This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

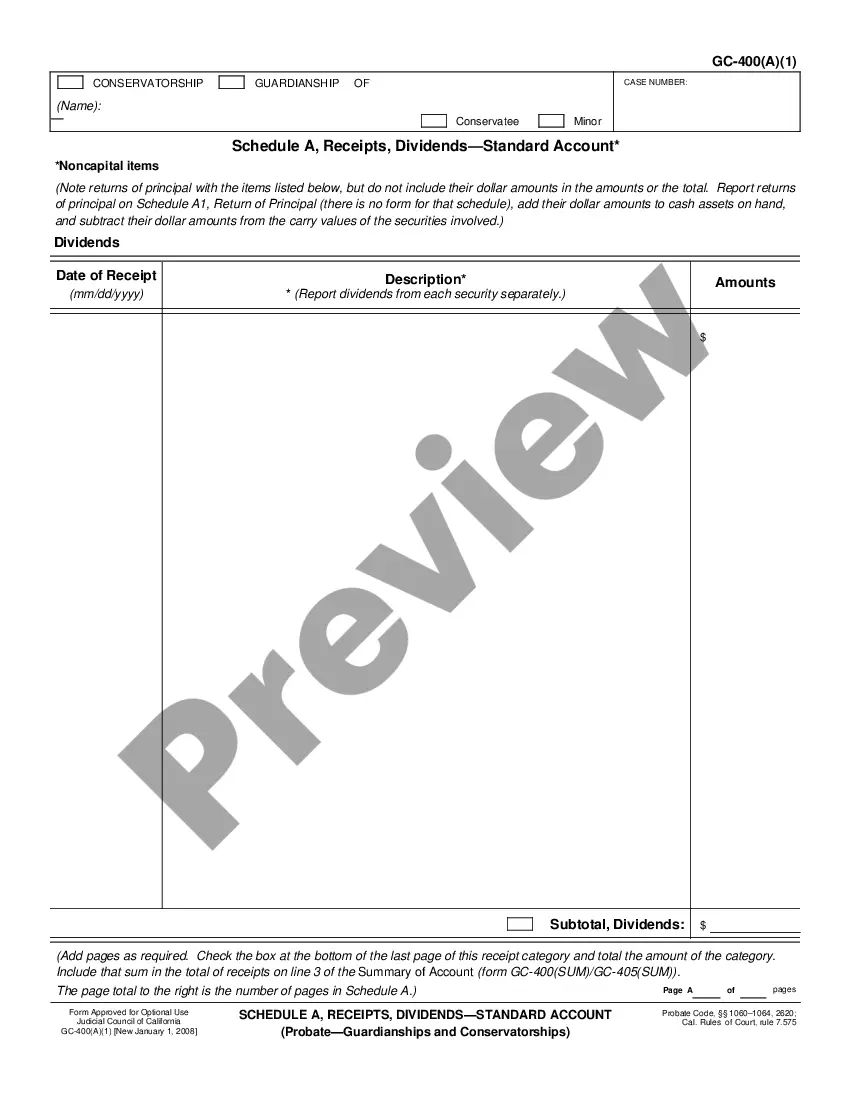

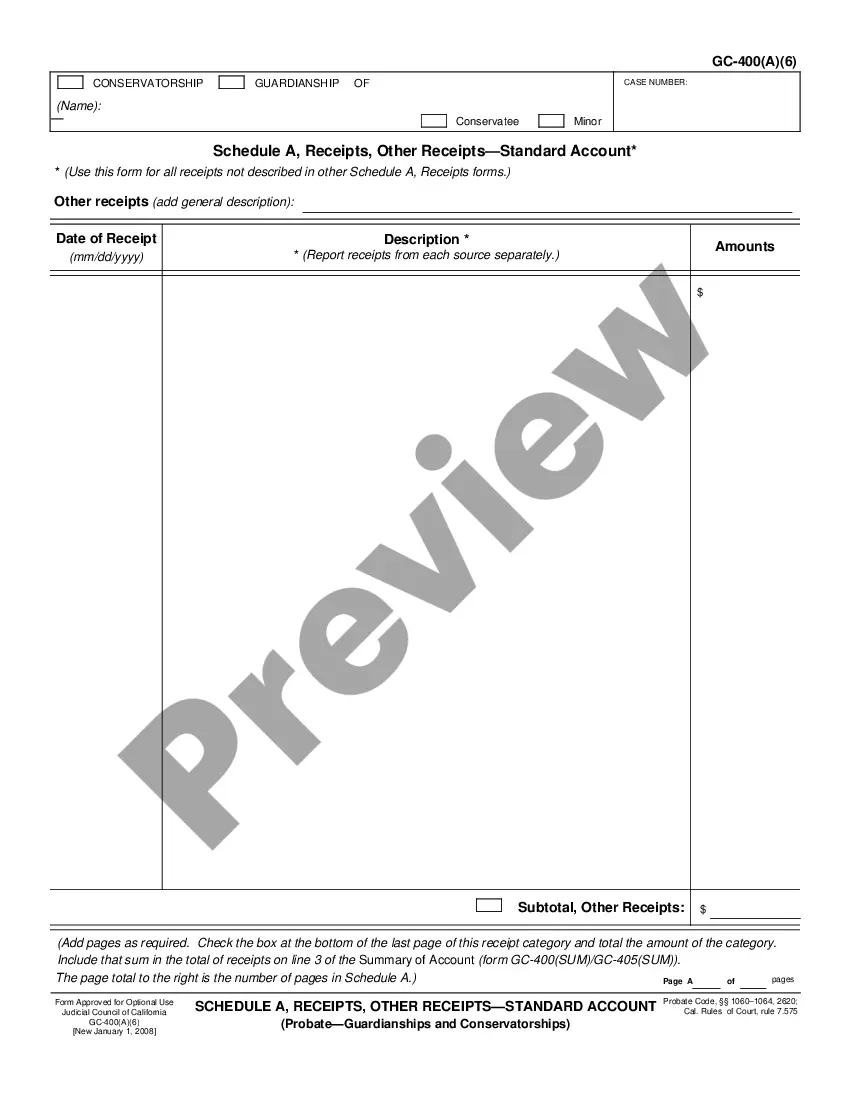

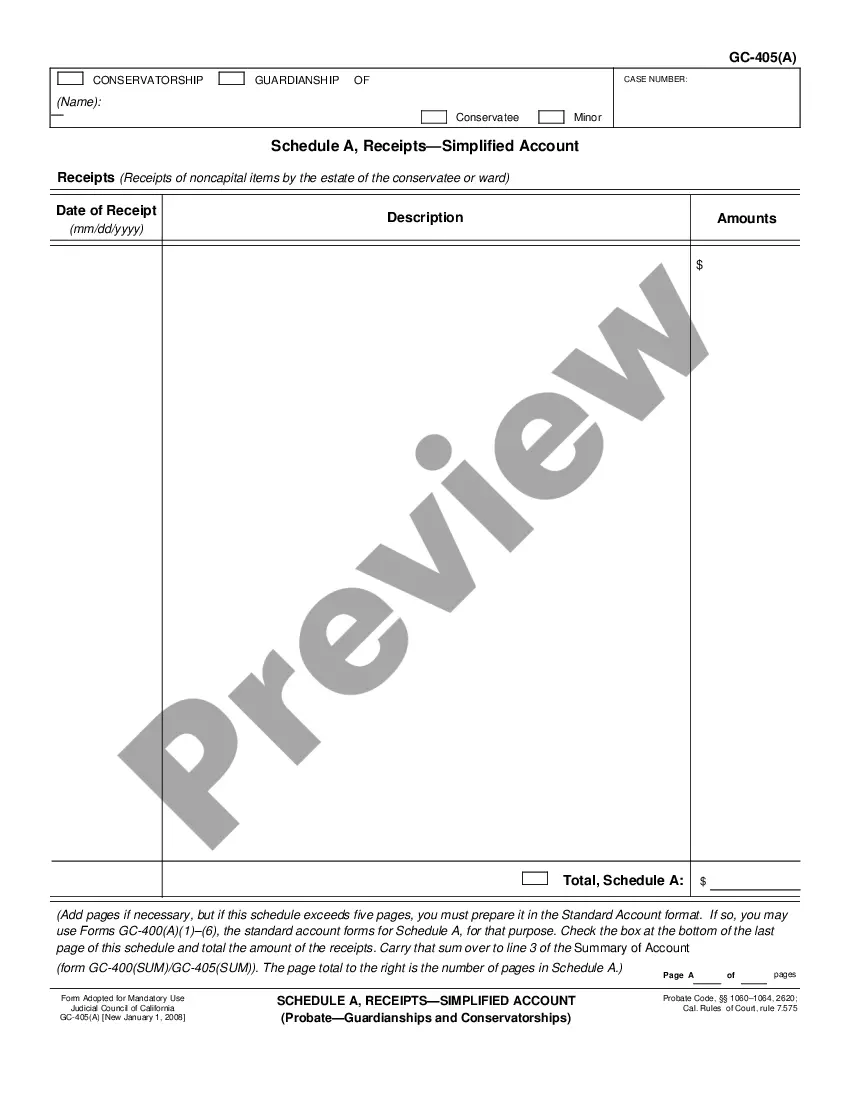

California Schedule A, Receipts, Rent-Standard Account

Description

How to fill out California Schedule A, Receipts, Rent-Standard Account?

If you are seeking precise California Schedule A, Receipts, Rent-Standard Account templates, US Legal Forms is what you require; locate documents crafted and verified by state-licensed attorneys.

Using US Legal Forms not only shields you from hassles corresponding to legal documents; moreover, you save time, effort, and costs!

And that’s it. In just a few easy clicks, you have an editable California Schedule A, Receipts, Rent-Standard Account. Once you set up your account, all subsequent orders will be processed even more easily. After obtaining a US Legal Forms subscription, simply Log In to your account and then click the Download button you can find on the form’s webpage. Then, whenever you need to use this template again, you'll always find it in the My documents section. Don't waste your time searching multiple forms across different platforms. Order accurate documents from just one secure service!

- Downloading, printing, and submitting a professional template is significantly less expensive than hiring an attorney to handle it for you.

- To begin, complete your registration process by entering your email and creating a password.

- Follow the instructions below to establish an account and acquire the California Schedule A, Receipts, Rent-Standard Account sample to address your needs.

- Use the Preview option or review the file description (if available) to ensure that the form is the correct one you need.

- Verify its validity in your residing state.

- Click Buy Now to place an order.

- Select a recommended pricing plan.

- Create your account and make payment using your credit card or PayPal.

Form popularity

FAQ

Yes, California does require landlords to provide rent receipts upon request. This necessity forms part of the legal standards outlined in the California Schedule A, Receipts, Rent-Standard Account. By maintaining accurate records, both landlords and tenants protect their financial interests and comply with state regulations. If you need assistance in generating professional-looking receipts, consider using platforms like USLegalForms to simplify the process.

Filling in Your Tax Return Use black or blue ink on the tax return you send to the FTB. Enter your social security number(s) (SSN) or individual taxpayer identification number(s) (ITIN) at the top of Form 540, Side 1. Print numbers and CAPITAL LETTERS between the combed lines. Be sure to line up dollar amounts.

Do not attach a federal return unless the client is filing Form 540 with any federal schedules other than Schedule A or Schedule B, Long or Short Form 540NR, or a return for an RDP couple. Note: For e-file, your software should transmit the federal return, when it is required, with the state return.

Apportioned revenue is the label applied to income that is only partially subject to taxes.Before determining the taxable revenue, the shop owner first subtracts his operating expenses and depreciation on equipment. Apportioned revenue is the default revenue label for business income.

Apportionment is the determination of the percentage of a business' profits subject to a given jurisdiction's corporate income or other business taxes. U.S. states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders.

Requirements for Children with Investment Income For each child under age 19 or student under age 24 who received more than $2,200 of investment income in 2020, complete Form 540 and form FTB 3800, Tax Computation for Certain Children with Unearned Income, to figure the tax on a separate Form 540 for your child.

The word apportionment generally refers to the division of net income between jurisdiction by the use of a formula containing apportionment factors, and the word allocation generally refers to the assignment of net income to a particular jurisdiction.

A Form 540 is also known as a California Resident Income Tax Return.This form is used each year to file taxes and determine if the filer owes taxes or is entitled to a tax refund. The form will be sent to the state organization that processes and records the tax information.

This schedule is used by all taxpayers who are required to apportion business income.The market assignment method and single-sales factor apportionment may result in California sourced income or apportionable business income if a taxpayer is receiving income from intangibles or services from California sources.

Apportionment formulas are designed to allocate to a taxing state, for tax purposes, a share of a company's income that corresponds to its business activity in the state. State formulas use one or more factors to determine each company's overall income apportionment percentage.