This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

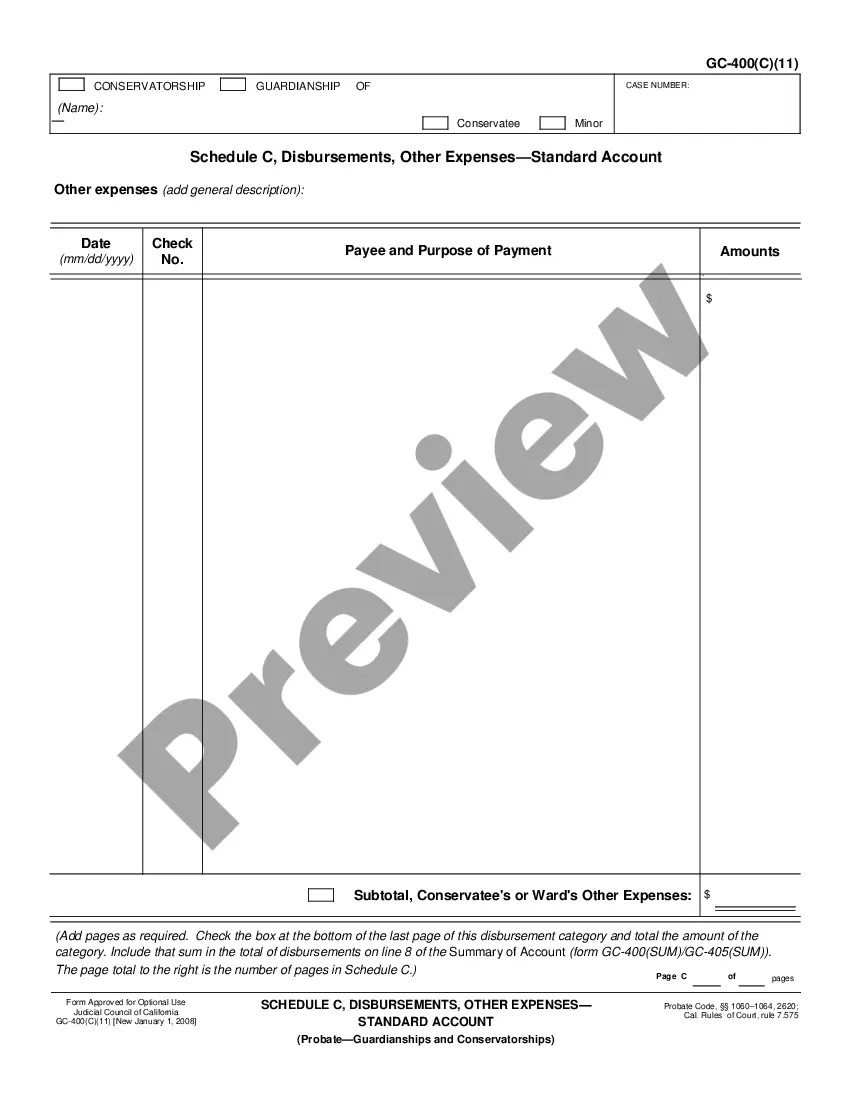

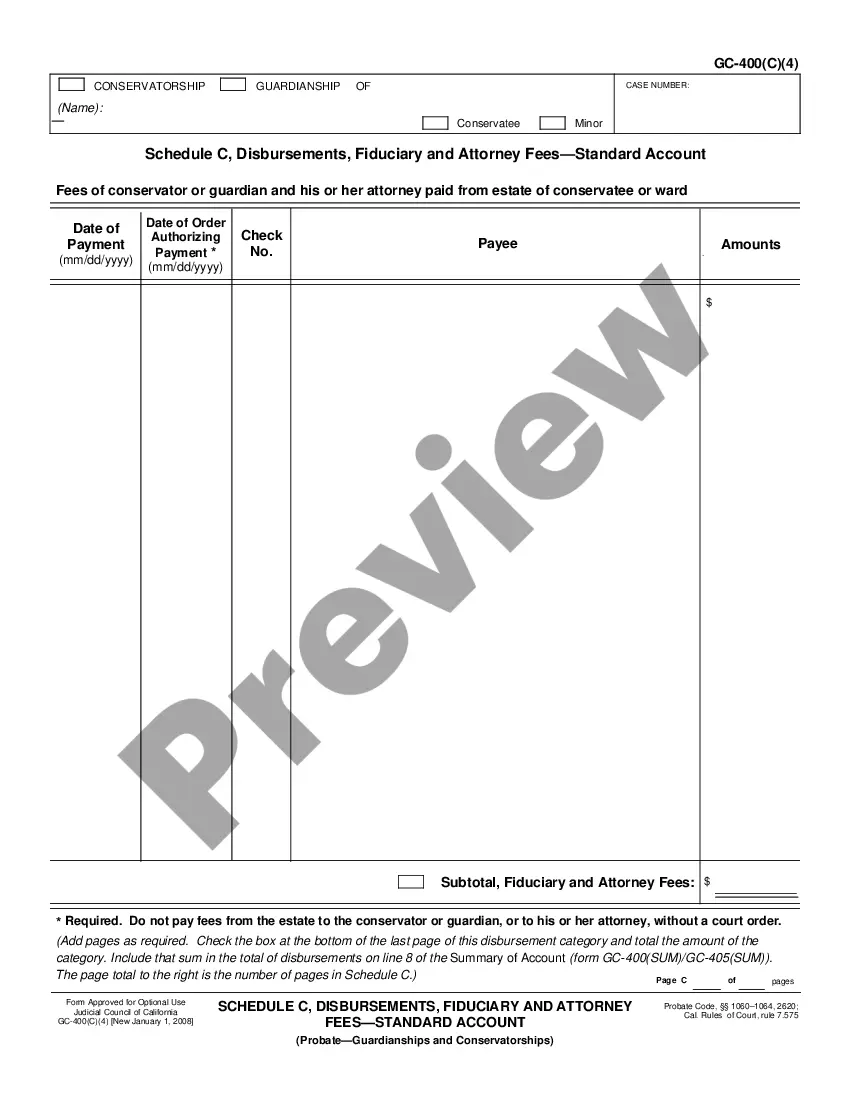

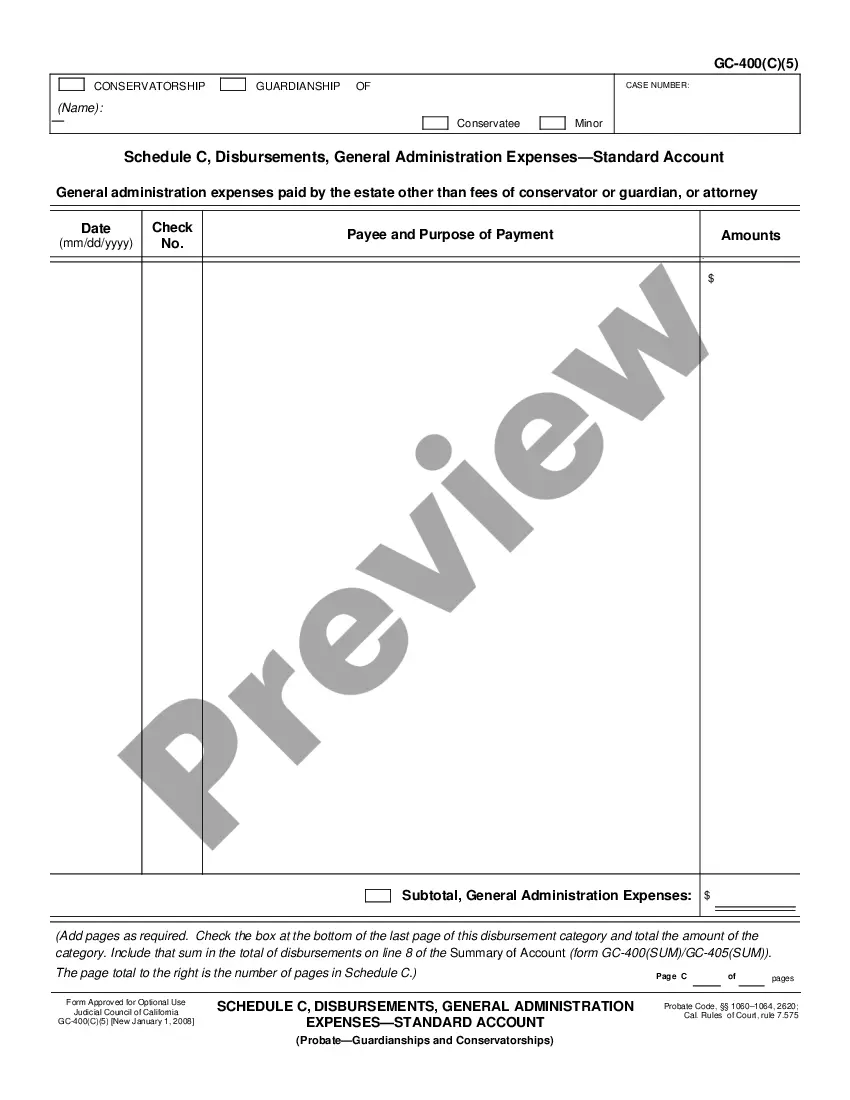

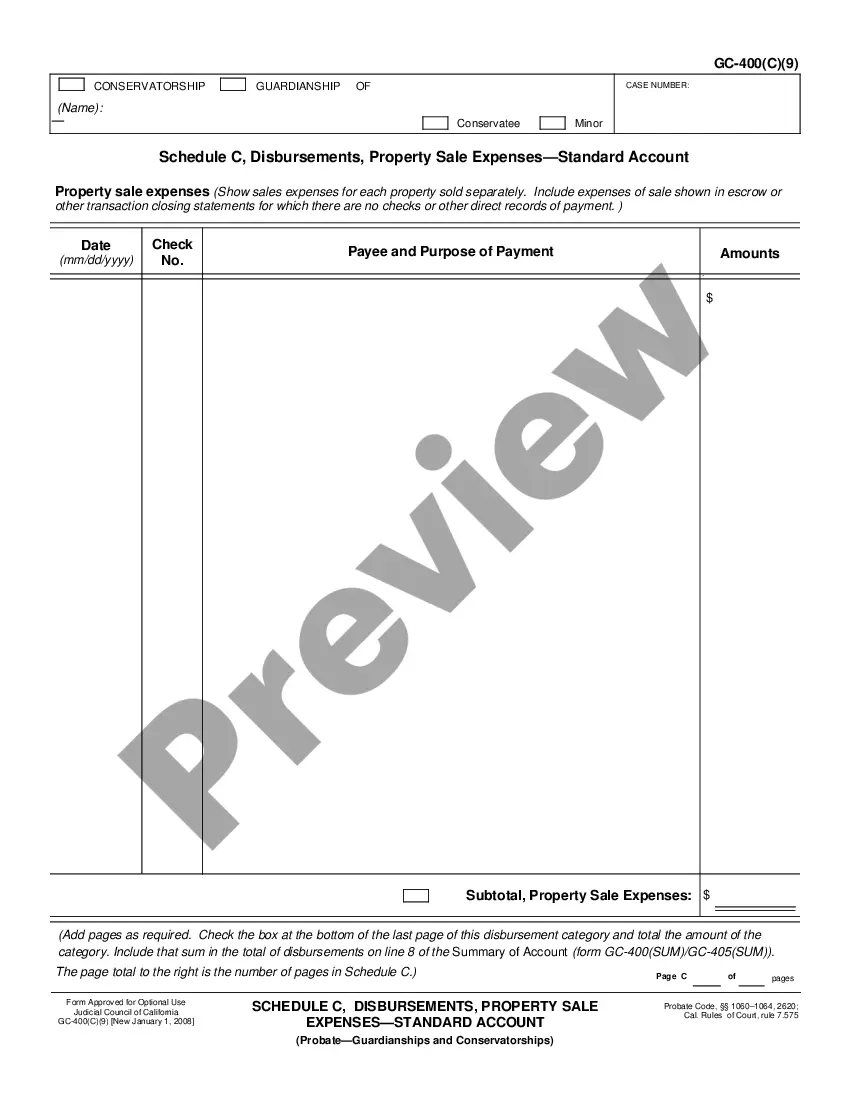

California Schedule C, Disbursements, Investment Expenses - Standard Account

Description

How to fill out California Schedule C, Disbursements, Investment Expenses - Standard Account?

If you're looking for precise California Schedule C, Disbursements, Investment Expenses - Standard Account copies, US Legal Forms is exactly what you require; access documents crafted and validated by state-certified attorneys.

Utilizing US Legal Forms not only alleviates concerns regarding official documents; you also save effort, time, and money! Downloading, printing, and completing a professional template is considerably less expensive than hiring a lawyer to draft it for you.

And that's it. In just a few simple clicks, you obtain an editable California Schedule C, Disbursements, Investment Expenses - Standard Account. Once you create your account, all future orders will be processed even more easily. After obtaining a US Legal Forms subscription, simply Log In to your profile and click the Download button visible on the form’s page. Then, when you need to use this template again, you'll always be able to find it in the My documents section. Don’t waste your time and energy searching through multiple forms on different websites. Purchase accurate templates from a single secure source!

- To start, complete your registration process by providing your email and creating a password.

- Follow the provided instructions to set up your account and locate the California Schedule C, Disbursements, Investment Expenses - Standard Account template to address your needs.

- Utilize the Preview feature or review the document description (if available) to ensure that the template is suitable for your requirements.

- Verify its legality in your residing state.

- Click Buy Now to place an order.

- Select a preferred pricing plan.

- Create your account and make a payment via credit card or PayPal.

- Choose a convenient format and download the form.

Form popularity

FAQ

For 2020, the standard deduction is $12,400 for single filers and $24,800 for married couples filing jointly. For 2021, it is $12,550 for singles and $25,100 for married couples.

The standard deduction amount for single or separate taxpayers will increase from $4,537 to $4,601 for tax year 2020. For married filing/Registered Domestic Partner (RDP) jointly, qualifying widower, or head of household taxpayers, the standard deduction increases from $9,074 to $9,202 for tax year 2020.

The 2020 annual standard deduction is $4,537, up from $4,401 in 2019, the department said. The value of a state annual allowance increased to $134.20, up from $129.80 in 2019.

For 2020, the additional standard deduction for married taxpayers 65 or over or blind will be $1,300 (same as for 2019). For a single taxpayer or head of household who is 65 or over or blind, the additional standard deduction for 2020 will be $1,650 (same as for 2019).

Medical expenses. Property, state, and local income taxes. Home mortgage interest. Charitable contributions. Investment interest expense. Miscellaneous deductions.

Personal Exemptions The personal exemption credits increase for 2020 to $124 (formerly, $122 for 2019) for single taxpayers, married taxpayers filing separately, and heads of households and to $248 (formerly, $244 for 2019) for married taxpayers filing jointly and surviving spouses.

Reasonable Living Expenses (RLEs) are guidelines to help ensure that a borrower in mortgage arrears maintains a reasonable standard of living while they try to resolve their debt problems. RLEs cover the borrower's day-to-day expenses, necessary to achieve a reasonable standard of living.

Other itemized deductions you can claim include medical expenses (though criteria must be met), real estate taxes, DMV fees, mortgage interest, charitable deductions, casualty losses from a federally declared disaster and any other miscellaneous itemized deductions.

California allows deductions for home mortgage interest on mortgages up to $1 million plus up to $100,000 in equity debt.