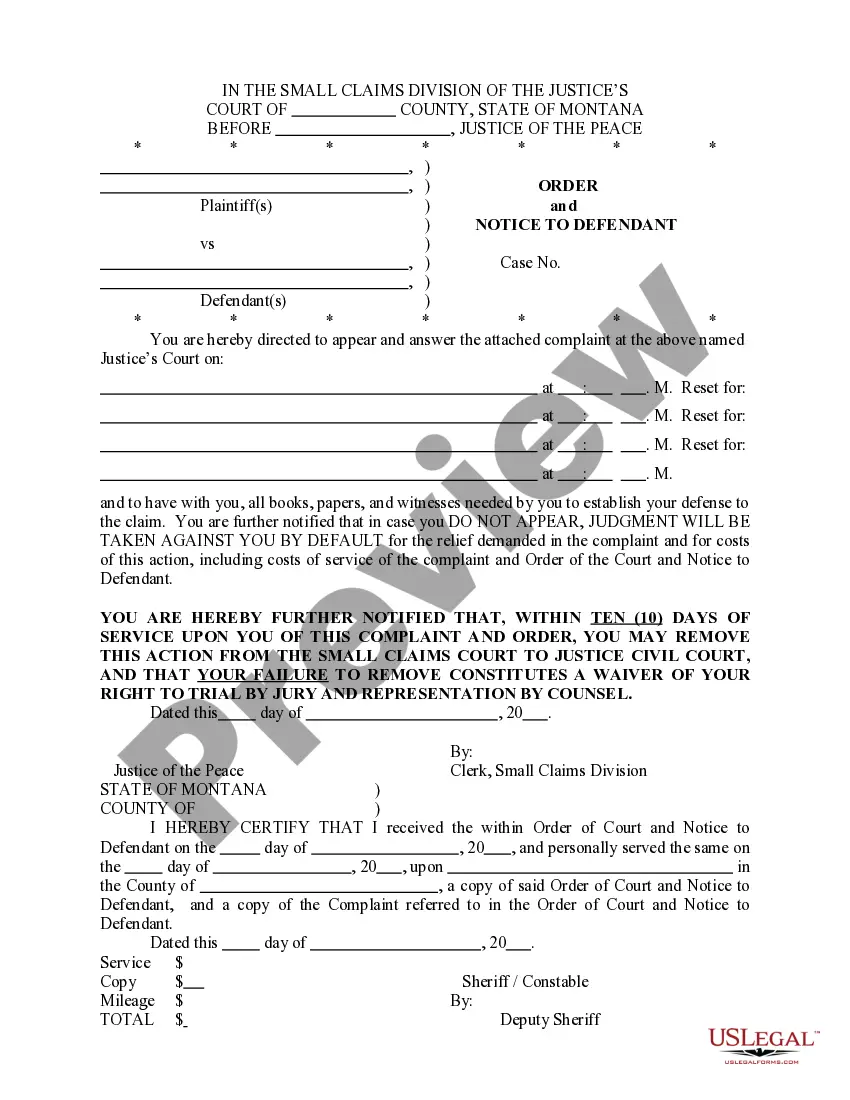

Figure Out How to Name the Defendant. Ask for Payment. Find the Right Court to File Your Claim. Fill Out Your Court Forms. File Your Claim. Serve Your Claim. Go to Court.