This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

California Schedule A, Receipts, Pensions, Annuities, and other Regular Periodic Payments-Standard Account

Description

How to fill out California Schedule A, Receipts, Pensions, Annuities, And Other Regular Periodic Payments-Standard Account?

If you're trying to find correct California Schedule A, Receipts, Pensions, Annuities, and other Regular Periodic Payments-Standard Account samples, US Legal Forms is what exactly you need; reach files developed and examined by state-certified legal professionals. Using US Legal Forms not only keeps you from bothers relating to lawful papers; furthermore, you save up effort and time, and funds! Downloading, printing out, and completing a professional form is much more affordable than inquiring an attorney to accomplish it for you personally.

To get going, finish your enrollment process by adding your email and making a password. Follow the instructions below to make an account and find the California Schedule A, Receipts, Pensions, Annuities, and other Regular Periodic Payments-Standard Account template to deal with your issues:

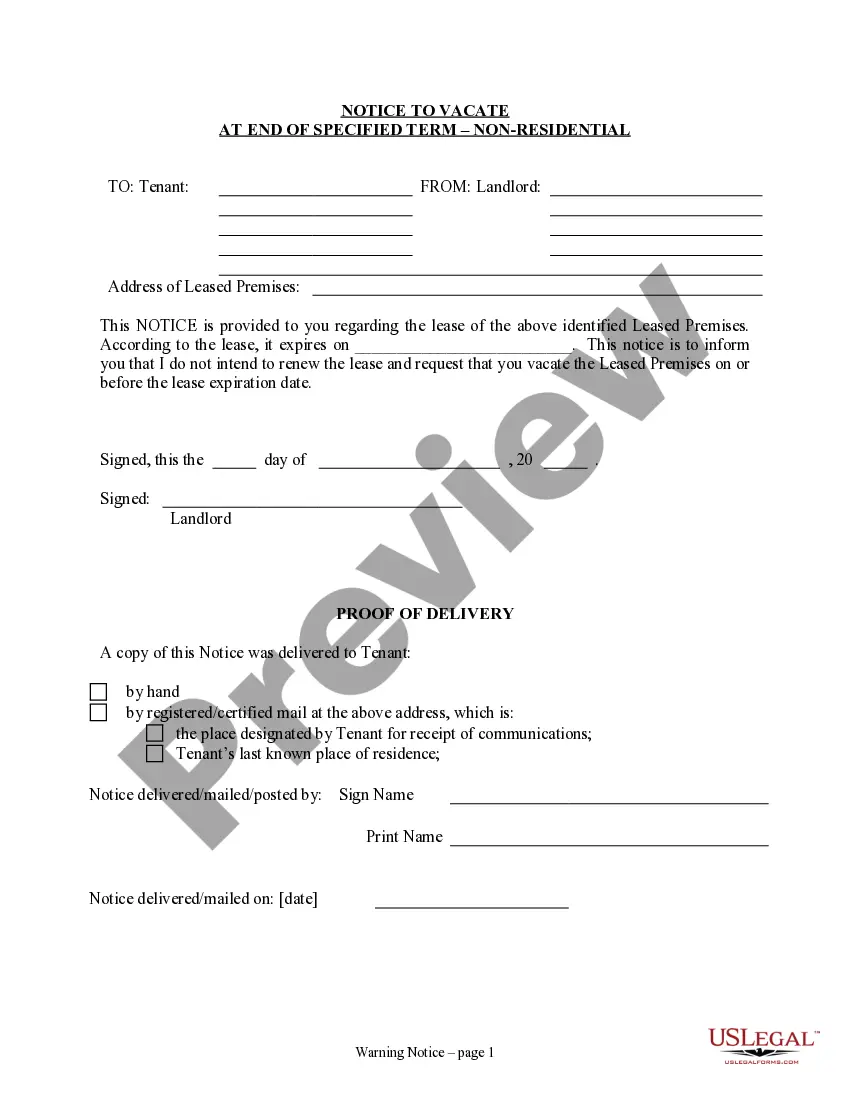

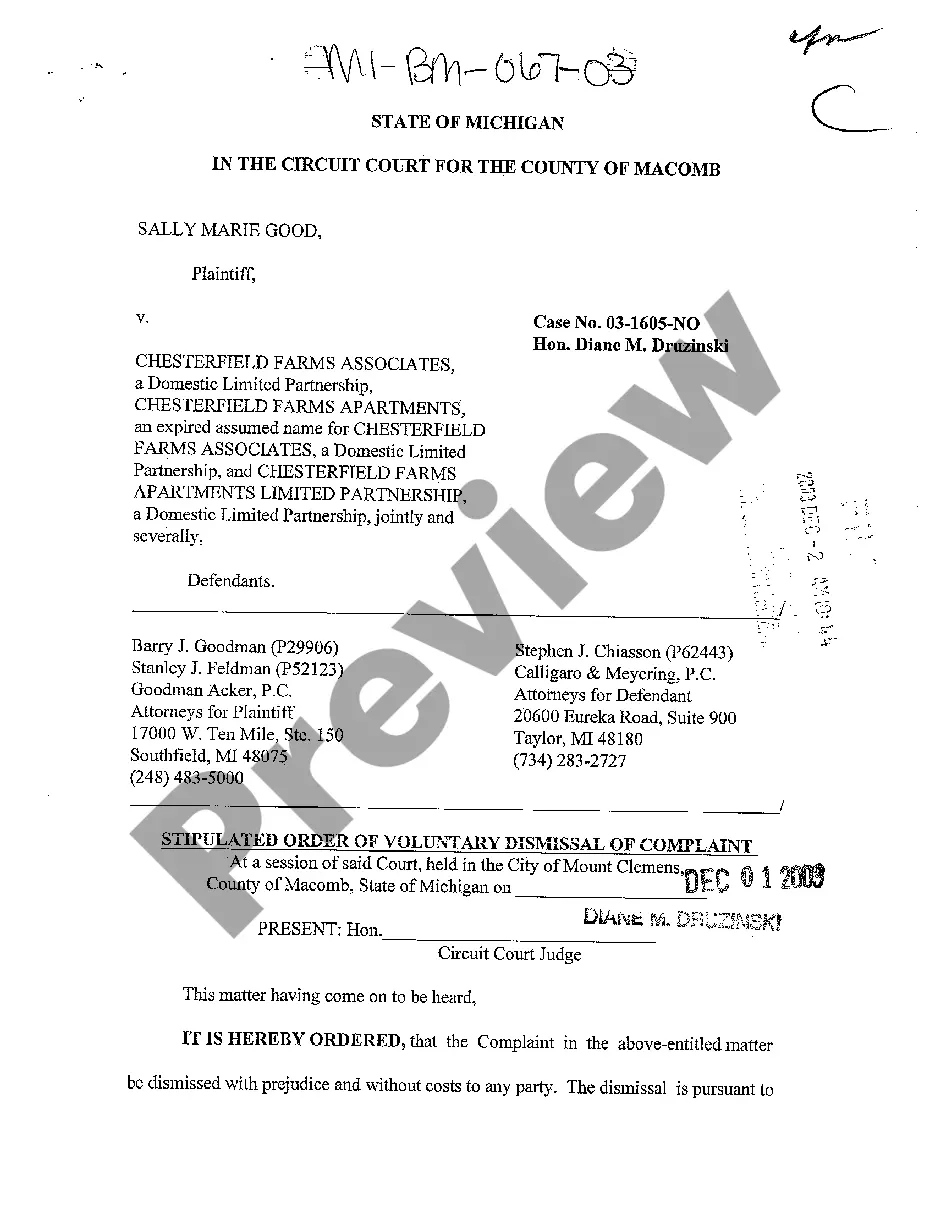

- Make use of the Preview tool or look at the file information (if provided) to ensure that the web template is the one you require.

- Check out its applicability where you live.

- Click Buy Now to create an order.

- Go with a preferred rates program.

- Create your account and pay with your visa or mastercard or PayPal.

- Pick an appropriate format and download the document.

And while, that is it. With a few simple actions you get an editable California Schedule A, Receipts, Pensions, Annuities, and other Regular Periodic Payments-Standard Account. After you create an account, all upcoming requests will be worked up even simpler. Once you have a US Legal Forms subscription, just log in account and then click the Download button you can find on the for’s web page. Then, when you should employ this blank once again, you'll constantly manage to find it in the My Forms menu. Don't squander your time comparing countless forms on several websites. Order accurate copies from just one secure service!

Form popularity

FAQ

Schedule A is required in any year you choose to itemize your deductions. The schedule has seven categories of expenses: medical and dental expenses, taxes, interest, gifts to charity, casualty and theft losses, job expenses and certain miscellaneous expenses.

Schedule A is the tax form used by taxpayers who choose to itemize their deductible expenses rather than take the standard deduction. Tax law changes in 2017 as a result of the Tax Cuts and Jobs Act (TCJA) eliminated many deductions and also nearly doubled the amount of the standard deduction.

Use Schedule A (Form 1040) to figure your itemized deductions.If you itemize, you can deduct a part of your medical and dental expenses, and amounts you paid for certain taxes, interest, contributions, and other expenses. You can also deduct certain casualty and theft losses.

Taxes You Paid Deductions for state and local sales tax (SALT), income, and property taxes can be itemized on Schedule A. The total amount you are claiming for state and local sales, income, and property taxes cannot exceed $10,000.

Schedule A is an IRS form used to claim itemized deductions on your tax return. You fill out and file a Schedule A at tax time and attach it to or file it electronically with your Form 1040. The title of IRS Schedule A is Itemized Deductions.

Also known as U.S. Tax Return for Seniors, Internal Revenue Service (IRS) Form 1040-SR is a result of the Bipartisan Budget Act of 2018. It has larger text and less shading than the regular 1040 to help older folks whose vision isn't what it used to be.

The simplest IRS form is the Form 1040EZ. The 1040A covers several additional items not addressed by the EZ. And finally, the IRS Form 1040 should be used when itemizing deductions and reporting more complex investments and other income. Here are a few general guidelines on which form to use.

Medical and Dental Expenses. State and Local Taxes. Mortgage and Home Equity Loan Interest. Charitable Deductions. Casualty and Theft Losses. Eliminated Itemized Deductions.