This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

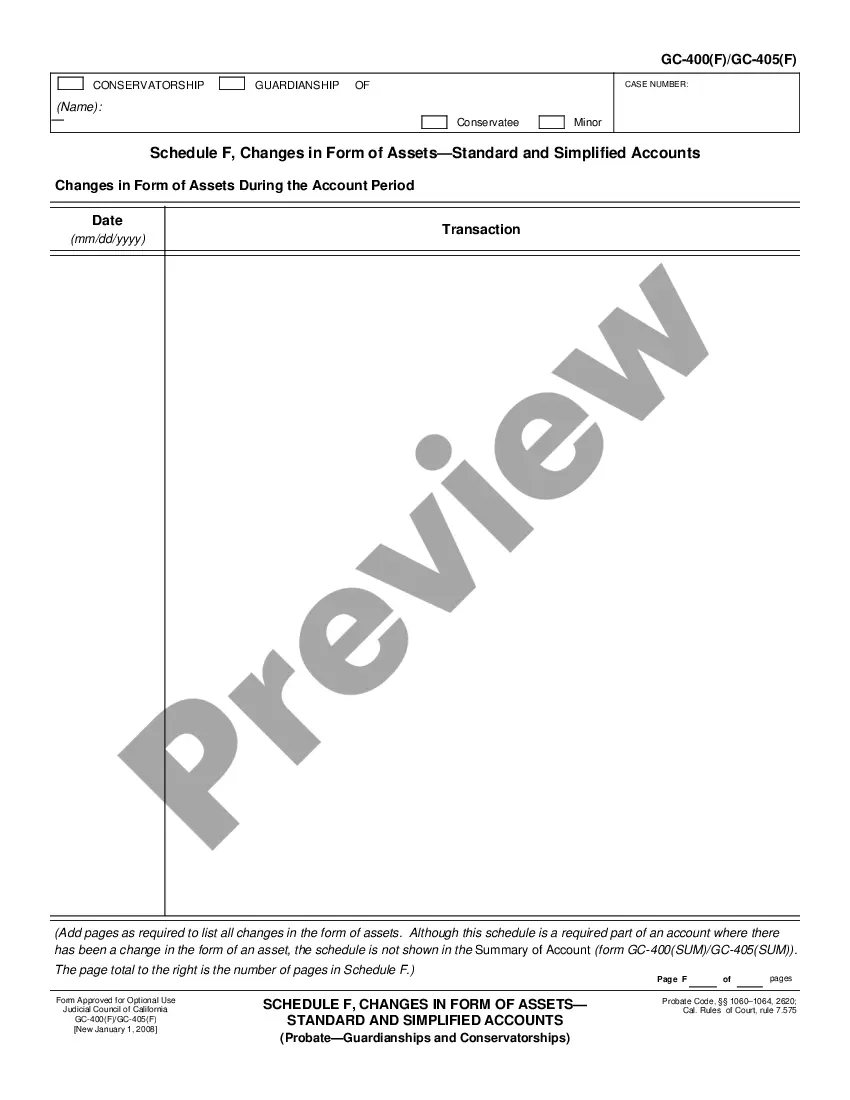

California Schedule F, Changes in Form of Assets - Standard and Simplified Accounts

Description

How to fill out California Schedule F, Changes In Form Of Assets - Standard And Simplified Accounts?

If you're looking for suitable California Schedule F, Changes in Form of Assets - Standard and Simplified Accounts examples, US Legal Forms is precisely what you need; obtain documents created and evaluated by state-certified attorneys.

Using US Legal Forms not only spares you from the stress related to legal documentation; you also conserve time and effort, as well as money!

Set up an account and pay using a credit card or PayPal. Choose an appropriate file format and save the document. And that's it! Within a few straightforward steps, you possess an editable California Schedule F, Changes in Form of Assets - Standard and Simplified Accounts. Once you create an account, all subsequent orders will be processed even more smoothly. When you have a US Legal Forms subscription, just Log In to your account and click the Download button you see on the form's page. Then, whenever you need to use this form again, you will always be able to locate it in the My documents section. Don’t waste your time searching through countless forms on various sites. Obtain accurate copies from one secure source!

- Downloading, printing, and completing a professional document is significantly less expensive than hiring an attorney to do it for you.

- To begin, finish your registration by providing your email and setting a password.

- Follow the steps below to establish your account and access the California Schedule F, Changes in Form of Assets - Standard and Simplified Accounts template to address your needs.

- Utilize the Preview option or review the document description (if available) to confirm that the form is the one you require.

- Check its relevance for your location.

- Click Buy Now to place an order.

- Select a recommended pricing option.

Form popularity

FAQ

Any tax due must be paid by April 15, 2020, to avoid penalties and interest. See form FTB 3519. You cannot use Form 540 2EZ if you make an extension payment with form FTB 3519. You can CalFile, e-file, or use Form 540, or Form 540NR when you file your tax return.

Qualifying to Use Form 540 2EZ Be 65 or older and claim the senior exemption. If your (or your spouse's/RDP's) 65th birthday is on January 1, 2021, you are considered to be age 65 on December 31, 2020.

Filling in Your Tax Return Use black or blue ink on the tax return you send to the FTB. Enter your social security number(s) (SSN) or individual taxpayer identification number(s) (ITIN) at the top of Form 540, Side 1. Print numbers and CAPITAL LETTERS between the combed lines. Be sure to line up dollar amounts.

A Form 540 is also known as a California Resident Income Tax Return. This form will be used for tax filing purposes by citizens living and working in the state of California. This form is used each year to file taxes and determine if the filer owes taxes or is entitled to a tax refund.

Filling in Your Tax Return Use black or blue ink on the tax return you send to the FTB. Enter your social security number(s) (SSN) or individual taxpayer identification number(s) (ITIN) at the top of Form 540, Side 1. Print numbers and CAPITAL LETTERS between the combed lines. Be sure to line up dollar amounts.