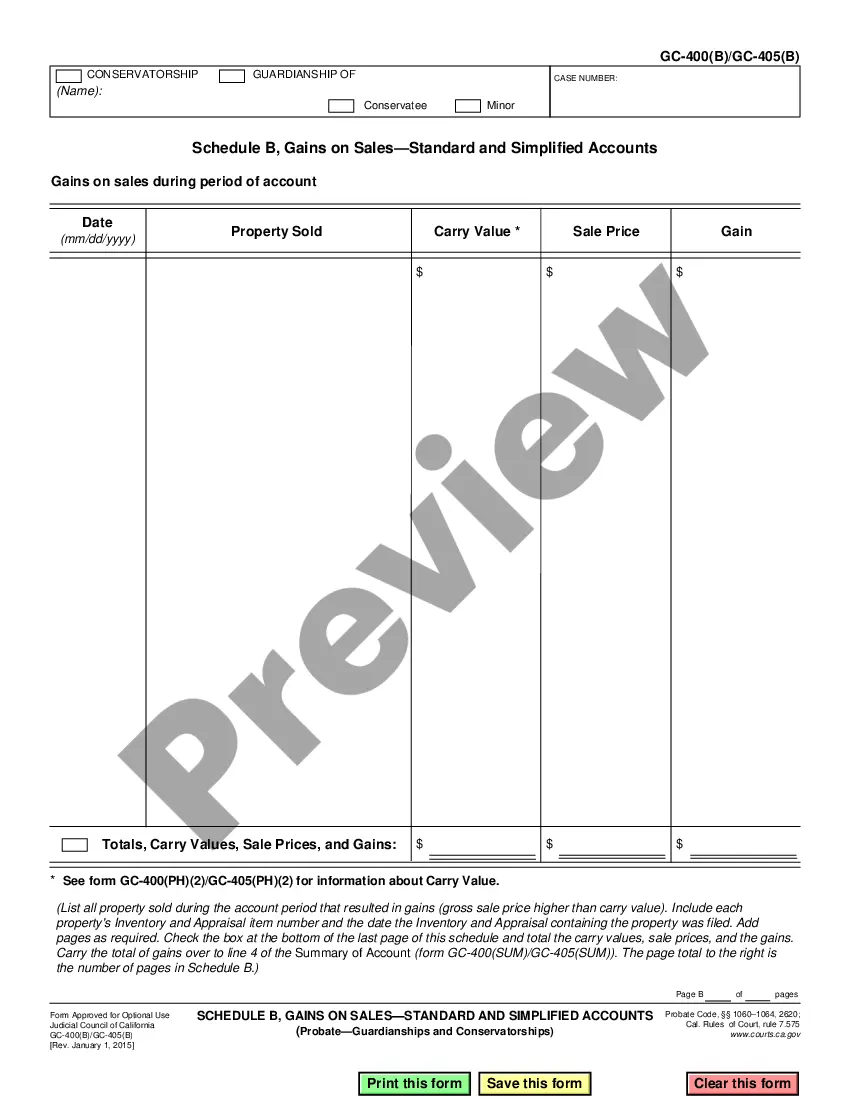

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

California Non-Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts

Description

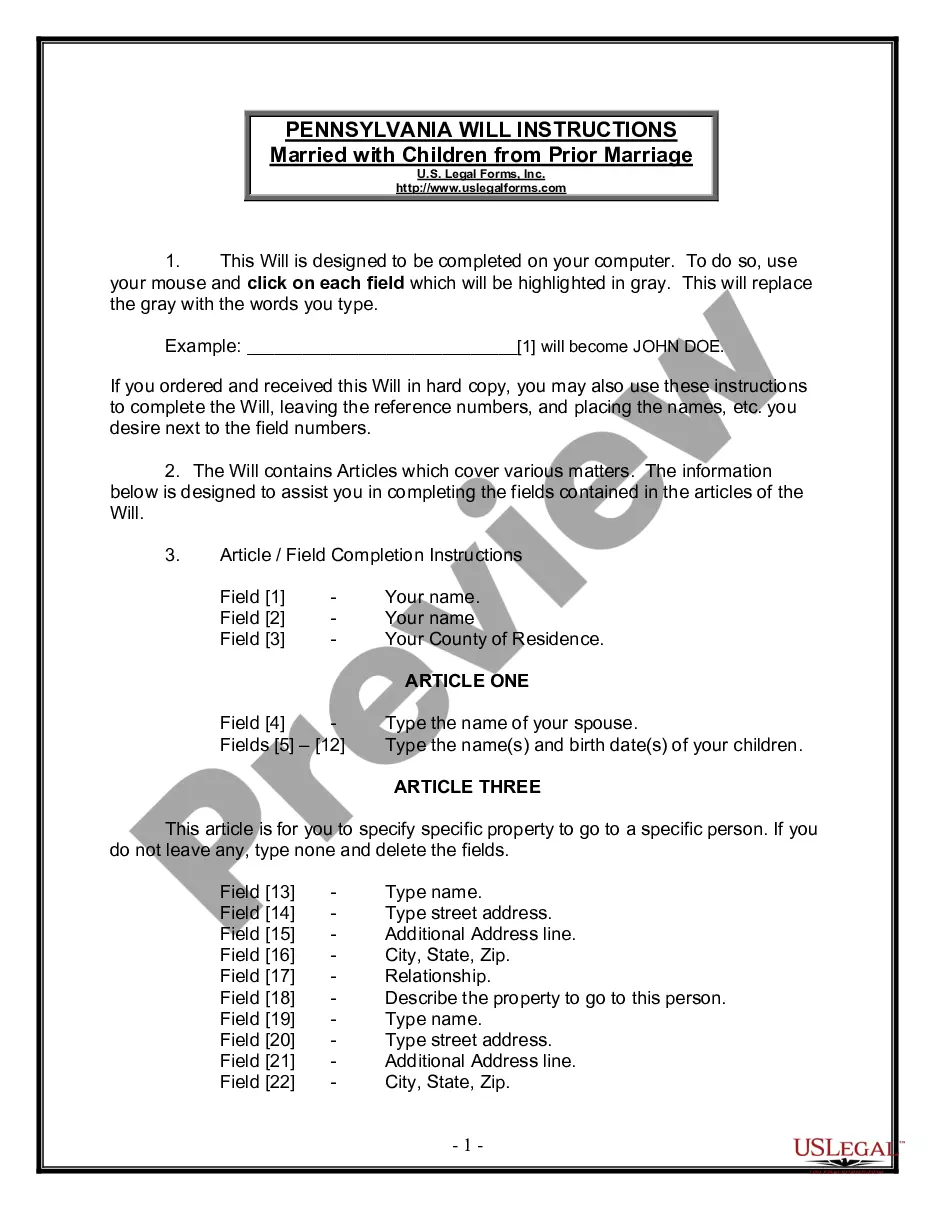

How to fill out California Non-Cash Assets On Hand At End Of Account Period-Standard And Simplified Accounts?

If you're seeking correct California Non-Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts web templates, US Legal Forms is the thing you need; locate files produced and verified by state-qualified attorneys. Benefiting US Legal Forms not merely saves you from bothers regarding legal papers; furthermore, you save up time and energy, and funds! Downloading, printing out, and completing a professional form is significantly less costly than requesting a lawyer to accomplish it for you.

To begin, finish your sign up process by providing your e-mail and building a security password. Stick to the instructions below to create an account and get the California Non-Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts exemplar to deal with your needs:

- Make use of the Preview solution or browse the document description (if available) to make sure that the template is the one you require.

- Check out its applicability where you live.

- Just click Buy Now to create your order.

- Select a preferred rates plan.

- Make an account and pay with the credit card or PayPal.

- Choose a handy formatting and conserve the file.

And while, that’s it. In just a couple of easy actions you get an editable California Non-Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts. After you create an account, all upcoming purchases will be worked up even easier. When you have a US Legal Forms subscription, just log in profile and then click the Download button you can find on the for’s webpage. Then, when you need to use this template again, you'll always be able to find it in the My Forms menu. Don't squander your time and energy comparing hundreds of forms on several websites. Purchase accurate documents from just one safe platform!

Form popularity

FAQ

Unlike a SNT, which classifies food expenses as income, an ABLE account can be used to pay for food without impacting means-tested Supplemental Security Income (SSI) benefits.

A CalABLE account is an investment and savings account available to Eligible Individuals with disabilities.ABLE Accounts allow individuals with disabilities to save and invest money without losing eligibility for certain means-tested public benefits programs, like Medicaid and Social Security Income (SSI).

The ABLE Act limits eligibility to individuals with significant disabilities with an age of onset of disability before turning 26 years of age. If you meet this age criteria and are also already receiving benefits under SSI and/or SSDI, you are automatically eligible to establish an ABLE account.

You can withdraw money from the account and use it for eligible expenses which cover most costs associated with living with a disability.

The purpose of an ABLE Account is to help individuals with disabilities maintain or improve their health, independence, and quality of life. ABLE Account earnings are not subject to federal income tax when used for Qualified Disability Expenses (QDEs).

ABLE accounts are bank accounts that allow people with special needs to save money without jeopardizing their disability benefits.The program is open to residents and nonresidents, and California residents can open ABLE accounts in other states that allow it.

California's ABLE account program is CalABLE. You can choose to open an account in another state's ABLE program.

Contributions to an ABLE account are not tax-deductible, but all investment earnings remain untaxed as long as money taken from the account is used for "qualified disability expenses." Such expenses include, among other things: Medical treatment.

You will also need two pieces of identification to open an account, at least one of which should be a government issued identification, such as a passport, driver's license, or state-issued identification card. You can find out about getting a California photo identification card at DMV website.